Will Global Quantitative Credit Easing Work?

Interest-Rates / Quantitative Easing Mar 15, 2009 - 06:41 AM GMT The Wall Street Journal: New fears as credit markets tighten

The Wall Street Journal: New fears as credit markets tighten

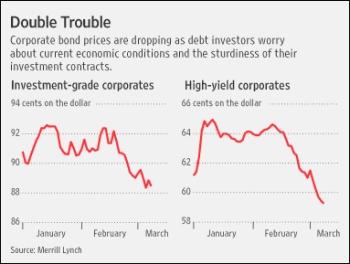

“The credit markets are seizing up again amid new anxieties about the global financial system.

“The fear and uncertainty that sent stocks to 12-year lows is now roiling the market for corporate bonds and loans, which have given back much of the gains they chalked up earlier in the year.

“Short-term credit markets are still performing better than they did last year thanks to government programs to buy commercial paper and guarantee short-term debt. But Libor, the London interbank offered rate, a common benchmark interest rate, has crept up over the past weeks, from 1.1% in mid-January to 1.3% on Friday, reflecting banks' concerns about being paid back for even short-term loans. It is still well below its peak of 4.8% last October.

“This time around, the economy is slipping deeper into a recession, and bond investors worry the government's repeated modifications to its financial-rescue packages are undermining the very foundations of bond investing: the right of creditors to claim their assets first if a borrower defaults. Without this assurance, bonds of even the most stalwart institutions are much riskier to own.

“After what seemed like the beginning of a thawing of debt markets early in the year, sentiment has deteriorated, analysts say. The markets remain open only to the strongest companies. A rally in US Treasury bonds last week reflects another bout of flight-to-quality buying. Junk bonds now yield 19 percentage points more than safe Treasury bonds, up from a 16-point spread in February, according to Merrill Lynch. The spread is still narrower than the 21-percentage-point premium reached last December, but any widening shows investors are becoming more fearful.

“Part of the problem is that investors are still waiting for key details from the government about its plans to bolster US banks and unfreeze the credit markets. After launching a $1 trillion program to kick-start consumer lending last week, the Obama administration is considering creating multiple investment funds to purchase bad loans and other distressed assets. The intent of the funds is to stabilize the prices of good assets and restore investor confidence.

“Without more clarity from the government on its bailout plans, the market could continue to drop, say analysts. That would further harm the economy and the institutions the government hopes to help, compounding its task of shoring up the financial system.”

Source: Liz Rappaport and Serena Ng, The Wall Street Journal , March 3, 2009.

BCA Research: A world of credit easing

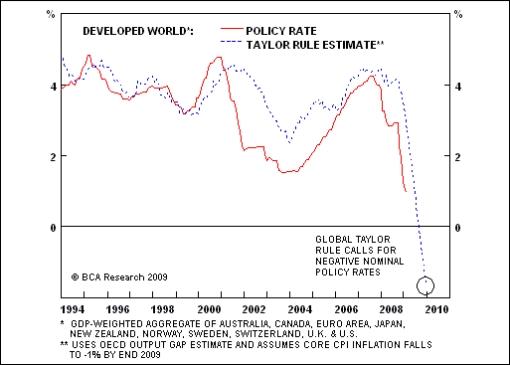

“Quantitative or credit easing, coupled with dramatic fiscal support, may be the only viable option to prevent a debt-deflation spiral from taking hold.

“The depth of the economic recession and widespread deflation suggests that nominal policy rates need to drop into negative territory in order to provide adequate stimulus, which is impossible. Conceptually, at equilibrium, the cost of capital in the aggregate economy should roughly be equivalent to nominal GDP growth (a proxy for the rate of return in the aggregate economy). If the authorities push interest rates below GDP growth for a prolonged period, they subsidize growth and run the risk of overheating the economy.

“Conversely, keeping interest rates above economic growth restricts activity and creates recessionary pressures. Given that there will likely be a rare decline in nominal GDP in the developed world this year, there is also a need for nominal policy rates to drop into negative territory (i.e. close to zero and accompanied by aggressive quantitative or credit easing) in order to provide sufficient stimulus. The Taylor rule for the developed countries provides a similar reading.

“Bottom line: The world economy is still at risk of falling into a debt-deflation spiral and reflation efforts will need to be ramped up further. Policy rates are converging on zero and aggressive quantitative or credit easing measures in each of the major countries can be expected. Ultimately, this should benefit high quality spread product, but also government bonds given that central banks will buy these bonds outright or will buy private sector assets that could help push government yields lower via arbitrage.”

Source: BCA Research , March 11, 2009.

Stuart Thomson (Ignis Asset Management): Quantitative easing should be global strategy

“Quantitative easing should help improve risk appetite in the markets and rebuild economic growth - but can only be a truly effective strategy if it is adopted globally, says Stuart Thomson, economist at Ignis Asset Management

“He argues that the Federal Reserve's current strategy isn't working. ‘Financial conditions have deteriorated to their worst level since last October with bonds and equity prices lower and the dollar higher.'

“Mr Thomson says the consequences of this deterioration have been further weakening of US activity in the first quarter. ‘Aggregate hours, which is an effective proxy for GDP assuming stable productivity, declined at an annualised rate of 8.2% during the first quarter,' he says. ‘There is a clear incentive for full QE, but we fear that the Fed will delay its own nuclear response to the credit crunch until the last possible minute.'

“He believes the US central bank may wait until June before taking decisive action, and suggests that the European Central Bank - traditionally seen as a policy laggard - could begin quantitative easing before the Fed.

“‘The ECB is expected to cut rates to 1% in either April, but most likely, May. This will force overnight rates to zero. However, the ECB staff's downgrades to growth forecasts implies rates should be below zero. This suggests the ECB will move to quantitative easing in either June or July.'”

Source: Stuart Thomson, Ignis Asset Management (via Financial Times ), March 10, 2009.

Bloomberg: Chang sees civil unrest spreading from global recession

“Ha-Joon Chang, a professor at the University of Cambridge, and Frank Holmes, chief executive officer of US Global Investors, talk with Bloomberg's Pimm Fox about the outlook for the global economic crisis. Chang and Holmes also discuss the outlook for trade, the credit market and investment strategy.”

Source: Bloomberg , March 9, 2009.

The Wall Street Journal: Obama, Geithner get low grades

“US President Barack Obama and Treasury Secretary Timothy Geithner received failing grades for their efforts to revive the economy from participants in the latest Wall Street Journal forecasting survey.

“The economists' assessment stands in stark contrast with Mr. Obama's popularity with the public, with a recent Wall Street Journal/NBC poll giving him a 60% approval rating. A majority of the 49 economists polled said they were dissatisfied with the administration's economic policies.

“On average, they gave the president a grade of 59 out of 100, and although there was a broad range of marks, 42% of respondents rated Mr. Obama below 60. Mr. Geithner received an average grade of 51. Federal Reserve Chairman Ben Bernanke scored better, with an average 71.

“The economists, many of whom have been continually surprised by the depth of the downturn, also pushed back yet again their forecasts for when a recovery would begin. On average, they expect the downturn to end in October. Last month, they said the bottom would arrive in August. They estimate that US gross domestic product will continue to contract in the first half of this year, with slow growth returning in the third quarter.

“Economists were divided over whether the $787 billion economic-stimulus package passed last month is enough. Some 43% said the US will need another stimulus package on the order of nearly $500 billion. Others were skeptical of the need for stimulus at all.

“However, economists' main criticism of the Obama team centered on delays in enacting key parts of plans to rescue banks. ‘They overpromised and underdelivered,' said Stephen Stanley of RBS Greenwich Capital. ‘Secretary Geithner scheduled a big speech and came out with just a vague blueprint. The uncertainty is hanging over everyone's head.'”

Source: Phil Izzo, The Wall Street Journal , March 11, 2009.

CNBC: Fed Chairman Bernanke on systemic risk

“Federal Reserve chairman Ben Bernanke says the Treasury and Fed will take any necessary steps to ensure banks have enough capital and liquidity.”

Source: CNBC , March 10, 2009.

Asha Bangalore (Northern Trust): Bernanke sketches out financial reform agenda to “address systemic risk”

“In his speech to the Council on Foreign Relations, Chairman Bernanke voiced the contours of financial reform. More importantly, he stressed that ‘until we stabilize the financial system, a sustainable economic recovery will remain out of reach. In particular, the continued viability of systemically important financial institutions is vital to this effort.'

“He went on to mention that ‘the Federal Reserve, other federal regulators, and the Treasury Department have stated that they will take any necessary and appropriate steps to ensure that our banking institutions have the capital and liquidity necessary to function well in even a severe economic downturn. Moreover, we have reiterated the US government's determination to ensure that systemically important financial institutions continue to be able to meet their commitments.'

“There were five aspects of future financial reform addressed in today's speech:

(1) The main thrust of Bernanke's judgment regarding the large interconnected firms or firms that are ‘too-big-to-fail' is that policymakers should concentrate on how to prevent these firms from excessive risk-taking and minimize the consequences of unwinding these ‘critical firms'.

(2) He noted that the ‘financial infrastructure' needs to be strengthened such that it will perform well under stress and indicated that gaps in the regulatory framework that allow a migration of firms to less-regulated from more-regulated forms should be eliminated.

(3) Bernanke stated that improved tools are necessary to addresses the unwinding of large non-bank financial institutions such that they are not a systemic risk and threaten public interest.

(4) He spoke about excessive procyclicality of capital standards and why they need to be changed because the current structure leads ‘financial institutions to ease credit in booms and tighten credit in downturns more than is justified by changes in the creditworthiness of borrowers, thereby intensifying cyclical changes.'

(5) He was of the opinion that ‘we should consider whether the creation of an authority specifically charged with monitoring and addressing systemic risks would help protect the system from financial crises like the one we are currently experiencing.'”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , March 10, 2009.

Bloomberg: JPMorgan's Dimon says US needs systemic risk regulator

“Jamie Dimon, chief executive officer of JPMorgan Chase, speaks about the need to establish a ‘systemic risk regulator' and set up procedures to deal with potential failures of large financial institutions. Dimon, speaking at a conference hosted by the US Chamber of Commerce in Washington, also discusses his firm's use of aid from the Troubled Asset Relief Program and the outlook for the financial market crisis.”

Source: Bloomberg , March 11, 2009.

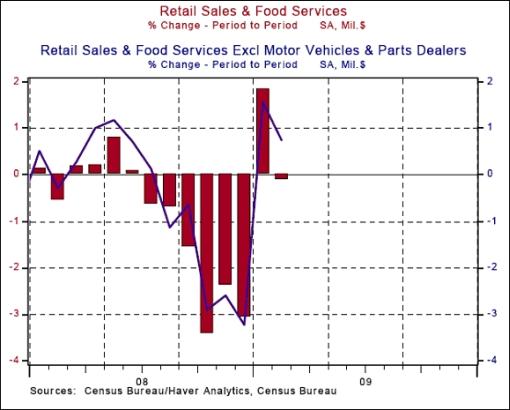

Asha Bangalore (Northern Trust): Consumer spending - less pronounced weakness

“Retail sales dropped 0.1% in February after a 1.8% gain in the prior month. Excluding autos (-4.3%) and gasoline (+3.4%), retail sales moved up 0.5% in February versus a 1.4% jump in January. Most of the major components of retail sales excluding autos and gasoline advanced in February - apparel (+2.8%), general merchandise (+1.3%), furniture (+0.7%), electronics and appliances (+1.2%). The exceptions were the 0.2% decline in sales of building materials and a 0.7% drop in purchases of food.

“In addition to the strength implied by these numbers, retail sales in January were revised to a 1.8% increase from the earlier estimate of a 0.7% gain, which implies that real consumer spending in January will be raised from the current estimate of a 0.4% increase. Therefore, on a quarterly basis, real consumer spending is most likely to show a decline in the first quarter but it will be significantly smaller than the 3.8% and 4.3% drops recorded in the third and fourth quarters of 2008.

“The important question is if this pace of gains in retail sales will prevail in an environment where employment conditions are abysmal. The dire employment situation persuades us to forecast weakness in consumer spending in the near term.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , March 12, 2009.

CEP News: Unemployment rate tops 10% in four US states

“The unemployment rate rose to double digits in four US states in January, the Department of Labor reported on Wednesday.

“Unemployment is now above 10% in California, Michigan, South Carolina and Rhode Island, the Labor Department's report on state unemployment showed. Michigan's rate, at 11.6%, is the highest in the country, followed by 10.4% in Rhode Island.

“At the other end of the scale, Wyoming recorded the lowest jobless rate at 3.7%.

“The jobless rate rose in 49 states and the District of Columbia in January compared to a year earlier, causing the national unemployment rate to rise to 7.6% from 7.2%. Louisiana was the only state to see a monthly drop in unemployment, where it fell to 5.1% from 5.5%.

“February unemployment, which was released last week by the Bureau of Labor Statistics, rose to a 25-year high of 8.1%.”

Source: Stephen Huebl, CEP News , March 11, 2009.

Bloomberg: Feldstein says US unemployment rate may rise above 10%

“Martin Feldstein, an economics professor at Harvard University, talks with Bloomberg's Kathleen Hays about the outlook for the US unemployment rate. Feldstein also discusses Citigroup's financial position, regulation of the banking industry, and the state of US and European economies.”

Source: Bloomberg , March 10, 2009.

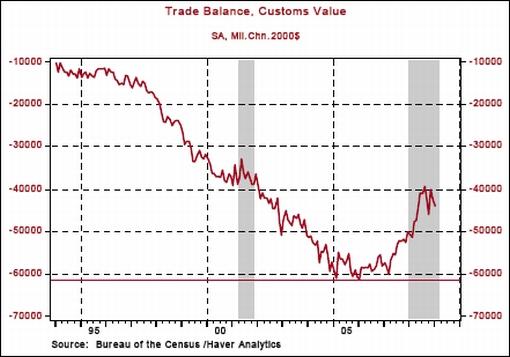

Asha Bangalore (Northern Trust): Real trade deficit will be a drag on Q1 GDP

“The trade deficit narrowed to $36.03 billion in January from $39.9 billion in the prior month. The nominal trade deficit has declined roughly 46% from a high of $66.97 billion in July 2006 - an impressive improvement in a very short period. In January, the price of imported oil dropped to $39.81 from $49.93 in the prior month and helped to narrow the trade deficit in addition to a reduction in the quantity of imported petroleum (-1.4%).

“More importantly, inflation adjusted trade data give a more accurate picture of the impact of the trade deficit on real GDP. The real trade deficit of goods widened in January to $44 billion from $42.9 billion in December, which is not a favorable factor for growth of real GDP in the first quarter, assuming the trade deficit fails to record a noteworthy improvement during February and March. Nonetheless, it is noteworthy, that the real trade deficit of goods has narrowed 28.4% from the widest trade gap in January 2006 ($61.4 billion).”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , March 13, 2009.

Asha Bangalore (Northern Trust): Household net worth records historic plunge

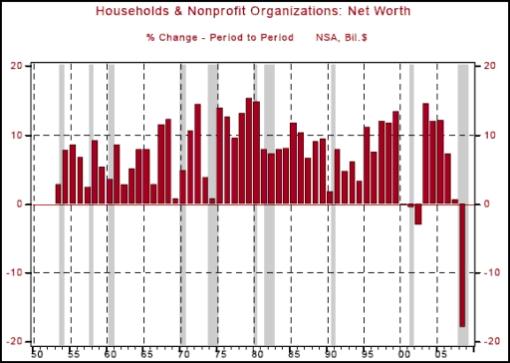

“Household net worth fell $5.1 trillion in the fourth quarter of 2008, putting the annual decline at $11.2 trillion. Net worth of households in 2008 is now slightly below the mark seen in 2004.

“The 2008 drop in net worth is the largest annual decline on record. During 2000-2002, households lost 3.8% of their net worth which was a record when it occurred. The 17.9% drop in net worth during 2008 is staggering and will have a significant impact on the future trajectory of household consumption and saving.

“Nearly 25% of the loss in net worth was from real estate, and equities and mutual fund shares made up 50% of the loss.

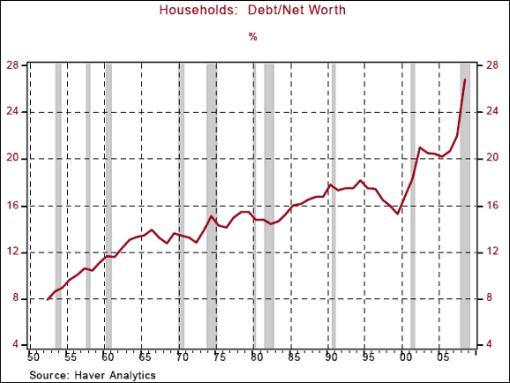

“Net worth of households has declined and their debt levels have grown noticeably slowly in 2008. But, the sharp drop in net worth has led to a debt-to-net worth ratio for households that is alarming.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , March 12, 2009.

The Wall Street Journal: Deleveraging - it's not over till it's over

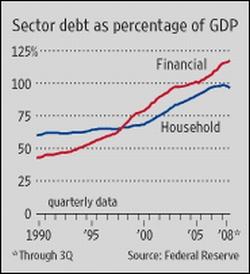

“Deleveraging has more to go. Just how far could become clearer when the Federal Reserve releases fourth-quarter flow-of-funds data Thursday. The third quarter marked the first decline in household debt since recordkeeping began in 1952, fueled by a record 2.4% drop in mortgage debt.

“Debt likely shrank even faster in the fourth quarter. According to already-released Fed data, non-mortgage consumer credit fell at a 3.2% annual rate. Another decline in mortgage debt, which is four times as big as non-consumer debt, is almost certain, given the collapse in sales and home-equity extraction, as well as surging loan delinquencies and defaults.

“Shedding more debt would be a healthy thing, since household debt levels in the third quarter were equal to 96% of gross domestic product and 130% of disposable income.

“The trick is figuring out just how far this deleveraging should go. There is ‘no magic number', suggests T. Rowe Price chief economist Alan Levenson, but one benchmark could be 1998, when foreign savings began to rise. Back then, the percentage of household income spent satisfying creditors was less than 12%, in line with the long-term average, compared with a near-record 14% now.

“Household debt was just 66% of GDP in 1998; and returning to that level would entail a 30% plunge in debt. That may be too extreme, particularly if the US homeownership rate keeps a floor under mortgage debt, despite declining from its 2005 peak.

“Suffice to say that consumer debt ratios will likely keep falling. An income boom would do the trick painlessly, but that seems unlikely. Otherwise, consumer spending will slow, keeping pressure on the financial sector, which is shedding debt much more slowly than households.”

Source: Jeff D. Opdyke, The Wall Street Journal , March 11, 2009.

Meredith Whitney (The Wall Street Journal): Credit cards are the next credit crunch

“Few doubt the importance of consumer spending to the US economy and its multiplier effect on the global economy, but what is underappreciated is the role of credit-card availability in that spending. Currently, there is roughly $5 trillion in credit-card lines outstanding in the US, and a little more than $800 billion is currently drawn upon. While those numbers look small relative to total mortgage debt of over $10.5 trillion, credit-card debt is revolving and accordingly being paid off and drawn down over and over, creating a critical role in commerce in America.

“Just six months ago, I estimated that at least $2 trillion of available credit-card lines would be expunged from the system by the end of 2010. However, today, that estimate now looks optimistic, as available lines were reduced by nearly $500 billion in the fourth quarter of 2008 alone. My revised estimates are that over $2 trillion of credit-card lines will be cut inside of 2009, and $2.7 trillion by the end of 2010.

“Inevitably, credit lines will continue to be reduced across the system, but the velocity at which it is already occurring and will continue to occur will result in unintended consequences for consumer confidence, spending and the overall economy. Lenders, regulators and politicians need to show thoughtful leadership now on this issue in order to derail what I believe will be at least a 57% contraction in credit-card lines.”

Click here for the full article.

Source: Meredith Whitney, The Wall Street Journal , March 10, 2009.

Dimitry Fleming (ING): Commercial property woes

“After the collapse in the US housing market, the non-residential property sector is now in trouble - posing a fresh threat to the banks, says Dimitry Fleming, economist at ING.

“He notes that US office vacancy rates have risen sharply as the service sector contracts and sheds jobs - and that plunging sales volumes have pushed retail vacancy rates to levels last seen in 1995.

“‘An unprecedented gap has opened up between demand for and supply of commercial structures, putting prices under severe pressure,' Mr Fleming says.

“Commercial real estate construction contracted in the fourth quarter of 2008 - and this looks to be only the start, he adds.

“‘Together with falling prices, the rise in loan defaults poses a big risk to bank loan portfolios. At the end of 2008, outstanding commercial property loans amounted to $2,500 billion, of which commercial banks and savings institutions held just over half.'

“Mr Fleming notes that Donald Kohn, the vice chairman of the Federal Reserve, has already stated that the banking sector is much more sensitive to a downturn in commercial real estate than in housing - and that exposure is high at some smaller banks.

“‘So, while these banks were able to dodge the bullet when housing collapsed, they may not do so when commercial real estate implodes.'

“The US banking sector's exposure to commercial property opens up the prospect of a further wave of bad debt-related writedowns.”

Source: Dimitry Fleming, ING (via Financial Times ), March 11, 2009.

CEP News: China “worried” about safety of US Treasuries

“China is growing ‘worried' about the safety of US Treasuries and wants assurances from the United States, according to Chinese Premier Wen Jiabao speaking at a press conference on Friday.

“‘I request the US to maintain its good credit, to honour its promises and to guarantee the safety of China's assets,' he said voicing concerns over the state of the American economy.

“The lawmaker added that the country remained firm in its commitment to deliver an annual 8% growth rate for 2009 and has ‘adequate ammunition' to ‘introduce new stimulus policies'.

“He also noted that Chinese exports have come under pressure due to an appreciation in the Chinese Yuan against a broad basket of currencies, not just the US dollar.

“China will keep the value of the Yuan ‘at a reasonable and balanced level', he promised, reiterating the country's intentions to diversify its foreign exchange holdings.”

Source: Erik Kevin Franco, CEP News , March 13, 2009.

Barry Ritholtz (The Big Picture): US bear market losses - $11 trillion dollars

“Here is a mind blowing stat: Stocks have lost $11 trillion in market value since the October 2007 peak, according to Marketwatch .

“This is based on the Dow Jones Wilshire 5000 index, which includes nearly every US-listed stock. Losses since the start of 2009 are $2.6 trillion. Nearly half of all stocks in the index are now trading at less than $5 and 37% are under $3.”

Source: Barry Ritholtz, The Big Picture , March 9, 2009.

John Authers (Financial Times): Silver lining for equities

“Perhaps the greatest reason for hope at present is that almost all hope seems to have been lost. The latest global self-off of stocks has been accompanied by commentary that no longer speculates on a rebound but instead tries to work out how much worse things could get, says John Authers.”

Click here for the full article.

Source: John Authers, Financial Times , March 9, 2009.

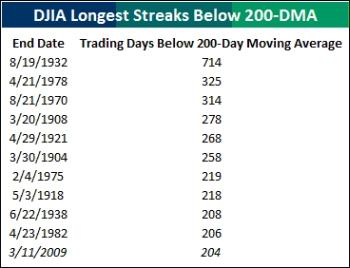

Bespoke: Dow Jones Industrial - longest streaks below 200-day moving average

“As we noted yesterday, even after Tuesday's strong rally, the major averages remain well below their long-term 200-day moving averages (DMA). The last time the Dow closed above its 200-DMA was 204 trading days ago (5/19/08). This represents the eleventh longest streak of trading below the 200-DMA in the Dow's history and the longest since 1982.

“Looking ahead, given the large spread between the current level of the Dow and its 200-DMA, we have a ways to go before the index reaches that level (or the moving average catches up to the index). Therefore, even if we get a strong rally over the next two months, by the time the Dow closes above its 200-DMA, the current streak is likely to be at least the sixth strongest in history.”

Source: Bespoke , March 11, 2009.

Todd Sullivan (Value Plays): How violent could a rally be?

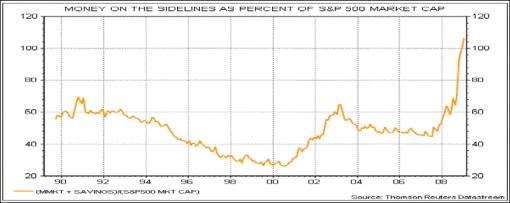

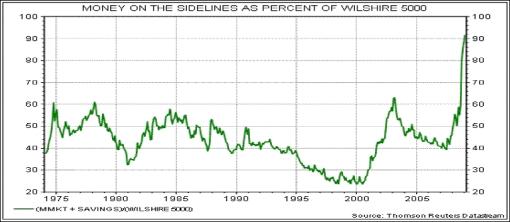

“Look at the charts below, the amount of cash sitting and waiting for a home is staggering. When it decides to flow into equities, the upside could be like nothing we have ever seen.

“What makes me think that? Well, the downside we have just seen is a once in a generation event (at least history tells us these are events that happen about every 90-100 years). We also have not seen cash levels this high in a generation.

“Now when does this happen? Hell, I don't know and anyone who tells you they do is full of it. But, what this does tell us is that the market is becoming a coiled spring. It is pulled back about as far as it can go and the cash buildup is the building tension.”

Source: Todd Sullivan, Value Plays , March 6, 2009 (hat tip: GreenLightAdvisor ).

Bespoke: What a difference a 10% rally makes

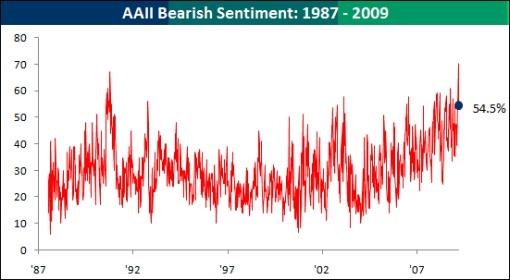

“Since its low of 666 last Friday, the S&P 500 has rallied by 10%. With the rally, there suddenly seems to have been a notable shift in sentiment among investors that all of the market's problems will be worked out.

“An example of the improved investor confidence can be seen in this week's survey by the American Association of Individual Investors (AAII). In it, bearish sentiment declined from last week's record high reading down to 54.5%. Isn't it amazing how a 10% rally can improve sentiment? Whether or not the rally is due to comments from CEOs in the banking sector, improved confidence in Washington, or simply an oversold bounce is debatable, but we'll take it.”

Source: Bespoke , March 12, 2009.

Bespoke: S&P 500 approaching November lows … on the upside

“After breaking through the November lows on the downside with barely a pause in late January, the S&P 500 is now testing that level on the upside. Hopefully for the bulls, it will be just as easy on the way up as it was on the way down.”

Source: Bespoke , March 12, 2009.

David Fuller (Fullermoney): More than a technical rally?

“The key question for investors: Is this just another temporary technical rally or the beginning of something more important?

“I suspect the latter … Inevitably, most investors are somewhat gun shy today and fearful of another failed rally in an ongoing bear market. There are also people who remain positioned for the bearish outcome with portfolios that are net short. There are even some who criticize us for not saying that the end of the world is nigh.

“In addition to the many obvious clues pointing to at least a good rally - markets are very oversold; sentiment is extremely bearish; more deleveraging has been completed; cash reserves have risen; valuations are more attractive; rescue operations are more advanced; some of last year's stimulus packages are beginning to kick in - we will have a technical divergence if this week's lows continue to hold for Wall Street and European stock markets.

“When the S&P 500 Index resumed its bear market last September, following a lengthy trading range, it soon took the rest of the world's stock markets with it. In contrast, this year's much more orderly decline by Wall Street, while persistent and significant in percentage terms, has not dragged all of Asia and the resources markets such as Brazil, downwards in its wake. Moreover, if the rally continues a number of stock market indices that did move to new bear market lows will register downside failures by pushing back into their prior trading ranges.”

Source: David Fuller, Fullermoney , March 11, 2009.

Richard Russell (Dow Theory Letters): Is this the bottom?

“Was today THE bottom? Has a new bull market started? Or was today simply part of an overdue correction? From a timing standpoint, I don't think this is the bottom. A 25-year bull market is not going to be corrected by a 17-month bear market.

“Furthermore, current valuations are not consistent with major bear market bottoms. The P/E ratio for the Dow is now 21.98. The dividend yield for the Dow is 4.68%. At the bottom of great bear markets, I expect the Dow P/E ratio to be well under 10, with the dividend yield nearer to 6%.

“Because of the severely oversold condition of this market, we could conceivably have a normal upside correction of 1/3 to 2/3 of the ground lost. Remember the phenomenon of the short squeeze. There's no more avid buyer than a panicky short who's being killed by a rally.

“But lets give the rebound its due. Today [Tuesday] was an impressive day with the Dow up significantly, and all the major averages in harmonious advance. It looks like this could be a 90% up-day, but the acid test will be how much lasting power is behind this rally over the next week or so. The Lowry's statistics gave no hint of a preceding trend of either declining, selling or rising volume. All of which suggests that we keep our powder dry. The bear is doing his ‘thing', giving the optimists a little ammunition. Says the bear, ‘sit tight, stay in the market. See, this market can go up as well as down'.

“There is absolutely no way of knowing how far this rally can carry, but I continue to think it's an upward correction in a bear market. Bear market corrections tend to travel considerably faster than bear market declines in the primary direction. Thus in a few weeks a bear market rally can wipe out months of bear market losses. It takes a very nimble trader to make money in a bear market rally. Beating the market when it's going against the primary trend is a matter of precise timing. Long ago I gave up trying to take profits out of a bear market correction. I sleep better watching a bear market correction than trying to make money in it.”

Source: Richard Russell, Dow Theory Letters , March 10, 2009.

Bespoke: Earnings growth estimates - the bad, the bad and the ugly

“The ugly actually came in the Q4 ‘08 numbers that are now 90% reported. The S&P 500 as a whole has seen earnings decline by 61.5% in Q4 ‘08 versus the fourth quarter of 2007. Health Care and Consumer Staples were the only two sectors that saw earnings growth.

“In the first three quarters of 2009, Energy, Materials, and Consumer Discretionary are expected to see earnings decline the most. In the first quarter, not one sector is expected to see year-over-year growth. Hopefully the analysts get it wrong on the downside in 2009 just as they got it wrong by keeping estimates too high in 2008.”

Source: Bespoke , March 11, 2009.

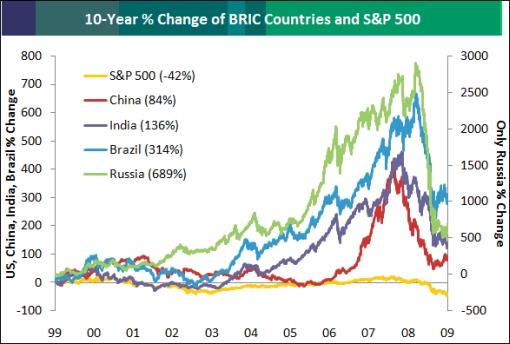

Bespoke: Checking up on the BRICs

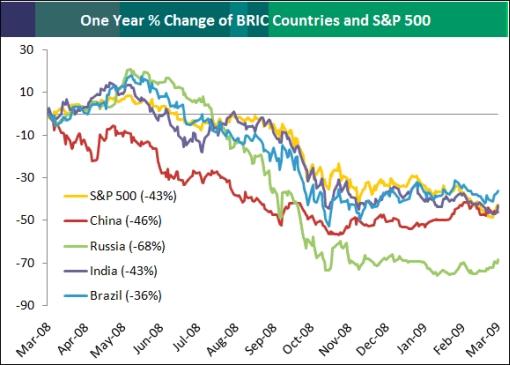

“It's been a while since we checked up on the BRIC countries (Brazil, Russia, India, China), so below we highlight two performance charts comparing them to the S&P 500. Over the last year, the US has performed better than Russia and China, inline with India, and worse than Brazil. Russia's stock market is down the most of the BRIC countries at -68%. China's Shanghai Composite is down 46% and has really seen a nice pickup lately. India's Sensex is down 43%, which is right inline with the S&P 500, and Brazil is down 36%.

“The last ten years have been very tough for US equity markets, with the S&P 500 now down 42% on a simple price basis. But even after the suffering that BRIC markets have had over the last year, their ten-year returns remain strong. Russia is down 68% over the last year, but it is still up 689% over the last decade (we had to put its performance on a secondary axis in the chart below). China is up 84%, India is up 136%, and Brazil is up 314%.”

Source: Bespoke , March 13, 2009.

CEP News: Japanese government may take measures to combat stock market decline

“The Japanese government may take measures to address the current credit squeeze due and falling share prices, Finance Minister Kaoru Yosano told reporters in Tokyo.

“‘We have a strong will to combat the credit crunch caused by the decline in the stock market,' Yosano said.

“The ruling Liberal Democratic Party is currently discussing ways to support equity markets after they reached a 26-year low earlier in the week, Yosano added.

“While the minister did not elaborate on what measures were being discussed, former Bank of Japan Deputy Governor Toshiro Muto warned that stock manipulation could damage the reputation of the Tokyo Stock Exchange and that stock prices should only be set by markets.

“Muto also said that deflation is a more pressing concern in Japan than inflation and that core price growth will soon begin to fall, possibly contracting by as much as 2% over the summer. He also said exports will be the main driver in Japan's economic recovery.”

Source: CEP News , March 10, 2009.

CEP News: US regulators considering uptick rule

“US officials could reintroduce measures that stifle short selling in as soon as a month, according to multiple reports.

“House Financial Services Committee Chairman Barney Frank called for the reinstatement of the rule, which was abolished in 2007. It prevents initiating a short position when the most recent trade is to the downside. Some market watchers believe it has made it easier to ‘raid' stocks.

“‘I am hopeful that the uptick rule will be restored within a month,' Frank told reporters on Tuesday after a meeting with US Securities and Exchange Commission (SEC) Chairperson Mary Shapiro. In January, prior to being confirmed as Chairperson, Shapiro said that examining the rule is ‘one of the things that I would be committed to doing very quickly'.

“US Senator Christopher Dodd also said on Tuesday that he wants the rule to be reinstated. ‘I wish they'd do it quickly,' the Senate Bank Committee Chairman told reporters.

“The SEC will make the final decision on the rule, but it will have to undergo a period of public scrutiny before it can be reintroduced.”

Source: Adam Button, CEP News , March 10, 2009.

John Authers (Financial Times): Devaluing the Swiss franc

“If the world is really following the script of the 1930s, then we are due for competitive devaluations, as nations attempt to make themselves more competitive at the expense of everyone else.

“So the Swiss National Bank's announcement that it is intervening to push down the Swiss franc sounds alarming. The speed with which the franc responded, dropping 3% against the euro in a matter of minutes, also shows that if a central bank wants its currency to fall, it can deliver.

“The problem is that not everyone can devalue at once - someone has to be left with an overvalued currency.

“The SNB's action does not necessarily herald such an outcome. The Swiss franc, like the Japanese yen, has been a ‘safe haven' currency, and thus had a perverse gain last year.

“With inflation virtually zero already, an overvalued franc created a severe risk of outright deflation - something the SNB reasonably wants to avert. As it also cut rates and said it would buy bonds, this move has more to do with attacking deflation than with boosting Swiss trade.

“Indeed, a cheaper franc is good news for eastern Europe. Their consumers had indulged in the Swiss franc carry trade, taking out mortgages denominated in Swiss francs. Since last July, the franc gained more than 50% against the Hungarian forint, making those mortgages unbearable.

“Thus, if anyone can pull off a deliberate devaluation without sparking ugly consequences elsewhere it may be the Swiss.

“But the precedent of a central bank attacking its own currency is disquieting. The falls in industrial production and world trade suggest that everyone on the planet would like a cheaper currency.

“This even includes China, which has allowed its currency to gain 26% on a trade-weighted basis over the past four years, and seen its exports suddenly tumble.”

Source: John Authers, Financial Times , March 12, 2009.

Times Online: Russia urged to coin currency

“President Nazarbayev of Kazakhstan has invited Russia and other former Soviet republics to set up a common currency to replace the US dollar or euro for use in trade between the states. Mr Nazarbayev, 68, said that the ‘yevraz' could be a stepping stone to a new international currency, and urged world leaders at next month's G20 summit in London to take up the idea. The proposal was seen as a snub, however, to Russia's ambitions of turning the rouble into a regional reserve currency.”

Source: Tony Halpin, Times Online , March 13, 2009.

Financial Times: Change of tack on commodities

“The majority of investors plan to increase their exposure to commodities but are shifting away from the long-only, passive indices that characterised the asset class in the early 2000s and are instead moving into more sophisticated instruments.

“The findings, in a survey by Barclays Capital among 230 institutional investors, corroborate anecdotal evidence that pension funds, sovereign wealth funds and other investors were shifting away from indices such as the S&P GSCI.

“The survey showed that only 12% of the investors anticipate gaining exposure to commodities in the coming year through long-only indices, with most shifting to long/short indices (26%) and third-party active management (22%), such as commodities hedge funds or in-house management.

“Exchange-traded products and structured commodity products are also popular.

“The Barclays Capital survey has been a reliable indicator of investors' appetite in commodities, predicting correctly the pick-up in money flows towards raw materials in 2006, 2007 and early-2008.

“The move away from the long-only, passive indices represents a sharp divergence with previous years when up to 40% of the investors said they planned to use those instruments.

“The majority of investors - 79% - said that they will increase their exposure to commodities in the next three years. with only 8% warning that they will cut their exposure or remain uninvested.

“The remaining 13% planned just to maintain their investment at the current level.

“Gold and crude oil are the preferred commodity investments for the year, according to the survey. Grains and freight were also cited by investors as potential winners, while base metals, such as copper and aluminium, attracted little interest.”

Source: Javier Blas, Financial Times , March 9, 2009.

David Fuller (Fullermoney): Longer-term outlook for gold is positive

“Demand for precious metals ETFs will inevitably fluctuate, just as we see with any other market. However, for most investors, gold is a comparatively new asset class, even though it has been around for far longer than any financial investment vehicle.

“Consequently, I believe that there are far more investors around the world who are potential buyers of gold than there are probable sellers over the medium to longer-term. Financial investors have had a major wakeup call over the last two years and counting. Buy-and-hold has been discredited for stocks and bonds. Companies can and do go bust but gold is still there, and its performance over the last decade is far better.

“Some OECD central banks and probably the IMF will remain sellers of gold. However, other central banks in countries with large surpluses are candidates for additional purchases of gold.

“Currently, gold is still in a consolidation following its brief push above the psychological $1,000 level on February 20. A close beneath $900 would be required to suggest a somewhat deeper correction before sideways to higher ranging occurs.”

Source: David Fuller, Fullermoney , March 9, 2009.

Financial Times: Hedge funds turn to gold

“Hedge fund investors who made money last year by betting against investment banks are now buying gold as a way of betting against central banks.

“The gold bulls include David Einhorn, founder of hedge fund Greenlight Capital, who last year came under the spotlight for his short selling of shares in Lehman Brothers, after arguing that the bank did not have enough capital to offset its exposure to falling property prices.

“Their belief in bullion is being expressed even as gold prices have retreated from last month's break above the $1,000 an ounce level. Spot gold in London closed last Friday at $939.10, after falling last week to $900.95 an ounce.

“Investors such as Mr Einhorn are turning to gold because they are worried about the response of the US Federal Reserve and other central banks to the global economic crisis. A bet on gold is essentially a bet against all paper currencies.

“‘The size of the Fed's balance sheet is exploding and the currency is being debased. Our guess is that if the chairman of the Fed is determined to debase the currency, he will succeed,' Mr Einhorn wrote in a recent letter to his investors. ‘Our instinct is that gold will do well either way: deflation will lead to further steps to debase the currency, while inflation speaks for itself.'

“Mr Einhorn's comments - and the revelation he is buying gold itself - are in line with the views held by other large institutional investors in Europe, according to bankers in London. The head of commodity sales at one major bullion bank told the Financial Times that he had never been so busy dealing in gold for large investors in his life.

“Goldman Sachs, Morgan Stanley and UBS all forecast the gold price will surge above $1,000 this year. Peter Munk, chairman of Barrick Gold, the world's largest miner of bullion, told investors last week that all countries have embarked on policies that will favour gold. ‘The only option to governments is to print and print more money,' he said. ‘That will end in tears.'”

Source: Henny Sender and Javier Blas, Financial Times , March 8, 2009.

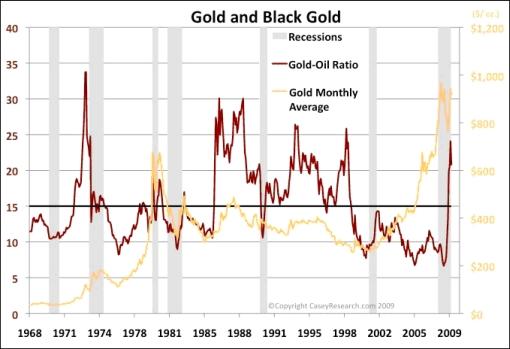

Casey's Charts: Gold and black gold

“While safe-haven buying is pushing gold higher, the global economic slowdown is suppressing the price of crude, driving the gold/oil ratio to 21, well above its 40-year average near 15. Translation: expect higher gold and lower oil (mining uses lots of energy) to mean soaring profits for gold producers.

“Will the ratio continue its upward momentum? The tea leaves aren't talking. But we do know that if the best gold producers in the world were profitable last year with $100 oil, that profit margins look ready to explode with $40 oil and $900 gold.”

Source: Casey's Charts , March 12, 2009.

CEP News: Eurozone investor confidence falls to 6-year low

“Investor confidence fell to its lowest level in at least six years in March as the eurozone economy suffers its worst contraction since the Second World War, the German research firm Sentix said.

“On Monday, Sentix reported that eurozone investor confidence weakened beyond expectations to a reading of -42.7 in March. Economists had expected a more modest fall in optimism to -38.0 after sentiment had improved to -36.1 in February.

“According to the research firm, sentiment towards the current economic situation worsened to a reading of -59.75 from -52.25 in February, while confidence towards the future fell to a reading of -23.5 after improving to -18.25 previously.

“‘This is hardly a spring revival,' Sentix said in a report. ‘It is critical for future economic prospects that investors see an end to further deterioration of the current situation.'”

Source: CEP News , March 9, 2009.

CEP News: UK industrial production falls at sharpest rate since 1981

“UK industrial production fell at speeds not seen since 1981, as the economy suffers through its deepest recession in almost 20 years, the Office for National Statistics reported on Tuesday.

“In a press release, the ONS reported that output in the UK industrial sector contracted 11.4%, its sharpest decline in 18 years, overshadowing both the 9.9% fall expected and the previous month's 9.3% decline. Meanwhile, December's figure was revised up from an initial reading of -9.4%.

“From December to January, UK industrial production fell 2.6%, down from both the 1.2% decline expected and adding to December's 1.5% slide, revised up from -1.7%. January's fall is the sharpest noted since June 2002.”

Source: CEP News , March 10, 2009.

Bloomberg: China trade surplus plunges as exports fall by record

“China's trade surplus plunged in February as exports fell by a record, adding pressure on the government to spur domestic consumption to prop up the world's third-biggest economy.

“The trade gap narrowed to $4.8 billion, about an eighth of the amount in the previous month, the customs bureau said in a statement. Exports tumbled 25.7% from a year earlier. Imports fell 24.1%.

“The government has halted the yuan's gains against the dollar and plans to cut export taxes to zero as demand dries up because of the global slump. Premier Wen Jiabao is relying on a 4 trillion yuan ($585 billion) stimulus package to propel economic expansion after the weakest growth in seven years threw millions out of work.

“‘There's no hope for export demand to recover any time soon,' said Wang Qian, a Hong Kong-based economist at JPMorgan Chase & Co. ‘How fast imports recover depends on how soon the government's stimulus package kicks in and creates real demand in major industries.'

“The timing of a Lunar New Year holiday masked what would otherwise have been a steeper decline in trade, said Mark Williams, a London-based economist at Capital Economics. The holiday meant that there were more working days in February this year than in 2008.

“The median estimates in a Bloomberg News survey of 16 economists were for a $28.3 billion trade surplus, a 1 percent decline in exports and a 22.5 percent drop in imports.”

Source: Li Yanping, Bloomberg , March 11, 2009.

CEP News: Majority of Chinese plan to spend rather than save

“With 65% of Chinese households seeing the deposit rate as too low, a rising percentage of consumers plan to spend rather than save, the People's Bank of China reported on Thursday.

“Citing the results of a survey, which includes the answers of approximately 20,000 households across 50 cities, the central bank also said that the number of respondents who see prices as too high fell from 49% in the first quarter of 2008 to below 25%.

“However, the survey showed nearly 20% of respondents expect their incomes to decline or are uncertain about their future financial situation.”

Source: Todd Wailoo, CEP News , March 12, 2009.

CEP News: China's CPI falls into deflation for first time in seven years

“China's consumer prices fell more than expected in February, dipping into deflation for the first time since 2002, China's National Bureau of Statistics reported.

“The Consumer Price Index fell 1.6% in February compared to February 2008, against expectations for a 1.0% decline. In February, consumer prices were up 8.7% compared to a year earlier.

“The report said food prices were down 1.9% on an annual basis, while non-food inflation was down 1.2%.”

Source: Stephen Huebl, CEP News , March 9, 2009.

Jon Stewart (The Daily Show): Interview with Jim Cramer

In Part 1 Jim Cramer criticizes Rick Santelli's rant and admits he made his own mistakes.

In Part 2 Jon presents Jim Cramer with some old footage from his shady hedge fund days in this exclusive, uncensored video.

In Part 3 Jim Cramer defends his role as a commentator on an entertainment show.

Source: Jon Stewart, The Daily Show , March 12, 2009.

The Wall Street Journal: Inside the Madoff scandal

“How did one of the largest financial scandals of our time go on for so long without being detected? WSJ reporters offer insight into Bernard Madoff's alleged Ponzi scheme.”

Source: The Wall Street Journa l, March 12, 2009.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.