Global Zero Interest Rates Policy Means Spend Now Pay Later

Interest-Rates / Global Financial System Mar 12, 2009 - 01:16 PM GMTBy: Mike_Shedlock

ECB President Trichet has effectively cut its interest rate policy to .5% by agreeing to provide banks an unlimited supply of cash.

ECB President Trichet has effectively cut its interest rate policy to .5% by agreeing to provide banks an unlimited supply of cash.

Let's tune in with a look at ECB Approaches Zero Rates by Stealth With New Weapon .

European Central Bank President Jean-Claude Trichet's new weapon to battle the recession is taking him closer than it seems to zero interest rates.

Trichet is allowing the ECB's deposit rate, which lenders earn on overnight deposits with the central bank, to usurp the benchmark refinancing rate and become the main driver of short- term borrowing costs. At just 0.5 percent, the deposit rate matches the Bank of England's key setting and is only a step away from the zero-to-0.25-percent range the Federal Reserve uses.

He “is implicitly admitting that the deposit rate has now become the key barometer of the ECB's policy,” said Nick Kounis, chief European economist at Fortis in Amsterdam. “The ECB has become more and more comfortable in pointing that out, not least because it's been accused of keeping interest rates too high.”

The euro overnight index average, or Eonia, fell to 0.85 percent yesterday after the ECB's latest rate cuts took effect -- about 0.7 percentage point below the 1.5 percent benchmark rate. Overnight deposits dropped to 56.3 billion euros, the lowest amount since Oct. 8.

The ECB's decision to offer banks unlimited amounts of cash, announced on Oct. 8, has culminated in the deposit rate setting the new de facto cost of short-term money. The measure removed the need for banks to borrow in the money market to meet their reserve requirements.

Unlimited cash “results in refinancing costs for banks well below the current benchmark interest rate,” ECB council member Axel Weber said on March 5. “We expect banks to pass this on to consumers and companies to stimulate the economy.”

The euro interbank offered rate, or Euribor, that banks say they charge each other for six-month loans dropped to a record low of 1.79 percent today. Market rates of the same maturity traded at 2.07 percent in the U.K. and 1.90 percent in the U.S.

Trichet hasn't ruled out further rate cuts. The ECB has “not decided ex-ante that the present level was the lowest,” he said during a press conference in Vienna today. Still, “we are at very low rates.”

Officials are hesitant to go much lower. There is “no reason to see the refinancing rate below 1 percent,” Weber said on March 10. “I also see a problem with lowering the deposit rate to zero. I would prefer to leave it at 0.5 percent.”

That reticence may be linked to Japan's experiment in the 1990s, when it lowered its key rate to zero to revive its economy in what became known as the “lost decade.”

Japan shows that keeping rates too low for too long “will cause interbank trading to run dry, despite the ECB's efforts to revive it,” said Michael Schubert, an economist at Commerzbank AG in Frankfurt.

Some ECB officials are concerned that too-low market rates will become counterproductive because they will sap banks' returns and give them less incentive to trade with each other. That would undermine the ECB's aim to revive interbank lending through its unlimited liquidity operations.

“If we had excessively low interest rates, why would banks start lending to each other?” ECB council member Yves Mersch asked March 10. “It would be much safer to put their excessive funds into the central bank rather than engage in the interbanking market.”

Global ZIRP Arrives

Effectively the US and Japan are now at 0-25% and the UK and EU are at .5%.

Thus, global ZIRP (Zero Interest Rate Policy), has arrived. The odds that this stimulates lending to customers or between banks is slim. Quantitative easing is the next step, and the Bank of England is already foolishly marching down that path.

The fact remains that quantitative easing did not help Japan one iota. Instead Japan has the highest debt to GDP ratio of G20.

Piling Up The Debt

Piling Up The Debt

Please consider Weighed Down By Government Debt .

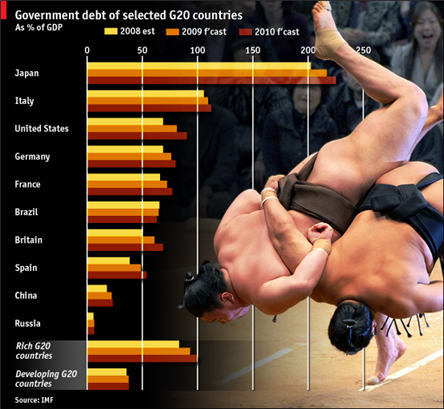

AMERICA, Britain and China are among the many countries that have adopted spend-now-pay-later policies to stave off economic disaster. But giant fiscal stimuluses, tax cuts and bail-outs are weighing heavily on public finances. In a paper prepared for the forthcoming G20 summit, the IMF sets out new forecasts for government debt. Japan's debt burden, which is already the largest of the world's big economies, will reach a sumo-sized 225% of GDP in 2010. Rich countries' debt is set to grow from 83.3% of GDP in 2008 to almost 100% in 2010. Developing economies will see much smaller growth from 35.7% to 37.8% in two years, but these countries also have lower debt tolerance than rich ones.

Keynesian clowns say the way out of this crisis is to spend more. One look at Japan's debt should be enough to prove that can't possibly work. Hell's bells, common sense alone should be all it takes to figure out that you cannot spend your way out of a hole when the hole was dug by spending.

Right now, New Zealand is the only country displaying any common sense. Please see In Search Of Common Sense for details.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.