Stock Market Random Walk Continues

Stock-Markets / Financial Markets 2009 Apr 02, 2009 - 04:26 AM GMTBy: PaddyPowerTrader

Equities take heart from marginally less awful than expected auto sales and Geithner's fighting talk of the economy gaining “traction” . G20 cheerleading helped as well, as a positive view on the prospects of easing mark-to-market rules and how this may impact financials Q1 results. Short-termist smoke and mirrors if you ask me. Today's London G20 summit is in danger of over-promising and under-delivering.

Equities take heart from marginally less awful than expected auto sales and Geithner's fighting talk of the economy gaining “traction” . G20 cheerleading helped as well, as a positive view on the prospects of easing mark-to-market rules and how this may impact financials Q1 results. Short-termist smoke and mirrors if you ask me. Today's London G20 summit is in danger of over-promising and under-delivering.

Today's Market Moving Stories

- Strength in equity markets continued into the Asian morning session. Auto makers were buoyed by better than expected US sales data, while industrial and materials stocks were spurred by the ISM-PMI survey. Changes to accounting standards are expected, and this could potentially help earnings estimates of the US banks.

- In the UK, the Nationwide HPI released overnight showed an unexpected monthly increase in house prices for the first time since Oct 07. The reading was +0.9% mom / -15.7% yoy . I would caution that volumes in the housing market remain extremely low. Indeed, in spite of the good figures, the lender cautioned against calling a housing bottom. According to Nationwide chief economist Fionnuala Earley “The moderation in the annual rate is somewhat distorted by conditions last year and so it would be unwise to draw strong conclusions.” This generally positive data comes on the back of Monday's Bank of England data showing new mortgage approvals beating estimates by rising 6,000 to 38,000 in February.

- The troubled US auto industry gained some grace in March when sales jumped from a recession low of 6.3 million to 7 million. But the producers are under a strict mandate to streamline production in three months because vehicle assembly has been running well above demand for many months. The prolonged drop in demand has boosted inventories and inventory sales ratios to record highs. In addition to expensive sales incentives, manufacturers have reduced output by 47% from its cycle peak. They will have to negotiate down its suppliers costs or the Obama administration will send them into the bankruptcy courts.

- Writing in Vox, Keiichiro Kobayashi writes that bad debt is at the root of the crisis . Fiscal stimulus may help economies for a couple of years but once the “painkilling” effect wears off, US and European economies will plunge back into crisis. The crisis won't be over until the nonperforming assets are off the balance sheets of US and European banks.

- Bank Ireland and Allied Irish Bank have submitted proposals to the Irish government on their version of a “bad bank” and how many assets they want to put into it. Apparently, the total figure is €35bn and will be mostly real estate/development loans which have crippled the Irish banks. There isn't any official comment from the banks yet, but AIB has the largest exposure of about €20bn with Bank of Ireland next on about €13bn. If all the six big names in Ireland were to dump their construction loans into the scheme it would be about €56bn.

- Adult education is a wonderful thing. Here's a rather nifty explanation from the one and only Paddy Hirsch of just why AIG has had to pay out so much taxpayers money to other banks. As always, he manages to illuminate the subject without either oversimplifying it or being patronising.

- Putting the ongoing (never ending) bailout of AIG(reed) into some perspective - their bailout exceeds value of Fort Knox gold !

- A quick recap of some of the best business April Fool's pranks .

- So, Obama gave the Queen an iPod . Now, I suppose you're wondering what was on it? Well, here's the playlist .

The G20 Jamboree

Bad news emanating from G20 land is that Germany's finance minister Peter Steinbruck ruled out any resolution scheme for the banking sector on the grounds that it would cost the taxpayer €200bn (it will get more expensive the longer you wait), and he adds this is not something that would be politically acceptable.

It appears to me that the failure to resolve the banking problem, the reluctance to stimulate the economy beyond a measly 1-2% a year, and the continued absence of consumption demand from the US and emerging countries means that Germany is heading into an economic depression that could last several years unless world trade improves dramatically. Don't take my word for it; IMF head Dominique Strauss Kahn says , from experience of 122 banking crises, “that you never recover before the cleaning up of the banking sector has been done”.

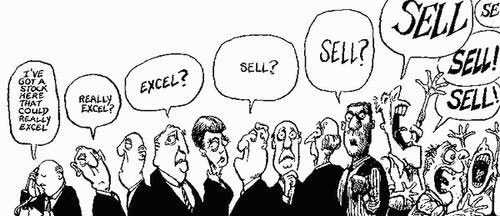

Fiscal stimulus is by far the most urgent and important issue at the G-20 jamboree. Unfortunately, it is also the most contentious, and it seems depressingly unlikely that an agreement will be reached with the polarization between the Anglo Saxon and Eurozone views of how to lift us out of the great recession . There is a disturbing lack of consistency in some of the arguments, and a lack of clarity in the debate. Eurozone countries are still reluctant to step up fiscal stimulus, and are relying largely on automatic stabilisers. They are censuring the US and UK for trying to spend their way out of this crisis, yet rely on them to provide an export-driven recovery. G-20 leaders must agree on a realistic redistribution of fiscal effort to stimulate a recovery while avoiding a recurrence of macroeconomic imbalances. If they fail to do so, market sentiment will be the first victim: the recent recovery in risk appetite will prove short-lived, and the current bear market rally could end quite quickly.

But the G20 meeting may not be a complete write-off. One area that is particularly appropriate for a global forum would be measures to kick-start world trade. The global recession means that world trade can be expected to contract by around 10% this year. However, trade has already fallen by as much as 40% on some measures. This suggests that there may be additional factors at work beyond the weakness of final demand. The prime suspect is a temporary shortage of trade finance – another casualty of the credit crunch. A package of measures to help restore the flow of trade finance might therefore result in a partial recovery in world trade, even before the global economy itself picks up. Needless to say, this would be of particular benefit to major exporters such as Germany, China and Japan, as well as many emerging economies.

Equities

- Nissan shares up 14% as their U.S. sales declining only 38% yoy vs an expected 42% drop.

- Steelmaker ArcelorMittal is up 10% this morning after securing refinancing of $1.2bn.

- Daimler and Renault are also stronger on the general tailwind for auto makers following yesterdays less awful than expected US sales figures.

- Miners like BHP Billiton and Rio Tinto are stronger on renewed strength in copper prices on the LME.

- K&S (Europe's largest salt maker!) is up 4% on news that it has agreed to buy Morton Salt from Dow Chemical for $1.68bn to make it the world's largest producer of salt.

Data Today

At 12:45, the ECB have an interest rate decision. They should get closer to joining the ZIRP club and cut from 1.5 to 1%. The ECB are also expected to (pre)-announce a corporate debt purchase program i.e. a form of quantitative easing .

February's US factory orders are released at 15:00. Stabilisation in the inventory / shipments (I/S) ratio would suggest that manufacturers are finally making much needed progress in rebalancing the level of stocks with demand. The market is forecasting a rise of 1.5%.

In the afternoon, the market should also be given the decision on the US FASB accounting changes relating to fair value accounting. If the draft proposal goes through then there will be more Level 3 assets, and the new rules would be able to be incorporated into the upcoming bank results period, beginning in the week of 16 April. Remember that many banks gave a fairly upbeat assessment for the first two months of the year. By the end of the month the first results of the government stress tests should also leak out. All said, there is likely to be extreme volatility in bank stocks in the next few weeks.

And Finally… More Jon Stewart On The Daily Show

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.

© 2009 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.