Economic & Financial Markets Forecast 2009: Collapsing Global Financial System Ponzi Scheme

Stock-Markets / Recession 2008 - 2010 Jan 30, 2009 - 05:22 PM GMTBy: Ty_Andros

As economic activity and PONZI finance fall off the face of the earth, we enter the stretch run of the CON game known as the Bond and FIAT currency markets. Although both are headed for their ultimate demise, the path will be quite different. In 2009, these challenges will be headed your way. Prepare properly and thrive, or fail to do so and fall to your demise.

As economic activity and PONZI finance fall off the face of the earth, we enter the stretch run of the CON game known as the Bond and FIAT currency markets. Although both are headed for their ultimate demise, the path will be quite different. In 2009, these challenges will be headed your way. Prepare properly and thrive, or fail to do so and fall to your demise.

Never before in history have so many investors made decisions based on PHONY data and false headlines. Most in the alternative information arena are fully aware and have reported extensively on the POLITICALLY correct but practically incorrect economic data emanating from G7 governments. This is nothing but PR for public consumption as the real numbers would spawn RIOTS in the streets. So the public are NEVER told the true story as it is too horrible to acknowledge. The public is fed FALSE data.

GDP, inflation, employment, credit ratings, corporate profits, balance sheets and much more have been MANIPULATED to FOOL the vast MAJORITIES of the electorate that can read and write. But many of these same people are functionally illiterate of history, economics, common sense, logic and the critical thinking skills necessary to sift through the FALSE and misleading rhetoric of the mainstream media, public serpents, er … servants and school systems.

This politically correct, but practically incorrect data has also been used when making investment decisions, thus creating assumptions which are often false and misleading. Who can argue that when a ratings agency places politically correct ratings on any type of bond or debt offering investors are effectively DUPED into investment decisions which are contrary to their goals and risk tolerances, and then entering into mal investments with expectations that are not correct.

Crop reports, unemployment reports, inflation reports, everything has now been colored by politicians and crony capitalists to create PR/illusions they wish to foster into the public at large in order to manipulate them. The MAIN STREAM media are willing facilitators of these FALSE reports. Many times the financial media make reports on companies' profits which do not reflect the true profits and losses which we find in a companies' tax return. Every investment and analysis made through the investment and commercial banks is BASED on these false OFFICIAL numbers and most have been massaged, thus any investment decision coming from this data is deeply FLAWED.

These FUNCTIONALLY illiterate people DO NOT know from where wealth comes, how it is generated and accumulated, nor how it was by our parents and grandparents. Many have never understood that to thrive you must “produce more than you consume” and accumulate savings. This is what leads to rising middle classes and living standards. These truths and virtues are NEVER mentioned in school. People are taught that they can have anything now by borrowing and unwittingly becoming debt slaves of the banking community as the true PRICE (after interest and compounding) of the purchase is NEVER clearly explained to them. They believe wealth, as well as solutions, to their problems come from government, rather than from their own efforts.

People are taught that they can rely on government for health care, food and welfare. They do not realize that government is invested in making them dependants rather than independent. As dependants, the power over their lives comes from their government masters and their crony capitalist partners. As independents, the power rests in their own hands. Let's take a look at the words of Ayn Rand, as this is where we have arrived TODAY:

"You cannot legislate the poor into freedom by legislating the wealthy out of freedom.

What one person receives without working for, another person must work for without receiving.

The government cannot give to anybody anything that the government does not first take from somebody else.

When half of the people get the idea that they do not have to work because the other half is going to take care of them, and when the other half gets the idea that it does no good to work because somebody else is going to get what they work for, that my dear friend, is about the end of any nation. You cannot multiply wealth by dividing it."

John Gault/Ayn Rand

A wonderful description of this individual can be found in an essay by Christopher Hedges entitled “ America the Illiterate ” (click on the link to read it and weep). It signals the fall of the America we have known for generations. This person is the SOMETHING FOR NOTHING citizen, and once Obama's Tax cuts for those who don't pay taxes are implemented, ‘ America the Illiterate' will constitute almost 60% of the US population . That is an enormous percentage of the population that will be completely illiterate in everything necessary to make good decisions. I refer to these people as CAPTIVE victims of the government and banking/financial systems. They have been and continue to be the sheep to be fleeced by the elites, public serpents, er … servants and crony capitalists.

Now they will be the instrument of the demise of the private sector as they provide the public servants with the ELECTORAL support to attack and rob the last of the productive and prudent parts of the G7 economies and transfer it to the morally, intellectually and fiscally bankrupt. As every government policy failure appears, public servants will stroke the fear in the ‘something for nothing illiterate' and use it to nationalize and destroy more and more of the private sector. They will double down on the spending, borrowing, printing and taxing required to pay for the next absurd idea to come out of the G7's capitals. Look no further than Obama's “Economic Recovery and Stabilization” stimulus package which spends 12 cents of every dollar on economic stimulus and 88 cents for sustaining and enlarging government spending and programs. A perfect name to DUPE America the Illiterate.

Morally, fiscally and intellectually BANKRUPT public servants and crony capitalists. Now we know why the banks and financial sectors were the greatest campaign contributors in the last election cycle and Obama's inaugural election. Decisions are being made upon political considerations, not economic ones. As the Speaker of the House so aptly put it, “We won the election so we wrote the stimulus bill.” This from a woman who brought the approval ratings of the Democrat controlled congress to 9% shortly before they rode Obama's coattails to victory.

The heads of Xerox, IBM and Honeywell applauded the stimulus bill; I guess they made their campaign donations appropriately… “Buy American” provisions are in the stimulus bill; these are shades of “Smoot Hawley” protectionism, which deepened the depression by many orders of magnitude. Smart gal and guy that Congresswoman and Speaker of the House Nancy Pel*si and Senate Majority Leader Senator Harry R*id; real students of history. It's only downhill from here.

George “Pinocchio” Bush expanded government by OVER 60% and NOW Barack “Pinocchio” Obama is doing a 25% expansion in the first month. FEAR, FEAR, FEAR and economic illiteracy drives citizens to accept absurd proposals as wisdom and solutions to their problems. Terrorism, recession, bank failures all provide public serpents the cover for taking more freedom and income from the private sector under the guise of protecting you!! Central planning of the economy, galloping socialism and Marxism are descending faster than I ever could have imagined; having taken a huge leap in velocity…

Now these realities will have to be priced into many investments/markets, and the adjustments are enormous OPPORTUNITIES for some and the demise of others. The greatest transfer of wealth from those that hold their wealth in paper to those that don't is unfolding in the G7 and the old European Union.

As this process unfolds it will present you with unbelievable VOLATILITY in stocks, bonds, commodities, precious metals and all markets as they are ALL mispriced to what is unfolding. Buy and hold is DEAD and will continue to be for quite some time. In order to thrive, you must become nimble and be able to manage risk as the markets whipsaw around in trend and countertrend manner. To understand the enormous potential of this approach if properly implemented, you may wish to read an overview I wrote called “ Turning Volatility into Opportunity ”. This is what I do for investors.

Fannie Mae and Freddie Mac are back at the government begging bowl for an aggregated total of $50 billion, and you can expect it to reach AT LEAST $600 to $800 billion before the losses are COVERED. Foreigners have QUIT buying agency paper.

The Bomb, er…Bond markets

I will start by saying that this is the MOST toxic area you can be in at this moment . Every assumption underlying the creation of a bond, its value as a “store of value and wealth” and repayment is NOW FALSE . Corporate and consumer income, government income, tax receipts, cash flow, level of business activity, asset values, future business, profitability and every qualifying metric used for borrowing are now significantly LESS. In most cases it WILL NOT recover for many years, if not a decade from now. And government stimulus activity will DELAY any recovery in income for years. Therefore, the expectations for repayment are considerably diminished.

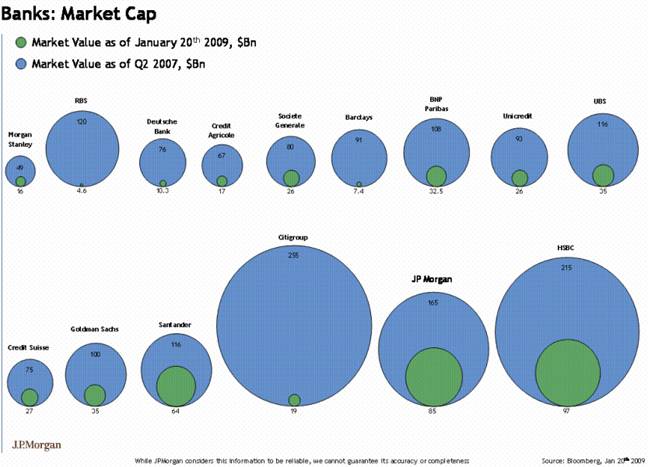

The first sector we will look at is banks who are on life support as a cardiac victim would be, hooked up to the respective central banks with IV's. They are functionally insolvent with no reserves to absorb the estimated $2 trillion PLUS of losses expected this year in the US and $6 plus trillion in the Euro zone. Looking at this chart of the biggest banks in the world puts perspective on the DEPTH of the problems:

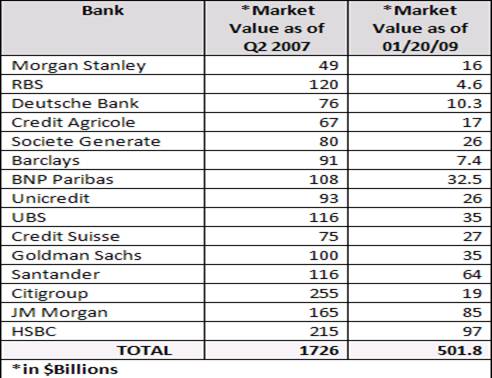

Since the numbers before and after are hard to read I have assembled them into a table for additional perspective…

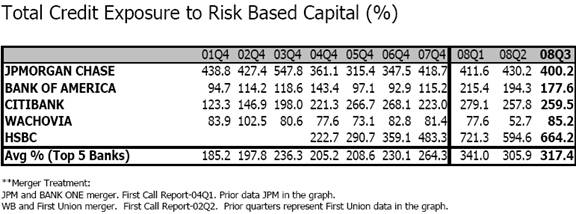

The $501 billion figure is what is known as TANGIBLE COMMON equity and it is actually the total net worth of these banks. Book value is a fiction; this is the true level of equity available to absorb future losses. To demonstrate how close they are to insolvency, I will show you measures of outstanding liabilities wherein this equity is leveraged:

These banks are representative of the problem they all face: INSOLVENCY. For a complete look at the picture, you can link to this report from the Office of the Comptroller of the Currency Administrator of the United States outlining the unbelievable LIABILITIES and LOSSES these banks face (P.S.: when reading this report, be sure to have fresh underwear close by as it is a thorough picture of the problems). This is a nightmare on WALL STREET and MAIN STREET .

A one percent loss on outstanding loans and derivatives turns ALL the biggest banks in the G7 into TOAST. What do you think the odds are of this happening? 100%. Once you see the picture you will understand why they are extremely cautious with their lending; they are on a tight rope. I don't care how much the mainstream financial media hoot and howl, these banks are WORTHLESS and so are their debt offerings. The public will pay to nationalize and rescue the banks then pay again, paying off the government guaranteed debt used in the FAILED rescue. No one talks about the unfunded CREDIT DEFAULT SWAPS they have written this past year insuring trillions of dollars of UNPAYABLE debt . When you see a rally in stocks that is lead by FINANCIALS and BANKS, you KNOW it's false and you should sell into it .

Cumulatively, these banks are LOSING somewhere north of $100 billion a WEEK on their portfolios (see Tedbits archives from, August 28, 2007, for ‘ Roach Motels ' to understand there is no end to this) as illustrated in last week's Tedbits. If forced to access the credit markets, they couldn't do so unless the GOVERNMENTS of these respective banks GUARANTEED the borrowings.

This would transfer the liabilities and inability to pay to the public at large . Today the government is saying that they will create a bad bank to take the toxic assets. I hope they have the trillions of dollars to deal with them. Of course, this is one more screw job of the public while the shareholders, unsecured bondholders and management get a free pass and it is in one word: DESPICABLE. The American public is the patsy. This also does NOT deal with the NAKED credit default liabilities which amount to TRILLIONS of dollars. Regardless of what media and credit ratings say, the G7 banking system is not worth a dime and will decline in value to that level eventually.

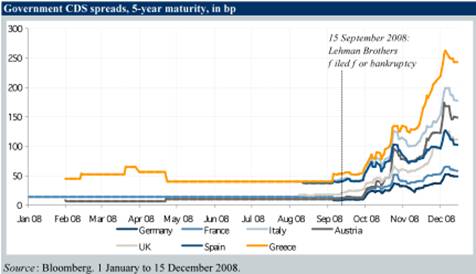

Now let's look at sovereign debt in the Euro zone and credit default spreads of its weakest and most over extended countries:

This is only the beginning as the Euro zone is ILL PREPARED to handle the quantitative easing, aka “money printing”, required to underpin the new debt and roll maturing issues. The southern euro zone now pays up to 3% more to borrow than Germany indicating an increasing reluctance by investors to hold these issues, and ultimately they will be REJECTED by the markets unless much more return is offered.

This is only the beginning as the Euro zone is ILL PREPARED to handle the quantitative easing, aka “money printing”, required to underpin the new debt and roll maturing issues. The southern euro zone now pays up to 3% more to borrow than Germany indicating an increasing reluctance by investors to hold these issues, and ultimately they will be REJECTED by the markets unless much more return is offered.

Quantitative easing and monetization of debt is prohibited by the Euro zone and the European central bank in its bylaws. These countries and banking systems are FUNCTIONALLY bankrupt, and savers everywhere would be well served in dumping their debt before the ILLUSION of the ability to pay through anything but the printing press becomes generally acknowledged by the mainstream financial media.

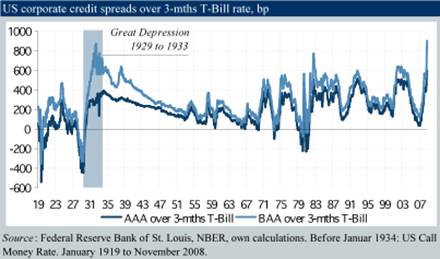

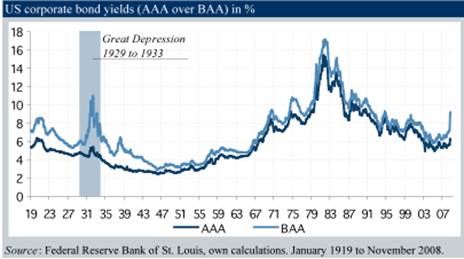

Now let's look at the INTEREST RATES paid by the corporate sectors compared to the treasury debt:

These spreads indicate the risk in the corporate sector , the “widest since the Great Depression.” Ignore these signals at your peril . Most companies CANNOT function with the cost of funds this high. Ultimately the Fed and other central banks will step in, and then it will really be interesting to see who gets to LIVE or DIE due to lack of affordable funding. Of course we know how they will determine this… it will depend on who is and has been the biggest contributors to the public serpents, er … servants who control the government PURSE STRINGS. This picture is echoed throughout the G7.

These spreads indicate the risk in the corporate sector , the “widest since the Great Depression.” Ignore these signals at your peril . Most companies CANNOT function with the cost of funds this high. Ultimately the Fed and other central banks will step in, and then it will really be interesting to see who gets to LIVE or DIE due to lack of affordable funding. Of course we know how they will determine this… it will depend on who is and has been the biggest contributors to the public serpents, er … servants who control the government PURSE STRINGS. This picture is echoed throughout the G7.

Trillions of dollars of maturing debt in the G7 corporate sector will bankrupt many corporations as they DO NOT have the money to pay in full and cannot roll their obligations forward. Their businesses no longer create the revenues and profits to service their previous commitments, let alone take on new ones. EVERY corporate borrower is less credit worthy now (by a wide margin) than they were in July 2008. They are becoming less so every day as business continues to COLLAPSE. You can look for this blow out in spreads to continue. In September, I wrote BLOW OUT and BLOW UP about the banks and brokers; NOW this applies to CORPORATIONS in general. Corporate failures loom in huge amounts, ipso facto BOND DEFAULTS.

Trillions of dollars of maturing debt in the G7 corporate sector will bankrupt many corporations as they DO NOT have the money to pay in full and cannot roll their obligations forward. Their businesses no longer create the revenues and profits to service their previous commitments, let alone take on new ones. EVERY corporate borrower is less credit worthy now (by a wide margin) than they were in July 2008. They are becoming less so every day as business continues to COLLAPSE. You can look for this blow out in spreads to continue. In September, I wrote BLOW OUT and BLOW UP about the banks and brokers; NOW this applies to CORPORATIONS in general. Corporate failures loom in huge amounts, ipso facto BOND DEFAULTS.

But the biggest deadbeats are the G7 governments themselves, perceived as being almost risk free; this could not be further from the truth. The level of G7 government debt as a percentage of GDP is many multiples of GDP. Most obligations are held OFF THE BOOKS to fool the broad public and INSTITUTIONS who purchase much of it. The US government's liabilities are now almost $60 trillion, and CLIMBING at almost $10 trillion a year if properly accounted for. This is in an economy of $13 trillion BEFORE the unfolding collapse in GDP.

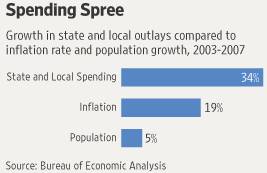

Let's look at state and municipal budget expansion as it is a good proxy for what we have seen at every level of G7 governments since the bubble years in credit creation began in 2002:

Cumulatively, governments, municipal up to federal, in the G7 consume more than 50% of GDP and even during this recession, REFUSE to curtail and control spending. Instead, they careen towards deeper and deeper uncontrollable and unpayable DEBT obligations.

Cumulatively, governments, municipal up to federal, in the G7 consume more than 50% of GDP and even during this recession, REFUSE to curtail and control spending. Instead, they careen towards deeper and deeper uncontrollable and unpayable DEBT obligations.

In yesterday's Federal Reserve statement, a clear evolution of quantitative easing emerged, from last month's reference to Federal Reserve buying of long-dated treasuries in which they stated that they were: “evaluating the potential benefits of buying treasuries” to the present in which they are “prepared” to buy them if “evolving circumstances indicate that such transactions would be particularly effective in improving conditions in the private credit markets”.

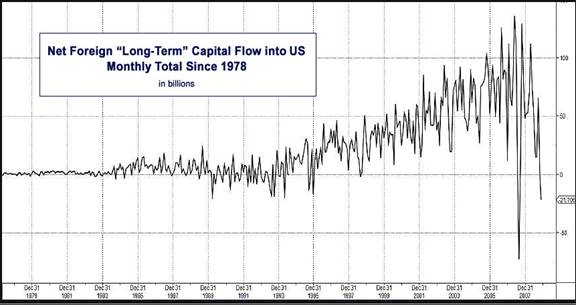

Well, here are the evolving circumstances as in the latest TIC's data (the measure of foreign direct inflows of funds into the US to finance the trade and budget deficits. FYI, it needs to exceed $2 billion a day):

Up until November, foreign investors had stopped buying agency and corporate bonds; now they have stopped buying TREASURIES and, cumulatively, China and Japan have SOLD $16.8 billion worth of them. Add to this the withdrawal of foreign PRIVATE investors EN MASSE:

- November 2007 year over year net purchases: $829 billion

- November 2008 year over year net purchases: $316 billion

This is a staggering decline of 61% year over year, accounting for over HALF OF A TRILLION dollars less in purchases. In total, private foreign investors were net SELLERS of -$18.9 billion in November and -$19.4 billion in October. Who will fill this GAP? We can see from the FEDERAL RESERVE STATEMENT who that will be: The Federal Reserve. The more they withdraw or FAIL to invest, the more the Fed WILL step in WITH THE PRINTING PRESS.

There is NO SAFETY in treasuries; it is an illusion.

As I write this, the guardian in the UK is reporting the newest totals of BAD assets in the EU banking system and the number 4.8 trillion Euros, which equals = $6.2 trillion. GASP!!! What investor in their right mind would buy a treasury bond of the G7 when it is INSTANTLY GONE ???!!! How much debt can be serviced by economies that ARE NOT GROWING? And if properly adjusted for inflation, are falling MUCH FASTER than allowed to be reported by the mainstream media.

The Chinese have slowly but surely been EXITING the agency and corporate bond markets and are quickly SWITCHING into shorter term US government maturities of 1 to 3 years. This helps keep the US government on a short leash. So any stupid move by POLITICIANS and PUBLIC SERPENTS to pin the tail for failing business conditions and the FINANCIAL meltdown in the US on the CHINESE, will be quickly met with failure to ROLL those securities. Translate that into instantly rising interest rates and a US bomb, er…bond market crash! That is, UNLESS the Federal Reserve and the other central banks start buying treasuries and PRINT/MONETISE the money out of thin air. THEY WILL.

I feel sorry for and am saying prayers for the UK as it is headed the way ICELAND is; the economics I have seen are absolutely HORRIFYING. Alistair Darling and Gordon ‘Sold the Gold' Brown just this afternoon directed the Bank of England to start BUYING assets; this is also known as ‘Printing the Money.” I am sure they wish they had that “barbarous relic” which was SOLD at the LOWS in 2001. The Bank of England does not have the ability to deal with the enormity of the problem as it is multiples of GDP. Soon UK gilts will crash.

Rolling bankruptcies loom EVERYWHERE throughout the G7. G7 governments face trillions of dollars of NEW issuance and considerable rolling requirements for maturing DEBT. Bonds are IOU'S, denominated in IOU's (fiat currencies) and PAYABLE in IOU's, and sound like a SYNTHETIC CDO (collateralized debt obligation made up of NAKED CREDIT DEFAULT SWAPS issued by BANKS that are BANKRUPT). Bonds are BOMBS like a firecracker and you are just waiting for them to BLOW UP or are waiting to be paid off with PRINTED coupons masquerading as MONEY. Muni's, Corporate's, Federal, mortgages, Private Equity, credit cards, commercial bonds all have huge downside risk. This is BLACK SWAN time, over and over again in paper markets. Get out of bonds now while there are still fools to take your holdings from you; who are thinking that an economic recovery or the recovery of the ability to repay is only a matter of a SHORT TIME. It isn't, and they are going to be SADLY MISTAKEN.

In conclusion: Hi ho, hi ho, off to the printing press they will go, as it is the only avenue of escape. Remember the adage about what would you do if someone pointed a gun at your head and you have the choice of ducking and living, or taking the bullet and dying? The answer is clear: YOU WOULD DUCK! PUBLIC SERVANTS, private and CENTRAL BANKERS and CRONY capitalist campaign contributors will do the same: THEY WILL LET THE PUBLIC TAKE THE BULLET. So we know what to do. Let the short term deflation play out, then seek the INDIRECT exchange as outlined by Von Mises.

You are going to see BLOW UP after BLOW UP in all corners of the credit markets and ultimately in G7 sovereign bonds. You can bet on it. You can trade the bonds if you dare, but never hold them for the duration. I will predict that PIMC* will BLOW UP before this meltdown is over.

Bonds, lenders and lending are the epicenter of the crisis; no one will be spared and I mean NO ONE, and ultimately they are ALL GOING DOWN to one extent or another. As the G7 financial system and banks GRASP for survival, they will bring down the FIAT currencies with them; it will be like a game of DOMINOES. One thing leading to another and what a glorious journey it will be for PREPARED investors.

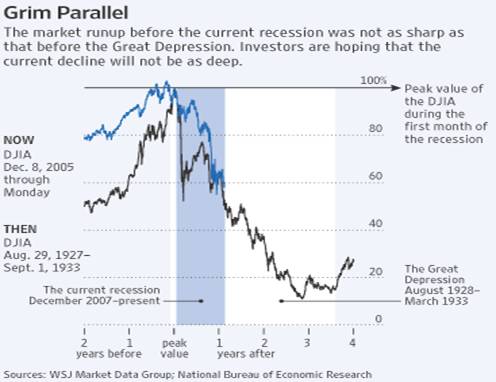

Don't despair, “VOLATILITY is OPPORTUNITY ”, you must learn to make money in rising and falling markets. Learn to “ turn volatility into opportunity ” (click here to learn how to do so). Stocks, bombs, er…. bonds, commodities, metals and currencies will ZOOM all over the place, allowing you opportunities to capture BIG profits. Learn how to do so with tight risk controls and diversify your portfolios. Buy and hold is dead except for precious metals. Learn how to fix your paper dollars and do the indirect exchange. Stocks are completely mispriced and reflect a different reality (do I hear the plunge protection team?). Here is a peak at an analog:

Note the HUGE bounce during the great depression. YOU CAN expect this to occur at some point this time around (currently the monthly RSI is the most oversold in HISTORY, signaling potential for a great BIG bounce); then this decline will be resolved ‘to the downside',

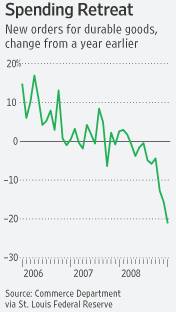

Durable goods were released today and they were horrid and the previous months decline we revised to double the decline. Take a look at this chart of durable goods:

New home sales were DOWN 15% to new all-time lows. Today's GDP was reported at -3.8 on a preliminary basis (another politically correct headline which will be quietly revised lower). Do you really think the economy declined -3.8% in the 4 th quarter based on the CRASH in durable goods? Jobs are disappearing and governments are swallowing the private sector RAPIDLY. Not a good recipe for INCOME growth.

New home sales were DOWN 15% to new all-time lows. Today's GDP was reported at -3.8 on a preliminary basis (another politically correct headline which will be quietly revised lower). Do you really think the economy declined -3.8% in the 4 th quarter based on the CRASH in durable goods? Jobs are disappearing and governments are swallowing the private sector RAPIDLY. Not a good recipe for INCOME growth.

Next week's 2009 outlook will look at the currency markets. Don't miss it!

Please remember that subscribers receive Tedbits two to three days before it is posted on the web. Subscribers will also start receiving guest essays from leading economic pundits, and a blog looms soon. So if you want it early and the added features SUBSCRIBE NOW it's FREE!

Thank you for reading Tedbits if you enjoyed it send it to a friend and subscribe its free at www.TraderView.com don't miss the next edition of Tedbits.

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2009 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

10 Feb 09, 03:18 |

Good piece

great report i really admire it |