The Real Ponzi Scheme– Unreal Interest Rates

Interest-Rates / US Interest Rates Mar 17, 2009 - 07:22 PM GMTBy: Rob_Kirby

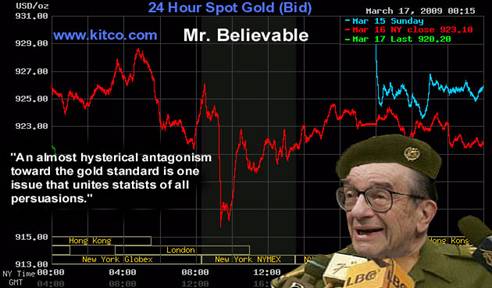

Recently, former chairman of the Federal Reserve – Alan Greenspan – penned an editorial, “ The Fed Didn't Cause the Housing Bubble ”. It was published in The Wall Street Journal March 11, 2009 .

Recently, former chairman of the Federal Reserve – Alan Greenspan – penned an editorial, “ The Fed Didn't Cause the Housing Bubble ”. It was published in The Wall Street Journal March 11, 2009 .

In the article Mr. Greenspan attempts to blame today's global financial crisis on “too-low mortgage rates” between 2002 and 2005 which led to a real estate bubble.

“There are at least two broad and competing explanations of the origins of this crisis. The first is that the "easy money" policies of the Federal Reserve produced the U.S. housing bubble that is at the core of today's financial mess.

The second, and far more credible, explanation agrees that it was indeed lower interest rates that spawned the speculative euphoria. However, the interest rate that mattered was not the federal-funds rate, but the rate on long-term, fixed-rate mortgages. Between 2002 and 2005, home mortgage rates led U.S. home price change by 11 months. This correlation between home prices and mortgage rates was highly significant, and a far better indicator of rising home prices than the fed-funds rate.”

Greenspan's statement that the Federal Reserve only controls short term rates [Fed Funds Rate] is false. So is his claim that long term rates were determined by excess savings in foreign lands – beyond the purview of the Fed:

“As I noted on this page in December 2007, the presumptive cause of the world-wide decline in long-term rates was the tectonic shift in the early 1990s by much of the developing world from heavy emphasis on central planning to increasingly dynamic, export-led market competition.

….. That ex ante excess of savings propelled global long-term interest rates progressively lower between early 2000 and 2005.”

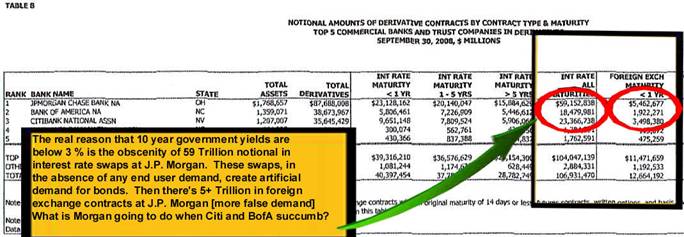

The historic low rates in the 2000 – 2005 time period as well as the rates we have today are the direct result of activity at the Federal Reserve's proxy bank - J.P. Morgan Chase, and their 59 Trillion [at Q3/08] notional interest rate derivatives book:

source: Comptroller of the Currency

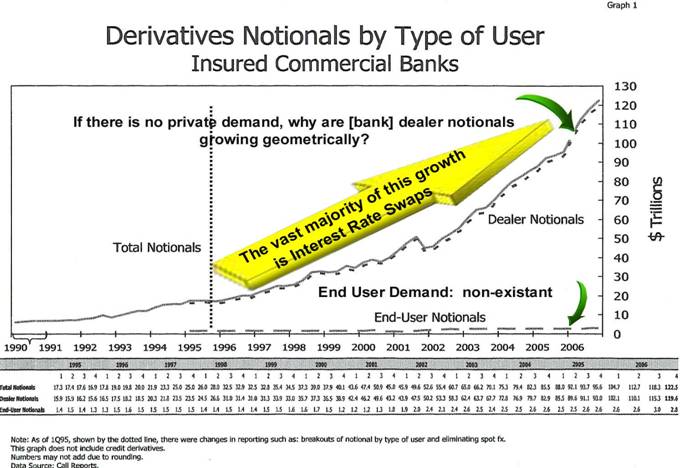

It was none other than Alan Greenspan himself who lobbied to have these and other OTC derivatives remain “unregulated” and thus beyond any sort of critical oversight with additional false claims that doing so gave the U.S. financial system “flexibility”. The tacit acceptance and encouragement by Greenspan of rampant growth of derivatives by banks and dealers resulted in extraordinary systemic risk in the financial system which is manifesting itself in the current financial crisis:

source: Comptroller of the Currency

The Fed's defacto management and control of the ENTIRE interest rate curve makes Bernie Madoff's and AIG's frauds [Charles Ponzi – R.I.P] look like child's play. Interest rate swaps with durations of 3 years or greater typically have a corresponding physical government bond trade embedded in them. Increasing outstanding notionals of interest rate swaps INCREASES aggregate demand for bonds – forcing rates DOWN .

In prior articles I have demonstrated the bond math showing how these interest rate derivatives were utilized to give the Federal Reserve [through its chief agent J.P. Morgan] effective control of the “long end” of the interest rate curve – neutering usury – engineering long term interest rates DOWN .

Hedging Mechanics of Interest Rate Swaps > 3 yrs. Duration

Interest rate swaps > 3 yrs. in duration customarily trade as a “spread” – expressed in basis points – over the current yield of a corresponding benchmark government bond. That is to say, for example, 5 year interest rate swaps [IRS] might be quoted in the market place as 80 – 85 over. This means that the 5 yr. swap is “bid” at 80 basis points over the 5 yr. government bond yield and it is “offered” at 85 basis points over the 5 year government bond yield. Let's assume that 5 year government bonds are yielding 1.90 % and the two counterparties in question consummate a trade for 25 million notional at a spread of 84 basis points over. Here are the mechanics of what happens:

The payer of fixed rate pays [1.90 % + 84 basis points =] 2.74 % annually on 25 million for 5 years. The other side of the trade - the floating rate payer – pays 3 month Libor on 25 million notional, reset quarterly - typically compounding successive floating rate payments at successive 3 month Libor rates so that actual cash exchanges are settled “net” annually. To ensure that the trade remains a “true spread trade” [and not a naked spec. on rates] and to confirm that 1.90 % is a true measure of where current 5 year government bond yields really are – the payer of the fixed rate actually buys 25 million worth of physical 5 year government bonds – at a price exactly equal to 1.90 % - from the receiver of the fixed rate at the front end of the trade. So, in this regard, we can say that 25 million IRS traded on a spread basis creates a “need” for 25 million worth of 5 year government bonds – because it has a 5 year bond trade of 25 million embedded in it.

* Interest rate swaps of duration < 3 years are typically hedged with strips of 3 month Eurodollar futures instead of government bonds.

Interest rate swaps were originally developed to [1] allow parties to exchange streams of interest payments for another party's stream of cash flows; [2] manage fixed or floating assets and liabilities and [3] to speculate - replicating unfunded bond exposures to profit from changes in interest rates. Growth in the first two of these activities are dependent on their being increased end-user-demand for these products – graph 1 above indicated that this is not the case:

In the case of J.P. Morgan in particular [forgetting about the lesser obscenities at Citi and B of A]; their interest rate swap book is so big that there are not enough U.S. Government bonds being issued or in existence for them to adequately hedge their positions.

This means that the obscene, explosive growth in interest rate derivatives was all about overwhelming the long end of the interest rate complex to ensure that every and any U.S. Government bond ever issued had a buyer on attractive terms for the issuer. Concurrent with the neutering of usury, the price of gold was also “capped” largely through Fed appointed banks “shorting gold futures” as well as brokering gold leases [sales in drag] sourcing vaulted Sovereign Central Bank gold bullion. The gold price had to be rigged concurrently because historically, according to observations outlined in Gibson's Paradox – lowering interest rates leads to a higher gold price. Gold price strength is historically synonymous with U.S. Dollar weakness which leads to higher financing costs or the possibility of capital flight.

Metaphorically, this meant the extinction [or assassination, perhaps?] of the fabled “bond vigilantes” who, in conjunction with a rising gold price, historically acted as the bond market's conscience whenever rampant monetary debasement reared its ugly head.

Alan Greenspan was more than aware of the obscene growth in derivatives activities at J.P. Morgan and was complicit in a litany of contributing events providing cover for this charade to develop and continue:

- During his tenure as chairman of the Federal Reserve, in November 1999, Congress repealed the Glass-Steagall Act—the culmination of a $300 million lobbying effort by the banking and financial-services industries, and spearheaded in Congress by Senator Phil Gramm. Glass-Steagall had long separated commercial banks (which lend money) and investment banks (which organize the sale of bonds and equities); it had been enacted in the aftermath of the Great Depression and was meant to curb the excesses of that era, including grave conflicts of interest. In one feel swoop the repeal of Glass-Steagall meant that future financial abuse would be “systemic” in nature instead of isolated.

* Also on Greenspan's watch, in April 2004, the Securities and Exchange Commission succumbed to intense lobbying chiefly by Goldman Sachs' Hank Paulson allow big investment banks to increase their debt-to-capital ratio (from 12:1 to 30:1, or higher) so that they could buy more mortgage-backed securities. This further inflated the housing bubble and made our already-casino-capital-markets even more RECKLESS.

Additionally, to think that Mr. Greenspan was not aware or may very well have had a hand in this development is unthinkable. First reported by Dawn Kopecki back in 2006 when she reported in BusinessWeek Online in a piece titled, Intelligence Czar Can Waive SEC Rules ,

"President George W. Bush has bestowed on his [then] intelligence czar, John Negroponte, broad authority, in the name of national security, to excuse publicly traded companies from their usual accounting and securities-disclosure obligations. Notice of the development came in a brief entry in the Federal Register, dated May 5, 2006 , that was opaque to the untrained eye."

What this means folks, if institutions like J.P. Morgan are deemed to be integral to U.S. National Security - they could be "legally" excused from reporting their true financial condition.

The entry in the Federal Register is described as follows:

The memo Bush signed on May 5, which was published seven days later in the Federal Register, had the unrevealing title "Assignment of Function Relating to Granting of Authority for Issuance of Certain Directives: Memorandum for the Director of National Intelligence." In the document, Bush addressed Negroponte, saying: "I hereby assign to you the function of the President under section 13(b)(3)(A) of the Securities Exchange Act of 1934, as amended."

A trip to the statute books showed that the amended version of the 1934 act states that "with respect to matters concerning the national security of the United States ," the President or the head of an Executive Branch agency may exempt companies from certain critical legal obligations. These obligations include keeping accurate "books, records, and accounts" and maintaining "a system of internal accounting controls sufficient" to ensure the propriety of financial transactions and the preparation of financial statements in compliance with "generally accepted accounting principles."

That this transfer occurred at all is highly suggestive that The Powers That Be were acutely aware that systemic financial problems were already manifesting themselves [likely at Fannie, Freddie and J.P. Morgan] or soon would be – and - they were going to attempt to fraudulently COVER IT UP in the name of National Security.

Folks need to understand that all of these shenanigans are occurring to perpetuate faith in the empirically failing irredeemable fiat U.S. Dollar based monetary system.

Are you a believer?

The balance of this article posted under the same title at Kirbyanalytics.com for subscribers includes an analysis of the U.S. Dollar, global fixed income markets, a section on murder-and-mayhem as well as a discussion on the likely signposts we are apt to see on our dissent into monetary disorder. Subscribe here .

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is the editor of the Kirby Analytics Bi-weekly Online Newsletter, which provides proprietary Macroeconomic Research. Subscribers to Kirbyanalytics.com are benefiting from paid in-depth research reports, analysis and commentary on rapidly unfolding economic developments as well as recommendations on courses of action to profit from chaos. Subscribe here .

Copyright © 2009 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.