Platinum and Commodities Bubble, Deflationary Crash

Commodities / Platinum Feb 09, 2009 - 06:19 AM GMTBy: Kyle_L_Lucas

Over the weekend I received a note from a reader asking me to evaluate the market for Platinum. I hope she doesn't mind if I just quote the better part of her note to me: good morning, Lucas. A theme that I'd like you to look at - if it interests you - are platinum futures. The platinum/gold ratio is interesting. I read that the reason platinum sold off so badly was that outfits like GM had to liquidate their usual 6 month supply stockpiles. I've been noticing that some of the producers in the PGM sector have been 'coming alive'; and showing some pretty good relative strength, even in relation to gold miners. Anyway, looking at this etf, PGM, also showing signs of life...as you know, PGM holds futures; I would be inclined to buy it; but don't know how to evaluate the contango issue; so don't know whether a buy here would be a losing play because of the 'roll premium' drag, as it has been, and will continue to be (i believe; but wtf do I know?) with USO, which I would not buy.

Over the weekend I received a note from a reader asking me to evaluate the market for Platinum. I hope she doesn't mind if I just quote the better part of her note to me: good morning, Lucas. A theme that I'd like you to look at - if it interests you - are platinum futures. The platinum/gold ratio is interesting. I read that the reason platinum sold off so badly was that outfits like GM had to liquidate their usual 6 month supply stockpiles. I've been noticing that some of the producers in the PGM sector have been 'coming alive'; and showing some pretty good relative strength, even in relation to gold miners. Anyway, looking at this etf, PGM, also showing signs of life...as you know, PGM holds futures; I would be inclined to buy it; but don't know how to evaluate the contango issue; so don't know whether a buy here would be a losing play because of the 'roll premium' drag, as it has been, and will continue to be (i believe; but wtf do I know?) with USO, which I would not buy.

First of all, let's examine this exchange traded something-or-other called PGM. According to the iPath website , PGM is what they are calling an “Exchange Traded Note,” or ETN for short. This I suppose makes it technically different from an Exchange Trade Fund (ETF) in that the ETN has an expiration or redemption date, whereas an ETF is supposed to be open-ended. The expiration of the PGM ETN is like 2037. But aside from this I'm not quite sure how, if at all, there is a functional difference between an ETF and and ETN. The reader may want to do her own research into the nuances of all these different gambling instruments before committing money.

First of all, let's examine this exchange traded something-or-other called PGM. According to the iPath website , PGM is what they are calling an “Exchange Traded Note,” or ETN for short. This I suppose makes it technically different from an Exchange Trade Fund (ETF) in that the ETN has an expiration or redemption date, whereas an ETF is supposed to be open-ended. The expiration of the PGM ETN is like 2037. But aside from this I'm not quite sure how, if at all, there is a functional difference between an ETF and and ETN. The reader may want to do her own research into the nuances of all these different gambling instruments before committing money.

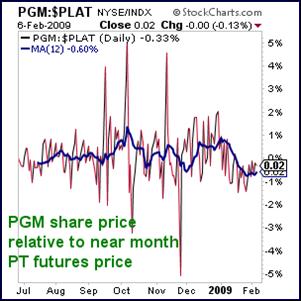

As for the 'roll premium' in the Platinum market, that's not a big issue at the moment. If you look at the ratio here of PGM against near month Platinum futures you will notice that the trend has been for the price of PGM to keep up pretty well with the near month price of the futures market. The volality of the ratio probably has more to do with the illiquidity of the Platinum market and PGM than anything else.

On Friday the closing price of April futures was 1004.3, while the July contract closed at 1008, so that indicates an annualised contango of about 1.5 percent, which is slightly higher but still in the same neighborhood of Gold's contango. In other words, the contango is nothing to worry about right now for Platinum. What should be of more concern to the potential buyer of PGM (or for that matter Platinum futures themselves) is getting a bad order fill due to how thin these markets trade. If entering a market order make sure the bid-ask spread isn't excessive.

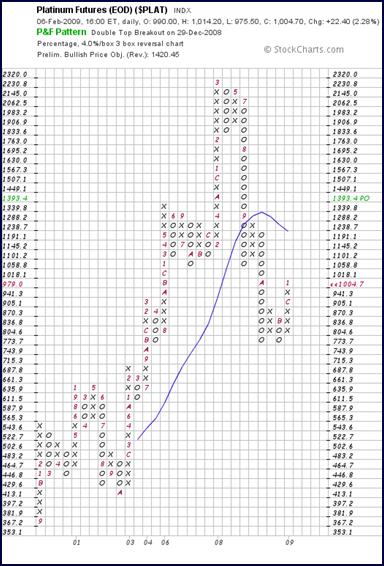

Platinum prices have made a decent rebound already from the lows last year. But the recent price formation seems to be indicating that there is the potential for further upside. The Point and Figure chart I've included gives a price objective of nearly 1400, and the .325 Padovan retracement is at 1255 and the .43 at 1417. If the price continues to move higher from here (which I have no firm conviction about) then I would be surprised if Platinum went higher than 1200 or 1300 on this particular rally.

The last time I studied Platinum, back in October (see this blog post ) I wrote, “I would guess that while platinum could go lower (whether priced in gold or dollars) I doubt it will go tremendously lower. most of the damage is done.”

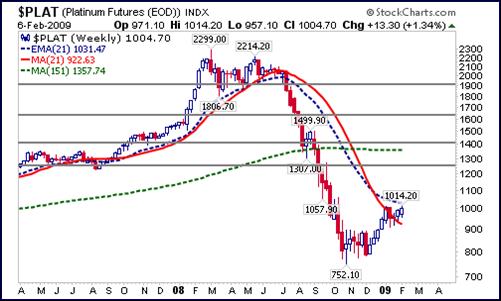

I guess I should have waited another couple weeks to write that post! The Dollar price of Platinum fell another $250 right after I wrote that:

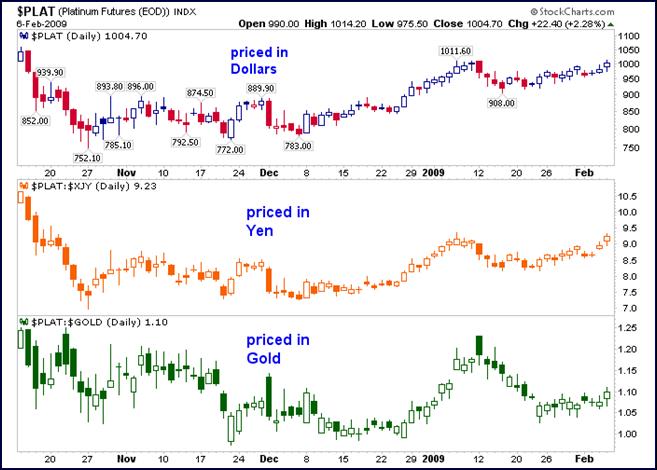

But now the Dollar price has got back almost to exactly where it was, although the Platinum/Gold ratio is still somewhat lower. With Platinum priced just a tad higher than Gold now, it sounds like the white stuff's a good deal compared to the 'yellow metal' (a term I loathe and will hopefully never use again). But the price of Platinum has actually been cheaper than Gold during past recessions and considering that the production of automobiles in the US and Japan has fallen dramatically the last several months I wonder whether the ratio can't fall somewhat below 1 to 1 when the next panic phase hits the markets.

The price appreciation from the lows last year seems entirely due to speculative and investment buying rather than industrial buying. As such, the metal becomes vulnerable to the eventual speculative liquidation. And the higher the price gets pushed in the near-term, the more painful will be the correction.

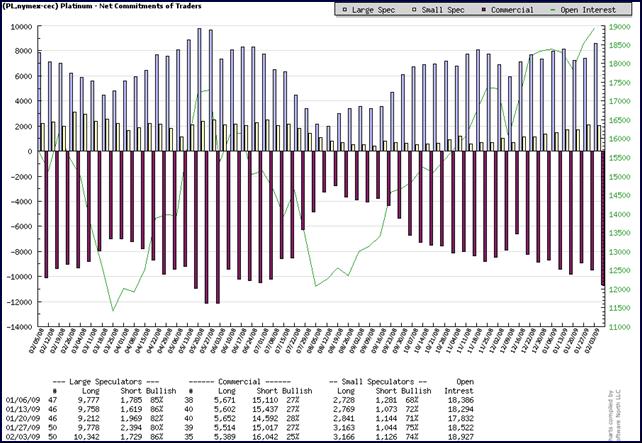

Just look at this Commitment of Traders graph:

Open interest in Platinum futures is now higher than at any point in the last year, while the net speculative long position has also grown rather large again. The chart doesn't mean that prices can't move even higher for a while, but it should make one cautious.

A bet on Platinum now is a bet that either industrial production will rebound this year or there will be a currency crisis, both of which appear rather doubtful to me at the moment.

This doesn't necessarily mean that a moderate, unleveraged purchase of Platinum is a completely bad idea, I just wouldn't get too excited about the metal just yet. Of course, I wouldn't recommend getting too excited about any market right now....

Since we are looking at Platinum we should also examine its sister metal, Palladium. I hope the reader will tolerate a few more charts this morning.

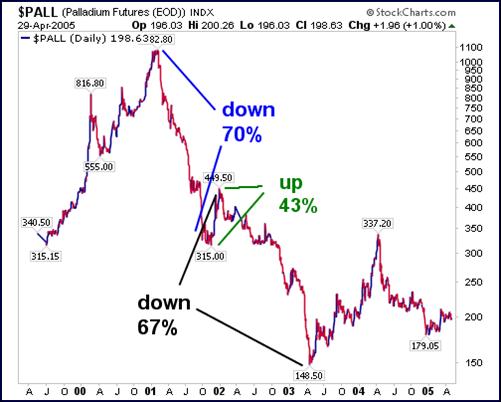

On the first chart are Palladium prices since 1990, the second chart is Platinum over the same period. I won't get into it much here, but you can see that Palladium went through a huge bubble phase about a decade ago. A prelude, if you will, of the overall bubble in commodities that began as Palladium entered its final bubble stage.

Examining how the Palladium bubble played out may be useful for those interested in forecasting the medium-term direction of the Commodities Complex at large and Platinum in particular.

The chart is pretty self-explanatory. Bubble topped, price collapsed 70 percent, price bounced up 43 percent, then collapsed again. At the end of the price deflation the price moved right into the range it was trading when the bubble began.

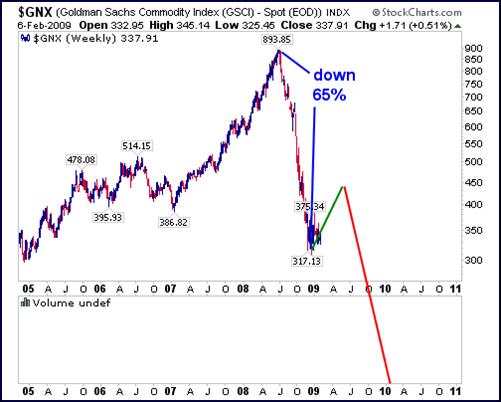

On the next page is a chart of the Goldman Sachs Commodities Index (Spot prices) and below that a chart of Platinum prices. This being a full service newsletter, I've done the math for you on each chart and drew a couple extrapolation lines.

Think of Palladium as your 'prototypical' ( definition #4 ) bubble. No two bubbles are alike, but they are all pretty similar. If Platinum follows Palladium's script, then we could expect it to jump up another 50 or 100 bucks from here and then crash again to say 350 to 450. If the GSCI index followed the script then it should bottom between 200 and 150.

To corroborate my assertion that bubbles are pretty similar to each other I also include here a chart of the Nikkei index since 1980. The main difference between this one and the Palladium bubble is obviously the time frame, the deflation having played out over a decade (and it may not be done yet!).

To corroborate my assertion that bubbles are pretty similar to each other I also include here a chart of the Nikkei index since 1980. The main difference between this one and the Palladium bubble is obviously the time frame, the deflation having played out over a decade (and it may not be done yet!).

But bubbles don't worry about time. For the same reason that Death doesn't worry about time. And why should it? Time is a concern of the Living. Depending on a climate, a carcass can decompose over the course of a day or 10,000 years. The deflationary side of a bubble is simply the entity's decomposition. No amount of praying or voodoo or 'stimulus' will bring it back to life. The best that can be hoped for is that it gets reïncarnated.

Also of note on this chart of the Nikkei is the bounce of 57 percent rather than the bounce of 43 percent we saw on the Palladium chart.

So the question becomes this: Was the Commodities 'bubble' a Real Bubble, or not? If so then historical precedent speaks strongly for another major wave of price deflation at some point in the future – quite possibly the fairly near future. However, if the price movements of the last decade don't constitute a real bubble, then the lows seen the last few months may not get breached again for years to come, if ever. But that begs the question, if it's not a 'real bubble' then just what the hell is it?

When or if I come up with a satisfactory answer to that question, I'll give it the up-most scrutiny. It could very well be that we discover a new kind of financial phenomenon, the 'Not-Bubble' we might call it. But until then I have no choice but to maintain a very cautious stance regarding commodities. The risk that the corpse hasn't completely decomposed is simply too great to brush under the rug.

Incidentally, I didn't begin this Letter with the intention that I would predict, or insinuate at least, that Platinum will drop to $400 an ounce or whatever. And that is not what I would want the reader to take away from this analytical exercise. I'm not sure where Platinum prices will trend. I just made the effort to explore the situation from what I hope has been a legitimate perspective.

In any case, this Bubble or Not-Bubble theme deserves further attention. If we can figure that out, and then get our portfolios positioned accordingly, then profits shall flow our way. But in the meantime we should remain cautious and keep a good deal of powder dry.

Have a good day, I'll see you tomorrow.

By Kyle Ledbetter Lucas

http://trendandvalue.blogspot.com/

Lucas is something of a philosopher with a knack for financial markets forecasting. He publishes the Trend & Value weblog and the new Trend & Value Letter, an investment newsletter published five mornings a week. Formerly a Precious Metals Broker, Lucas now lives in Quito, Ecuador.

Copyright © 2009 Kyle Ledbetter Lucas - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.