Will Gold Push Above $900 Break its Downtrend?

Commodities / Gold & Silver 2009 Feb 01, 2009 - 10:14 PM GMT

Financial Times: Gold pushes above $900 in buying spree

Financial Times: Gold pushes above $900 in buying spree

“Strong investor buying on Monday pushed the price of gold above $900 a troy ounce, hitting a 3½-month high in dollar terms and posting all-time highs in euro and sterling, in a stark sign of money seeking refuge from equities and bond markets.

“Traders said that investors, particularly in continental Europe and the UK, were pouring money into gold exchange-traded funds - a popular way to gain access to the metal - and also noted strong buying of physical gold, from coins to bars.

“Edel Tully at Mitsui & Co Precious Metals in London said gold was the ‘obvious shelter' for safe-haven investors.

“The total amount of gold held by the world's gold ETFs last week rose for the first time above the 40 million ounce level. Together, such investment vehicles are now the largest holders of physical gold after the official reserves of the US, Germany, the International Monetary Fund, France and Italy.

“In the short term, traders said gold was likely to consolidate above $900 an ounce this week and could test the $930 an ounce level previously touched in October.”

Source: Javier Blas, Financial Times , January 26, 2009.

Bespoke: Will gold break its downtrend?

“After briefly piercing the $1,000 level in March of last year, the price of gold went into a long-term downtrend with a series of lower highs and lower lows. However, since bottoming out at $681 in October, gold has rallied to over $900 per ounce. This has brought the commodity right to the top of its downtrend line from the March 2008 high. While the current rally in gold has been attributed to fears over competitive currency devaluations across the globe, how the commodity acts in the coming days will go a long way in determining how valid those fears are.”

Source: Bespoke , January 26, 2009.

Richard Russell (Dow Theory Letters): Gold benefits from devaluations

“The world battle for exports, with the help of cheap currencies is on. They call it competitive devaluations, and the whole picture is not lost on gold. The move is starting - to move to hard assets. The hardest of all assets is gold. Gold, in case you forget, is pure wealth, it's the only money with no debt against it or without a counter-partner. Gold needs no nation or central bank to attest, by fiat - that it's money.”

Source: Richard Russell, Dow Theory Letters , January 26, 2009.

Bloomberg: StockCharts's Murphy sees gold at $1,000 by year end

“John Murphy, chief technical analyst at StockCharts.com, talks with Bloomberg's Brennan Lothery about the outlook for the gold price in 2009. Murphy also discusses commodity prices, the US equity market and investment strategy.”

Source: Bloomberg , January 27, 2009.

Bespoke: Baltic Dry Index up seven days in a row

“The Baltic Dry Index gained another 1% today, which makes seven up days in a row. Since bottoming in December, the Index has formed a nice uptrend, gaining over 50%. Longer term, however, the Index's highs from last Spring are still a long way off. While the Index bottomed on December 5 with a 94.4% decline from its all-time high of 11,793, at its current level of 1,014, it is still down 91.4% from its May 20 high. In order to get back to those highs, the index would have to rally an additional 1,063%. Hey, you have to start somewhere.”

Source: Bespoke , January 28, 2009.

CNBC: Oil move to $20?

“Crude oil may fall to $20 this year, says Joe Petrowksi, Gulf Oil and Cumberland Farms CEO.”

Source: CNBC , January 27, 2009.

Victoria Marklew (Northern Trust): Eurozone - is that light at the end of the tunnel?

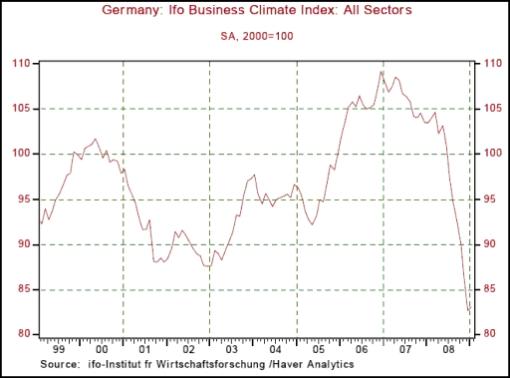

“Today's [Tuesday] Ifo and last week's Belgian leading indicator offer the tantalizing hope that the economic downturn across the Eurozone is starting to bottom out - but one month is not enough to call a trend, and the ‘zone' in general, and Germany in particular, are still likely in for a rough first quarter of 2009.

“First, the Ifo index in Germany. The headline business climate index edged upward from 82.7 in December to 83.0 in January, the first improvement in eight months. Nevertheless, the difference between the current conditions and expectations indices remains wide, suggesting that the economy will contract again in Q1 2009 and that the government's latest forecast of -2.25% real GDP growth this year is about right.

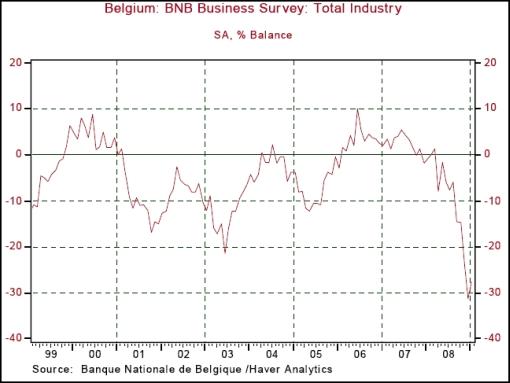

“Which takes us to our favorite Eurozone leading indicator, the Belgian National Bank's (BNB) business confidence indicator. As we've noted before, thanks to Belgium's strong trade ties with its neighbors (about 80% of Belgium's manufacturing output is sold abroad, mostly to fellow EU members), the BNB's business confidence index is a reliable leading indicator - about six months out - for GDP growth in the Eurozone as a whole.

“The Belgian and German data imply that the Eurozone as a whole will see a marked contraction in Q4 2008 and Q1 2009, flat-to-negative growth in the middle of the year, and a sustained improvement finally underway by Q4.”

Source: Victoria Marklew, Northern Trust - Daily Global Commentary , January 27, 2009.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.