Gold and Gold Stocks Behaviour During Deflation and Inflation

Commodities / Gold & Silver 2009 Mar 18, 2009 - 05:27 AM GMTBy: Jordan_Roy_Byrne

I've heard more than a few pundits question an investment in gold or gold stocks in the current environment. They point to deflation and the lack of inflation in the foreseeable future as reasons why precious metals should be avoided. Sounds intelligent on the surface but it reveals to this analyst, a lack of any thought and analysis.

I've heard more than a few pundits question an investment in gold or gold stocks in the current environment. They point to deflation and the lack of inflation in the foreseeable future as reasons why precious metals should be avoided. Sounds intelligent on the surface but it reveals to this analyst, a lack of any thought and analysis.

We must remember that success in trading and investing often requires a counterintuitive approach. The markets often go the opposite way they should. Here are a few examples. Gold was in a bear market for 20 years despite what can be called a credit hyperinflation in the United States. Gold has performed spectacularly this decade in the absence of the kind of price inflation we saw in the 1970s. Treasuries have risen this decade along with Gold, Oil and Commodities. When has that happened in history?

Now back to precious metals. The main idea for investing in this sector is to protect your purchasing power or protect against inflation. So it makes sense to buy the sector during an inflationary period. Right? A look at history combined with some common sense analysis reveals that precious metals and the producing companies outperform during deflationary periods and in advance of an inflation cycle.

Let's look at the 1930s and 1940s. The Great Depression initially was a deflationary event but it concluded in inflation. Using the calculator from inflationdata.com, I calculated the change in prices in the 1930s and 1940s. In the 1930s, prices fell 18%, while they rose 70% in the 1940s. But what happened in the markets?

Which gold bug hasn't seen this chart of Homestake Mining, from http://www.gold-eagle.com. If I remember correctly, its bull market lasted from 1921 to 1937. The stock made a lower low in the early 1940s and wouldn't surpass its Great Depression peak until the 1960s. The stock performed especially well from 1931 to 1934, during the later stages of deflation and initial stages of inflation.

This is a chart of the Barrons Gold Mining Index, dating back to 1939. Thanks to http://www.bgmi.us . The rectangle shows 1940 to 1950. There was deflation in the 1930s and huge inflation in the 1940s. Yet the gold stocks performed far worse in the 1940s.

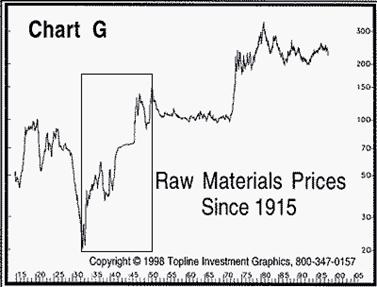

It was the commodity sector that prospered most during the inflation of the 1940s. The rectangle shows 1933 to 1951. Chart from TopLine Investment Graphics: http://www.topline-charts.com/ .

The reality is that the precious metals complex outperforms AHEAD of reinflation, while the rest of the commodity sector outperforms DURING the ensuing inflation. Gold stocks perform best when their margins are expanding. That can happen when the price of Gold stays flat and cost inputs (oil, steel, labor) fall. It can happen when gold rises and rises faster than cost inputs. When inflation begins to take hold, the precious metals complex has already anticipated it. Inflation raises the cost of everything. As the cost of steel, oil and labor rise, it hurts the profit margins of gold producers. Hence, gold companies outperformed during the deflation and early reinflation of the 1930s, but underperformed during the inflation of the 1940s.

How did the gold stocks do in the 1970s? The aforementioned BGMI index, rose from a bottom of less than 100 to a peak of about 1300. Let's call it a 14-bagger. Outstanding right? Well, consider that the price of Gold rose from $35/oz to as high as $888/oz. That is a 25-bagger! Gold stocks unperformed Gold despite a rising gold price. Why? Because of rising commodity prices and rising inflation, gold companies didn't benefit as much as you'd expect. In relative terms, gold stocks were better performers in the 1960s. The BGMI rose very nicely, while the price of gold remained fixed.

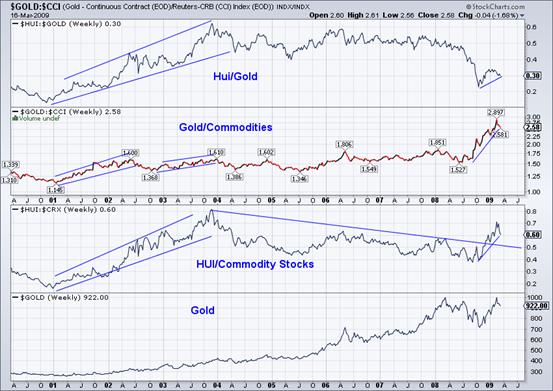

In the early 2000s, there was a fear of deflation. As you can see from the chart below, from 2001-2003 gold stocks strongly outperformed gold as well as commodity stocks. Gold bottomed before the rest of the commodity sector and advanced before inflation began to take hold. As inflation began to take hold, the gold stocks underperformed both gold and commodity stocks and even while the price of gold rose from $600 to over $1,000.

Conclusion

It appears the consensus is wrong on both counts. One side says there is no inflation on the horizon, so the precious metals sector isn't an appropriate investment. The other side says that there will be hyperinflation, so buy gold. Hyperinflation may be good for physical gold but it is deleterious to everything else including society and the political structure. The reality is that the current macroeconomic environment is most advantageous for gold stocks and then gold. However, if and when inflation begins to take root the precious metals complex will underperform and your funds will best be utilized elsewhere. For more on this analysis, visit our website and consider joining our newsletter. Good Luck!

By Jordan Roy-Byrne

trendsman@trendsman.com

Editor of Trendsman Newsletter

http://trendsman.com

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.