Can the Banks Toxic Asset Problem be Fixed So Easily?

Stock-Markets / Credit Crisis Bailouts Mar 24, 2009 - 02:49 PM GMTBy: Marty_Chenard

Geithner and the Banks - What is one of the major purposes for removing the toxic assets from the banking system? To get banks to start lending , so companies can borrow to keep their operations going, for consumers to start borrowing so they can spend, for mortgage rates to drop so housing sales can start up again ... Everything needed for the economy to start a turn around so that the stock market can get out of this Bear market.

Geithner and the Banks - What is one of the major purposes for removing the toxic assets from the banking system? To get banks to start lending , so companies can borrow to keep their operations going, for consumers to start borrowing so they can spend, for mortgage rates to drop so housing sales can start up again ... Everything needed for the economy to start a turn around so that the stock market can get out of this Bear market.

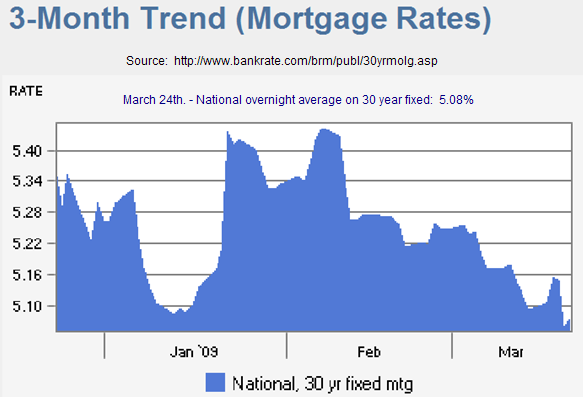

For weeks now, the Fed has had an objective of driving down mortgage rates to 4.25% to 4.5%. As of this morning, overnight rate chart shows the latest national info on 30 year mortgages ... the national overnight rate was 5.08%.

See the next paragraph ...

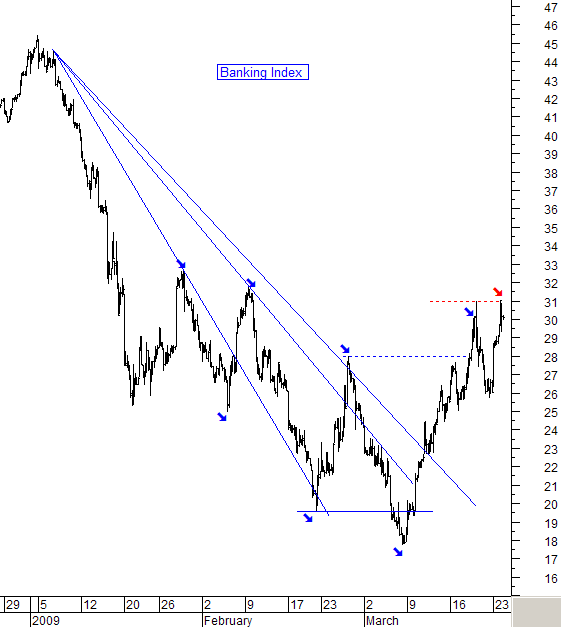

Yesterday, the Banking Index closed at 30.88 which a test level of the most recent intra-day high ... see the chart below. We should be at the first step for Banking index to begin going through a bottoming process. Update continued below ...

In spite of Geithner's plan yesterday ... Realize that the slow attempt for the Banking index to stabilize is not on a cessation of banking problems, not on a cessation of new credit card defaults, not on banks starting to lend yet, and not on banking profits. It will be hard for banks to make "good loans" with the number of people still without jobs, or with pay cuts. In other words, all the problems have not magically disappeared.

The economy needs bank lending to start opening up for the economy to start moving .

Banks have to start lending for Geithner's toxic asset program to show any signs of working ... in spite of the stock market's jump yesterday, there was no signs of lending improvements yet. The national overnight 30 year fixed mortgage rate was 5.08% last night. That is a far cry from the Fed's 4.25% to 4.5% thirty year mortgage rate goal. The Fed's discount rate to the banks are more than enough for them to have been offering 4.5% or less. Instead of doing so, they kept the rates up in order to profit from a higher spread. In other words, they have not passed on the Fed's gift to home buyers.

If the toxic asset plan does not erase this bottleneck , then this will be a negative shock to the market as investors will wonder what the Fed and Government have left in their bag of tricks to breakup this financial log jam.

Our sources tell us that it won't be until this Friday that the Fed starts to buy some of the toxic assets which means that will we not get the test, for whether or not banks will open the lending spigots, until next week.

________________________________________________

*** Feel free to share this page with others by using the "Send this Page to a Friend" link below.

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.