America's Second Great Depression and Great Stocks Bear Market Have Arrived

Stock-Markets / Recession 2008 - 2010 Mar 10, 2009 - 05:00 AM GMT

Emergency Briefing Transcript - America's Second Great Depression has arrived; and a great bear market is here. I prayed this day would never come as often as I predicted it. But now that it's here, I have a new prayer:

Emergency Briefing Transcript - America's Second Great Depression has arrived; and a great bear market is here. I prayed this day would never come as often as I predicted it. But now that it's here, I have a new prayer:

That you will boldly defend your assets before

the next big decline; build your wealth during the decline;

and reinvest it in America after the decline,

when we hit rock bottom.

No one can know in advance at what level that bottom will be. Nor can we know for sure when it will come.

But today, as the crisis unfolds in a rapid staccato of collapses, and as the severity of the damage is revealed, we can gain a firmer grasp on certain unassailable facts:

Fact #1. As in the early 1930s, the essence of this crisis is a debt collapse .

Fact #2. The debts today are far greater; and their collapse, more impactful. Specifically, in 1929, for every dollar of GDP, the U.S. had $1.70 in debt; today, it has $3.50, or nearly twice as much. In 1929, there were virtually no derivatives; today, among U.S. commercial banks alone, there are $176 trillion. In 1929, the U.S. was a creditor nation with no debts to foreign countries; now it's the world's largest debtor nation, owing more than $2 trillion abroad.

Fact #3. Between its peak in 1929 and its ultimate bottom in 1932, the Dow Jones Industrial Average fell 89 percent, the equivalent of a decline to Dow 1500 in today's market.

Thus, even if this depression is not more severe than the 1930s, a devastating, long-term bear market still lies ahead.

That's why we recently held an emergency briefing on bear market strategies. And that's why I'm dedicating this triple-length issue to the transcript …

The 11 Laws of Bear Market Success

with Mike Larson, Claus Vogt and Martin Weiss

(Edited Transcript)

Martin Weiss: Today marks an historic tipping point in this crisis; and this event marks a turning point for my company, for me personally and for you as well.

For the past three years, my team and I have repeatedly warned of a real estate collapse, a debt disaster, an economic catastrophe and a great bear market.

Now, the time to merely warn of future crises is behind us. They have arrived. They are headline news not just in America, but all over the world.

So now, it's time for us to play a new role — to inspire you to fight back, seize control of your own destiny, and triumph.

We want you to be able to harness the many profit opportunities that every bear market offers with confidence , so you can emerge from this crisis with greater wealth than you have today. And we want to help you seize those opportunities sensibly and prudently, preserving what you have now while building upon that foundation for the future.

Today, I am taking a giant new step toward accomplishing that goal. I am going to do something I've never done before. I will use this event to make the announcement for the first time.

Unfortunately, on Wall Street today, many advisers are little more than professional cheerleaders. They have put millions of investors into stocks and other investments that are at ground zero in this crisis. And now they are hoping against hope that, somehow, those companies will dodge the next bullets. They are hoping that, someday, the stocks will recover most of what they've lost. But instead, most of those stocks have just continued plunging, wiping out half or sometimes almost all of the money invested.

Meanwhile, on the other side of the spectrum, there are also many advisers who are defeatists, who would have you abandon your desire to profit in this environment; who say you must surrender your dreams for a better life.

The Wall Street cheerleaders were obviously wrong, and as we'll see in a moment, the results of their disastrous investment choices prove it. But the defeatists are also wrong. It is not hard to make money in a bear market. The only reason people believe it's hard is because they've been investing their money in all the wrong places!

That's a terrible shame.Bear markets are legendary for their ability to create solid money-making opportunities. And investors who follow the crowd — or investors who bow out — will miss not one, but two of the greatest profit opportunities of our lifetimes: The opportunity to earn healthy bear market profits now on the way down … and … the opportunity to earn solid profits again when markets inevitably touch bottom and turn back up.

That's why my message to you today is one of optimism, encouragement, and empowerment. You can do this. And today I'll show you how you can do it with confidence.

To help me, I have invited the two financial experts who have worked the closest with me in recent years on my Safe Money Report.

Mike Larson is the co-editor of the U.S. edition of Safe Money.

Claus Vogt is the co-editor of the German edition, called Sicheres Geld — the first and largest contrarian investment letter in Europe. Although the basic concept of that publication is based on my Safe Money Report, the content is different. Mr. Vogt has provided new, independent insights and amazingly accurate forecasts, which, in turn, we have imported back to the U.S. to add value to Safe Money.

Claus is also the editor of a European ETF trader, which has delivered overall gains (including losers) in the high double digits even while the U.S. stock market suffered its worst year since 1932. And Claus is the Research Director of a German bank which, thanks to his input, was one of the very few that made good money for its clients in 2008.

Today, Mike, Claus and I are going to do three things. First, we're going to show how Wall Street portfolio managers have violated nearly every major rule that's vital for making money in times like these. This is a bear market. But they're still following BULL market rules. And by so doing, they are ripping investment portfolios to shreds.

Second we're going to share with you our rules — our 11 LAWS for bear market success. We call them laws because we follow them religiously, and we'll show you why.

Third, we're going show you precisely how we're applying our 11 laws in practice , in an actual investment portfolio and why it's going to be easy for you to do the same.

Mike, you did a great job in our last event, thanks for joining again.

Mike Larson: Thank you.

Martin: Claus, welcome back to the United States!

Claus Vogt: It's great to be here again.

Martin: Actually, I'm kind of glad you also spend a lot of time in Germany.

Claus: Really?

Martin: Yes, because from your vantage point in Germany, you can track the U.S. economy and the U.S. markets just as closely as anyone on Wall Street. But unlike most people on Wall Street, your vantage point from afar lets you see the big picture that Wall Street has obviously missed.

In 1999, you accurately predicted the bear market of 2000-2002 that ultimately hammered the Nasdaq down by 75 percent.

|

And look at this book! This is a book about the American economy that virtually no one in U.S. saw or read, but which became a bestseller in Germany. It was published back in 2004, two full years before the first signs of the housing bust in America. Let me read the main conclusion:

“When the U.S. real estate bubble bursts, it will not only trigger a recession and a stock market crash, but it will endanger the whole financial system, especially Fannie Mae and Freddie Mac.”

Claus, you're the author of this book.

Claus: The co-author, with Roland Leuschel.

Martin: Yes, and in this one short paragraph, you predicted, well ahead of time, the precise sequence of events that has unfolded since. You predicted the U.S. housing bust. You predicted the U.S. recession. You specifically named Fannie Mae and Freddie Mac as primary casualties. And you warned about the entire crisis in our financial system. I think that shows amazing insight and foresight.

|

Claus: Thank you. Unfortunately, I think the situation could be even worse in Europe and elsewhere. So, in many ways, Americans are still fortunate. But our book was a warning to investors everywhere.

Martin: And you didn't stop there. Every month and almost every day since, you've been providing equally specific and accurate warnings to investors, institutions and governments. Fortunately, many have gotten your recommendations to get out of the stock market, to get to safety, to buy investments that soared in 2008 and that soared even more in recent months.

Claus: True, but UNfortunately, there are many more who have not gotten my recommendations — or yours. Instead, they have followed the advice of large money managers, mutual fund managers, pension fund managers, financial planners and other advisors. I've seen the portfolios of U.S. investors. So I have pretty good idea of what they own and what kind of advice they're getting.

Martin: And you're prepared right now to show us what those portfolios look like.

Claus: Yes. What you're going to see is that stocks are down sharply in the past year. That's no big surprise. What's surprising — often shocking — is that the portfolios handled by highly paid Wall Street money managers, the people so many investors trust with their money, are down even more . Just look at what they own and what they're buying.

I've put together a composite based on a wide spectrum of actual U.S. investment portfolios that are managed by major money management companies like Fisher Investments, Merrill Lynch, Morgan Stanley, plus bank trust departments and financial planners

Martin: I presume it's also similar to what you see in big mutual fund portfolios.

Claus: Very similar. Despite everything that's happened, they are almost fully invested in equities that are among the most vulnerable to huge losses in a bear market. Fisher, for example, manages about $45 billion and is almost fully invested in stocks. Merrill Lynch offers a wide variety of strategies and approaches, but almost all of them are heavily invested in the stock market. Same for most major brokers and mutual funds.

Martin: Can we go through some of the individual items?

|

Claus: Sure. This portfolio is actually fortunate in that it holds some stocks that have fallen less than the market, but not many. Johnson & Johnson is down only 13 percent. That's actually pretty good. But Exxon is down 20 percent. Procter and Gamble, down 26 percent. Lockheed, down 29 percent.

Martin: Not too horrendous. But I hate to see what's coming next on this list.

Claus: HP is down 30 percent. Occidental Petroleum, down 34 percent. United Technologies, down 38 percent. Merck, 39 percent.

What's ironic is that some of these are the stocks money managers are proud of.

These are the ones they hold out as if they were their winners, saying they helped you “lose less money.” I don't think many people are happy to pay for the privilege of “losing less money.”

Martin: A lot of investors hold these stocks today, I presume.

Claus: Yes, these stocks are in virtually every investor portfolio, either directly or through mutual funds. Same for the next ones: Target Corporation, down 45 percent. Honeywell, down 48 percent. Caterpillar down 61 percent. General Electric down 69 percent.

Martin: And the financials?

Claus: The financials stocks have now erased ALL of their gains since 1992! The entire bull market of the Clinton era — and more — is now gone. Again, this portfolio is actually fortunate in that it has only two financials: AFLAC, which is down 72 percent and Citigroup, which is down 88 percent.

[Editor's note: Just in the few days since this conference, all of the above shares have fallen significantly further, across the board.]

Martin: And it looks like they're still holding on to General Motors, which is nearly a total wipe-out.

Claus: Yes, they're riding it all the way down to zero. And remember: All of these declines you see here are just over the past 12 months . The declines from their peak levels are actually far deeper. And unfortunately, many investors, based on the bull market advice they were getting from Wall Street, rushed in to buy at, or near, the peak. And today, they are still operating under bull market rules .

Martin: Everyone now recognizes that this is a bear market. So why are they still operating under bull market rules? Let me rephrase the question this way: What steps, if any, did these big money managers take to protect their clients?

Claus: Only one step that we can see. They tried to add what they thought was a measure of diversification. They bought stocks in different sectors — real estate stocks, consumer goods, technology, aerospace, financial, and others you'd expect to plunge in a bear market. And of course, all of those sectors are falling. They bought large, diversified mutual funds , but those funds have also fallen sharply.

Martin: For example?

Claus: For example, Fidelity Magellan, which is off 51 percent in the past year, significantly more than the averages.

Martin: So much for stock market diversification!

Claus: It obviously didn't work. Plus, it's not uncommon to find foreign stocks in U.S. portfolios today. This portfolio has the iShares MSC Emerging Markets ETF, down 54 percent. It has Banco Santander shares, down 65 percent. And it has a very popular Russia fund, Market Vectors Russia, down 75 percent just in the last 12 months.

Martin: Didn't any of these big money mangers and advisers move to cash?

Claus: Some did to some degree. But many also did the opposite. They added more exposure on each major rally, and then they got caught with even bigger losses when those rallies failed.

Martin: Did any of the big managers hedge? Did they put on short positions or buy inverse ETFs?

Claus: No. I rarely, if ever, see hedges in these portfolios.

Mike: Martin, you and I have been reviewing your new blog, and we've been reading the thousands of comments from our readers. Many are very upset about what Wall Street has done to their investment portfolios. So I'd like to ask some of the questions they've been asking, or would be asking. And the first question is this:

You just showed us how big managers like Fisher, Merrill and others are still fully invested in stocks. But at the same time, those same managers now know we have a very severe recession and bear market, the worst since the Great Depression. Isn't that a contradiction? What explains this huge discrepancy between what they know and what they're doing with our money?

Claus: The simple answer is that Wall Street has no trouble buying investments and stuffing them into your portfolio. Their big problem — their big mental block — is selling those investments. No matter how far those investments sink, they just hold, hold, hold.

Martin: I'm sure there are some smaller, independent firms that have bucked the trend, that have greatly reduced their clients stock exposure, that have hedged against losses, even some that have made good money for their clients in the bear market.

Claus: Yes, there are. But the overwhelming bulk of the money at nearly all of the big firms is managed pretty much like I just showed you on the chart — mostly big cap stocks down anywhere from about 20 percent to 90 percent.

Mike: What about annuities?

Claus: Most of the annuities people own today are variable annuities, which are essentially mutual funds with an insurance overlay. But the losses there are just as bad.

Mike: Some people run their own account. And they seem to be more heavily into mutual funds than individual stocks. Are all major mutual funds down over 50 percent in the past year like Magellan?

Claus: No. There are some that are doing better. But there are also many mutual funds that are doing far worse. Among the nation's 25 largest mutual funds, most are underperforming the averages.

|

Mike: And for that they charge huge fees! Now I can see more clearly why many investors are so angry and so frustrated.

I'd be willing to bet that few of these professional money manager would dream of holding these stocks with their own money.

And yet, they're throwing other people's money at these investments like crazy. The bloggers on your site say they can't trust the advice coming out of Wall Street any more. Now I see why!

Claus: It's worse than most people realize.

Martin: In what sense?

Claus: Managers at trust funds, pension funds, and retirement funds are making themselves richer investing your money in things they know will probably make you poorer.

Martin: I often wonder where they find the unmitigated gall to continue doing that.

Mike: I watch real estate very closely. And the blunders in real estate stocks are among the most shocking to me. By 2008, every taxi driver from Manhattan to Miami or from Las Vegas to Los Angeles knew real estate and construction firms were dropping like flies. Yet the managers at major funds loaded up with — guess what — real estate and construction companies.

Last year, anyone with a TV, two good eyes and a pulsecould see that financial stocks were crashing 80 percent or 90 percent in value. So why did managers at many funds buy still MORE shares in National City, Sun Trust, Washington Mutual, Fannie Mae and other doomed financial companies?

Last year, everyone knew GM was hanging by a thread and could go bankrupt at any moment. So why did some major funds load up with General Motors? It's a shame and it's shameful.

Martin: Well said, Mike. But let me interrupt this discussion to say a word to our readers …

From your many comments on my blog, I know that you have a better understanding of what's happening today than most portfolio managers, Wall Street brokers or so-called economic “experts.”

You also have a better understanding the investment vehicles you can use to escape the stock market and still make money, or to even use this bear market as a continuing source of profit opportunities.

But you have confessed that you lack the confidence to put that knowledge to practical use — to start making money. Today, I'm taking some major steps to help provide that confidence, and the first of those steps is to share with you the 11 laws of bear market success that we use.

The 11 Laws

Claus: The first law of bear market success is protect your capital . It's easy to look back at the mistakes that big managers like Fisher made and big brokers like Merrill made and say, “Look! They bought the wrong investments. They screwed up.” True. That was a big mistake. But the bigger mistake they made was not their investment choices or timing. It was in their failure to protect your capital.

Act promptly to get rid of losers. Keep a ready store of cash. Remember: Just by keeping what you have you'll be far ahead of virtually everyone else.

The second law is: Use common sense — follow your own instinct! If you can see with your own eyes that a company is going down the tubes, get out. Don't let a broker or a financial planner talk you out of selling investments that are obviously burning a hole in your portfolio.

Law #3. Don't count on the government to turn the economy around or save sinking investments. The government has already loaned, spent or guaranteed trillions of dollars, and the economy is still sinking. Trillions more are not going to change that trend. Yes, the government can stimulate temporary rallies in the stock market. But when and if it does, use them as opportunities to unload the bad investments you've been stuck with.

Mike: Many investors say they have trouble distinguishing between a temporary rally and a real bottom.

Martin: Don't worry. We'll show you how we're going to make that very easy for you in just a moment.

Claus: Law #4. Invest exclusively in liquid, heavily traded investments.

Martin: In other words, stay away from investments that are easy to buy but hard to sell.

Claus: Exactly. Beware of mutual funds, annuities, insurance policies or even bank CDs that lock you in with sales fees or penalties. Stay away from thinly-traded small cap stocks, municipal bonds or exoteric plans that can entrap you. It doesn't matter how good the investment may appear. If you can't jump out at a moment's notice, it's no good for these uncertain times.

Law #5. Stay flexible. One of the big mistakes Wall Street managers make is to limit their choices to stocks and be stuck in that mold. So when all stocks fall, there's no way they can avoid losing money. Instead, expand your horizons beyond traditional investing approaches. As long as it's based on common sense and as long as you can buy and sell it easily in an ordinary brokerage account, don't scratch it off your list just because it's new to you.

Law #6. Use investments that move independently of stocks and bonds. For example, currencies, which you can buy through simple instruments such as currency exchange traded funds —

Martin: Currency ETFs.

Claus: Exactly. Plus, gold and commodities, which you can also buy through ETFs.

Law #7. Find special situations that go up DESPITE a falling market — companies that are virtually depression-proof.

Law #8. Use investments that go up BECAUSE of a falling market , such as inverseETFs that soar when stocks sink.

Law #9. Balance your portfolio. You saw how it was obviously a mistake to place all bets on a bull market without any counterbalancing investments or hedges. Similarly, it could be a mistake to place all your bets on a bear market. In addition to inverse investments, at the right time, make sure you have some counter-balancing positions … in special situation companies, plus currencies, gold and even some commodities.

Mike: I'm assuming all this can be done without getting into esoteric investments and without opening special brokerage accounts.

Claus: Right, with your standard stock brokerage account or even a retirement account. If you can buy IBM or AT&T, you can buy this diverse field of investments for a bear market.

Law #10. Don't fall in love with your investments. Take your profits along the way. Then roll those profits into new opportunities.

Martin: The big timing question is when will the market hit rock bottom, something we're going to cover in a moment. But let me give you a heads up by explaining law #11: Above all, be a contrarian and buck the crowd.

Looking back, whenever a broker, an adviser, even a friend or relative told you to “buy, buy, buy,” it was the worst possible time to invest. Likewise, looking ahead, when everyone finally throws in the towel and tells you to “sell, sell, sell,” it could be the best time to invest.

My father was the ultimate contrarian and it served him well, especially in bear markets. In 1930, when the market had enjoyed a big rally and everyone thought a new bull market had begun, he borrowed $500 from his mother — my grandmother — shorted the market and, by the time the market hit rock bottom two years later, he had over $100,000.

Mike: What would that be in today's dollars?

Martin: More than $1.2 million. He multiplied that $500 two hundred times over. But here's the other half of the half the story:

In 1933, when thousands of banks were failing and everyone thought the world was coming to an end, he turned bullish and bought big cap stocks with both fists. He bought General Motors, AT&T, General Electric, Sears and many others for pennies on the dollar. The sentiment was so bearish that trading had practically come to a halt. Only 400,000 shares of stock traded that day on the entire New York Stock Exchange, less than one single transaction in today's market. Yet, it was the best time to buy.

You could have done equally well in the major bear markets of the mid 1970s, early 1980s and 1990. That shows the power of contrarian investing.

Mike: Everyone knows that to profit, you need to buy low and sell high. That means buying what nobody else wants at fire-sale prices and selling what everybody is clamoring for at top dollar. But to do that, you have to be a contrarian investor. And as we mentioned at the outset, for many investors, the piece of this puzzle that's missing, especially in bear markets, is confidence. It takes confidence to diverge from the crowd and find opportunity where others see only danger. It takes confidence to ACT when others are frozen by fear, to actually do what must be done to get your wealth growing again.

So if I may represent the reader, I say I need an anchor. I need something to give me that confidence.

Martin: Esteemed reader, I hear you! I have read your comments on my blog. For me, it was a major education unlike any I've ever had. I have taken your comments to heart. That's why I am taking a very unusual, unprecedented step today.

I am opening an account at Fidelity.com — because Fidelity gives me an unaffiliated, third-party tracking of what we do. I am funding that account with my money. And I am going to invest that money using our 11 laws of bear market success to go for generous profits beginning right away.

Mike: How do you see this helping our readers?

Martin: We're going to do all of this in broad daylight, with full transparency. Claus is going to give our readers a head start on me by telling readers what we're about to buy or sell 48 hours in advance — and he's going to post our actual results — the statements Fidelity sends us — online.

Mike: That is very unusual. How much are you putting in this account?

Martin: One million dollars.

Mike: Why one million?

Martin: It's not the amount that counts. By investing a million dollars, I just want to send a very clear message that I am serious, that I am confident in what we do.

I'm confident in the instruments we're going to invest in. And I'm confident in Claus' track record, his prudence and his contrarian approach. Investing a round million is my way of conveying that confidence to you, the investor, so you can also be confident, to invest in what I invest, to understand that we're in this together, to know that this is real and that I have skin in the game.

I'm confident in our 11 laws of bear market success — to make money in down markets. And I'm confident we will know when the bear market ends to make money on the upside.

Mike: Martin, a lot of people commenting on your blog are going to be very happy you're doing this. They've been saying: I can't believe for one moment that people like Fisher or people at Merrill are actually putting their own money into Citigroup, into Fannie Mae, or into a Russia fund and just letting it sink to practically nothing. But now you are doing exactly what our readers are asking you to do: You're putting your money where your mouth is.

Martin: I have every incentive to make sure Claus follows each of the 11 laws to the letter. And Claus also has a strong incentive to do the same.

After mid-March, he's going to start recommending allocating the funds in my account. He's going to start by recommending investments that can generate generous profits in a great bear market … and then, as each major market sector touches bottom in sequence, he's going to go for profits on the upside.

Mike: What are you calling this portfolio?

Martin: I've named it “Weiss Research's Million-Dollar Contrarian Portfolio.”

Mike: How will investors be able to follow what you do?

Martin: That's the second very unusual aspect of this approach: We are going to invite investors to follow our portfolio by becoming members of our new service, the Million Dollar Contrarian Portfolio.

Claus: Before we buy anything, I am going to give all our members a heads up. I'm going to send out an instant alert at least two full trading days ahead of time, always giving members the opportunity to buy before we buy.

Likewise, before we sell anything, I am going to do exactly the same thing. I'm going to send all members an advance alert. And I am going to give members at least two trading days to sell before we do.

Martin: The point is to build our wealth together. You will never have to wonder if these are things I'd buy with my own money. I am buying them with my own money! This is an usual approach but I think it's very fitting for these unusual times. It provides the transparency and the confidence investors need to preserve their capital and make money in difficult times like we're going through right now, religiously applying the 11 laws of bear market success.

Claus: To give investors a sense of how I apply those laws in practice, I think it would be helpful if I share with everyone what types of opportunities I'm looking at.

Martin: Yes, please, but before you do, I want to stress three things to our readers:

First, you don't have to invest a million dollars. That's the investment I am personally making to convey to you how confident I am in what we're doing, in what Claus is going to do. But if that's too much for you, you can invest much less. Or if you wish, you can invest more. The ultimate decision of how much you want to invest is up to you, based on your personal circumstances.

Claus: We will never violate law #4. We will always invest in liquid, heavily-traded instruments. So the size of your account should not be an issue.

Martin: Right. Second, I recommend that investors not wait for the day I invest. When Claus sends you an alert, go ahead. Buy before I buy and sell before I sell. I'm delaying my buys and sells not because I think I'll get better prices by waiting. I'm doing it strictly to make sure that if anyone is going to have a strategic advantage, it's going to be you, not me.

Third, remember Claus is not managing your money. He's issuing recommendations for me to invest my money, while showing you how, so you can invest along with me. You're the one who must make the final decision regarding what to buy and how much. But don't worry. If you're away from your desk or even if you're on vacation, we have instant communication tools set up to make sure we can reach you without delay.

Mike: I have some specific questions.

Claus: Go ahead.

Mike: No slight intended, Claus, but Martin, you have a separate affiliate which manages money. Since they also have many yeas of bear market expertise and experience, why didn't you choose one of their portfolio managers to manage your money?

Martin: I'm glad you asked. Claus does not manage my money. He provides research and portfolio recommendations to me and our members. We, in turn, must make our own decisions to execute those recommendations in self-directed brokerage accounts. In contrast, our separate affiliate, Weiss Capital Management does manage accounts for individual investors and institutions, but does not provide portfolio recommendations for self-directed accounts. Each provides two very different and separate services.

Claus has the track record in both bull and bear markets. He has access to our vast databases. He can pick up the phone and talk immediately to every one of our experts at any time. He will always be applying our 11 laws of bear market success.

Plus, we now have a major advantage that my Dad could never have imagined in his wildest dreams. We can now use bear market vehicles that are more familiar and comfortable than anything Wall Street offered back in the 1930s. They're far simpler to buy, they're not nerve-wracking to hold, and they're easy to sell.

Mike: Do I need any special approvals or qualifications to open an account?

Claus: No. Just your standard stock brokerage account. It doesn't have to be Fidelity.

Mike: Can I do this in a retirement account?

Claus: In an IRA, yes. In a 401(k), in which your choices are limited to a small number of mutual funds, no.

Mike: Is this for my core money? Or is it just for my risk money?

Claus: You should never put all of your money in one strategy or program. But to answer your question, we will do both. Most of the portfolio will be invested conservatively. But we will also include more aggressive strategies for a modest portion of the portfolio.

Martin: A great advantage of this approach is the transparency and disclosure that it allows. Everything I do in my Million Dollar Contrarian Portfolio will be in full display on our members-only website.

Claus: If you're a member, you'll see exactly what we're buying or selling at what price and when. You'll see how much we're paying in commissions. You'll see how much we're making in interest or dividends. You'll see the profits and the losses, the winners and the losers. You'll see how much we paid for each investment, how much it's worth today based on current prices, how much it's up or how much it's down. You get the ultimate in transparency. You'll also be able to see every trade confirmation and brokerage statement the broker sends us.

You'll meet your fellow members online to talk about the portfolio or the markets. You'll join me in our monthly war room sessions where you can ask me any questions you want, live. You will not only have the opportunity to grow your money with us, but you will also learn how we apply our 11 laws in practice.

But the main goal, of course, is all-weather profit potential. My mission is to make as many profits as possible now in this crisis and to do it again when each sector starts to recover.

Upcoming Opportunities

Martin: Now's the time to tell us more about the opportunities you see.

Claus: The first opportunity is right here and now — to make money from investments that automatically go up when stocks go down.

Mike: You're talking about inverse ETFs.

Claus: Primarily, yes. There are now over 50 different inverse ETFs available. You can buy inverse ETFs that automatically rise with a falling Dow. You can buy other inverse ETFs that automatically rise with a falling Nasdaq. There are also inverse ETFs to profit from falling real estate stocks, falling financial stocks, falling energy stocks, falling small cap stocks, even falling stocks in Europe, Japan, China, or emerging markets.

Mike: I work closely with ETFs and I can tell you that, with inverse ETFs, the potential for profit is quite extraordinary even if the market is not moving dramatically.

Martin: And you have some examples of that.

Mike: Yes, for example, between June 5 and July 15, 2008, as tech stocks fell, the inverse ETF that's tied to technology stocks enjoyed a gain of 30.9 percent, while the inverse ETF tied to the semiconductor index rose 37.2 percent. Those are large gains for such a short period of time.

Around the same time frame, stocks in the real estate sector fell even more sharply. Result: a gain of 46.1 percent in the corresponding inverse ETF between May 15 and July 15.

Claus: And, financial stocks took a huge beating, as we've seen.

Mike: Yes, and that drove up the inverse ETF tied to the financial stocks by 106.7 percent in the same period. But as the markets fall more precipitously, the potential gains in inverse ETFs could be even larger.

For example, in September and October 2008, we saw a 61 percent gain in just 15 days. We saw an 89.1 percent gain in just 19 days as the real estate sector dropped; an 89.6 percent gain in 19 days as the consumer services sector plunged; and an 89.9 percent gain in 8 days as the financial sector slumped.

Martin: Claus, I'm not expecting you're going to be able to catch the tops and bottoms of each major move.

Claus: I'm glad, because I probably won't. But it's crucial to understand two things: First, in each case Mike just cited, your risk in inverse ETFs is strictly limited to what you invest — not a penny more. And second, these kinds of gains can go a long way toward helping you through an economic crisis. The more those markets or sectors fall, the more money you can make.

Martin: Of course, the converse is also true. If the market goes UP and you hold inverse ETFs, you will lose money. So one of my requirements for this account is that Claus maintain, and strictly enforce, stop-loss limits on all ETFs.

Claus: There are definitely going to be sharp temporary rallies. But as we all can plainly see, the massive, overriding trend is likely to be down for many months — maybe even years — to come. I don't see the markets staging any major recovery any time soon.

Martin: If Dad were alive today, he'd have had a field day with inverse ETFs, especially the way markets are falling right now. Then, he'd have another field day with standard ETFs when the market hits rock bottom.

When the Market Hits Bottom

Mike: What happens when the market finally hits rock bottom?

Claus: Then, it will be time to buy some of the best bargains of the century.

Mike: But investors are asking: “How long do we have to wait for that?” Many investors are already approaching retirement. Some are in their 70s, 80s or even 90s. If this crisis is going least for a long time, are you going to just wait all that time before the first buying opportunity comes around.

Claus: That's a major misconception. We won't have to wait for one, singular moment in time when everything hits bottom simultaneously. In the real world, that's not what happens. Instead, you're going to see a series of bottoms, with some investments hitting bottom much sooner … and others hitting bottom much later. So instead of waiting years for the one, large 100-year buying opportunity, you should have many 100-year buying opportunities. I call them 100-year buying opportunities because, with good timing, you could be picking up some of the best bargains of the century.

Mike: Even former Fed Chairman Greenspan called this a 100-year tsunami.

Claus: Yes, but that's focusing strictly on the negative side. The positive side is that the worst crisis in 100 years also generates the best buying opportunities in 100 years.

Mike: Starting where?

Claus: Starting in the bond market, with Treasury bonds. In every depression or deflation in history, the value of Treasury bonds has gone up dramatically, sometimes even more sharply than stocks.

Mike: But in this cycle, they already have gone up dramatically. So most investors are asking: “Isn't it already too late? Haven't we missed that chance?”

Claus: No. With the federal deficit exploding, long-term Treasury bonds are going to temporarily plunge in price. And that will be your chance to pick them up at a big discount.

Mike: This is what seems to puzzle many investors the most. They're asking: “If the Treasury's finances are going to be messed up that badly, why do you recommend them?”

Martin: We don't recommend the long-term Treasury bonds right now — just the short-term Treasury bills. But in the near future, we believe there's going to be an opportunity to pick up Treasury bonds at a much lower price, and lock in a very nice yield. So if you've missed the first chance to buy Treasury bonds and lock in high yields, you should have another chance.

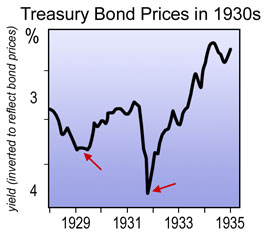

As you can see in this chart, back in the 1930s, yes, the first opportunity to buy bonds was before the crash of ‘29, in this period here. (See first red arrow.)

|

But in the early 1930s, there was a second big plunge in Treasury bond prices and a second, even better buying opportunity to lock in tremendous yields. (See second arrow.)

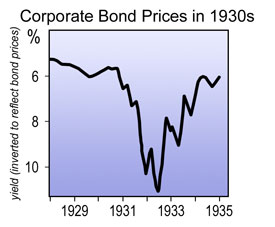

Claus: This cycle should be similar. And the second major buying opportunity I anticipate will be in high quality corporate bonds.

Mike: Before stocks?

Claus: Yes, probably.

Mike: Why?

Claus: Two reasons: Investors will be afraid of stocks and hungry for yield. Plus, after such a massive collapse in the economy, it's going to take time for corporate profits to recover. So investors in their stocks may have to wait a long time before they see growth.

Martin: Meanwhile, your investment is dead in the water.

Claus: In stocks, yes. But not in bonds. In bonds, while you're waiting, the company is paying you fat, double-digit yields. It's paying you to wait. And as soon as people realize that the company isn't going broke, you could see deeply discounted bond prices surge dramatically in value.

|

Martin: In the 1930s, deeply discounted bonds doubled in value within two or three years, sometimes within just a few months. And we're not talking about stocks. We're talking about bonds .

Mike: What about this time around? Will they double in price?

Claus: Too soon to say. But if I'm right, you could buy high quality bonds in some of America's largest, most stable companies for 50 cents on the dollar. You could lock in a yield of upwards of 15 percent per year. On top of that, you could see your bonds surge from 50 to, say, 75 cents on the dollar — maybe in a two-year time period.

Martin: That would be a capital gain of 50 percent for the two years.

Claus: Right, or 25 percent per year for the two years. If you add the 15 percent interest, you'd be talking about total returns of 40 percent or more.

Mike: That's strictly during the bond market recovery period when corporate bonds are bouncing back in price, right?

Claus: Correct. Then, if markets stabilize, your total return would settle back at 15 percent — just the interest portion. You could sell it at that point and earn the capital gain. Or you could just sit with it and lock in the 15 percent for many years.

Martin: Both very good choices to have!

Mike: What about stocks paying solid dividends?

Claus: The same logic applies to dividend-paying stocks. If, despite recession, depression, deflation and financial collapse, a company can continue to pay good dividends, that's the most reliable evidence you could possibly have that the company's solid, that it's worthy of your money. And the beauty of it is you can invest with a lot less risk than you would in the best of times.

Mike: Why less risk?

Claus: For several reasons. First, because the company will be cheap. So that reduces our downside risk right from the beginning. Second because the company is paying us dividends. That flow of cash into our portfolio also helps cover a lot of downside risk. And third, because, like I said, the company has just been through the harshest stress tests of all — the test of truly tough times — and it has not only survived as a company, it's dividends have also survived.

Martin: But at that point, most investors will be too frightened to take advantage of it. They'll still have too many losses in their portfolio. Their confidence will be shot to hell and the dividend paying stocks will be extremely cheap. That's why it pays to invest as a contrarian, and to do so with confidence.

Mike: Can you give us some examples of high dividend paying companies?

Claus: It's too soon to pinpoint which ones we'll be buying. But Weiss Research's dividend specialist, Nilus Mattive has given us some good historical examples to illustrate the power of dividends.

Take Procter and Gamble, for example. Its shareholders have received larger and larger dividend checks every year for 52 consecutive years. But you wouldn't have to go back that far. If you had bought P&G just 15 years earlier, by 2007 you would be earning an effective dividend yield of 11.3 percent, more than twice what you could get on a Treasury bond at that time.

Mike: Isn't it possible they'll reduce or even suspend their dividends in a depression?

Claus: Yes! But for us, that's an opportunity to buy at a much cheaper price. Here are some more examples: Investors who bought Johnson & Johnson shares 15 years ago received an effective dividend yield of nearly 17 percent. Investors who bought Altria were getting 18.6 percent.

Once these markets touch rock bottom, you're going to have major opportunities in every sector — technology, energy, and even financial stocks. We can already begin to see which banks are going to survive. It's too soon to buy them now. But when the worst of the crisis is past, those banks are going to inherit tremendous market share from failed banks. Buying these stocks for pennies on the dollar you'll feel like a child in a candy shop. Our challenge is not going to be finding opportunities. The challenge will be to reject the less sweet opportunities.

Martin: Thank you, Claus. That sums it up nicely. You are going to start allocating funds promptly after mid-March.

Claus: Yes. So investors who want to join must enroll now or not at all. You have to be on board before I make the portfolio allocations. We can't have new members joining at any time. So we have a very fixed, limited enrollment period, which will close March 18.

Thank you Mike, Claus. And thank you, our viewers and readers — not only for joining us today but also for your great comments on my blog. I look forward to many more.

Editor's note: To underscore the urgency of getting on board now before this market makes its next huge move, we've structured the pricing for the service in way that encourages you to join during this enrollment period.

If you join before enrollment closes on March 18, 2009, it's $1,500. If you wait until a possible enrolment period sometime in the future, whenever that may be, it will be $2,000.

For more information on the Million-Dollar Contrarian Portfolio, or to join now, click here.

Good luck and God bless!

Martin

This investment news is brought to you by Money and Markets . Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com .

Money and Markets Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.