Financial Markets React to Bank Bailout Blackhole

Stock-Markets / Financial Markets 2009 Feb 15, 2009 - 04:33 PM GMT “Words from the Wise” this week comes to you from my abode in a visibly depressed Europe, from where I am compiling this report as welcome relief from gloomy conversations with taxi drivers and cheerless meals in deserted eateries.

“Words from the Wise” this week comes to you from my abode in a visibly depressed Europe, from where I am compiling this report as welcome relief from gloomy conversations with taxi drivers and cheerless meals in deserted eateries.

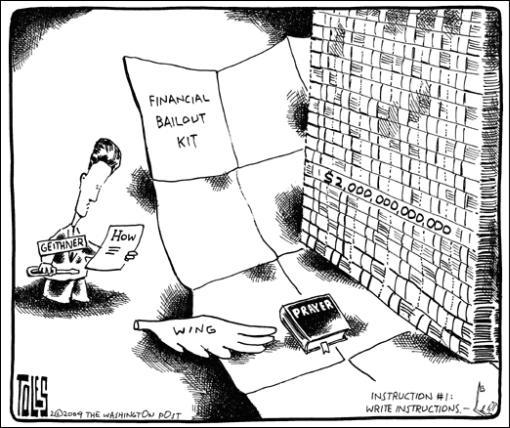

Events during the past few days were dominated by the announcement of US Treasury Secretary Timothy Geithner's financial stability plan and a deal reached by Congress on the economic stimulus bill. However, the much-anticipated bailout bang soon whimpered as investors were disappointed about the lack of “beef”. Meanwhile, markets were also mired in uncertainty on the back of fresh evidence of headwinds facing the global economy - notably in major economies such as the UK, continental Europe and Japan.

Jim Rogers gave the bank rescue plan a big thumbs-down: “(Geithner) … has been dead wrong about everything for 15 years in a row … This (the rescue plan) is not going to solve the problem, it's going to make it worse.”

Referring to the stimulus bill, Steve Forbes said: “It's just a grab bag of every spending proposal that's been banging around Congress for years.”

And Bill King ( The King Report ) commented as follows: “A cure should have something to do with the diagnosis. The classic argument for fiscal stimulus presumes that the central cause of our current economic problems is this: We, the people and our government, are not doing nearly enough borrowing and spending on consumer goods. The government must step in to force us all to borrow and spend more. This diagnosis is tragically comic once said aloud.”

Stock markets were on the receiving end as risk-averse investors sought out the safe havens of the US dollar (+0.8% in the case of the US Dollar Index), gold (+3.1%) and bonds (with the yields of 10-year Bunds and Gilts down by 21 and 17 basis points respectively).

The week's movements of the MSCI Global Index (-3.9%, YTD -9.0%) and MSCI Emerging Markets Index (-0.6%, YTD -2.2%) reflect global investors' skepticism about the rescue plans. Strong performances came from China (+6.4%) and Russia (+14.3%), but still left these markets in the red by 61.9% and 63.0% since their respective bull market highs. As mentioned before, the chart pattern of the Chinese Shanghai Composite Index shows arguably one of the most bullish formations of the major stock market indices.

The major US indices suffered their worst weekly losses this year (to record five losing weeks out of six): Dow Jones Industrial Index -5.2% (YTD -10.6%), S&P 500 Index -4.8% (YTD -8.5%), Nasdaq Composite Index -3.6% (YTD -2.7%) and Russell 2000 Index -4.7% (YTD -10.2%).

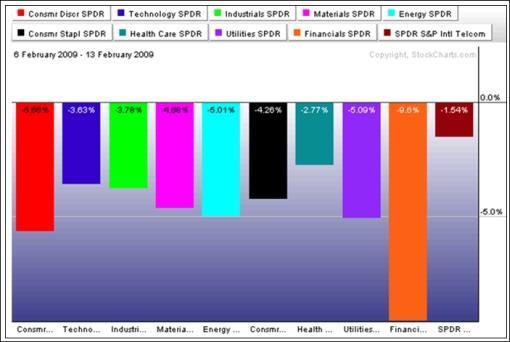

John Nyaradi ( Wall Street Sector Selector ) pointed out that among the exchange-traded funds (ETFs) none of the main economic sectors registered positive returns, as summarized in the chart below. Not shown, the KBW Bank Index ETF (KBE) lost 14.3% on the week, and the Dow Jones US Real Estate Index ETF (IYR) 12.0%. The ProShares Short Dow30 ETF (DOG) led the way among inverse funds with a gain of +5.3%.

Source: StockCharts.com

As investors became more fearful of the economic situation, gold bullion (+3.1%) assumed its traditional safe-haven role. “Inflows into gold-backed exchange-traded funds surged in January, pushing their bullion holdings to an all-time high of 1,317 tons. Last month's flows of 105 tons were above September's previous record of 104 tons, and absorbed about half the world's gold mine output for January,” said Barclays Capital, as reported by the Financial Times .

The chart below shows the long-term trend of the yellow metal (green line) together with a 14-month rate of change (ROC) indicator (red line). Monthly indicators come in handy for defining the primary trend. In this case the ROC line above zero depicts the bull market in bullion that commenced in 2001. And there is more to come: According to Gary Dugan , the chief investment officer of Merrill Lynch, gold prices may hit US$1,500 an ounce in the next 12 to 15 months.

Source: StockCharts.com

In addition to last week's bailout actions, policymakers are also working on a housing subsidy plan that will use government money to help reduce interest rates for struggling borrowers. The details are to be announced by President Obama on Wednesday.

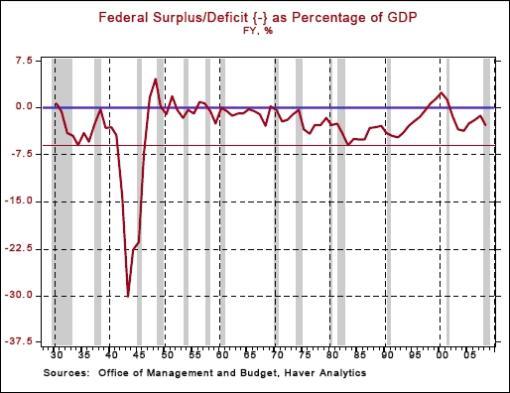

Needless to say, Capitol Hill's various actions come at a hefty price. According to The Wall Street Journal , Strategas Research estimates that the federal budget will work out to roughly 13.5% of GDP in 2009. Asha Bangalore ( Northern Trust ) added: “2009 will go down in history as the year during which the US economy recorded the largest federal budget deficit as a percent of GDP in a span of eighty years, excluding the war years. The budget deficit as a percent of GDP through the war years of 1942 to 1945 was 14.2%, 30.3%, 22.7% and 21.5%, respectively.”

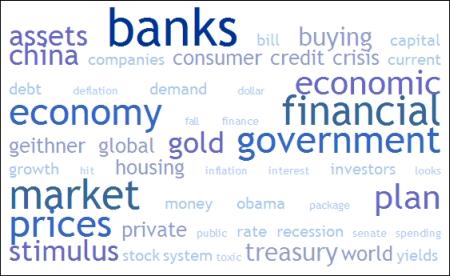

Next, a tag cloud of the text of all the articles I have read during the past week. This is a way of visualizing word frequencies at a glance. As the saying goes: A picture paints a thousand words …

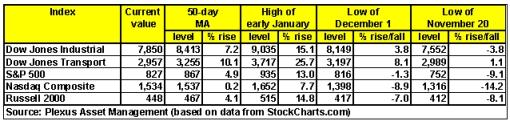

But back to the stock market. Key resistance and support levels for the major US indices are shown in the table below. All the indices are trading below their 50-day moving averages and the Industrial and Transportation Averages have also breached the December 1 lows. The all-important November 20 lows are now within close reach - already broken by the Transportation Average - and must hold in order to prevent considerable technical damage.

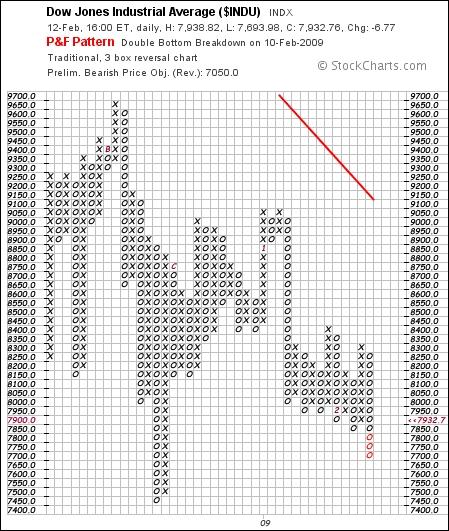

Richard Russell ( Dow Theory Letters ), 84-year old doyen of investment newsletter writers, interprets the technical situation as follows: “The Point & Figure chart below may currently be the most important single chart in the world. This is the DJ Industrial Average, and it's in the act of testing its November 20 low. If the Dow violates its low, it will have confirmed the prior bearish penetration of the Transportation Average. If that happens, the primary bear market will be reconfirmed. But if the Industrials stubbornly refuse to break to a new low, then the inference is that something else is happening. The inference is that the bear market may be forming a temporary bottom.”

“What I think we've seen, so far, is the end of forced selling. At this point, professionals are trying to gauge whether the huge market collapse of 2007-2008 has discounted the worst to come or whether ‘the worst' still lies ahead,” said Russell. “The drama should be played out over the next week or so.”

Given all the cross-currents, short-term movements are almost impossible to predict and traders will simply have to remain level-headed and wait for Mr Market to show his hand, especially as far as the November 20 lows are concerned.

For more discussion about the direction of stock markets, also see my recent posts “ Finally, the plan … sort of ” and “ Video-o-rama: Risk appetite fades on stimulus gloom “.

Economy

“There is no let-up in the dark pessimism that engulfs nearly all businesses across the globe. Global business sentiment weakened again in early February back close to the record low set in mid-December,” said the latest Survey of Business Confidence of the World conducted by Moody's Economy.com . “Confidence is poor across the globe; if there is a distinction it is that Asian businesses are a bit more upbeat than businesses everywhere else.”

A snapshot of the week's US economic data is provided below. (Click on the dates to see Northern Trust 's assessment of the various reports.)

Friday, February 13

• Fiscal stimulus package in a nutshell

• Federal budget deficit in turbulent times

• Consumer sentiment remains gloomy

Thursday, February 12

• Retail sales stabilized in January, future remains gloomy

Wednesday, February 11

• Sharp drop in exports and imports reflects global recession

Tuesday, February 10

• Geithner unveils financial stability plan

Monday, February 9

• Market spreads - moving in the desired direction but more is necessary in the mortgage market

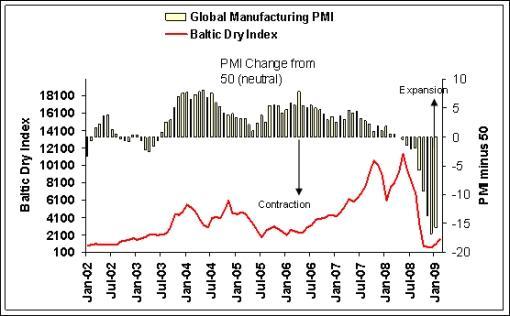

In last Sunday's “ Words from the Wise ” I referred to the surge in the Baltic Dry Index (BDI) - measuring freight rates for iron ore and other bulk goods. The Index has gained 188% over the past two months after plunging by 94% since its high in May. In my opinion, the rally in the BDI is in the expectation (or, should I say, “hope”) that the manufacturing Purchasing Managers' Indices (PMIs) will start improving, i.e. moving closer to the neutral level of 50 (see graph below). This does not mean the global economy will expand, but merely that the trough of the logjam in international trade might have been reached. Not shown, the trends of the BDI and credit spreads follow a strong inversely correlated path.

Source: Plexus Asset Management

Week's economic reports

Click here for the week's economy in pictures, courtesy of Jake of EconomPic Data .

Date |

Time (ET) |

Statistic |

For |

Actual |

Briefing Forecast |

Market Expects |

Prior |

| Feb 10 | 10:00 AM | Wholesale Inventories | Dec | -1.4% | -0.7% | -0.7% | -0.9% |

| Feb 11 | 8:30 AM | Trade Balance | Dec | -$39.9B | -$36.0B | -$35.7B | -$41.6B |

| Feb 11 | 2:00 PM | Treasury Budget | Jan | - | NA | -$75.0B | -$83.6B |

| Feb 12 | 8:30 AM | Initial Claims | 02/07 | 623K | 600K | 610K | 631K |

| Feb 12 | 8:30 AM | Retail Sales | Jan | 1.0% | -0.6% | -0.8% | -3.0% |

| Feb 12 | 8:30 AM | Retail Sales ex-auto | Jan | 0.9% | -0.6% | -0.4% | -3.2% |

| Feb 12 | 10:00 AM | Business Inventories | Dec | -1.3% | -1.2% | -0.9% | -1.1% |

| Feb 13 | 10:00 AM | Mich Sentiment-Prel | Feb | 56.2 | 62.0 | 60.2 | 61.2 |

Source: Yahoo Finance , February 13, 2009.

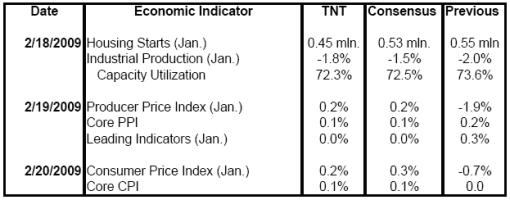

In addition to Fed Chairman Bernanke speaking at the National Press Club in Washington (Wednesday, February 18) and the Bank of Japan's monetary policy announcement (Thursday, February 19), the US economic highlights for the week include the following:

Source: Northern Trust

Click the links below for the following reports:

• Wachovia's Weekly US Economic & Financial Commentary (February 13, 2009)

• Wachovia's Global Chartbook (February 2009)

Markets

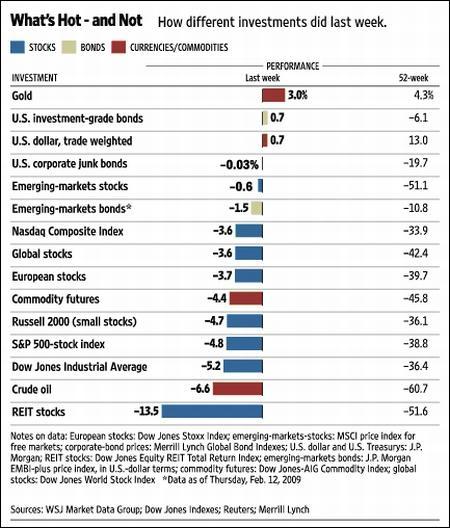

The performance chart obtained from the Wall Street Journal Online shows how different global markets performed during the past week.

Source: Wall Street Journal Online , February 13, 2009.

“It is the markets' job to reallocate money from the ignorant to the intelligent, from the lazy to the hard working and studious, from the naive to the educated, and from the speculator to the investor,” said Barry Ritholtz ( The Big Picture ). Hopefully the “Words from the Wise” reviews offer assistance to Investment Postcards ‘ readers not to get separated from their hard-earned funds in these taxing times.

That's the way it looks from Cape Town (or, more accurately, from “gnomeland”, Switzerland, for the next few days).

Barry Ritholtz (The Big Picture): Stimulus package explained (Q&A)

“Sometime this year, taxpayers will receive an Economic Stimulus Payment. This is a very exciting new program that I will explain using the Q and A format:

Q. What is an Economic Stimulus Payment?

A. It is money that the federal government will send to taxpayers.

Q. Where will the government get this money?

A. From taxpayers.

Q. So the government is giving me back my own money?

A. No, they are borrowing it from China. Your children are expected to repay the Chinese.

Q. What is the purpose of this payment?

A. The plan is that you will use the money to purchase a high-definition TV set, thus stimulating the economy.

Q. But isn't that stimulating the economy of China?

A. Shut up.

“Below is some helpful advice on how to best help the US economy by spending your stimulus check wisely:

If you spend that money at Wal-Mart, all the money will go to China.

If you spend it on gasoline it will go to Hugo Chavez, the Arabs and Al Queda

If you purchase a computer it will go to Taiwan.

If you purchase fruit and vegetables it will go to Mexico, Honduras, and Guatemala (unless you buy organic).

If you buy a car it will go to Japan and Korea.

If you purchase prescription drugs it will go to India

If you purchase heroin it will go to the Taliban in Afghanistan

If you give it to a charitable cause, it will go to Nigeria.

“And none of it will help the American economy. We need to keep that money here in America. You can keep the money in America by spending it at yard sales, going to a baseball game, or spend it on prostitutes, beer (domestic only), or tattoos, since those are the only businesses still in the US.”

Source: Barry Ritholtz, The Big Picture , February 13, 2009.

CEP News: Financial rescue plan unveiled

“The US Treasury's financial rescue package includes up to $1 trillion in insurance financing for the purchase of toxic assets, and the expansion of a Fed lending facility (TALF) - backing up to another $1 trillion in consumer debt including mortgage backed securities. Under the program, the US Treasury will enter into a private and public sector partnership where both sides will provide insurance financing on toxic debt.

“However, the final details of the toxic debt program remain unclear, according to Treasury Secretary Tim Geithner. ‘We are exploring a range of different structures for this program, and we will seek input from market participants and the public as we design it,' Geithner said. ‘We believe this program should ultimately provide up to $1 trillion in financing capacity, but we plan to start it on a scale of $500 billion, and expand it based on what works.'”

Source: CEP News , February 10, 2009.

BCA Research: Where's the beef Mr. Geithner?

“There is still no clarity about how the US will ‘fix' its troubled banking sector.

“Markets yesterday gave Treasury Secretary Geithner's Financial Stability Plan a resounding thumbs down because of a lack of detail about how it will work, following a build-up of expectations that concrete measures were ready to go.

“The plan's tenets are broadly sound - examining and stress testing bank balance sheets and then using government money to re-capitalize banks and eventually induce private sector purchases of the banks' toxic assets; supporting a US$1 trillion Consumer and Business Lending Initiative modeled on the Fed's Term Asset Backed Securities Loan Facility (TALF) to keep credit flowing to the private sector; and, launching a comprehensive program to stabilize the beleaguered housing sector.

“Yet, Geithner offered no specifics on the implementation process needed to identify and value the toxic assets, compel banks to disgorge them, and incentivize private capital to acquire them, though he indicated that details would be forthcoming in the weeks ahead. In short, many of the hurdles that befell the original TARP plan remain in place.

“Bottom line: Financial market risks will remain elevated until policymakers spell out more clearly how banks can be restored to health and encouraged to lend.”

Source: BCA Research , February 11, 2009.

CNN: Yves Smith - “ Banks must be nationalized”

“Blogger Yves Smith says that ‘bad bank' proposals won't work; the government must take direct control of troubled lenders.”

Source: CNN , February 11, 2009.

Martin Wolf (Financial Times): Why Obama's new Tarp will fail to rescue the banks

“Has Barack Obama's presidency already failed? In normal times, this would be a ludicrous question. But these are not normal times. They are times of great danger. Today, the new US administration can disown responsibility for its inheritance; tomorrow, it will own it. Today, it can offer solutions; tomorrow it will have become the problem. Today, it is in control of events; tomorrow, events will take control of it. Doing too little is now far riskier than doing too much. If he fails to act decisively, the president risks being overwhelmed, like his predecessor. The costs to the US and the world of another failed presidency do not bear contemplating.

“What is needed? The answer is: focus and ferocity. If Mr Obama does not fix this crisis, all he hopes from his presidency will be lost. If he does, he can reshape the agenda. Hoping for the best is foolish. He should expect the worst and act accordingly.

“Yet hoping for the best is what one sees in the stimulus programme and - so far as I can judge from Tuesday's sketchy announcement by Tim Geithner, Treasury secretary - also in the new plans for fixing the banking system. I would merely add that it is extraordinary that a popular new president, confronting a once-in-80-years' economic crisis, has let Congress shape the outcome.

“The banking programme seems to be yet another child of the failed interventions of the past one and a half years: optimistic and indecisive. If this “progeny of the troubled asset relief programme” fails, Mr Obama's credibility will be ruined. Now is the time for action that seems close to certain to resolve the problem; this, however, does not seem to be it.

Click here for the full article.

Source: Martin Wolf, Financial Times , February 10, 2009.

Bill King: Tell the truth about toxic assets

“Only weeks ago the fin media hyped the Great & Powerful Geithner as a market savior!

“Though Geithner offered up to $2 trillion to aid banks and credit markets, stocks tanked because the plan had few specifics and was lamer than what had been leaked and proffered over the past several weeks.

“More importantly, Geithner and Team Obama have been furiously polling private equity and Street titans to gauge their interest and participation thresholds in various bailout plans. Geithner's lame plan implicitly indicates that few people wanted to participate in the leaked/proposed plans.

“Private investors know toxic paper remains incalculable with open-ended liability. The market understands that no bank bailout has been announced because there is no plan, barring an outright gift, that will fly with private investors. And an outright gift will infuriate taxpayers.

“Also, as any trader that has bought into any syndicate or group offering would tell you, a major problem is calculating the behavior of the other buyers. How much pain can they stand? When will they panic?

“If other buyers cannot endure pain or go bust themselves, bids will be hit and the entire buying group will suffer huge losses … It keeps coming back to toxic payer and transparency.

“Geithner asserted, ‘We will have to try things we've never tried before.' You mean like telling the truth about the quantity and quality of toxic assets?”

Source: Bill King, The King Report , February 11, 2009.

Financial Times: Nouriel Roubini - Anglo-Saxon model has failed

“The Anglo-Saxon model of supervision and regulation of the financial system has failed, Nouriel Roubini, chairman of RGE Monitor and professor of economics at New York University, told the Financial Times on Monday.

“Answering questions from FT.com readers, Prof Roubini, who is widely credited with having predicted the current financial crisis, said the supervisory system “relied on self-regulation that, in effect, meant no regulation; on market discipline that does not exist when there is euphoria and irrational exuberance; on internal risk management models that fail because - as a former chief executive of Citi put it - when the music is playing you gotta stand up and dance.”

“‘All the pillars of Basel II have already failed even before being implemented,' he added, referring to the internationally agreed set of banking regulations that are forcing banks to set aside more capital to maintain their existing lending.

“Prof Roubini also predicted that it was possible another large bank could fail, saying: ‘In many countries the banks may be too big to fail but also too big to save, as the fiscal/financial resources of the sovereign may not be large enough to rescue such large insolvencies in the financial system.'

“He also criticised the US and UK approach to bank bail-outs, comparing it with attempts by Japan in the 1990s to solve its banking crisis. ‘The current US and UK approach may end up looking like the zombie banks of Japan that were never properly restructured and ended up perpetuating the credit crunch and credit freeze,' he said.”

Source: Financial Times , February 9, 2009.

CEP News: US Senate approves $787 billion stimulus bill

“The US Senate approved President Barack Obama's $787 billion stimulus bill late Friday night, satisfying his request that the bill be ready for signing after President's Day long weekend.

“The bill, which Obama says is designed to energize the American economy and save 3.5 million jobs, passed in a 60-38 vote. Three moderate Republicans voted in support of the bill, giving it the crucial 60-vote support, which it needed to be approved.

“Earlier on Friday, the House or Representatives voted 246-183 in favour of the bill, while no Republicans supported the legislation.

“The bill contains roughly $212 billion, or 27%, in tax cuts for individuals and businesses. Republicans had wanted at least 40% of the bill to be dedicated to tax relief.

“A stabilization fund for education, police and fire services at the state level was set at $53.6 billion, and $87 billion was allotted for Medicaid.

“The final version of the bill scales back tax credits for home and car first-time buyers.

“The final version of the package also contains a softer version of the controversial ‘Buy American' clause, which now stipulates that all government spending from the plan must use American-made products and labour, but only if this does not violate current trade deals with US trade partners.”

Source: CEP News , February 14, 2009.

Bloomberg: Krugman says stimulus not up to scale of recession

“Paul Krugman, a professor at Princeton University and winner of the 2008 Nobel Prize for economics, talks with Bloomberg's Kathleen Hays about the likely effectiveness of President Barack Obama's $787 billion economic stimulus plan. Krugman also discusses the outlook for government debt and potential nationalization of troubled banks.”

Source: Bloomberg , February 13, 2009.

Bloomberg: Feldstein says Senate stimulus bill better than House's

“Martin Feldstein, an economics professor at Harvard University, talks with Bloomberg's Kathleen Hays about the US economic stimulus package scheduled for a critical procedural vote in the Senate. Feldstein also discusses the outlook for Treasury Secretary Timothy Geithner's financial rescue plan, the Federal Reserve's efforts to increase consumer lending and the priorities of President Barack Obama's Economic Recovery Advisory Board.”

Source: Bloomberg , February 9, 2009.

Bloomberg: US housing plan to fund interest-rate reductions

“The Obama administration's housing plan will use government money to help reduce interest rates for struggling borrowers, while asking lawmakers to approve more ways to modify mortgages, according to a person briefed on the proposal.

“US Treasury Secretary Timothy Geithner intends to make the plan public in coming days, possibly within a week, said the person, who declined to be identified before the announcement. Some elements can begin immediately, and others must be considered by Congress.

“Foreclosure filings in the US surged 81% last year to 2.3 million, the highest on record, as home prices fell and tighter mortgage standards made it harder for homeowners to sell or refinance, according to RealtyTrac, a provider of real estate data. The administration has pledged to use $50 billion to $100 billion for housing relief, taken from the $700 billion bank rescue package enacted last year.

“‘Our focus will begin on using the full resources of the government to help bring down mortgage payments and help reduce mortgage interest rates,' Geithner told the Senate Banking Committee yesterday.”

Source: Rebecca Christie and Margaret Chadbourn, Bloomberg , February 12 2009.

CEP News: JPMorgan and Citigroup announce moratorium on foreclosures

“Three major US financial institutions have announced they will halt foreclosures after coming under intense pressure from US politicians on Wednesday to do something to help US citizens weather the financial crisis.

“Citigroup announced it will be halting foreclosures starting February 12. The bank said it will uphold this commitment until US President Barack Obama has finalized the details of his plan to modify mortgage loans to benefit US residents at risk of losing their homes.

“Minutes later, JPMorgan announced it will also put a moratorium on foreclosures for a three-week period, or until March 6. Morgan Stanley later made a similar statement.

“Bank of America CEO Ken Lewis already announced a similar pledge earlier this week in a hearing before the House Financial Services Committee.

“On Wednesday, CEOs from Bank of America, Goldman Sachs, Citigroup, Morgan Stanley, Wells Fargo, JPMorgan Chase, Bank of New York Mellon and State Street all faced harsh criticism from lawmakers for allowing the financial system to come crashing down in 2008.

“All of the executives said they will do what they can to boost lending and stem foreclosures to aid the US economic recovery.”

Source: CEP News , February 13, 2009.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.