Sales Tax Time Bomb Explodes as Consumption in Freefall

Economics / Recession 2008 - 2010 Feb 17, 2009 - 08:16 PM GMTBy: Mike_Shedlock

Inquiring minds are reading Holiday Blues: Weakness Unmatched In 35 Years

Inquiring minds are reading Holiday Blues: Weakness Unmatched In 35 Years

Consumption: From Excess to Freefall

What's happened to consumption since the middle of 2008 is nothing short of stunning, both in speed and magnitude. Several examples will make this point.

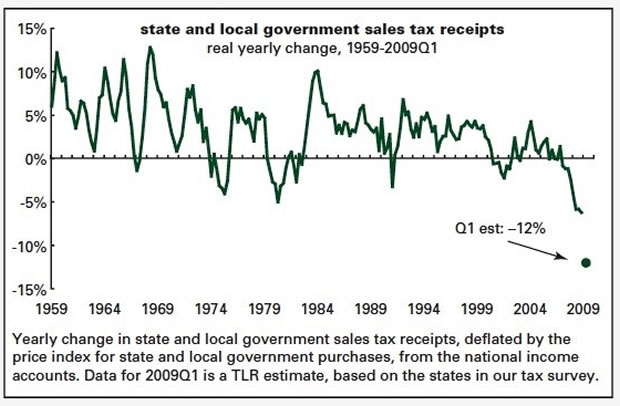

Let's start with one of the mainstays of this report, sales taxes. Graphed below is the yearly change in state and local government (SLG) sales tax receipts adjusted for inflation from the national income accounts. (The price index is that for SLG purchases.)

The last entry on the graph is our projection, based on the results of our January survey -- a 10% nominal decline with a 2-point inflation adjustment, or a 12% estimated decline.

(The estimate of 2% inflation is rough; it was about 3% in the fourth quarter, down from around 6% at midyear.) The actual result for the fourth quarter of 2008 was -6.3%, a little worse than the previous two quarters, which came in at -5.9%. That -6% neighborhood for late 2008 is the worst in the history of the series; its closest rival is the -5.1% hit during the sharp 1980 consumer recession, when Jimmy Carter got on TV and told people that it was their patriotic duty to stop using their credit cards -- which they actually did for a while, though not for long. This quarter should shape up to be a record-breaker.

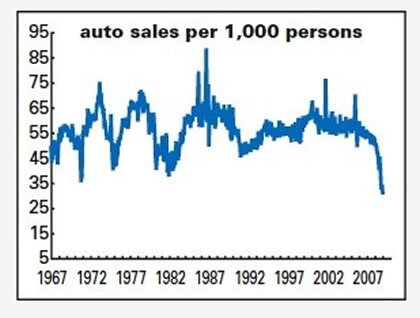

OK, moving on to auto sales. Graphed below are monthly unit sales at a seasonally adjusted annual rate per 1,000 people. Adjusting for population really brings home the weakness. January's 9.5 million rate (for autos plus light trucks) is one of the lowest in history, but its earlier rivals were at times when the U.S. population was considerably lower than it is today.

January's rate translates into 31.1 units per 1,000 people, which is 3.5 standard deviations below the mean, and well below November 1970's 36.1, a dismal performance created not by economic weakness, but by a two-month strike at GM. It's also worse than the lowest levels of the 1973-75 and 1981-82 recessions (40.8 and 38.3 respectively). It comes after a 17-year period when there was basically no auto recession. But the contraction has hit suddenly and hard: sales were 50.3 per 1,000 in February 2008. The yearly drop-off is the worst since the numbers begin in 1968.

Impact On State Budgets

The above shows what is happening let's now take a look at how that is impacting states. Please consider State Budget Troubles Worsen .

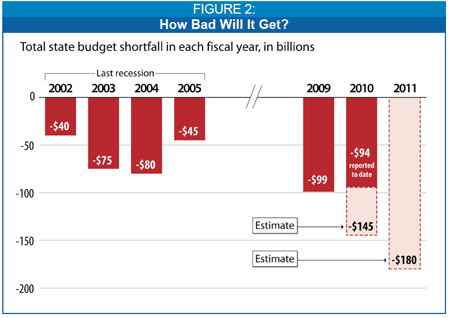

States are facing a great fiscal crisis. At least 46 states faced or are facing shortfalls in their budgets for this and/or next year, and severe fiscal problems are highly likely to continue into the following year as well. Combined budget gaps for the remainder of this fiscal year and state fiscal years 2010 and 2011 are estimated to total more than $350 billion.

States are currently at the mid-point of fiscal year 2009 — which started July 1 in most states — and are in the process of preparing their budgets for the next year. Over half the states had already cut spending, used reserves, or raised revenues in order to adopt a balanced budget for the current fiscal year — which started July 1 in most states. Now, their budgets have fallen out of balance again. New gaps of $51 billion (over 10% of state budgets) have opened up in the budgets of at least 42 states plus the District of Columbia. These budget gaps are in addition to the $48 billion shortfalls that these and other states faced as they adopted their budgets for the current fiscal year, bringing total gaps for the year to 15 percent of budgets.

Unemployment, which peaked after the last recession at 6.3 percent, has already hit 7.6 percent, and many economists expect it to rise to 9 percent or higher, which will reduce state income taxes and increase demand for Medicaid and other services.

With consumers' reduced access to home equity loans and other sources of credit, sales taxes are also likely to fall more steeply than they did in the last recession.

These factors suggest that state budget gaps will be significantly larger than in the last recession. Based on past experience and the depth of this recession, it appears likely that all but a handful of states will face shortfalls in fiscal year 2010 and these deficits will end up totaling about $145 billion. If, as is widely expected, the economy does not begin to significantly recover until the end of calendar year 2009, state deficits are likely to be even larger in state fiscal year 2011 (which begins in July 2010 in most states). The deficits over the next two-and-a half years are likely to be in the $350 billion to $370 billion range.

The vast majority of states cannot run a deficit or borrow to cover their operating expenditures. As a result, states have three primary actions they can take during a fiscal crisis: they can draw down available reserves, they can cut expenditures, or they can raise taxes. States already have begun drawing down reserves; the remaining reserves are not sufficient to allow states to weather a significant downturn or recession. The other alternatives — spending cuts and tax increases — can.

Showdown In California and Kansas

California and Kansas are scrambling like mad right now to do something about shortfalls. Both states have delayed income tax refunds over the budget crisis.

Republicans in California are refusing to hike taxes while Republicans in Kansas refuse to allow the checks to be issued until the budget is balanced, somehow. Please see Kansas Suspends Income Tax Refunds; California One Vote Shy On Budget Impasse for more details.

Bring A Toothbrush

The California Impasse Continues today, still one vote shy of passage.

California lawmakers failed to reach agreement on how to eliminate a $42 billion budget shortfall as Governor Arnold Schwarzenegger prepares to shut down hundreds of public works projects and fire thousands of state workers.

Senate President Darrell Steinberg, a Democrat, plans to lock lawmakers in the capitol unless they pass a $40 billion package of tax increases, spending cuts and bond sales today. The bills, backed by the Republican governor and by Democrats, remain one Republican vote short.

Steinberg said he will put the tax increases up for a vote at 10 a.m. in Sacramento. If the measure doesn't pass, he said he will lock senators in the capitol until an agreement is reached. “Bring a toothbrush,” he said in a speech on the Senate floor late yesterday.

“Our state has been spending beyond its means for many years now,” said Assemblyman Chuck DeVore, an Orange County Republican. “We're asking the taxpayers of California for too much of their own money to cover over a problem of our own making.”

Without a new budget in place, Schwarzenegger will notify 20,000 state employees today that they could lose their jobs, a step he put off taking last week as a deal seemed imminent.

Tomorrow he will shut down $3.8 billion of public works projects, including many already under construction, because the state doesn't have enough money left to pay for them. That could jeopardize 32,000 jobs, Will Kempton, state director of transportation, said at a hearing today.

California is, like many states simply spending beyond its means. Promises have been made than cannot be kept. Raising taxes is not the answer in California or anywhere else.

Eventually someone will give in. Will it be the one needed Republican or a group of Democrats who agree to cut more spending?

Either way the point is moot except for an initial cheer of exhaustion. Falling sales tax revenue and falling property tax collections ensures another budget crisis is coming up in a few more months, not just in California but 46 states.

Think Obama's stimulus plan will counteract this on top of everything else that is going wrong? Think again.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.