United States Enters The Greatest Depression

Economics / Recession 2008 - 2010 Mar 09, 2009 - 01:45 AM GMT Prison Planet: Celente - US has entered “The Greatest Depression”

Prison Planet: Celente - US has entered “The Greatest Depression”

“Trends research analyst Gerald Celente, who has risen in prominence on the back of his deadly accurate economic predictions, says that the collapse of financial markets heralds the start of ‘The Greatest Depression'.

“In his latest Trend Alert bulletin, Celente attacks mainstream pundits who falsely predicted a market bottom and the start of a recovery, noting that conventional analysts have been proven ‘dead wrong' again and that, ‘There will be no turn around in the second quarter of 2009 or 2010 or 2011.'

“‘The global financial system, built on endless supplies of cheap money, rampant speculation, fraud, greed, and delusion is terminally ill and will not be coaxed into remission by stimulus packages nor restored to health by government buyouts and bailouts,' writes Celente.

“The most positive prediction that Celente makes is that the Dow will not reach zero, a tongue in cheek reaction to yesterday's record plunge which saw the Dow rolled back to 1997 levels well below 7,000.

“Celente warns that the first signs of real panic are starting to set in, unrest that will cause governments to ‘take draconian measures to prevent total economic collapse and public panic'.

“‘Expect massive bank failures, runs on banks, and bank holidays,' writes Celente. ‘Even if deposits are FDIC insured, quick access to money is by no means assured. At minimum, have reserves on hand for emergencies,' he forecasts.

“Celente cites gold as one of the few investments that will continue to rise in value, eventually reaching $2,000 an ounce and beyond.

“Celente's dire forecasts were initially scoffed at by the media but as the crisis has worsened, his credibility has soared.

“Celente, who successfully predicted the 1997 Asian Currency Crisis, the subprime mortgage collapse and the massive devaluation of the US dollar, told UPI in November 2007 that the following year would be known as ‘The Panic of 2008′, adding that ‘giants (would) tumble to their deaths', which is exactly what we have witnessed with the collapse of Lehman Brothers, Bear Stearns and others.”

Source: Paul Watson, Prison Planet , March 3, 2009.

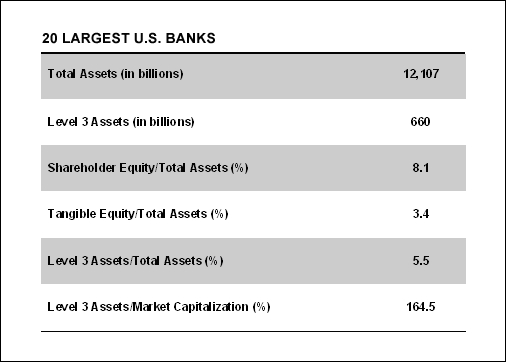

BCA Research: US Capital Assistance Program - a costly necessity

“It is difficult to estimate how much capital the government will need to inject into the financial sector under the Capital Assistance Program (CAP), but the number will likely be substantial.

“The Chairman of the FDIC, Sheila Bair, contends that US banks are well capitalized. However, she must be referring to the multitude of small banks, rather than large banks (i.e. there are many small banks that are well capitalized).

“The top 20 financial institutions have a thin capital cushion of only 3.4% (defined as tangible capital/total assets). In other words, it would require a writedown of total assets of only 3%-4% to wipe out all tangible capital for the largest banks.

“The FDIC data on the broader banking universe confirms that the capital cushion of large banks is much less than their smaller counterparts. Moreover, toxic assets are concentrated in large financial institutions. Level 3 assets represent 5.5% of total assets and are 62% larger than tangible capital, for the top 20 institutions.

“The implication is that the stress tests will likely reveal that many of these institutions are not properly capitalized even in the base-case economic scenario (not to mention the worst-case scenario). We suspect that the authorities are publicly downplaying the amount of recapitalization that is likely to be required, but behind closed doors they must realize that the CAP will be a large sinkhole for taxpayer funds. Indeed, the Administration has ‘penciled in' another $750 billion for bank support in its budget proposal for the next fiscal year.

“Bottom line: The final cost of the bailout plan announced last week will be dramatic. Nonetheless, it is a critical element in ending the financial crisis and stabilizing the economy.”

Source: BCA Research , March 4, 2009.

Bloomberg: Ron Paul – Government needs to get out of the way and let the market sort itself out

CNBC: Roubini - nationalization debate is moot

“The debate isn't about nationalization anymore, says Nouriel Roubini, chairman of RGE Monitor. He tells CNBC's Martin Soong and Sri Jegarajah that the real discussion is whether banks should be wholly or partially nationalized.”

Source: CNBC , March 3, 2009.

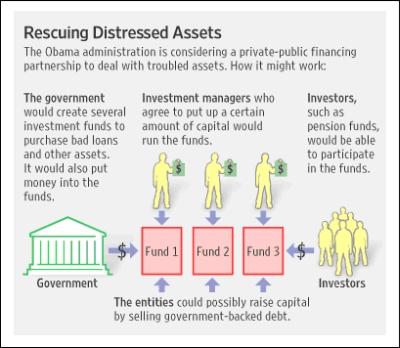

The Wall Street Journal: “Bad Bank” funding plan starts to get fleshed out

“The Obama administration, filling in some of the blanks in its bank bailout, is considering creating multiple investment funds to purchase the bad loans and other distressed assets that lie at the heart of the financial crisis, according to people familiar with the matter.

“The Obama team announced its intention to partner with the private sector to buy $500 billion to $1 trillion of distressed assets as part of its revamping of the $700 billion bank bailout last month. It's central to the administration's efforts to unglue credit markets, alongside a Federal Reserve program aimed at spurring consumer lending in areas such as credit cards and home loans that will be officially launched Tuesday.

“No decision has been made on the final structure of what the administration is calling a private-public financing partnership, but one leading idea is to establish separate funds to be run by private investment managers. The managers would have to put up a certain amount of capital. Additional financing would come from the government, which would share in any profit or loss.

“These private investment managers would run the funds, deciding which assets to buy and what prices to pay. The government would contribute money from the $700 billion bailout, with additional financing likely coming from the Federal Reserve and by selling government-backed debt. Other investors, such as pension funds, could also participate. To encourage participation, the government would try to minimize risk for private investors, possibly by offering non-recourse loans.

“… the government wants to encourage private investors to buy up the assets in a way that would come closer to setting a market price where no market currently exists. Some within the administration believe establishing multiple funds could help with that goal. The funds would most likely target all types of assets, such as mortgage-backed securities, rather than focusing on one specific type of distressed security.”

Source: Deborah Solomon and Jon Hilsenrath, The New York Times , March 3, 2009.

AFP: FDIC warns US bank deposit insurance fund may tank

“The Federal Deposit Insurance Corporation is warning banks that its deposit insurance fund could dry up this year amid rising bank failures although the deposits would remain fully backed by the government.

“The head of the Federal Deposit Insurance Corporation, Sheila Bair, in a letter to bank chief executives dated March 2, defended the FDIC's plan to raise fees on banks and assess an emergency fee to shore up the fund and maintain investor confidence.

“Bair acknowledged the new fees, announced Friday, would put additional pressure on banks at time of financial crisis and a deepening recession, but insisted they were critical to keep the insurance fund solvent and protected.

“‘Without these assessments, the deposit insurance fund could become insolvent this year,' Bair wrote.

“The FDIC chief said in the letter that the rapidly deteriorating economic conditions raised the prospects of ‘a large number' of bank failures through 2010.”

Source: AFP (via Google ), March 6, 2009.

Bloomberg: Gary Shilling says US getting “close” to depression

“Gary Shilling, president of A. Gary Shilling & Co., talks with Bloomberg's Peter Cook about the outlook for the US economy. Shilling also discusses the labor market, housing and the government's economic stimulus efforts.”

Source: Bloomberg , March 6, 2009.

CNBC: Fed Chairman Bernanke's testimony to House committee

“Federal Reserve chairman Ben Bernanke discusses the stress in the markets and the significant decline in the economy with the House Financial Services Committee.”

Source: CNBC , March 3, 2009.

Asha Bangalore (Northern Trust): Bernanke hints more may be necessary

“Chairman Bernanke's testimony before the Senate Budget Committee was noteworthy in two respects.

“One, he hinted that more policy action may be necessary when he noted the following: ‘The goal of the fiscal package is not just to provide a one-time boost to the economy, but to lay the groundwork for a self-sustaining, broad-based recovery. Historical experience strongly suggests that without a reasonable degree of financial stability, a sustainable recovery will not occur. Although progress has been made on the financial front since last fall, more needs to be done.

“‘As you know, in response to ongoing concerns about the health of financial institutions, the Treasury recently announced plans for further steps to ensure the strength and soundness of the financial system and to promote a more smooth flow of credit to households and businesses. The plan would use the remaining resources appropriated to the Treasury under the Emergency Economic Stabilization Act - approximately $350 billion - and also involve additional spending to support the activities of Fannie Mae and Freddie Mac.

“‘Whether further funds will be needed depends on the results of the current supervisory assessment of banks, the evolution of the economy, and other factors. The Administration has included a placeholder in its budget for more funding for financial stabilization, should it be necessary.'

“Two, he also indicated that any early consideration of reducing the accommodation from easy monetary and fiscal policy action carries the risk of stopping the recovery process. In other words, caution is the key. Here is the excerpt from the testimony: ‘In particular, the Congress will need to weigh the costs of running large budget deficits for a time against the possibility of a premature removal of fiscal stimulus that could blunt the recovery. We at the Federal Reserve will face similar difficult judgment calls regarding monetary policy.'”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , March 3, 2009.

Asha Bangalore (Northern Trust): Employment report underscores severity of recession

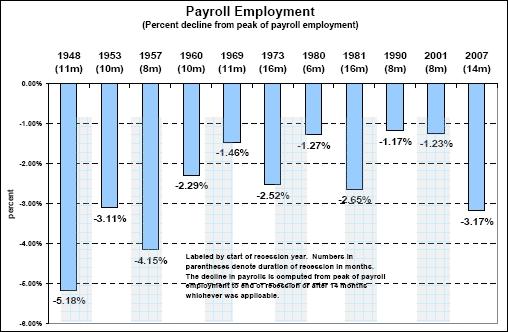

“The February employment report is bleak, with the unemployment rate at 8.1% versus 7.6% in January. In February, 651,000 jobs were lost, with the total job losses since the recession commenced in December 2007 amounting to 4.38 million. A little over one-half of the losses (2.6 million) have occurred in the last four months. This staggering decline in employment is the largest four-month loss of jobs since the war-related drop in jobs during the latter half of 1945.

“Even so, the sharp plunge in payroll employment needs to be evaluated within the context of the growth of the labor force. The chart below takes into account the growth of the labor force and indicates the extent of job losses in each recession in the post-war period from the peak of payroll employment to the end of a recession or after 14 months whichever is applicable (recessions vary in duration). The 3.17% drop in payroll employment in the current recession of 14 months is the largest percentage drop in jobs since the 1957 recession.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , March 6, 2009.

Bloomberg: Hatzius sees US unemployment rate rising into 2010

“Jan Hatzius, chief US economist at Goldman Sachs, talks with Bloomberg's Julie Hyman about today's February US jobs report and the US economy. The unemployment rate jumped in February to 8.1%, the highest level in more than a quarter century, as employers cut 651,000 jobs. Bloomberg's Peter Cook also speaks.”

Source: Bloomberg , March 6, 2009.

CEP News: US Treasury unveils details of mortgage modification plan

“The US mortgage modification program will only apply to conventional mortgages that are owner occupied and primary residences, according to additional details released by the Treasury Department on Wednesday.

“The program announced last week aims to alleviate the terms of more than 7 million homeowners in the United States through smaller payments and debt reduction by banks.

“‘It is imperative that we continue to move with speed to help make housing more affordable and help arrest the damaging spiral in our housing markets, just as we work to stabilize our financial system, create jobs and help businesses thrive,' said Treasury Secretary Tim Geithner in the Treasury Department's press release. ‘Economic recovery requires action on all three fronts.'

“Lenders will have to reduce mortgage payments to no more than 38% of the Front-End Debt-to-Income (DTI) ratio, after which the government will match an additional reduction to 31% of this ratio.

“The program also includes reductions on principal for mortgage borrowers who make their payments on time, as well as incentives for lenders to participate in the program.

“Last week the Treasury also announced intentions to broaden portfolios on Fannie Mae and Freddie Mac.”

Source: Erik Kevin Franco, CEP News , March 4, 2009.

Breitbart: 12% in US behind on mortgage or in foreclosure

“A stunning 48% of the nation's homeowners who have a subprime, adjustable-rate mortgage are behind on their payments or in foreclosure, and the rate for homeowners with all mortgage types hit a new record, new data Thursday showed. But that's not the worst of it.

“The reckless lending practices in states like Florida, California and Nevada that were the epicenter of the housing crisis are no longer driving up the nation's delinquency rate. Instead, the foreclosure crisis now is being fueled by a spike in defaults in states like Louisiana, New York, Georgia and Texas, where the economies are rapidly deteriorating and thousands are losing their jobs.

“A record 5.4 million American homeowners with a mortgage of any kind, or nearly 12%, were at least one month late or in foreclosure at the end of last year, the Mortgage Bankers Association reported. That's up from 10% at the end of the third quarter, and up from 8% at the end of 2007.”

Source: J.W. Elphinstone, Breitbart , March 5, 2009.

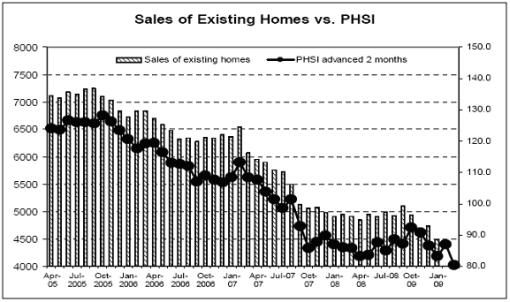

Asha Bangalore (Northern Trust): Home sales remain under stress

“The National Association of Realtors Pending Home Sales Index (PHSI) fell 7.7% to 80.4 in January, after a 4.7% increase in December. The PHSI leads actual sales of existing homes by one-to-two months. The pickup in PHSI during December was not reflected in sales of existing homes in January (-5.3%). The Mortgage Purchase Index during the first three weeks of February was down roughly 20% from the first three weeks of January. There is only a small chance the increase in the PHSI in December may translate into actual sales in February.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , January 3, 2009.

Asha Bangalore (Northern Trust): Auto sales decline once again

“Sales of autos dropped to annual rate of 9.12 million units in February versus 9.54 million in the prior month. The February sales pace of autos is the lowest since December 1981 when 8.849 million units were sold. Consumer spending in January rose 0.4% after adjusting for inflation, which pointed to the possibility of less-than-expected weakness in consumer purchases in the first quarter. However, today's auto sales numbers dampens these expectations somewhat.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , March 3, 2009.

Barry Ritholtz (The Big Picture): Vehicle sales halve

“The data on vehicle sales continues to be nothing short of abysmal:

• GM's sales fell 53%

• Ford's sales dropped 48%

• Toyota's declined 40%

• Volkswagen US fell 18%

• Nissan sales dropped 37%

• Mercedes-Benz posted a 21% decline

• BMW's total car sales fell about 24%

• Honda sales dropped 40%

“Hyundai Motor was the sole automaker to post a month over month sales gain (down 1.5% year over year).”

Source: Barry Ritholtz, The Big Picture , March 3, 2009.

Asha Bangalore (Northern Trust): Jobless claims - too early to identify a turning point

“Initial jobless claims for the week ended February 28 fell 31,000 to 639,000. Is the previous week's reading of 670,000 initial jobless claims, the peak for the current cycle? It is premature to identify the latest decline as the turning point, particularly given the weakness of the US economy.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , March 5, 2009.

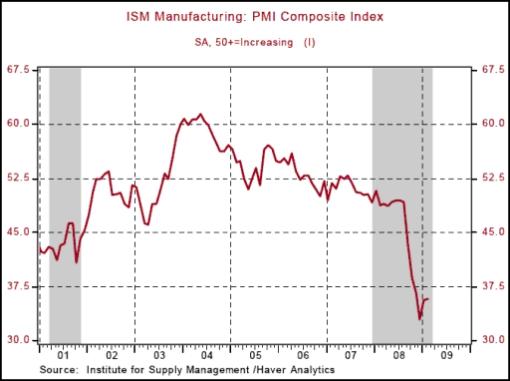

Asha Bangalore (Northern Trust): ISM Manufacturing Survey - insignificant gain in February

“The ISM Manufacturing Survey results for February show signs of stability, for the most part. The composite index was up slightly (35.8 versus 35.6 in January) from the prior month. The factory sector remains mired in weak economic conditions, but the good news is that sub-indexes are close to the levels seen in January, with the exception of the employment index.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , March 2, 2009.

Asha Bangalore (Northern Trust): Consumer spending gains strength in January

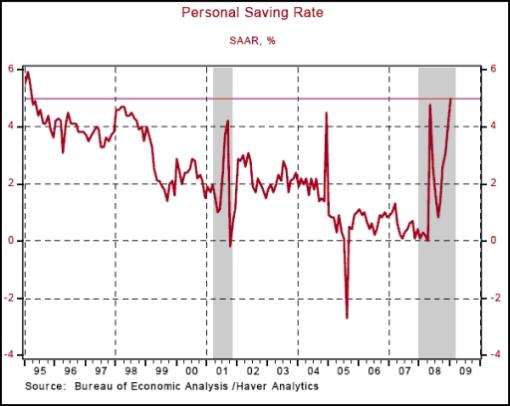

“Consumer spending, after adjusting for inflation, rose 0.4% in January, after posting only one monthly gain (November 2008) since June 2008. Among the three major components of consumer spending, purchases of non-durables (food, clothing, gasoline, shoes) increased 0.7% in January with food and gasoline outlays accounting for a large part of the increase in consumer spending in January. A 0.3% increase in services and a 0.2% gain in purchases of durables (cars, furniture, appliances) were also noteworthy.

“Personal saving as a percentage of disposable income was 5.0% in January. The spike in the saving rate in May/June 2008 was related to the tax rebates of 2008. On a monthly basis, the personal saving rate in January 2009 is the largest since March 1995.

“Net worth of households and the saving rate move in opposite directions. Given the large loss in net worth of households, the rising unemployment rate, and uncertainty in the economy, it is not surprising that the saving rate has risen in the past few months.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , March 2, 2009.

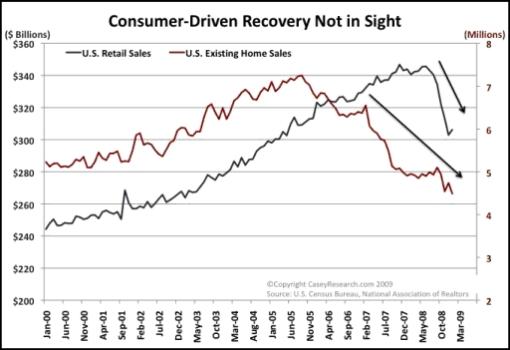

Casey's Charts: Shop till you drop

“Americans have fueled the world's economic engine for decades. But the deflating housing bubble has dropped home sales by 31% and housing prices by 25% in two short years, leaving the home equity credit well tapped dry.

“With consumers losing access to credit and incomes being threatened by rising unemployment, the spending spree has come to an end. As a result, retail sales have fallen 11% since June, GDP contracted by 6.4% in the fourth quarter, and consumer confidence is the lowest on record. The economy is barely running on fumes, and Washington has now become the ‘spender of last resort'.”

Source: Casey's Charts , March 5, 2009.

Reuters: Food stamp enrolment jumps to record 31.8 million

“A record 31.8 million Americans received food stamps at the latest count, an increase of 700,000 people in one month with the United States in recession, government figures showed on Thursday.

“Food stamps, which help poor people buy groceries, are the major US anti-hunger program, forecast to cost at least $51 billion in this fiscal year ending September 30, up $10 billion from fiscal 2008.

“‘A weakened economy means that many more individuals are turning to SNAP/food stamps,' said the Food Research and Action Center. Last summer food stamps were renamed the Supplemental Nutrition Assistance Program, or SNAP.

“The average food stamp benefit is $115 a month for individuals and $255 a month per household.

“In April, food stamp benefits will increase temporarily by 13% under provisions of the recently enacted economic stimulus law. Ellen Vollenger of the Food Research and Action Center said some families will see increases of $80 a month.”

Source: Charles Abbott, Reuters , March 5, 2009.

Bloomberg: Hidden pension fiasco

“Public pension funds across the US are hiding the size of a crisis that's been looming for years. Retirement plans play accounting games with numbers, giving the illusion that the funds are healthy.

“The paper alchemy gives governors and legislators the easy choice to contribute too little or nothing to the funds, year after year.

“The misleading numbers posted by retirement fund administrators help mask this reality: Public pensions in the US had total liabilities of $2.9 trillion as of December 16, according to the Center for Retirement Research at Boston College. Their total assets are about 30% less than that, at $2 trillion.

“With stock market losses this year, public pensions in the US are now underfunded by more than $1 trillion.

“That lack of funds explains why dozens of retirement plans in the US have issued more than $50 billion in pension obligation bonds during the past 25 years - more than half of them since 1997 - public records show.

“The quick fix for pension funds becomes a future albatross for taxpayers.”

Source: David Evans, Bloomberg , March 3, 2009.

The Razor's Edge: AIG and Hank - the divorce is final

“Hank Greenberg, the long time leader of insurance giant AIG, is reportedly suing the company as he believes mismanagement and even fraud have cost him $2 billion personally. The financial media has jumped on this story with vigor as it purportedly entails anger, greed, and betrayal.

“Former AIG CEO Hank Greenberg is now suing the embattled company. He's accusing the company of securities fraud. Yesterday, AIG posted that unbelievable loss, $62 billion. Greenberg's lawsuit claims that AIG's material misrepresentations and omissions led him to buy shares in his deferred compensation participation plan.

“Greenberg lead AIG for more than 40 years until he came under pressure to leave the company because of fraud charges from the New York Attorney General, Elliot Spitzer. He now claims that he was encouraged to buy stock in AIG at more than $50 per share and was mislead by the current management as to just how bad the collateralized debt on AIG's balance sheet would turn out to be.

“The dispute arose from an investor conference in December of 2007, when the company's stock was trading in the high $50's. Greenberg claims that management seriously downplayed the risks to the company and shareholders, and that their auditors had already told AIG about a ‘material weakness'.”

Source: The Razor's Edge , March 3, 2009.

Financial Times: Bank of England plans to buy gilts

Click here for the article.

Source: John Authers, Financial Times , March 5, 2009.

Bespoke: Same markets, different year

“So much for those hoping that a change in the calendar year would also bring about a change in the direction of the market. After two more months of huge declines for global equity markets, 2009 is looking just like 2008, if not worse.

“Below we highlight the year to date performance for 83 equity markets around the world. As shown, just 10 countries are up year to date, with China leading the way at 14.97%. Venezuela, Colombia, Abu Dhabi, and Israel have also managed to register gains so far this year.

“Unfortunately, there are twice as many countries already down 20% year to date as there are countries that are up. Puerto Rico is down by far the most at -54%, followed by Qatar (-36.6%), Romania (-34%), Ukraine (-30%), and Kenya (-29.7%).

“Of the G-7 countries, Canada is doing the best this year with a decline of 9.62%. Germany has been the worst G-7 country with a decline of 21.74%. And with a decline of 18.62%, the US ranks in the bottom 30% as far as 2009 performance goes.”

Source: Bespoke , March 2, 2009.

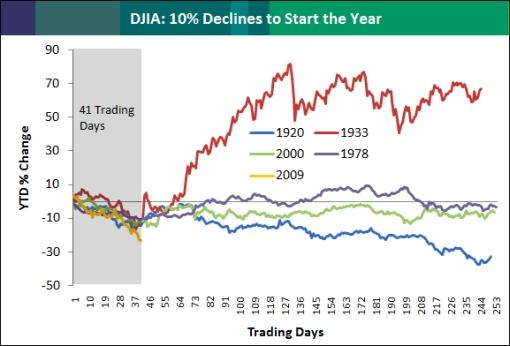

Bespoke: 2009 - by far the worst start to a year since 1900

“The Dow's current decline of 23.21% is by far the worst start to a year for the index this many days in since 1900. The second worst year at this point was 14.25% in 1920. There have been 19 prior years where the Dow was down 5% or more at this point, and only four of those years ultimately finished in positive territory.

“Below we highlight the five years where the Dow started the year down 10% or more at this point. In 1920, the Dow continued lower for the rest of the year, but in the three other years, the market ended higher from the level that it was at 41 trading days in.

“One positive is that 1933 is one of the five years that started off down 10% this many trading days in. While this did occur during the Great Depression, it was also FDR's first year in office. With many comparing Obama and his plans to FDR and the New Deal, it's interesting that the market got off to a very bad start in 1933 after he was elected, but reversed when he took office (in March) and finished his first year 66.7% higher! We can only hope that 2009 turns out that way, even though it doesn't say much for 2010, 2011, 2012, etc.”

Source: Bespoke , March 3, 2009.

Bespoke: Top strategists still expecting a 46% gain from here

“While two more Wall Street strategists lowered their year-end S&P 500 price targets recently, collectively they're still looking for a 46% gain from the index's current levels.

“As shown below, UBS, Goldman, and Credit Suisse have now lowered their year-end price targets since the start of the year. The UBS move from 1,300 to 1,100 makes Deutsche Bank the most bullish with a target of 1,140. Barclays has the lowest price target of 874, which would be a 27% increase from here.”

Source: Bespoke , March 5, 2009.

CNBC: Yamada - Dow could hit 4,000

“Louise Yamada, managing director at Louise Yamada Technical Research Advisors, tells CNBC hope is not an investment strategy. Her primary target for the Dow is 6,000, and her secondary target is 4,000.”

Source: CNBC , March 6, 2009.

Bloomberg: Leuthold says stocks will surge, depression avoided

“Steve Leuthold, whose Grizzly Short Fund returned 74% last year betting against US stocks, said now is the time to buy equities because investors are too fearful about the economy.

“‘These comparisons people make with the Great Depression are totally out of touch with reality, and pretty stupid,' he told Bloomberg Television in an interview today. ‘We've been in much worse, much more panicked and more scary situations in the US.'

“The economy isn't as bad as it was in 1974, when stocks began rebounding, said Leuthold, who oversees $3.2 billion at Leuthold Weeden Capital Management in Minneapolis. He predicted the Standard & Poor's 500 Index will surge to at least 1,000 in 2009, representing a gain of 44% from yesterday's 12-year low of 696.33.

“Because a rally is likely, Leuthold said investors shouldn't buy his Grizzly Short Fund. It has returned 26% in 2009. Short seller Bill Fleckenstein, who warned of the housing bubble in 2005, closed his 13-year-old bear market fund last year because valuations made it ‘too dangerous' to bet on more losses, he said in a interview last month.”

Source: Betty Liu and Lynn Thomasson, Bloomberg , March 4, 2009.

John Authers (Financial Times): Awaiting the bottom

“This week's brutal sales of stocks across the world brought indices to historic levels. Harder questions are how far stocks must fall to get there, and how long it will take to climb out, says John Authers.”

Click here for the article.

Source: John Authers, Financial Times , March 3, 2009.

Bespoke: US dollar at multi-year high

“Trillion dollar bailouts, trillion dollar deficits, and the largest spending bill in US history. These days, one would think that with all this spending, the US dollar would be as popular as a Wall Street CEO. However, this morning, the US dollar index hit its highest level since April 2006 even as news of another bailout for AIG hit the tapes. But when you're competing against the likes of Europe, the dollar suddenly doesn't look so bad. In a similar comparison, normally Lloyd Blankfein and Jamie Dimon would be worried about their jobs after GS and JPM have both declined by roughly 60%. But when your competition is Jimmy Cayne, Stan O'Neal, John Thain, Dick Fuld, etc. … they look like superstars.”

“Longer term, however, the US Dollar Index remains well off its highs of this decade, or even the last six years. As shown below, as recently as 2003, the index traded above 100, which is about 12.5% above current levels.”

Source: Bespoke , February 2, 2009.

Mansoor Mohi-uddin (UBS): Dollar strength will linger

“The inability of non-US banks to roll over short term funding of investments in illiquid US assets has been a key factor behind the dollar's strength since last summer - and should continue to support the greenback, says Mansoor Mohi-uddin, managing director of foreign exchange strategy at UBS.

“‘At the height of the credit bubble in mid-2007, the Bank for International Settlements estimates that major European banks' dollar funding needs was around $1,300 billion,' he says.

“‘As the credit crunch ensued and then worsened after the bankruptcy of Lehman in September 2008, securing this funding became very difficult due to the severe disruptions in interbank and foreign exchange swap markets and in money market funds.

“‘Also, some central banks withdrew dollar foreign exchange reserves they had placed with commercial banks before the crisis.'

“Mr Mohi-uddin notes that to ease the dollar shortage, the Federal Reserve provided swap lines with other central banks in October 2008. These have been extended until October this year, reflecting the need of foreign banks to keep borrowing dollars from domestic central banks.

“‘Of course, foreign banks also bought dollars in the spot markets, as evidenced by the drop in euro/dollar since last summer.

“‘While the dollar funding shortage in global banking persists, investors in the foreign exchange spot markets should expect the greenback to stay supported against the other majors.'”

Source: Mansoor Mohi-uddin, UBS (via Financial Times ), March 4, 2009.

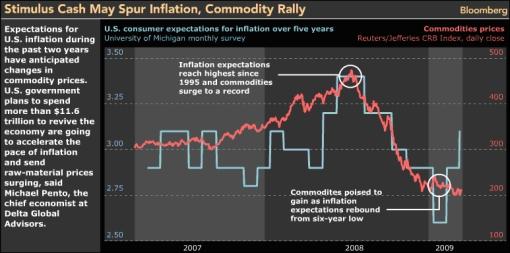

Bloomberg: Stimulus cash to spur inflation, commodity rally

Click here for the article.

Source: Bloomberg , March 5, 2009.

Bloomberg: Dennis Gartman sees $40 oil for “long period of time”

“Dennis Gartman, an economist and the editor of the Virginia-based Gartman Letter, talks with Bloomberg's Carol Massar and Matt Miller about the outlook for crude oil and gold. Gartman sees oil on ‘either side of' $40 for a ‘long period of time' and says he might cut his gold position.”

Source: Bloomberg , March 5, 2009.

Business Intelligence: Christopher Wood - gold may rise to US$3,500 by 2010

“CLSA's International Equity strategist Christopher Wood, whom the Wall Street Journal dubbed in 2007, at the start of the subprime crisis, as ‘the man who saw it coming', recently told a conference in Japan that gold will hit US$3,500 an ounce by 2010.

“The US is facing a deflationary collapse more severe than the crash that hobbled Japan's economy in the 1990s, leaving gold as the only defensive play for investors, he said.

“Speaking at CLSA's annual Japan Forum Conference last week, Wood said: ‘The collapse of securitization is a much more deflationary situation in the US than anything seen in Japan when the bubble collapsed in the early 1990s. What we need in the future is a more fundamentally disciplined system, even at the cost of higher levels of growth.'

“Gold is likely to more than triple from the current level to US$3,500 in 2010, he said. ‘It's the only form of money or credit not contaminated by the credit system - and the fact it's still money is that central banks still own a lot of it, the global paper currency system will steadily deteriorate, eastern and central Europe will face a full-scale currency collapse, putting huge pressure on western Europe.”

“Wood, who in 2003 predicted the US housing crisis and the subprime crisis, has been consistently rated among the top equity strategists on Asia - most recently by Institutional Investor magazine.”

Source: Business Intelligence , March 1, 2009.

CEP News: Euro zone manufacturing PMI hits record low in February

“Manufacturing activity in the euro zone fell at a record pace in February as companies reduced output and cut staff in response to slowing demand.

“According to Markit Economics, the euro zone manufacturing purchasing managers index fell to 33.5 in February, down from both the advance estimate of 33.6 and January's 34.4 level.

“The decline in the activities indicator was driven primarily by new orders, employment and output contracting at record paces in the month.

“‘The final Eurozone PMI data are a further disappointment on the earlier flash numbers for February, and indicate that the rate of decline of manufacturing has yet to stabilise,' Markit chief economist Chris Williamson said in a press release.

“‘The data are consistent with manufacturing output and employment falling at annual rates in the region of 12% and 5% respectively.'”

Source: CEP News , March 2, 2009.

CEP News: Euro Zone GDP confirmed to have contracted at record pace in Q4

“Eurostat has confirmed that the overall economic output in the euro zone has fallen at a record pace in the fourth quarter of 2008.

“According to preliminary estimates, euro zone GDP fell by a record 1.5% in the fourth quarter, in line with expectations and flash estimates. Economic output had contracted 0.2% previously.

“Disaggregating the figures, Eurostat noted that the weakness was widespread over the quarter. From Q3 to Q4, household consumption fell 0.9%, despite expectations of a 0.2% fall after rising 0.1% previously.

“At the same time, government expenditure fell 0.6% quarter-over-quarter, down from the +0.7% figure forecast, while investment spending also lost ground, falling 2.7% in Q4 and adding to Q3's 0.6% slide.

“After remaining stable in the third quarter, exports fell 7.3% in the three months to December. Imports slid 5.5% after spiking 1.4% previously.

“Year-over-year, euro zone GDP fell 1.3% in Q4, down from both the 1.2% decline expected and Q3's 0.6% annualized increase.”

Source: CEP News , March 5, 2009.

CEP News: ECB's Noyer says EU will aid troubled member nations

“The probability of a country within the European Union failing seems far-fetched, but if such an event were to occur, the Union would be compelled to come to its aid, European Central Bank Governing Council member Christian Noyer told lawmakers in Paris on Tuesday.

“The central banker, who is also the governor of the Bank of France, echoed comments by European finance ministers and central bankers on Tuesday about the possibility that some European countries will have to seek IMF loans to finance their balance of payments deficits.

“Closer to home, Noyer also noted that credit conditions within France are improving and that a recovery in the country's banking system is conceivable.

“He also criticized the so-called ‘Bad Bank' plan, which would take troubled assets off the balance sheets of financial institutions, arguing that such a model is difficult to implement and not necessary in France.”

Source: CEP News , March 3, 2009.

CEP News: Quantitative easing is BoE's new monetary policy tool

“Quantitative easing is the new monetary policy tool of the Bank of England now that the central bank cut its benchmark interest rate by 50 bps, as expected, to 0.50% on Thursday and unveiled an ambitious plan to buy UK government paper and private assets by printing money.

“‘Quantitative easing is clearly now going to be at the forefront in the Bank of England's ongoing efforts to stimulate the economy,' said IHS Global Insight Economist Howard Archer, who suggested that the BoE will expand the £75 billion in asset purchases authorized under the plan.

“The transactions will be made using the existing Asset Purchase Facility and will be funded using the central bank's balance sheet rather than the original plan to finance the APF by using short-term debt from the Treasury, the majority of which would be government paper.

“The monetary policy decisions taken by the Bank of England on Thursday were fully expected, explained Rob Carnell at ING.

“‘At £75 billion, the amount earmarked for the expanded APF is at the lower end of expectations of £50-£150 billion. But it looks as if the Governor of the Bank of England had asked for the facility to be £150 billion,' he said. ‘It is unclear at this stage whether there is a further £75 billion waiting in the wings and that might be only a first instalment.'”

Source: CEP News , March 5, 2009.

Financial Times: Martin Wolf - BoE's monetary policy should start unfreezing credit markets

“If the Bank of England is sufficiently ruthless, expansionary and imaginative, its new monetary policy should begin to unfreeze credit markets and allow the government to increase its spending, says Martin Wolf.”

Source: Financial Times , March 5, 2009.

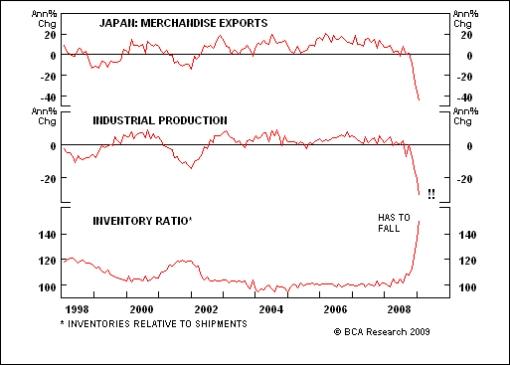

BCA Research: Japan - economic implosion!

“The Japanese manufacturing sector has collapsed, and further production cuts lie ahead.

“Industrial production plunged 10% in January, on the heels of a similar decline in prior months. Output has contracted a mind-boggling 25% in the past three months, exceeding the rate of decline in US production at any point during the Great Depression. The cuts in the transport and electronics sectors have been even more severe.

“Unfortunately, more pain looms in light of the spectacular surge in the inventory ratio, to the highest level on record. Firms will have to reduce production sharply to clear their excessive inventories in the absence of a pronounced pickup in demand, which is not in the cards.

“Last week's export data reinforced how difficult the current situation is for Japanese producers, with overseas sales down 46% in the past year and even more sharply in the past few months.

“Policy is likely to provide little support in the near term. Instead, any improvement in Japanese activity awaits an upturn in external demand. There is no sign of that anytime soon. Bottom line: Japan's economy will remain severely depressed in the coming months.”

Source: BCA Research , March 2, 2009.

CEP News: Chinese manufacturing PMI strengthens for third straight month

“China's manufacturing sector continued to strengthen in February, according to a report from the National Bureau of Statistics and the Federation of Logistics and Purchasing on Wednesday, which noted a third straight monthly increase in its headline manufacturing index.

“The headline index increased to 49.0 from 45.3 in January marking a three-month rebound from November's low of 38.8.

“The new orders component rebounded to 50.4 from 45.0 in January while the output index advanced to 51.2 from 45.5.

“The employment index also increased to 46.1 from 43.0.

“The report, coupled with expectations of additional stimulus from the Chinese government, are beginning to improve estimates of economic growth in 2009, according to Andrew Pyle, Wealth Adviser at ScotiaMcLeod.

“‘Estimates for the country's growth outlook in 2009 have also started to levitate from the alarming 5-6% suggestions earlier this year back to 8%. Not as lofty as what we have been used to, but firm enough to put a floor under commodity prices and that's what we're seeing this morning,' he said.”

Source: Erik Kevin Franco, CEP News , March 4, 2009.

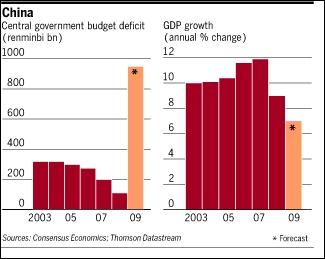

Financial Times: China sets sights on 8% rise in growth

“Chinese premier Wen Jiabao promised on Thursday to deliver 8% economic growth and record government spending this year, although he failed to outline the new stimulus package many investors had been expecting.

“In a two-hour speech outlining his ‘work report' to the National People's Congress, China's parliament, Mr Wen said the global financial crisis was deepening but the goal of 8% growth remained realistic.

“‘The global financial crisis continues to spread and get worse. Demand continues to shrink on international markets; the trend toward global deflation is obvious; and trade protectionism is resurging,' he said.

“But, ‘as long as we adopt the right policies and appropriate measures and implement them effectively, we will be able to achieve this target', he added.

“He provided few extra details to help clarify how much of that investment would be genuinely new spending and where the money would be allocated.

“Mr Wen said China would run a budget deficit this year of Rmb950bn, equivalent to nearly 3% of gross domestic product - a record in recent times for China but modest compared with some of the fiscal packages being considered round the world.

“Indeed, for all the talk about China's big fiscal plans for 2009, the 21% increase in total government expenditures for this year is slower than the 25.4% rise last year.

“Economists said China's relatively low debt levels meant the government could expand its fiscal stimulus during the course of the year if there were few signs of recovery.”

Source: Geoff Dyer, Financial Times , March 5, 2009.

CNBC: Chinese economy unlikely to grow 8%

“Gerard Lyons, chief economist and group head of global research at Standard Chartered, says China's stimulus efforts will work, but it is unlikely the economy will grow 8% this year. He speaks to CNBC's Martin Soong and Karen Tso.”

Source: CNBC , March 6, 2009.

Colbert Nation: Market psychology - Jim Cramer

“Jim Cramer discusses the psychology of the market with puppies and kittens behind him.”

Source: Stephen Colbert, Colbert Nation , March 6, 2009.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.