Gold Price Drop: A gift horse

Commodities / Gold & Silver May 11, 2007 - 12:53 PM GMTBy: Adrian_Ash

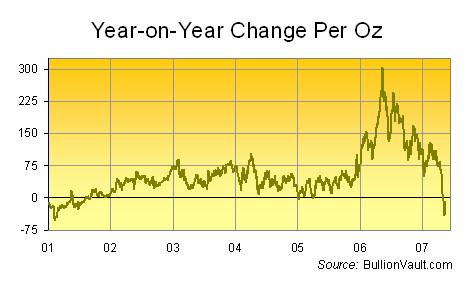

"...This week's sell-off in gold was only to be expected. It opened Monday lower from 12 months earlier for the first time since 2001..."

WHAT TO MAKE of gold's 2.6% drop after failing to hold $690 for the third time in two months?

"The market sees a falling gold price as a gift horse," reckons Jon Bergtheil, head of metals at J.P.Morgan in London .

"The fundamentals are still very positive."

How positive exactly? Other than the price, nothing has changed since Monday. The gold market is still getting squeezed between tightening supply and rising long-term demand.

Let's put this week's strike at Peru 's Yamacocha mine – the world's largest gold producer – to one side for a moment. AngloGold Ashanti , the world's third largest gold mining company, just reported first quarter production down 1% from last year and 10% lower from December. The decline came despite a 25% rise in capital expenditure. Cash costs rose 7.4% per ounce.

Gold Fields Ltd of South Africa , the world's fourth largest gold producer, saw output drop 3% between Jan. and March. Total cash costs were nearly 16% higher from a year earlier. Newmont Mining, majority-owner of Yamacocha and the world's second-largest gold company, is also forecast by Wall Street to suffer declining revenues in 2008.

All told, said GFMS – the widely respected London consultancy – on Thursday, we should expect total world gold supply from central banks, miners and scrap jewelry to decline for the third year running in 2007.

South African gold production fell 10.8% year-on-year in March according to an official report out Friday morning. Production of non-gold minerals slipped only 0.7%. Annual gold output in South Africa – the world's No.1 producer – has more than halved in the last decade. Analysts at Virtual Metals now forecast a further 2% drop this year.

The bubble in gold-mining stock mergers, meantime, far outweighs spending on trying to find new sources. Non-ferrous exploration budgets hit a record $7.13 billion last year according to the Metals Economics Group. But M&A spending in the gold sector alone was nearly three times as much judging by Merrill Lynch estimates.

On the other side of the equation, demand from investors wanting to buy gold bullion fell sharply this week. Given that Monday saw the first year-on-year drop in the gold price since the current bull market got started in 2001, disappointment was only to be expected.

StreetTracks GLD, the largest US-listed gold ETF, saw net sales equivalent to five tonnes between Wednesday and Thursday. The spot price of gold bullion sank nearly 3% over those two days. GLD shareholders wanting to quit would have been further frustrated that they could only trade during US hours.

In the futures market, further pressure came as this week's sell-off coincided with the start of the quarterly roll-over. Long positions in Comex June contracts stood above 200,000 before the drop began. Anyone willing to pay 1% of their underlying position to roll a paper position forward each year (that's anything up to one-sixth or more of their cash investment) now needs to start closing out June to buy Sept. That could well depress physical gold bullion prices over the coming fortnight.

But looking further ahead, the key driver of this bull market in gold – a surge in the global money supply, destroying the value of official currency – looks set to roll on.

US retail sales in April slipped 0.2% from March, said the Commerce Dept. on Friday, confirming previous data showing the US economy slowing as a result of the ongoing collapse in subprime mortgage lending.

Producer prices, however, rose 0.7% for the month, said the Dept. of Labor – outstripping Wall Street consensus and showing that input costs are still rising.

Stuck between rising inflation and slowing growth, therefore, the US Fed looks set to keep Dollar rates on hold, just as it did on Wednesday. And as the real rate of interest gets squeezed in between, investors are likely to choose gold for protection.

They'll certainly spurn high-yield bonds. US Treasury prices failed to rally on Thursday despite the shake-out in world stock indices. Emerging markets may seem to offer short-term capital growth, but local currencies are racing to debase so quickly, an epic bubble in local equities has now formed in China .

Real rates of interest on the Chinese Yuan stand around minus 3.0%. No wonder that 300,000 new stock brokerage accounts are being opened every day! Total trading volumes in Shanghai and Shenzen hit $50 billion on Wednesday, ten times the volume of only six months ago.

Across the Pacific, meantime, "I believe very strongly that a strong Dollar is in our nation's interest," said US Treasury Secretary Henry Paulson in a PBC interview due to air Friday evening. But the US stock market's recent highs have also come on the back of a falling currency. Trading near long-term support on its trade-weighted index, the Dollar priced against other currencies is as low today as at any time since the mid-70s. Measured against gold, as the gold price chart shows, the US Dollar has more than halved since 2002.

To be fair, Paulson's timing looks impeccable. The Dollar this week pushed the Euro down to one-month low – more than 1.5% off its record top of April 27th. But repeating the word "strong" when speaking of the Dollar does not create a "strong Dollar" policy. And rather than urging Congress to slow Washington's spending – and instead of asking Ben Bernanke to hike Dollar interest rates way ahead of inflation – Paulson chose this week to accuse the Chinese authorities of refusing to let their currency, the Yuan, float freely.

Does that really make the basis of a strong Dollar policy?

Across the Atlantic , Paulson's talk will no doubt fail to impress finance ministers in Europe . Now under pressure themselves to debase the Euro, the European Central Bank – just like the Fed – claimed this week that it remains "vigilant" on inflation. Yet it also failed to raise its interest rates too, despite the Eurozone M3 money supply growing at a near two-decade pace in March.

British Pound interest rates, meanwhile, still fail to beat tax and inflation as well, even after Thursday's much-awaited increase to 5.5%. So outside of basket-case currencies such as the Icelandic Krona and New Zealand Dollar, in short, no one will reward cash savers today for holding money instead of borrowing it.

History says that just as in the '70s and during the Deflation Scare that followed the Tech Stock Crash, gold will gain value against paper assets.

By Adrian Ash

BullionVault.com

Gold price chart, no delay | Gold prices live | Latest gold market news

City correspondent for The Daily Reckoning in London and a regular contributor to MoneyWeek magazine, Adrian Ash is the editor of Gold News and head of research at www.BullionVault.com , giving you direct access to investment gold, vaulted in Zurich , on $3 spreads and 0.8% dealing fees.

(c) BullionVault 2007

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.