Some of My Favorite ETFs at New Record Highs

Stock-Markets / Global Stock Markets May 11, 2007 - 12:00 PM GMT

Dan Ascani here with a special guest article on ETFs.

I'm the ETF portfolio manager at Weiss Capital Management, an SEC Registered Investment Adviser, and a separate affiliate of Weiss Research.

And I just came out of Weiss Capital Management's Investment Committee meeting, where we discussed the portfolio strategies for our individually managed accounts. So the timing is right to give you a quick run-down of what we see ahead for global markets.

Here are our views:

First, this stock-market rally has been impressive.

Just in the past few weeks, we've seen major global equity indices rebound dramatically from their March correction lows, with some, such as Brazil's Bovespa Index, the Shanghai Chinese stock indexes, and the Dow Jones Industrials reaching new record highs.

Second, this rally is especially evident in select investments like ETFs, my vehicle of choice for most investors.

In my article here in April, I highlighted the long-term trends in some of my favorite ETFs. Today, let me give you an update, focusing on the last few months, including both the February sell-off and the subsequent rebound. Remember — these are examples, not recommendations to buy or sell a specific security.

The iShares MSCI EAFE® Index (EFA) is a case in point. With the late-February decline, it fell from nearly $77 per share to about $71. But it bounced back quickly, soon surpassed its February high, and then continued rising to $80, where it closed yesterday.

I like this ETF because it tracks one of the most diversified benchmark overseas indices I've seen to date. It targets coverage of 85% of the market cap of countries in Europe like the United Kingdom, France, Germany, Ireland and Switzerland; and in the Far East like Australia, Hong Kong, Japan, New Zealand and Singapore.

So it offers investors a nice stake in what I consider some of the most economically promising — and politically stable — stock markets of the world today.

The second example I highlighted last month was the iShares FTSE/Xinhua China 25 Index , which gives investors a stake in one of the most rapidly growing large economies in the world today — China.

It's followed a similar pattern since February — down about 16 points during the sell-off, but recovering all of that loss, and more, for a total rise of nearly 20 points from its recent low.

Of course, as with any investment, past performance is no assurance of future results, and there are risks associated with investing in international ETFs. But with continuing high GDP growth rates, I believe that China — and the 25 leading Chinese companies held by this ETF — offer excellent long-term growth potential.

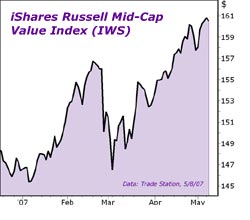

Meanwhile, my favorite sectors in the U.S. market are also picking up speed. The iShares Russell Mid-cap Value Index (IWS) , for example, despite an approximate 10-point decline during the February market fall, is now up by over 14 points from its recent low.

The iShares managers took the Russell Mid-cap Index and created an index that tracks approximately 60% of the total capitalized value of the Russell Mid-cap Index — the part that I like best. Reason: As I said last month, that's the group of domestic mid-cap companies I believe perform the best in global stock market rallies. 1

We can't guarantee these trends will continue, and as I've illustrated, sell-offs are to be expected. But that leads me to …

My third point: Our Investment Committee believes this global rally is not a short-term event.

We see better economic growth in almost every major region of the world. This growth is helping the U.S. economy, in our opinion, benefiting many U.S. stocks.

China is still the engine of global economic growth. But it's not the only one. We see a similar growth pattern spreading throughout most of East Asia … into South Asia … Eastern Europe … and even Western Europe.

Western Europe's emergence from its doldrums, with Germany at the core, is especially heartening. If, despite their social welfare burdens, these nations can inject new life into their economies, that should help sustain the growth pattern we're seeing internationally.

Fourth, there is still real risk in this market.

No market goes straight up. Nor can you count on last year's stellar performers to be this year's stars. So I firmly believe you need a strategy in place to protect yourself from the downside.

That's why I've been putting so much emphasis on diversification.

I'm not referring strictly to diversification in the traditional sense of spreading risk among different U.S. sectors. Investors used to think this strategy qualified as "diversification." I don't think so. Rather, I'm talking about diversification in a much broader sense — including various asset classes and various regions of the world.

More specifically, I am recommending you consider …

- Diversification across several continents — such as Asia, South America, Europe and North America, plus …

- Diversification by market cap — large caps, mid caps and even small caps, plus …

- Diversification between equities and fixed-income instruments, plus …

- Diversification across industry sectors — natural resources, consumer staples, and healthy financial companies, plus …

- Diversification into alternative investments, including world commodities like gold and energy to help protect buying power from the effects of inflation.

You may already be pretty well diversified. For example, you may have some of your money in stocks, some in bonds, some in real estate, and in cash.

That's a good start. But you may want to diversify even more broadly and more strategically.

In addition, I feel that a key to your investment success will not only be based on which asset classes you invest in, but also what percentage of your overall portfolio you decide to allocate to each area.

Take a look at the chart below to see how different asset classes have performed over the past 10 years. It shows that …

- market leadership has shifted from year to year,

- each major asset class has had its turn, and, most important …

- true, broad diversification (among all these asset classes) generally reduces short-term risk and can provide more consistent investment returns over the long term.

The exact percentage you allocate to each asset class will depend on your goals and your personal financial situation. That's why you should adapt your portfolio to your own individual circumstances.

Where do ETFs fit in? In my opinion …

ETFs Are Among the Most Flexible, Lowest-Cost Investment Vehicles Available

If your goal is to maximize diversification, as I believe it should be, then exchange traded funds (ETFs) are a great choice. That's why I use exclusively ETFs in Weiss Capital Management's ETF Strategic Allocation Portfolio .

Just a few years ago, ETFs were still in their infancy. Then, just last year, there were over 200. Now, the number of ETFs has mushroomed to almost 500, with many more in the pipeline. And within a year, I believe there will be almost 1000 ETFs.

Not only are the ETFs growing in number, but they're fanning out in terms of investment styles, sectors, strategies, objectives and asset classes. In a word, the rapidly growing world of ETFs can give you the ultimate in diversification — the entire focus of my message to you today.

With ETFs, you can invest in stocks from Europe, the United Kingdom, the Pacific Rim, Latin America, Mexico, South Africa, the U.S., and China.

With ETFs, you can diversify into U.S. Treasuries and corporate bonds … gold, commodities, and or other inflation-sensitive assets … even the real-estate sector.

In short, by using ETFs — in a single-brokerage account — you can own a broadly diversified stake in what I believe are the world's primary asset classes:

- Some of the most-promising industry sectors in the United States today.

- Some of the most-reliable income-producing investments, with our favorite bond ETFs and high-dividend ETFs.

- In-demand natural resources, such as gold, silver and energy, with alternative ETFs.

- Rapidly growing foreign economies, with ETFs tied to countries like China or Brazil, as well as more developed economies in Europe and Asia.

- Even some of the most-solid foreign currencies, with ETFs linked to the euro, the Swiss franc or the Japanese yen.

You can sort through the universe of about 500 ETFs on your own, or we can do it for you in our Weiss ETF Strategic Allocation Portfolio.

This core investment strategy, suitable for investors with a moderate risk tolerance, offers the potential for capital appreciation by investing in a portfolio of exchange traded funds. It is strategically allocated across three different asset classes — equities, fixed income and alternatives, and when market conditions dictate, cash — to help manage risk. And it spans domestic and international markets.

Discounted Fees Until May 31!

Weiss Capital Management has been managing money for individual investors and institutions for 26 years. We are registered with the SEC as an investment adviser. And using our managed account programs, we have the ability to help match your personal investment goals to our various programs.

If you feel our ETF Strategic Allocation Portfolio is right for you, you may be interested in our special offer: Invest $250,000* in our Weiss ETF Strategic Allocation Portfolio . And if you invest before May 31, 2007, you can permanently lock in our introductory management fee of just 1% (one percent).

Important: For investments made after June 1, the fee will be higher.

The number to call for more information and to talk with one of our financial advisers is 1-800-814-3045. Or just click here to send us an email .

Best wishes,

Dan Ascani, Executive Vice President

Portfolio Manager, Weiss ETF Strategic Allocation Portfolio

DAscani@WeissCM.com

P.S. And for sources and important disclaimers, please click here .

* New or additional investments only.

This investment news is brought to you by Money and Markets . Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com .

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.