Stock Market January Losses May Not Bode Well For Bulls

Stock-Markets / Stock Index Trading Jan 31, 2009 - 01:53 PM GMT

Two days after a fiery rally that broke through resistance, the indexes have been pushed back into their previous trading ranges. If you are going either long or short, this is indeed a frustrating market.

Two days after a fiery rally that broke through resistance, the indexes have been pushed back into their previous trading ranges. If you are going either long or short, this is indeed a frustrating market.

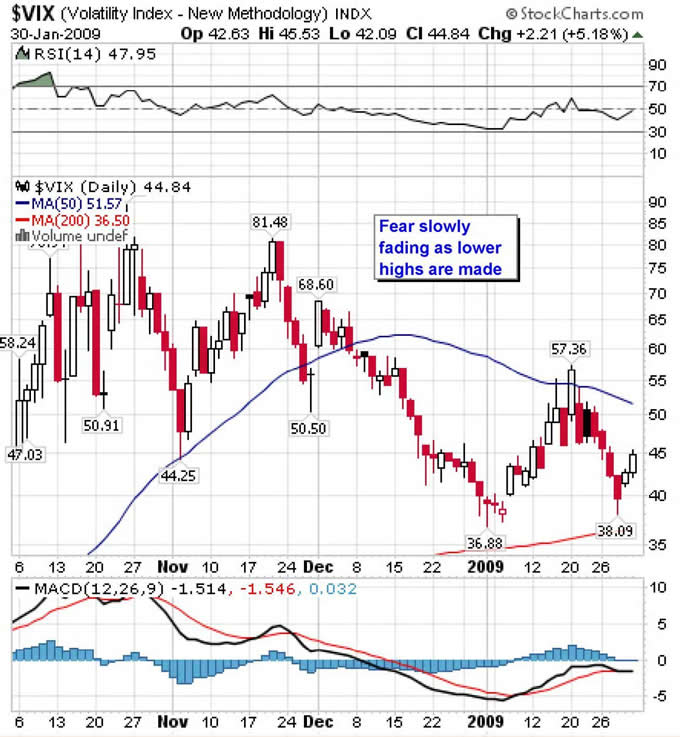

The positive aspects of today's decline was that while volume was higher than the previous day, it is still rather low. Investors should also consider the movement of the VIX . While it has increased over the last two days, it is still caught in a downtrend. The 50 dma is slowly rolling over while the 200 dma is bound to be tested soon.

The indexes are still above recently formed higher lows as well as the support levels of 800 for the S$P 500 and 1400 for the NASDAQ.

January was a horrible month for the market. The S&P 500 had its worse month EVER, dropping 8.2%. The DJIA was the laggard with a loss of 8.8%. The NASDAQ lost 6.4%. One may have heard the conventional wisdom that small caps lead in January. The Russell 2000 did lead, but in the wrong direction. It lost 11.2%, also its worst January on record.

As for the rest of the year, the January Barometer is not painting a rosy picture. This gauge, as described by the Stock Traders' Almanac, has predicted the direction of the market 91.4% of the time. Therefore, if January is a down month, the market will end the year with a loss.

It is a frustrating situation. This type of market is a meat-grinder for position traders. Unless you are daytrading , the stock market will devour one's trading stake. It is advisable to wait until a trend, be it up or down, is established before entering positions and risking capital.

I have also added some weekly charts further down to block out some of the daily noise. From a

longer term perspective, the trading ranges can be clearly seen on both indexes. This is constructive, unless of course, we go down.

By Kingsley Anderson

http://tradethebreakout.blogspot.com

Kingsley Anderson (pseudonym) is a long-time individual trader. When not analyzing stocks, he is an attorney at a large law firm. Prior to entering private practice, he served as a judge advocate in the U.S. Army for five years and continues to serve in the U.S. Army Reserves. Kingsley primarily relies on technical analysis to decipher the markets.

Kingsley's website is Trade The Breakout (http://tradethebreakout.blogspot.com)

© 2009 Copyright Kingsley Anderson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Kingsley Anderson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.