The Long-term Recovery Process Well Underway in South African Gold Mining Stocks

Commodities / Gold & Silver Stocks May 02, 2007 - 12:36 PM GMTBy: Clif_Droke

You wouldn't know it by looking at the latest headlines and earnings announcements, but our old friend of DDRDGOLD (formerly Durban Roodepoort Deep) has been looking good from a relative strength standpoint. Not only that, but DROOY made it past its latest 13-week quarterly cycle bottom without taking so much as a minor hit. Will miracles never cease!

You wouldn't know it by looking at the latest headlines and earnings announcements, but our old friend of DDRDGOLD (formerly Durban Roodepoort Deep) has been looking good from a relative strength standpoint. Not only that, but DROOY made it past its latest 13-week quarterly cycle bottom without taking so much as a minor hit. Will miracles never cease!

Granted, the company has a long road ahead of it and the turnaround is a long-term process that has only been underway since 2005. But I remain convinced that the 2005 low we saw -- and all the negative baggage that came with it -- was the longer-term internal/psychological low for DROOY and that the recovery process has actually been underway since then (though not visible to most observers).

Going over the company's latest shareholder report you can see that even the Chief Executive, John Sayers, remains optimistic about DRD's turnaround prospects (although he understandably tempers his enthusiasm with lots of caution). Yes there were the inevitable losses during the latest earnings period along with a workers strike, some fault-related damage to the mines, and other problems. But looking back at the developments over the past few earnings quarters and you can sense the turnaround shaping up, however slow and gradual it may be.

One positive thing that came out of the latest quarter is the sale of the company's stake (through its 79% holding in Emperor) in the Vatukoula and associated Fijian assets and liabilities to Westech Gold Ltd., as well as the announced conditional agreement to sell its 20% interest in Porgera to Barrick Gold Corp. for US$250 million. As John Sayers stated in last week's shareholder report: “Proceeds from the sale of its Porgera interest will allow Emperor to repay debt in full. After the sale and debt repayment, its key assets will include the wholly-owned Tolukuma gold mine, a significant copper/gold exploration portfolio incorporating over 5,000 square kilometres of exploration tenements in minerals-rich PNG, and a significant amount of cash on the balance sheet.”

Sayers also reported that the group has begun work at Blyvoor on defining the uranium resource contained in the 110 million tons of slimes and 10 million tons of rock dump material available. (Uranium was produced at Blyvoor until 1982 and mining reefs containing uranium has continued subsequently). This is another positive on the company's balance sheet as it continues it long-term turnaround process.

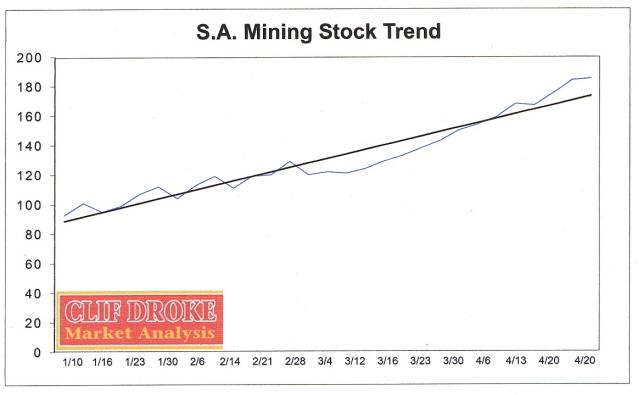

Adding to this backdrop of recovery by DRD, in Friday's report we looked at how the South African mining stock sector as a whole has been in a confirmed bull market since at least October 2006. The actively traded S.A. mining stocks listed on the U.S. exchanges have combined to form a continuous rise since last fall as the weekly advance/decline line of the S.A. mining stocks shows (see chart below). It always adds strength to a recovery or turnaround within an individual company when its sector is also in a confirmed upward trend.

Continuing our discussion of the South African economic resurgence, an article appearing today in the Financial Times zeroed in on the subject of Chinese bank loans being made to various African countries, including S.A. These loans have helped the countries greatly improve their infrastructures including power grids, hydroelectric dams and resource development. China is in dire need of minerals and other commodities which resource-rich Africa is providing her.

Alan Beattie, the author of the FT article entitled “Loans that could cost Africa dear,” opines that “The money China is pouring into Africa could damage the economics and politics of the continent.” This may be true in the very long-term, especially for African countries that have past records of default. But South African enterprise should be able to turn profits on the much-needed cash infusions from China and the turnaround stories coming from that country have been mounting in the just the past year alone.

Back in February it was reported that South Africa's budget surplus was 0.3 percent in the 2006-07 tax year (which comes to about $705 million or R5bn). The surplus comes after a 7 percent deficit in the ‘90s following the country's emergence from apartheid. During his announcement of the first budget surplus, S.A. finance minister Trever Manuel also made a surprise announcement that the secondary tax on companies would be phased out. This measure has been an obstacle to long-term investment in S.A. and its removal will only speed the growth and encourage greater investment.

As I wrote then, “Yes friends, those dark and sometimes scary days from the ‘80s and ‘90s appear to be ending. We all remember when you couldn't read a report from S.A. without someone mentioning how horrendous the political situation was and how dangerous it was to live there. But that's all part and parcel of the international ‘urban renewal' cycle and was merely a reflection of the bottom phase of the cycle. Now the up-phase of the cycle is underway and S.A. should start reaping the benefits.”

And of course we've also read in the past two years, with regard to DRDGOLD and the S.A. mining outlook, about how bleak it all looked to analysts and investors…yet our outlook told us not to give up hope on the S.A. mining sector and now that optimism is slowly being rewarded.

Another article appearing on the front page of the Financial Times newspaper of April 10 was headlined, “Concern on SA law to empower blacks.” This was the news item we've been waiting for and knew instinctively would sooner or later show up. For the past couple of years we've had to endure the long-term South African bears telling us how the black empowerment laws would spell the end for profitable mining in the country and would be the death of Durban Deep/DRDGOLD and the other big S.A. mining enterprises.

Yet the chart always tells the *real* story and our reading of the chart since 2005 was one of longer-term optimism. Our experience in the market business tells us that news is almost always a lagging indicator and almost never a leading indicator. So it comes as no surprise that what seems to be major bad news comes out on the front pages of newspapers just as the long-term price lows are being made in stocks. Conversely, only after a bottom has been established and prices begin rallying does the good news finally ever come out again. The rosier the news appears to be, the closer the stock is to a major top.

This latest news coming out of South African is positive but by no means rosy, for there remains much work to be done in the way of cleaning up the damage done by the laws that essentially penalized S.A. mining concerns in recent years, including our old friend DROOY. This is good because it tells me there is much more upside potential for the S.A. mining companies in the years ahead as China and other Asian countries begin developing South Africa for their growing commodity needs.

The S.A. mines aren't dead by any stretch; to the contrary they're showing signs of life again. It's still early in the growth and development phase of the cycle and there remains much to be done before momentum kicks in and takes over, but the foundation has been established and things are definitely looking up!

By Clif Droke

www.clifdroke.com

Clif Droke is editor of the daily Durban Deep/XAU Report which covers South African, U.S. and Canadian gold and silver mining equities and forecasts PM trends, short- and intermediate-term, using unique proprietary analytical methods and internal momentum analysis. He is also the author of numerous books, including "Stock Trading with Moving Averages." For more information visit www.clifdroke.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.