Global Stock Markets Favour Stimulus Over Bad Economic Data

Stock-Markets / Global Stock Markets Feb 08, 2009 - 05:02 AM GMT

Global stock markets shrugged off dire news on the US employment front, arguing that the gloomy data would hasten US lawmakers' passage of a stimulus package. After falling for four straight weeks and recording the worst performance of the major US indices for January on record, Wall Street reversed course on the back of a stimulus-induced rally.

Global stock markets shrugged off dire news on the US employment front, arguing that the gloomy data would hasten US lawmakers' passage of a stimulus package. After falling for four straight weeks and recording the worst performance of the major US indices for January on record, Wall Street reversed course on the back of a stimulus-induced rally.

The US government seems on track to announce two new recovery plans next week. Firstly, Senate Democrats reached an agreement with Republican moderates on Friday regarding a fiscal stimulus package. The deal, in essence, entails about $110 billion in cuts to the roughly $900 billion legislation, according to The New York Times . Secondly, a rescue plan to inject billions of dollars into banks and entice investors to purchase toxic assets will be outlined on Monday by Treasury Secretary Timothy Geithner.

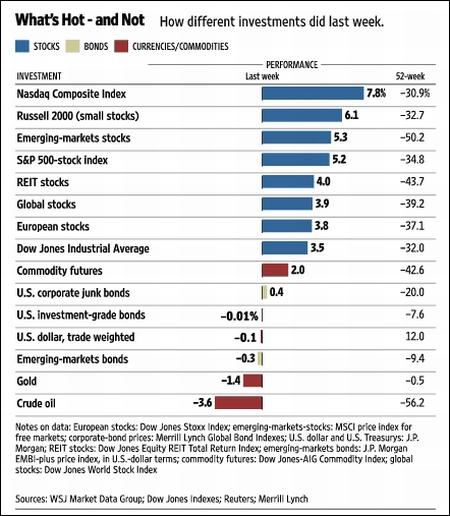

As investors' risk appetite returned, the MSCI World Index and the MSCI Emerging Markets Index chalked up decent gains of 3.8% (YTD -5.4%) and 5.3% (YTD -1.7%) respectively. Among exchange-traded fund (ETFs), sector leaders were China (see additional comments below), Brazil and South Korea - all recording double-digit gains, according to John Nyaradi ( Wall Street Sector Selector ).

All the major US indices revved higher, as seen from the week's movements: Dow Jones Industrial Index + 3.5% (YTD -5.6%), S&P 500 Index + 5.2% (YTD -3.8%), Nasdaq Composite Index +7.8% (YTD +0.9%) and Russell 2000 Index +6.1% (YTD -5.8%). Interestingly, the Nasdaq has been outperforming the Dow and S&P 500 since the beginning of December. Leadership by the technology sector is often good for the market as a whole.

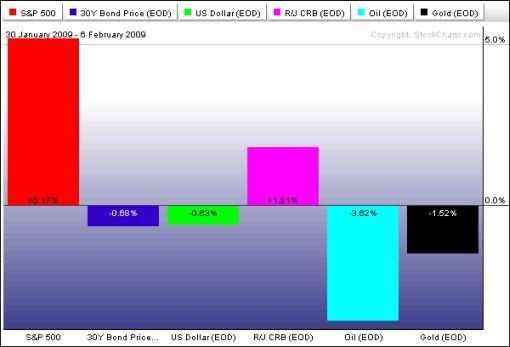

Recent safe-haven trades such as US Treasuries (-0.7% in the case of 30-year bonds), the US dollar (-0.6%) and gold (-1.5%) took a back seat, as investors favored equities and commodities such as copper (+4.9%) and aluminum (+7.7%).

While pundits were speculating about when the Federal Reserve would enter the market as a buyer of US government bonds, Treasuries sold off as a large issuance of sovereign debt looms. However, German bonds gained handsomely on the perception that the European Central Bank was behind the curve with interest rate cuts against the backdrop of poor economic data.

The performance of the major asset classes is summarized by the chart below, courtesy of StockCharts.com .

Giving a glimmer of hope, the Baltic Dry Index (BDI) - measuring freight rates for iron ore and other bulk goods - jumped by 40% last week due to increased Chinese demand for iron ore. The Index has gained 125% over the past two months after plunging by 94% since its May high. The chart below illustrates the close relationship between the BDI (red line) and Reuters/Jeffries CRB Index (green line). (Not shown, the trends of the BDI and US Treasury yields also follow more or less the same path.)

As reported in my “ Credit Crisis Watch ” review of a few days ago, the past few months saw progress on the credit front, with a number of spreads having peaked. The TED spread, LIBOR-OIS spread and GSE mortgage spreads have all narrowed markedly since the record highs. Corporate bonds have also seen a strong improvement, but high-yield spreads remain at distressed levels. The tide seems to be turning, but the thawing of the credit markets still has some way to go before liquidity starts to move freely and confidence returns to the world's financial system again.

Speaking of confidence, Montek Ahluwalia, deputy chairman of India's planning commission, made the following remark at the recent Davos Forum: “Confidence grows at the rate a coconut tree grows. It falls at the rate a coconut falls.”

Back to the planned US rescue packages, and specifically Bill King 's comments: “The main problem plaguing the US economy is too much debt has been accumulated on gratuitous spending and the papering over of declining US living standards. Solons espouse a monstrous surge in debt to fund even more consumer spending. The toxin is not the cure. Inducements to save and invest in production are the remedy. But the welfare state and its ruling class are trying a last grandiose socialist [Keynesian] binge in the hope of salvaging their realm.”

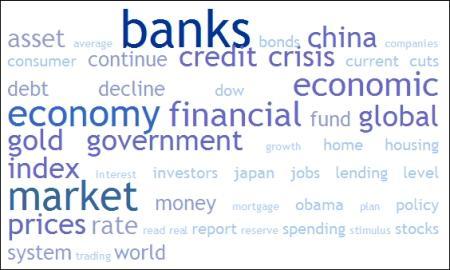

Next, a tag cloud of my week's reading. This is a way of visualizing word frequencies at a glance. Key words such as “bank”, “economy” and “market” dominated the list, whereas “China” seems to be gaining more prominence.

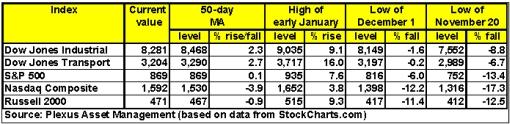

Stock markets have been in a “holding pattern”, or trading range, since the beginning of December. Key resistance and support levels for the major US indices are shown in the table below. The immediate upside target is the 50-day moving average (the Nasdaq and Russell 2000 are already above this line), followed by the early January highs. On the downside, the December 1 and all-important November 20 lows must hold in order to prevent considerable technical damage.

Here is Richard Russell's ( Dow Theory Letters ) interpretation of the situation: “Frankly, I'm very impressed by the stubborn and continuing resistance of the DJ Industrial Average. I don't think many analysts realize the extreme importance of the Industrial's steady refusal to violate its November 20 low. The action of the Dow contains the answer to the trillion-dollar question - ‘Is the bear market in a halting process - or will the stock market signal a continuation of the primary bear market?'

“So here we are - at a crossroads to history. The market will issue its verdict when, and only when, it is ready. But for now - if there's anything traders love, it's a market rising in the face of lousy news.

“An optimistic outcome would be a continued refusal by the Industrials to close below 7,552. An obviously more bullish outcome would be the DJ Industrial Average and the DJ Transportation Average continuing to rally and ultimately (both Averages) bettering their early-January peaks.

“Clearly, the most bearish outcome would be the Industrials finally breaking below the November 20 low and thereby confirming that we are still locked in a continuing primary bear market.”

From across the pond in London, David Fuller ( Fullermoney ) said: “… there is a scenario which few other people are taking about. As part of our often-mentioned forecast for a ranging, reversion to the mean recovery rally first hypothesized in late October, there is a possibility that stock markets will do surprisingly well in the next few weeks. Strong rallies would eventually leave markets susceptible to partial pullbacks, including some right-hand base formation extension.

“How could strong rallies possibly occur when everyone is talking about depression? The answers can be found in sentiment and liquidity. Today, most people are either incredibly bearish or despondent, but extreme forecasts are seldom accurate, as I have mentioned before. However, there is plenty of liquidity in many portfolios and governments have significantly increased money supply in recent months. A rising stock market would force a reappraisal by bears, leading to a reversal of short positions, while long-only investors put more of their cash back into the stock market.”

My view is that stock markets, in general, are still caught between the actions of central banks furiously fending off a total economic meltdown on the one hand, and a grim economic and corporate picture on the other. While we figure out whether we are in a normal bounce or witnessing the start of something bigger, I am not averse to selective stock picking - picking out the choice morsels, so to speak.

As far as specific countries are concerned, I alluded to the Year of the Ox in my “ Performance Round-up ” of last week and mentioned that this is regarded as a sign of prosperity that has been very rewarding in the history of China. And what a start to the year it has been with the Shanghai Composite Index gaining 9.6% during the past week.

The chart pattern (see graph below) shows arguably one of the best base formations of the major stock market indices, followed by Friday's breakout. Although the Index is still down by 64.2% since its high of October 16, 2007, it has moved to the top slot among global stock market performances for the year to date with returns of +19.8% (local currency) and +19.4% (US dollar terms).

For more discussion about the direction of stock markets, also see my post “ Video-o-rama: Stimulus ad nauseum “.

Economy

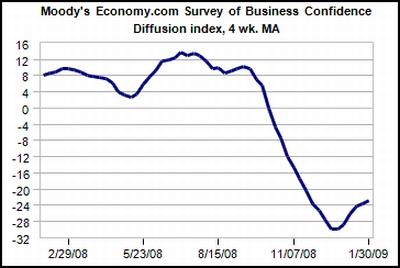

“Global businesses remain very pessimistic. Sentiment is dark across the globe. Those that work in government are most worried, followed by businesses in financial and business services,” said the latest Survey of Business Confidence of the World conducted by Moody's Economy.com . “Pricing power has sharply eroded, suggesting that deflation is increasingly likely. The only silver lining is that business confidence has not declined further since hitting bottom in mid-December.”

The latest US economic reports were less grim in some instances than in previous reports, with a few indicators showing that the pace of decline could be slowing down. This view is shared by Nouriel Roubini ( RGE Monitor ) who wrote in Forbes : “In the US … the second derivative of growth and of other economic indicators is approaching positive territory (i.e. growth is still negative, but GDP may be falling at a slowing rate).”

A snapshot of the week's US economic data is provided below. (Click on the dates to see Northern Trust 's assessment of the various reports.)

Friday, February 6

• Employment Report: Severity of weakness will stimulate votes for fiscal stimulus under consideration

Thursday, February 5

• Initial Claims: Labor market situation is dismal

• Productivity: Advanced in fourth quarter

• Factory Orders: Inventories/shipments ratio keeps advancing

Tuesday, February 4

• ISM Non-Manufacturing Survey: Pace of deceleration is slowing

Monday, February 2

• Senior Loan Officer Survey: Includes positive aspects

• Consumer Spending: Significant reduction

• ISM Manufacturing Survey: Positive news, but more is necessary

• Construction Spending: Remains week

BCA Research added: “In nominal terms, consumer spending declined at an annualized pace of 11% in the three months to December - the largest contraction since the 1930s. For most consumers and companies it is the trend in nominal dollars that matters, not the statistical artifact of ‘real' dollars, measured in the national accounts. The need for dramatic stimulus is obvious: declining nominal activity points to a deepening financial crisis.”

Elsewhere in the world, the Bank of England (BoE) slashed its key repo rate by 50 basis points to 1.0% (the lowest level since the BoE was formed in 1694), whereas the Reserve Bank of Australia (RBA) cut its cash rate by 100 basis points to 3.25% (the lowest level in two decades). As expected, the European Central Bank (ECB) maintained its key policy rate at 2%, but will in all likelihood reduce the rate further in coming months as economic indicators show the Eurozone still contracting and inflationary pressures easing.

Further afield, the International Monetary Fund halved its 2009 growth forecast for Asia from 4.9% to 2.7%. “Clearly the hopes that Asia would experience a mild downturn while the global economy retrenched have now been firmly dismissed,” said Glenn Maguire, Asia chief economist at Société Générale, in the Financial Times .

Japan, according to Roubini , is entering another severe slump, one that looks worse than that of other advanced economies, and the fall is still accelerating, resembling a severe case of stag-deflation.

More dire news came from the Russian economics ministry, forecasting the economy's slide into recession in 2009. GDP growth is forecast to be -0.2% this year compared with 5.6% in 2008. Meanwhile, the ruble has slumped by 35% against the US dollar since August to its weakest level in 11 years. Concerns about the downgrading of the country's credit rating and a $200 billion reduction of its currency stockpile weighed on sentiment.

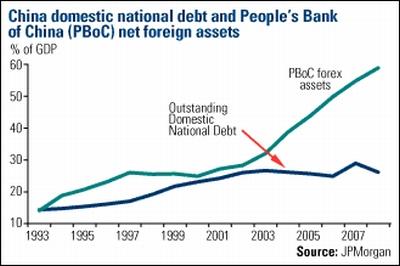

On a more positive note, strong Chinese bank lending and manufacturing data provided signs that the government's attempts to spend its way out of the economic slowdown are starting to show results. China may also consider tapping into its $1.95 trillion foreign reserves to help boost demand. With domestic government debt only 16.2% of GDP, the country is in a better position to do so than most major economies, according to US Global Investors .

Week's economic reports

Click here for the week's economy in pictures, courtesy of Jake of EconomPic Data .

| Date | Time (ET) | Statistic | For | Actual | Briefing Forecast | Market Expects | Prior |

| Feb 2 | 8:30 AM | Personal Income | Dec | -0.2% | -0.4% | -0.4% | -0.4% |

| Feb 2 | 8:30 AM | Personal Spending | Dec | -1.0% | -0.8% | -0.9% | -0.8% |

| Feb 2 | 10:00 AM | Construction Spending | Dec | -1.4% | -1.0% | -1.2% | -1.2% |

| Feb 2 | 10:00 AM | ISM Index | Jan | 35.6 | 32.0 | 32.5 | 32.9 |

| Feb 3 | 10:00 AM | Pending Home Sales | Dec | 6.3% | -0.5% | 0.0% | -3.7% |

| Feb 3 | 2:00 PM | Auto Sales | Jan | - | NA | NA | 3.6 m |

| Feb 3 | 2:00 PM | Truck Sales | Jan | - | NA | NA | 4.2 m |

| Feb 4 | 8:15 AM | ADP Employment Change | Jan | -522K | -525K | -535K | -659K |

| Feb 4 | 10:00 AM | ISM Services | Jan | 42.9 | 39.5 | 39.0 | 40.1 |

| Feb 4 | 10:30 AM | Crude Inventories | 01/30 | 7.17 m | NA | NA | 6.2 m |

| Feb 5 | 8:30 AM | Initial Claims | 01/31 | 626K | 585K | 580K | 591K |

| Feb 5 | 8:30 AM | Productivity -Prel | Q4 | 3.2% | 1.0% | 1.5% | 1.5% |

| Feb 5 | 8:30 AM | Unit Labor Costs | Q4 | 1.8% | 3.0% | 2.8% | 2.6% |

| Feb 5 | 10:00 AM | Factory Orders | Dec | -3.9% | -3.5% | -3.1% | -6.5% |

| Feb 6 | 8:30 AM | Average Workweek | Jan | 33.3 | 33.3 | 33.3 | 33.3 |

| Feb 6 | 8:30 AM | Hourly Earnings | Jan | 0.3% | 0.3% | 0.2% | 0.4% |

| Feb 6 | 8:30 AM | Nonfarm Payrolls | Jan | -598 | -525K | -540K | -577K |

| Feb 6 | 8:30 AM | Unemployment Rate | Jan | 7.6% | 7.5% | 7.5% | 7.2% |

| Feb 6 | 3:00 PM | Consumer Credit | Dec | -$6.6B | -$3.0 | -$3.5B | -$11.0B |

Source: Yahoo Finance , February 6, 2009.

In addition to Fed Chairman Bernanke's testimony on the Central Bank's lending programs in Washington (Tuesday, February 10), the US economic highlights for the week include the following: Wholesale Inventories on Tuesday, the Trade Balance and Treasury Budget on Wednesday, Initial Jobless Claims, Retail Sales and Business Inventories on Thursday, and Michigan Sentiment on Friday.

Click here for a summary of Wachovia's weekly economic and financial commentary.

Markets

The performance chart obtained from the Wall Street Journal Online shows how different global markets performed during the past week.

Source: Wall Street Journal Online , February 6, 2009.

In a world faced with untold uncertainty, my concluding thought today is borrowed from Briefing.com , saying that the situation reminds them of a scene in the Oscar-winning movie Terms of Endearment where Shirley MacLaine's character is confronted with news from a doctor that her daughter has a malignant tumor. Upon hearing this, she asks what she should do. The doctor responds that she tells family members “to hope for the best, but prepare for the worst”. To this McClain's character responds, “And they let you get away with that?” Don't we all feel like the doctor these days?

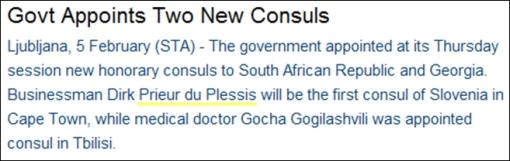

My bags are packed and I am ready to make my way to the airport for a ten-day visit to Europe (Dublin, London, Geneva and Ljubljana). For those not familiar with Ljubljana, it is the charming capital of Slovenia - a country situated in the heart of Central Europe (see my post “ Slovenia - the best-kept secret of Central Europe “). And this country will in future be playing a very special role in my life as I have just been appointed as its Honorary Consul for South Africa. And so begins my career as a part-time diplomat …

That's the way it looks from Cape Town.

Richard Russell (Dow Theory Letters): Survival plan for unprecedented situation

“Don't be married to any specific scenario. Anything may happen in response to the current situation. Follow the market - the market will know what's happening before anyone else.

“The best survival plan is to be diversified. Nobody knows who or what will be ‘the last investment standing'. Will it be Treasury paper, high-grade bonds, real estate, diamonds, T-bills, cash, top-grade corporate stocks or gold?

“T-bills are the choice of many sophisticated investors. But T-bills are denominated in dollars, and dollars are vulnerable as are bonds or any other items denominated in Federal Reserve notes (‘dollars').

“Real estate and diamonds represent intrinsic wealth, although they are not instantly liquid, meaning that they cannot be instantly turned into cash.

“Gold has been accepted as wealth for thousands of years. When all other forms of supposed wealth crashes (deflates) or becomes suspect, the last wealth asset to stand will be gold. Gold has no counter-party nor has it any debt aligned against it. Gold needs no central bank to ensure its acceptance. Gold is accepted everywhere and in any quantity as a form of indestructible, eternal wealth.

“Today, investment money is so suspicious of the viability of any given asset that they are placing their money in an item that bears the full faith and credit of the US government - I'm referring to Treasury paper. Actually, one major worry with T-bills is a possible collapse of the dollar.

“The following are my suggestions as to where an investor might place his money.

“AIG bonds (the government has bought the preferred stock of AIG, and the bonds should rate higher). Invest with the government.

“PHK - the high-yield fund run by PIMCO - speculative, but an interesting fund that's 60% in investment-grade bonds.

“CD's that are backed by the FDIC up to $250,000.

“Gold (GLD or CEF) or actual gold coins if possible.”

Source: Richard Russell, Dow Theory Letters , February 3, 2009.

The New York Times: Senators reach accord on stimulus plan

“Senate Democrats reached an agreement with Republican moderates on Friday to pare a huge economic recovery measure, clearing the way for approval of a package that President Obama said was urgently needed in light of mounting job losses.

“The deal, announced on the Senate floor, was a result of two days of tense negotiations and political theater. Mr. Obama dispatched his chief of staff to Capitol Hill to help conclude the talks and reassure senators in his own party, and he called three key Republicans to applaud them for their patriotism.

“The fine print was not immediately available, and the numbers were shifting. But in essence, the Democratic leadership and two centrist Republicans announced they had struck a deal on about $110 billion in cuts to the roughly $900 billion legislation - a deal expected to provide at least the 60 votes needed to send the bill out of the Senate and into negotiations with the House, which has passed its own version.

“The pact, which is expected to be approved in the next few days, was concluded just hours after the Labor Department announced that 598,000 jobs were lost in January.

“As the negotiations were under way, lawmakers said it was time to stop quibbling about the exact parameters of the legislation - which mixes safety-net spending, tax cuts and a huge infusion of dollars into federal programs - and to begin work toward a final agreement that could be sent to Mr. Obama next week.”

Source: Carl Hulse and David Herszenhorn, The New York Times , February 6, 2009.

CEP News: President Obama says US must avoid a “trade war”

“US President Barack Obama signalled on Tuesday that a controversial ‘Buy American' provision in his stimulus bill would be reviewed in order to prevent a global trade war.

“In an ABC news interview on Tuesday, Obama said that any clause in the stimulus bill being considered by US lawmakers that would violate World Trade Organization agreements and signal protectionism would be a ‘mistake right now'.

“‘That is a potential source of trade wars that we can't afford at a time when trade is sinking all across the globe,' he said. ‘We need to make sure that any provisions that are in there are not going to trigger a trade war.'

“Obama's comments come following a chorus of criticism from leaders around the world who object to a proposed ‘Buy American' clause in the stimulus bill that would require infrastructure projects to use only manufactured goods made in the United States.

“Canada's Ambassador to the United States, Michael Wilson, warned earlier in the day that such a policy could spark a global trade retaliation.

“‘A rush of protectionist actions could create a downward spiral like the world experienced in the 1930s,' Wilson wrote in a letter to Republican and Democratic Senate leaders.”

Source: CEP News , February 3, 2009.

Bloomberg: Faber - US stimulus may lead to “dire consequences”

“Marc Faber, publisher of the ‘Gloom, Boom & Doom Report', talks with Bloomberg's Carol Massar about the prospects for a US economic stimulus package. Faber, speaking from Hong Kong, also discusses gold prices, the appeal of US technology stocks and the outlook for the banking industry.”

Source: Bloomberg , February 6, 2009.

Yahoo Finance: Peter Schiff - stimulus bill will lead to “unmitigated disaster”

“The fiscal stimulus bill being debated in Congress not only won't help the economy, it will make the recession much worse, says Peter Schiff, president of Euro Pacific Capital.

“Schiff scoffs at the notion the economic decline is starting to level off and concedes no government action means a ‘terrible' recession. But the path of increased government intervention will lead to ‘unmitigated disaster', says Schiff, who gained notoriety in 2007-08 for his prescient calls on the housing bubble and US stocks.

“The problem, he says, is the government is trying to perpetuate a ‘phony economy' based on borrowing and spending. With the US consumer tapped out, the government is ‘now taking on the mantle' of consumer of last resort, he continues, predicting the bond bubble will soon burst - if it hasn't already - ultimately leading to a collapse of the dollar and an ‘inflationary depression worse than anything any of us have ever seen'.

“If nothing else, Schiff is a nonpartisan critic of American policymakers, comparing President Bush to Herbert Hoover and President Obama to FDR, and neither in a favorable way.”

Source: Aaron Task, Yahoo Finance , February 6, 2009.

Bloomberg: Gross says trillions needed to avoid “mini-depression”

“Bill Gross, co-chief investment officer of Pacific Investment Management Co., talks with Bloomberg's Kathleen Hays about the need for a US stimulus package. Gross, speaking in Newport Beach, California, also discusses his bond picks.”

Source: Bloomberg , February 5, 2009.

Bloomberg: Volcker urges more transparency in hedge funds

Source: Bloomberg (via YouTube ), February 5, 2009.

The New York Times: New plan to help banks sell bad assets

“After weeks of internal debate, the Obama administration has settled on a plan to inject billions of dollars in fresh capital into banks and entice investors to purchase their most troubled assets.

“The new financial industry rescue plan, to be outlined in broad terms on Monday in a speech by the Treasury secretary, Timothy F. Geithner, will not require banks to increase their lending. That is despite criticism that institutions that already received money from the Troubled Asset Relief Program, or TARP, either hoarded it or used the funds to acquire other banks.

“The incentives to investors could be in the form of commitments to absorb some of the losses from any assets they purchase, should their values continue to decline. The goal is to relieve the banks of their worst assets so that private investors might then provide more capital.

“Officials hope that part of the plan is not labeled a ‘bad bank' administered by the government, although they expect that some might call it that.

“No matter what it is called, the government would assume some of the risk of declining assets at the heart of the economic crisis. But by relying on a combination of private investors and government guarantees, the administration hopes to reduce its exposure to losses and avoid the problem of having to place a value on assets that the institutions have been unable to sell.

“A central element of the plan would be a major expansion of a lending facility begun in November by the Federal Reserve Bank of New York when it was headed by Mr. Geithner. The program, which was initially financed by $200 billion in Fed money and $20 billion in seed capital from the $700 billion bailout fund, lent money to investors to buy securities backed by student, auto and credit card loans, as well as loans guaranteed by the Small Business Administration.”

Source: Stephen Labaton, The New York Times , February 6, 2009.

Bill Gross: Stop the decline in asset prices

“The current financial and economic crisis is difficult to appreciate, not only for the drop in elevation, but because of the swiftness of the declines. It's been a Wile E. Coyote 12 months - straight down like a dead weight.

“A year ago, global equity prices were nearly twice today's levels and recession was only a whisper on the lips of the gloomiest of economists. Today, descriptions drawing parallels to the Great Depression make it obvious that a major shift in economic growth and its historic financial model, as well as policy prescriptions for its revival, are underway. Most of the world's connected economies and its citizens are in shock, conscious but not fully aware of the seismic shifts that will unfold in future years.

“PIMCO's thesis for several years has held that the levered global economy long ago morphed from a banking-dominated regime to one that hid behind securitized lending and structures resembling a ‘shadow banking' system. SIVs, hedge funds, CDOs and increasingly levered mortgage and investment banks fueled asset appreciation in all investment markets, which in turn propelled real economic growth and employment to unsustainable levels.

“But, with the US housing prices as its trigger, the deleveraging process did a Wile E. Coyote and headed over the cliff in mid-year 2007, dragging down almost all asset prices except government bonds. The real economy followed shortly thereafter, not just in the US, but globally, proving that linkages work on the ‘down' as well as the upside.

“To PIMCO, the remedy for this deflationary deleveraging and mini-depression is simple and almost axiomatic: stop the decline in asset prices. If that can be done, the real economy will level out as well. When home prices stop going down, newly created households will be more willing to take a chance on ownership as opposed to renting. If stock prices consolidate, recently burned investors will be more willing to invest, as opposed to stuffing their 401(k) mattresses with Treasury bills. Business investment, jobs, and profits should follow quickly behind.”

Source: Bill Gross, Pimco - Investment Outlook , February 2009.

Edmund Conway (Telegraph): Recession - glimmers of hope?

“The pace of economic decline is slowing. Housing sales are picking up, even if prices are falling. Credit markets have begun to thaw.

“This is the time-honoured pattern you expect to see when the downward spiral burns itself out and the cycle slowly starts to turn, helped this time by an unprecedented global monetary and fiscal blitz. But it may equally be a false dawn.

“The Baltic Dry Index measuring freight rates for iron ore and other bulk goods has been creeping up for two months after crashing 94% in the worst fall in shipping history. Copper prices are also edging up after plunging by two-thirds from their June peak. So are lumber prices.

“The debt markets have opened like a flower in spring, at least in one sense. Companies issued $246 billion in bonds in January, the most since the credit crisis began. Blue-chip groups can borrow again.

“‘The mood is upbeat. There are swathes of cash pouring back into credit,' said Suki Mann, a credit strategist at Société Générale. ‘The market closed down after the Lehmans collapse so there was a lot of pent-up demand, but they are having to pay materially higher spreads than pre-Lehmans.'

“So far this has not helped the rest of the corporate universe. Average yields on BBB-rated debt are a prohibitive 19.6%. ‘The market is absolutely closed. There is no trickle-down yet,' he said.

“The interbank freeze has started to thaw, again in one sense. David Buik, from BGC Partners, said interest spreads on three-month dollar Libor have come down to 1% from the extremes above 2% at the height of the panic. ‘The cost of money is coming down, but the banks are still not lending to each other. It's virtually moribund,' he said.

“The US Federal Reserve's loan survey this week showed that lending is again picking up, albeit tentatively. The number of banks expecting to tighten credit has fallen from 80% in the autumn to nearer 60%, the lowest in a year.”

Click here for the full article.

Source: Ambrose Evans-Pritchard, Telegraph , February 5, 2009.

Bloomberg: Roubini says ECB “wrong”, rate cuts too little, too late

“Nouriel Roubini, professor at New York University's Stern School of Business, talks with Bloomberg's Ellen Pinchuk about the global economy and European Central Bank monetary policy.”

Source: Bloomberg , February 4, 2009.

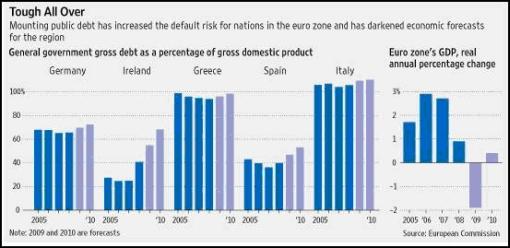

European Commission: Escalating public debt

Hap tip: Phil's Stock World .

Financial Times: IMF cuts forecast for Asian growth

“The scale of the economic slowdown in Asia was starkly underlined on Tuesday when the International Monetary Fund virtually halved its 2009 growth forecast for the region.

“The IMF slashed its forecast to 2.7% from an estimate of 4.9% made only two months ago. The move came as both Australia and Japan announced new measures to sustain their flagging economies.

“In Australia, the government unveiled a A$42 billion ($26.5 billion) fiscal stimulus and the central bank cut interest rates to 3.25%, the lowest level since the 1960s. In Tokyo, the Bank of Japan unveiled a plan to spend up to Y1,000bn ($11.2 billion) to buy shares owned by banks amid growing concerns over the impact of falling stock prices on the financial system.

“‘Clearly the hopes that Asia would experience a mild downturn while the global economy retrenched have now been firmly dismissed,' said Glenn Maguire, Asia chief economist at Société Générale.

“‘There is a clear realisation that this is going to be a major economic readjustment and economies that are most leveraged to the global trade cycle will be most affected.'”

Source: Raphael Minder and Christian Oliver, Financial Times , February 3, 2009.

CEP News: Obama unveils economic recovery advisory board

“US President Barack Obama unveiled a new advisory board consisting of former government officials, union members and executives from some of the country's largest firms who will provide guidance on how the US should respond to the economic crisis.

“The Economic Recovery Advisory Board will be led by former Fed Chairman Paul Volcker, Obama announced.

“The members will include: former Securities and Exchange Commission Chairman William Donaldson, former Fed Vice-Chairman Roger Ferguson, UBS Americas CEO Robert Wolf, GE CEO Jeffrey Immelt, Yale University's CIO David Swensen, Caterpillar CEO Jim Owens, and Service Employees International Union Secretary-Treasurer Anna Burger.

“If the US government does not act soon, the US economy will continue to lose jobs and the downturn will accelerate, Obama said as he unveiled the board on Friday.”

Source: CEP News , February 6, 2009.

CEP News: Citigroup unveils plans to lend $36.5 billion

“In an effort to pass the benefits of the TARP onto the real economy, Citigroup unveiled plans to spend $36.5 billion in a series of new initiatives to spur credit card, mortgage and other consumer and business lending operations.

“The aims of the initiatives are, ‘to help expand available credit for consumers and businesses; restore liquidity and stability to the capital markets; and support the recovery of the US economy', according to a new quarterly publication from Citigroup detailing how it plans to spend part of the $45 billion it borrowed from the US Treasury's Troubled Asset Relief Program.

“The firm plans to make $25.7 billion in direct loans available to homebuyers and support the mortgage-backed securities market, spend $2.5 billion in consumer and business loans, $1.0 billion for student loans, $5.9 billion in credit card lending and $1.5 billion in corporate lending activity.

“Citigroup also said it made $75 billion in loans in the fourth quarter and plans to continue its partnership with the government, ‘to increase available lending and liquidity in the US financial markets and to help put the US economy back on track,' Citi Chief Executive Officer Vikram Pandit said.”

Source: Financial Times , February 3, 2009.

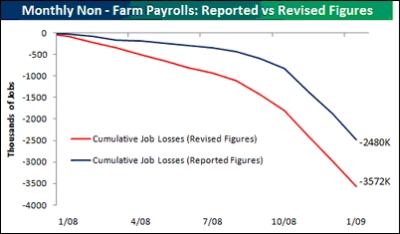

Bespoke: Cumulative job losses - getting worse with time

“While they say things get better with time, the jobs picture is at least one exception. Today's release of monthly non-farm payrolls showed that employers cut 598K jobs during the month of January. As shown, the US economy has lost a total of 3.6 million jobs since the start of 2008 with the bulk of those declines (80%) coming during the last five months. While the magnitude of the decline in jobs has been large, the pace of downward revisions is making things even worse.

“In the chart below, we show the cumulative decline in monthly jobs using the reported figures on the day of the initial release as well as the most recently revised numbers. As shown, based on reported numbers, the US economy would have lost 2.48 million jobs since the start of 2008. However, once we take into account the negative revisions, the US economy has lost another 1.1 million jobs, representing a 44% increase in jobs lost.”

Source: Bespoke , February 6, 2009.

CNBC: El-Erian on the employment picture

“The big loss of jobs will push the Obama administration to do more, says Mohamed El-Erian, Pimco co-chief investment officer/co-CEO.”

Source: CNBC , February 6, 2009.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.