Gold Premiums on Ebay Rise Again Despite Record Prices

Commodities / Gold & Silver 2009 Feb 24, 2009 - 07:51 AM GMTBy: Stefan_Pernar

Are you surprised? Once again one can not help but feel a certain unease about the latest and greatest in global economic news. What has once been unthinkable in terms of collapse first became a fringe perspective , then an analyst's opinion , and has now evolved into prime time entertainment . What a difference a year makes…

Are you surprised? Once again one can not help but feel a certain unease about the latest and greatest in global economic news. What has once been unthinkable in terms of collapse first became a fringe perspective , then an analyst's opinion , and has now evolved into prime time entertainment . What a difference a year makes…

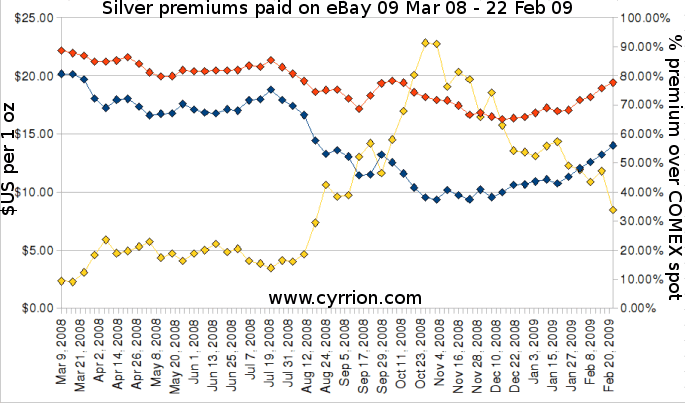

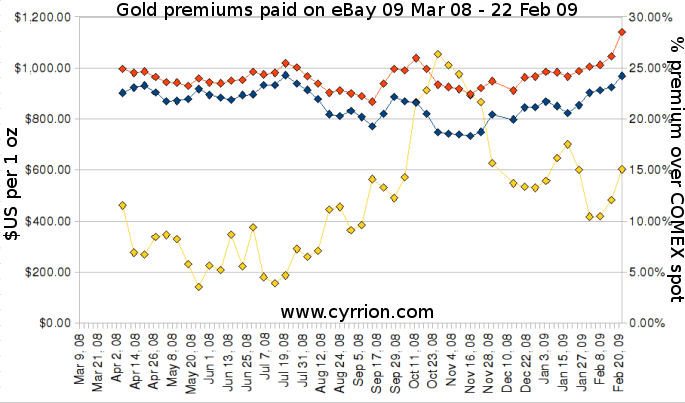

Today I once again found the time to update the charts comparing spot prices of gold as well as silver with investment grade American gold eagles , gold buffaloes and silver eagles as sold on eBay . . In a nutshell: premiums remain high. However, there are perceivable differences between gold and silver premiums. While silver premiums continue to recede and investors are now ‘only' willing to pay as much as 33.8% over spot, gold premiums have actually seen an increase of 50% from 10% over spot on February 8th to 15% over spot today.

(yellow = percent premium paid on eBay, blue = COMEX spot price weekly average, red = eBay price weekly average)

These premiums can be understood as thermometers of trust as well as manipulation. On the one hand, investors, eager to posses physical gold or silver, are flocking to eBay in order to convert untrusted cash into trusted ‘can-bury-in-the-yard-and-trade-for-bag-of-potatoes'-physical bullion. This represents the perceived danger posed by counter party risk when owning paper gold/silver - meaning future contracts - known as ‘ GLD ‘ and ‘ SLV ‘ respectively in combination with an expected rise of inflation.

Gold as well as silver prices again rose sharply in the past 30 days. Silver however shot up 20% while gold saw a respectable yet comparatively moderate 10% rise in prices. Add to that, that silver manipulation appears to now be concentrated in a single bank and a drop in premiums for silver bullion becomes understandable. Silver prices are moving where they should be faster than do gold prices.

There are however two additional bits of information that are of particular interest to me. For one, the price of gold has recently decoupled from EUR/USD and has since then been rising independently from currency fluctuations. Additionally, gold is honing in on the long term Gold/Dow ratio of 1/1 or 1/2 which according to Mark O'Byrne means that:

Given the degree of money printing and credit creation we believe that soon deflation will abate and will be superceded by virulent inflationary pressures. This could lead to a Dow/Gold ratio of 1:1 or 2:1 at higher levels ( the DJIA at 5000 and gold at $5000/oz or the DJIA at 6000 and gold at $3,000/oz).

Hear hear. A major concern this week continues to be eastern European banks who apparently require a mega bailout . In light of this situation and if Der Spiegel is correct, the German finance ministry is drafting rescue plans to prevent default on the edges of the eurozone that is feared to lead to a full-blown collapse of Europe's monetary system in a chain reaction of debt defaults .

All of this is of course dwarfed by the US situation, considering that depending on how you slice it, US obligations of $US65 Trillion exceed the entire world GDP and that recently four banks have gone bust in a single day .

What is one to do? Not having had the experience of a Weimar Republic style hyperinflation the US may very well proceed to become a nation of dirt poor Trillionairs . The EU on the other hand with an inflation shocked Germay may very well opt for a series of defaults and takeovers. The former would thereby socialize the effects and wipe out all savings, pensions and debt thus creating a blank slate. The latter would see a severe cash squeeze with selected individuals being left with nothing while a few lucky winners will have hit the jackpot of having chosen the right bank or insurance company.

Time for some best practice sharing:

- Protect Your Wealth from Collapsing Monetary Systems

- The Great Depression II Survival Strategies

- Dmitry Orlov on Social Collapse Best Practice at the Long Now Foundation

- Dmitry Orlov's book Reinventing Collapse: The Soviet Example and American Prospects

- Invest in Gold and Silver coins

By Stefan Pernar

© 2009 Copyright Stefan Pernar - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.