Gold Bull Market Being Driven by Low Interest Rates

Commodities / Gold & Silver 2009 Feb 24, 2009 - 08:01 AM GMTBy: Mark_OByrne

Gold and silver remained resilient yesterday (gold slightly lower; silver slightly higher) despite the continual wave of mini tsunamis shaking the global economy. World stock markets continue to reel from the deterioration of the financial system which is spreading to the global economy and the DJIA fell to levels last seen in 1997 and the Nikkei fell to levels last seen 26 years ago in 1983.

Gold and silver remained resilient yesterday (gold slightly lower; silver slightly higher) despite the continual wave of mini tsunamis shaking the global economy. World stock markets continue to reel from the deterioration of the financial system which is spreading to the global economy and the DJIA fell to levels last seen in 1997 and the Nikkei fell to levels last seen 26 years ago in 1983.

The United States vowed to prop up ailing banks such as Citigroup and the giant insurer AIG if needed, but worries that yet more massive bailouts, cash injections and even nationalisation will fail to staunch the global economic crisis are weighing on stock markets around the world and mean that safe haven demand for gold remains robust.

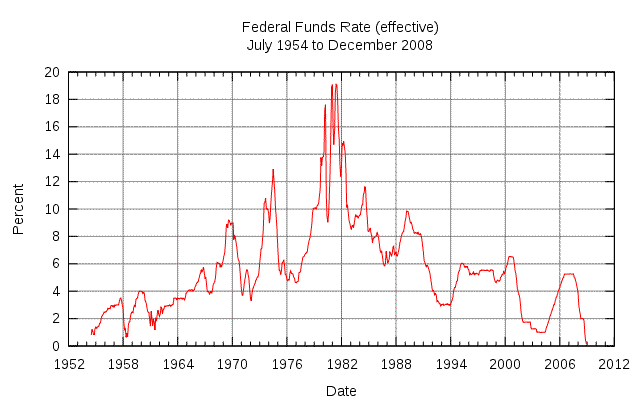

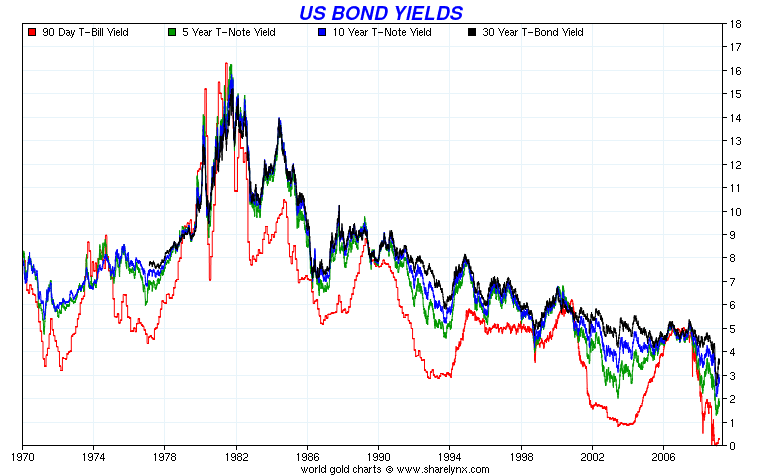

As long as central banks continue to debase their currencies by trying to inflate their way out of this recession through zero interest rate policies and massive money printing and digital money creation, gold will remain in a bull market. This is clearly seen in the charts below in which the correlation between rising interest rates and rising gold prices can be seen. Gold rose by 2,400% from 1971 to 1980. During the same period, the Federal Funds Rate rose from below 4% to over 18%.

Today, interest rates are close to zero and thus there is no opportunity cost to owning the non yielding finite currency that is gold. Indeed there is unprecedented counterparty and systemic risk in keeping one’s savings in a bank. And government bonds look increasingly risky with even the most developed nations sovereign bonds being at risk of being downgraded. Considering they are considering printing money top buy their own bonds it is amazing that they have not been downgraded already.

Only when bond yields and interest rates have risen significantly and systemic risk abated will gold prices stop rising. We are a long way from there yet. As the bubble in bond markets begins to unravel, large sums of capital will flow into the safe haven of gold.

Indeed there are interesting parallels with the mid 1970’s. Gold rose from $35/oz to $200/oz or nearly 6 times. Then gold prices fell from $200/oz to $100/oz in 1976 prior to surging by more than 800% - from $100/oz to over $800/oz in the latter part of the 1970’s.

Gold fell from $1,030/oz in March 2008 to a low of just above $700/oz in late 2008. If gold were to repeat the performance of the mid to late 1970’s then it could rise to over $5,000/oz ( 8 X $700/oz = $5,600/oz) in the coming years. Thus besides essential safe haven diversification attributes, gold also has significant potential for real and substantial capital gains that could help investors recoup some of the significant losses they have suffered in property and equity markets in recent years.

By Mark O'Byrne, Executive Director

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold and Silver Investments Limited No. 1 Cornhill London, EC3V 3ND United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@www.goldassets.co.uk Web www.goldassets.co.uk |

Gold and Silver Investments Ltd. have been awarded the MoneyMate and Investor Magazine Financial Analyst of 2006.

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Mark O'Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.