Stock Market Investors Buoyed By Positive G20 Global Economy Developments

Stock-Markets / Financial Markets 2009 Apr 05, 2009 - 08:27 AM GMT

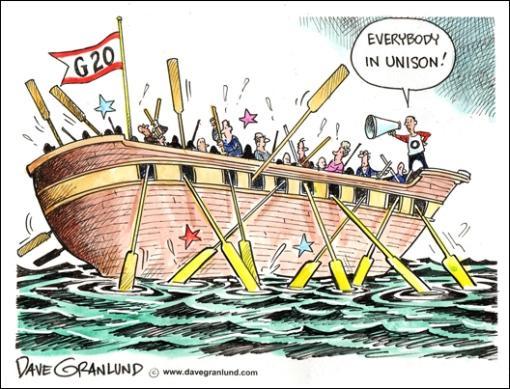

Investors' mood benefited last week from the potentially positive implications for the global economy emanating from the London G20 meeting, and the Financial Accounting Standards Board's decision to relax mark-to-market accounting rules. And the previous week's announcement of the Geithner plan to remove toxic assets from the balance sheets of banks was also still seen as a tailwind for stock markets.

Investors' mood benefited last week from the potentially positive implications for the global economy emanating from the London G20 meeting, and the Financial Accounting Standards Board's decision to relax mark-to-market accounting rules. And the previous week's announcement of the Geithner plan to remove toxic assets from the balance sheets of banks was also still seen as a tailwind for stock markets.

Source: Chicago Tribune

Has the avalanche of policy actions and bank guarantees backstopped the global economy? If stock markets are a gauge of better tidings, it would seem that a bottoming phase might have started. Risk-taking investors pushed the S&P 500 Index to a straight four-week winning streak, registering a gain of 23.3% - the strongest since April 1933. But the jury is still out on whether the bear is simply offering a temporary reprieve.

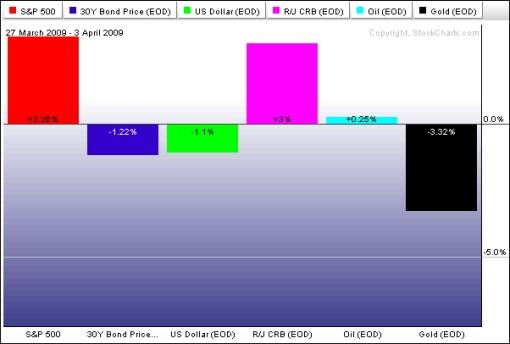

The performance of the major asset classes is summarized by the chart below, courtesy of StockCharts.com .

For discussion about the direction of stock markets, see my recent posts “ Video-o-rama: The road to recovery “, “ Schiff interviews Faber “, “ Stock market performance round-up: Signs of recovery ” and “ Donald Coxe: Investment Recommendations (March 2009) “. (And do make a point of listening to Donald Coxe's webcast of April 3, which can be accessed from the sidebar of the Investment Postcards site.)

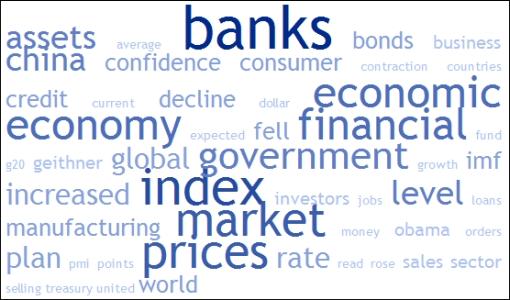

Next, a tag cloud of all the articles I read during the past week. This is a way of visualizing word frequencies at a glance. Key words such as “bank”, “market”, “index”, “prices”, “economy” and “financial” featured prominently.

Economy

“Business pessimism remains deep and widespread across all industries and regions of the globe. Survey responses regarding hiring and equipment and software investment fell to record lows last week,” said the latest Survey of Business Confidence of the World conducted by Moody's Economy.com . However, the Survey concluded that it was encouraging that businesses were becoming steadily less negative about the economy's prospects later this year.

Source: Moody's Economy.com , March 30, 2009.

A snapshot of the week's US economic data is provided below. (Click on the dates to see Northern Trust 's assessment of the various data releases.)

April 03

• Employment situation remains grim

April 02

• China: Signs of a recovery - already?

April 01

• Factory sector is tiptoeing towards a recovery

• Housing market: Pending Home Sales Index - positive signs

• Auto sales stage small rebound

• Japan: More news about a worsening situation

March 31

• Case-Shiller Home Price Index - downward spiral of home prices persists

• Consumer confidence retraces a small part of loss

Week's economic reports

Click here for the week's economy in pictures, courtesy of Jake of EconomPic Data .

Date |

Time (ET) |

Statistic |

For |

Actual |

Briefing Forecast |

Market Expects |

Prior |

| Mar 31 | 9:00 AM | Consumer Confidence | Mar | - | 28.0 | 28.0 | 25.0 |

| Mar 31 | 9:00 AM | S&P/Case-Shiller Home Price Index | Jan | -18.97% | NA | -18.6% | -18.60% |

| Mar 31 | 9:45 AM | Chicago PMI | Mar | 31.4 | 36.0 | 34.3 | 34.2 |

| Mar 31 | 10:00 AM | Consumer Confidence | Mar | 26.0 | 28.0 | 28.0 | 25.3 |

| Apr 1 | 8:15 AM | ADP Employment Change | Mar | -742K | -635K | -663K | -706 |

| Apr 1 | 10:00 AM | Construction Spending | Feb | -0.9% | -2.0% | -1.9% | -3.5% |

| Apr 1 | 10:00 AM | ISM Index | Mar | 36.3 | 37.0 | 36.0 | 35.8 |

| Apr 1 | 10:00 AM | Pending Home Sales | Feb | 2.1% | -1.0% | 0.0% | -7.7% |

| Apr 1 | 10:30 AM | Crude Inventories | 03/27 | +2840K | NA | NA | +3300K |

| Apr 2 | 8:30 AM | Initial Claims | 03/28 | 669K | 645K | 650K | 657K |

| Apr 2 | 10:00 AM | Factory Orders | Feb | 1.8% | 1.2% | 1.5% | -3.5% |

| Apr 3 | 8:30 AM | Average Workweek | Mar | 33.2 | 33.3 | 33.3 | 33.3 |

| Apr 3 | 8:30 AM | Hourly Earnings | Mar | 0.2% | 0.2% | 0.2% | 0.2% |

| Apr 3 | 8:30 AM | Non-farm Payrolls | Mar | -663k | -670K | -660K | -651K |

| Apr 3 | 8:30 AM | Unemployment Rate | Mar | 8.5% | 8.5% | 8.5% | 8.1% |

| Apr 3 | 10:00 AM | ISM Services | Mar | 40.8 | 43.0 | 42.0 | 41.6 |

Source: Yahoo Finance , April 3, 2009.

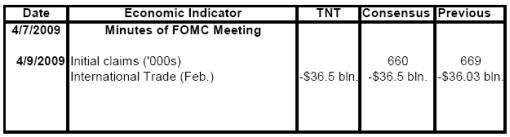

In addition to interest rate announcements by the Bank of Japan (Wednesday) and the Bank of England (Thursday), the US economic highlights for the week include the following:

Source: Northern Trust .

Click here for a summary of Wachovia's weekly economic and financial commentary.

Markets

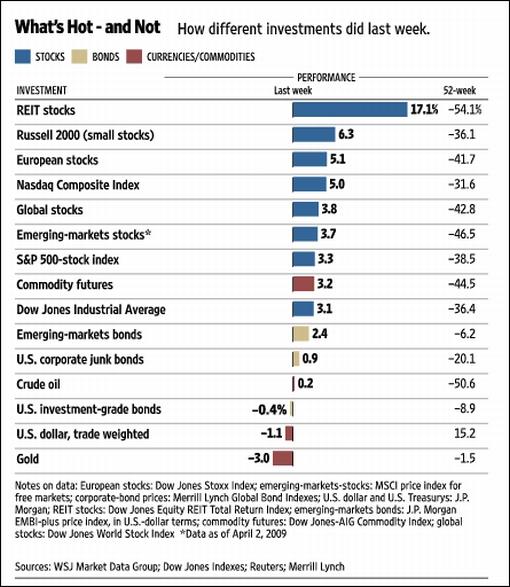

The performance chart obtained from the Wall Street Journal Online shows how different global markets performed during the past week.

Source: Wall Street Journal Online , April 3, 2009.

John Maxwell said: “The pessimist complains about the wind. The optimist expects it to change. The leader adjusts the sails.” (Hat tip: Charles Kirk .) Hopefully the “Words from the Wise” reviews will assist Investment Postcards readers in steering their investment portfolios to make the best use of the tailwinds and be cognizant of the dreaded headwinds.

That's the way it looks from Cape Town (or, more accurately, from beautiful La Jolla, California, for the next few days).

Paul Kedrosky (Infectious Greed): The Trump-Madoff Connection

“I hear you are personally acquainted with Bernie Madoff, who visited your country club in Palm Beach.

“I met Madoff a number of times at Mar-a-Lago. He loved golf, and I'd also see him at my golf club, which is nearby. One time he said to me, ‘Why don't you invest with me?' I said jokingly, ‘No thanks, I can lose my own money.'”

From an interview with Donald Trump in weekend NYT .

Source: Paul Kedrosky, Infectious Greed , March 29, 2009.

CEP News: G20 commits to ambitious stimulus plan extending into 2010

“The G20 will stand together to engage in additional stimulus plans aimed at creating jobs, cleaning up financial institutions and stimulating emerging market economies, according to the communiqué released on Thursday.

“Member nations said total stimulus spending will reach $5 trillion by the end of 2010, and that they will add an additional $1 trillion in global stimulus through the IMF and other international agencies.

“Meanwhile, the IMF has been promised $750 billion in funding for its lending operations worldwide through the sale of some of its gold reserves to increase its capital base. The Fund will also deploy $250 billion in Special Drawing Rights, a move analysts have said would effectively amount to a broad creation of global money supply.

“The G20 also agreed to regulate ‘systemically important hedge funds', and says it will work together to develop a framework for reforming financial institutions, including responsible compensation schemes for employees.

“On global trade, the Group has agreed to provide $250 billion in financing to stimulate global trade, and has voiced calls to conclude the Doha talks.

“The G20 has asked the OECD to publish a list of tax havens which the G20 will target to limit tax evasion.”

Source: Erik Kevin Franco, CEP News , April 2, 2009.

CNBC: One-on-one with Soros

“Discussing new promises to increase spending in emerging economies, with George Soros, Soros Fund Management and CNBC's Maria Bartiromo.”

CEP News: FASB eases mark-to-market accounting rules

“Accounting standards for US financial institutions were eased on Thursday when the US Financial Accounting Standards Board recommended allowing firms to use ‘significant' judgment when valuing toxic assets on their books.

“Analysts interviewed by Bloomberg said the move could increase net income for financial institutions by as much as 20%, by significantly easing the hit that financial institutions have had to take on so-called toxic debt on their balance sheets.

“‘Cynics will claim this is a thinly veiled attempt to disguise the seriousness of the financial crisis and losses being faced,' said Marc Chandler at Brown Brothers Harriman. ‘On the other hand, there are many who see the mark-to-market as an unreasonable demand for financial instruments with no markets.'

“Indeed, over the last several quarters, market participants have argued that interest in toxic assets, such as mortgage-backed securities, has essentially dried up, meaning that firms have had to value some assets as worthless even though they could eventually regain their worth.

“The decision also comes ahead of earnings season, with the first quarter of 2009 having ended last week, and with Alcoa expected to release their report on Tuesday. The FASB also said the decision will be retroactive, allowing firms to take less writedowns.

“Furthermore, analysts have argued that the decision will reduce the effectiveness of the US Treasury's Public Private Partnership Investment Program, whereby the government will back the purchase of toxic assets.”

Source: Erik Kevin Franco, CEP News , April 2, 2009.

Barry Habib (Mortgage Success Source): The real reason behind the economic crisis - “mark to market”

“The current economic crisis is the top news story for nearly every media outlet. But, somehow, one of the most important factors that led to this challenging market is also one of the least discussed.”

Source: Barry Habib, Mortgage Success Source .

Financial Times: Bailed-out banks eye toxic asset buys

“US banks that have received government aid, including Citigroup, Goldman Sachs, Morgan Stanley and JPMorgan Chase, are considering buying toxic assets to be sold by rivals under the Treasury's $1,000 billion plan to revive the financial system.

“The plans proved controversial, with critics charging that the government's public-private partnership - which provide generous loans to investors - are intended to help banks sell, rather than acquire, troubled securities and loans.

“Spencer Bachus, the top Republican on the House financial services committee, vowed after being told of the plans by the FT to introduce legislation to stop financial institutions ‘gaming the system to reap taxpayer-subsidised windfalls'.

“Mr Bachus added it would mark ‘a new level of absurdity' if financial institutions were ‘colluding to swap assets at inflated prices using taxpayers' dollars'.

“Many experts think it is essential to take these assets from leveraged institutions such as banks that are responsible for the lion's share of lending, into the hands of unleveraged financial institutions such as traditional asset managers, where they will have much less impact on the flow of credit to the economy.

“Banks have three options if they want to buy toxic assets: apply to become one of four or five fund managers that will purchase troubled securities; bid for packages of bad loans; or buy into funds set up by others. The government plan does not allow banks to buy their own assets, but there is no ban on the purchase of securities and loans sold by others.”

Source: Francesco Guerrera and Krishna Guha, Financial Times , April 2, 2009.

Financial Times: Obama gets tough on US car industry

“The Obama administration on Monday ratcheted up the government's involvement in the US auto industry, raising the spectre of bankruptcy if debtholders, unions and executives at General Motors and Chrysler fail to make new sacrifices.

“Condemning ‘a failure of leadership' from Washington to Detroit for the decline of America's carmakers, President Barack Obama rejected the turnaround plans GM and Chrysler presented to his administration last month. He said the government would fund GM for 60 days as it tries to put together a more aggressive restructuring programme. He gave smaller Chrysler 30 days to strike an acceptable rescue alliance with Italian carmaker Fiat.

“The deadlines marked the latest step in the administration's increasingly interventionist approach to the auto industry. Just hours after forcing Rick Wagoner out as GM chief, the Obama administration said it would let GM and Chrysler slide into bankruptcy if necessary to facilitate the industry's restructuring. ‘Their best chance at success may well require utilising the bankruptcy code in a quick and surgical way,' it said.

“Fritz Henderson, speaking on his first day as GM's chief executive, indicated that he believed the risk of GM filing for bankruptcy had grown.

“The federal government appears to favour a restructuring plan - in development since November - under which GM could file for bankruptcy protection within a month and then split the viable parts of its business from its messier obligations, people close to the matter say.

“A ‘new' GM containing the good assets - and backed by a plan to build and sell cars that the government feels is acceptable - could then emerge from bankruptcy protection.”

Source: Tom Braithwaite, Julie MacIntosh, Bertrand Benoit and John Reed, Financial Times , March 30, 2009.

MarketWatch: California may tap US Treasury, Europe for credit

“California's ‘liquidity problems' may force the state to seek federal backstops for sales of its short-term notes this summer, even though it received heavy demand from retail buyers in a recent bond sale, its state treasurer said Tuesday.

“California Treasurer Bill Lockyer said in an interview that the state is talking with Treasury Department staff, including Secretary Timothy Geithner, about getting federally issued letters of credit to back upcoming issues of short-term securities known as revenue anticipation notes.

“Lockyer also said the state will probably issue about $12 billion to $16 billion revenue anticipation notes this summer.

“But it may have trouble getting private banks to issue letters of credit to secure the notes, a possibility that's prompted it to seek government backup.

“‘What we're starting to talk to them about is … short-term liquidity problems' at the state and its municipalities, he said.

“Backup from the federal government would be for ‘contingency' purposes. ‘We may need to get letters of credit from Treasury,' he added.”

Source: Laura Mandaro & Stacey Delo, MarketWatch , March 31, 2009.

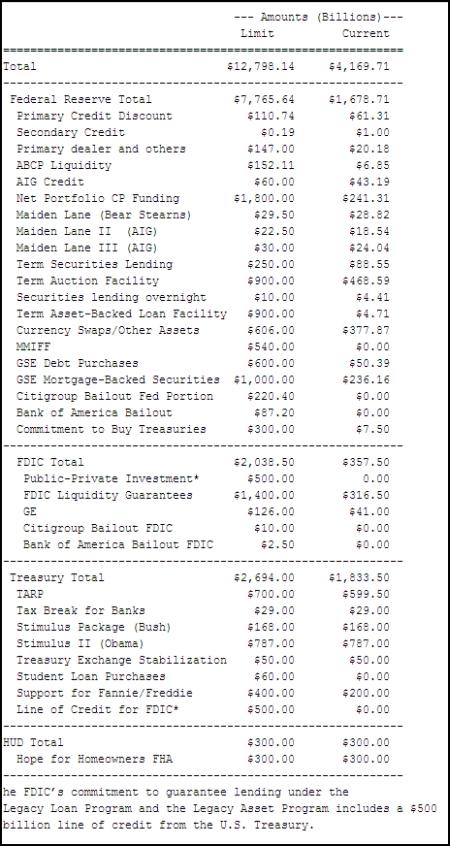

Bloomberg: Financial rescue nears GDP as pledges top $12.8 trillion

“The US government and the Federal Reserve have spent, lent or committed $12.8 trillion, an amount that approaches the value of everything produced in the country last year, to stem the longest recession since the 1930s.

“New pledges from the Fed, the Treasury Department and the Federal Deposit Insurance Corp. include $1 trillion for the Public-Private Investment Program, designed to help investors buy distressed loans and other assets from US banks. The money works out to $42,105 for every man, woman and child in the US and 14 times the $899.8 billion of currency in circulation. The nation's gross domestic product was $14.2 trillion in 2008.

“President Barack Obama and Treasury Secretary Timothy Geithner met with the chief executives of the nation's 12 biggest banks on March 27 at the White House to enlist their support to thaw a 20-month freeze in bank lending.

“‘The president and Treasury Secretary Geithner have said they will do what it takes,' Goldman Sachs Group Chief Executive Officer Lloyd Blankfein said after the meeting. ‘If it is enough, that will be great. If it is not enough, they will have to do more.'

“The following table details how the Fed and the government have committed the money on behalf of American taxpayers over the past 20 months, according to data compiled by Bloomberg.”

Source: Mark Pittman and Bob Ivry, Bloomberg , March 31, 2009.

The New York Times: Obama's ersatz capitalism

“The Obama administration's $500 billion or more proposal to deal with America's ailing banks has been described by some in the financial markets as a win-win-win proposal. Actually, it is a win-win-lose proposal: the banks win, investors win - and taxpayers lose …

“With the government absorbing the losses, the market doesn't care if the banks are ‘cheating' them by selling their lousiest assets, because the government bears the cost …

“Paying fair market values for the assets will not work. Only by overpaying for the assets will the banks be adequately recapitalized. But overpaying for the assets simply shifts the losses to the government. In other words, the Geithner plan works only if and when the taxpayer loses big time.

“Some Americans are afraid that the government might temporarily ‘nationalize' the banks, but that option would be preferable to the Geithner plan. After all, the FDIC has taken control of failing banks before, and done it well …

“What the Obama administration is doing is far worse than nationalization: it is ersatz capitalism, the privatizing of gains and the socializing of losses. It is a ‘partnership' in which one partner robs the other.”

Source: Joseph Stiglitz, The New York Times , March 31, 2009.

CNBC: Roubini's read on the recession

“The solutions and government interventions that need to be tackled in order to take the economy and financial system off of life support, with Nouriel Roubini, RGE Monitor chairman/NYU Stern School of Business professor, and Arianna Huffington, Huffington Post.”

Source: CNBC , March 31, 2009.

Financial Times: OECD predicts 10% jobless rate for 2010

“One in 10 workers in advanced economies will be without a job next year, ‘practically with no exceptions', the head of the Organisation for Economic Co-operation and Development said on Monday.

“In a graphic indication of the global recession's transmission from the financial sector to the rest of the economy, Angel Gurría warned that the ranks of the unemployed in the 30 advanced OECD countries would swell ‘by about 25 million people, by far the largest and most rapid increase in OECD unemployment in the postwar period'.

“He said the misery of joblessness - what Mr Gurría described as ‘rapidly turning into a jobs and social crisis' - would come as the OECD expected advanced economies to contract by 4.3% in 2009 with little or no growth expected in 2010. The forecast is significantly worse than the International Monetary Fund's most recent estimate of a 3-3.5% contraction for 2009.”

Source: Chris Giles, Ralph Atkins and Mark Mulligan, Financial Times , March 30, 2009.

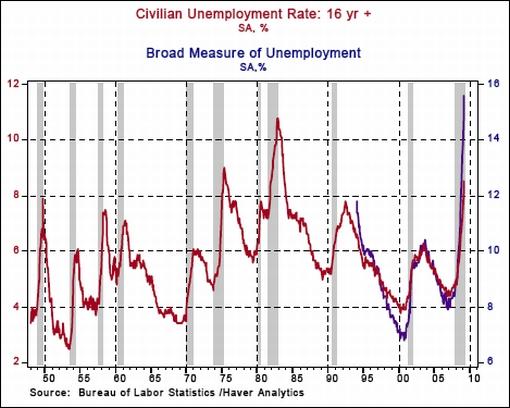

Asha Bangalore (Northern Trust): Employment situation remains grim

• Civilian Unemployment Rate : 8.5% in March versus 8.1% in February, cycle low is 4.4% in March 2007.

• Payroll Employment : -663,000 in March versus -651,000 in February, net loss of 86,000 jobs after revisions of payroll estimates for January and February.

• Hourly earnings : +3 cents to $18.50, 3.35% yoy change versus 3.59% yoy change in February, cycle high is 4.28% yoy change in December 2006.

“The headlines and details of the employment report present a dismal picture of employment conditions in the US economy. The main message is that the Fed is on hold for the foreseeable future. That said, there are positive aspects in the report we are watching closely – employment in construction, manufacturing, and temporary help (see charts 7 and – and it is a matter of time before we can conclude if in fact these are meaningful signals of economic recovery.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary, April 3, 2009.

CNBC: Pimco's Gross talks jobs report

“Reacting to the jobs report and how the markets will respond, with William Gross, Pimco co-chief investment officer/founder.”

Source: CNBC , April 3, 2009.

Yahoo Finance: Nouriel Roubini sounds, GASP, positive about economy!

“Okay, not ‘positive', exactly, but certainly less negative than he's sounded over the past 18 months.

“NYU professor Nouriel Roubini, you'll recall, is known as ‘Dr. Doom', the most famous of the handful of economists who actually predicted the current debacle. A few days ago, after a speech in Italy, he was quoted as saying he might see some ‘light at the end of the tunnel'. And he repeats a similarly non-apocalyptic outlook on TechTicker in our interview here.

“To be clear: Roubini is NOT predicting an imminent recovery. He thinks that most economists are still way too bullish, that the stock market will retest its lows, and that unemployment will eventually rise over 10%. He just thinks that the quarter that is now ending, Q1, will be the worst rate of decline in the economy and that things will gradually stop deteriorating and then get better from here.”

Source: Yahoo Finance , March 31, 2009.

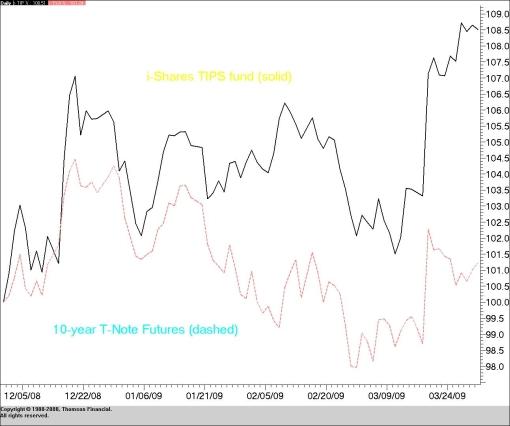

(in)efficient frontiers: Rising inflation expectations

“I've written in the past about the misinterpretation of yield numbers on TIPS (Treasury Inflation Protected Securities). While the yield numbers (and price when expressed as percentage of par unadjusted for the inflation index ratio) have given false readings, the dollar value of a basket of TIPS does offer insight. Consider the chart below:

“The chart illustrates the relative price performance of the Barclay's iShare TIPS fund and the 10-year T-note futures over the last 4 months. As can be seen from the chart, the basket of TIPS in the iShare has appreciated by about 8% while the treasury contract has been roughly flat. The best explanation for this relative outperformance is rising inflationary expectations.

“Last fall, when TIPS falsely appeared to be signaling deflation, those who championed massive government spending cited TIPS performance as supportive evidence. Now that TIPS are clearly starting to warn of rising inflation, those same voices are noticeably silent on this fact.”

Source: Jeff Korzenik, (in)efficient frontiers , March 31, 2009.

CNBC: Bernanke - housing & the economy

“Federal Reserve chairman Ben Bernanke says the Fed has sought to avoid credit risk and allocation in lending programs.”

Source: CNBC , April 3, 2009.

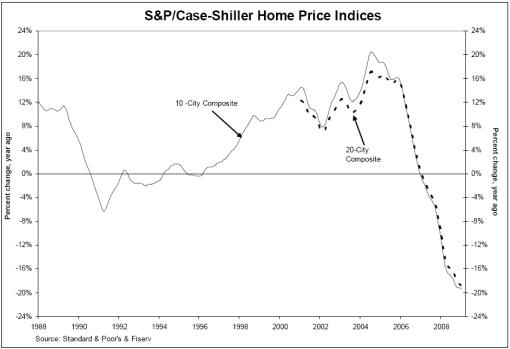

Case Shiller: S&P/Case-Shiller - downward spiral of home prices persists

“Data through January 2009, released today by Standard & Poor's for its S&P/Case-Shiller Home Price Indices, the leading measure of US home prices, shows continued broad based declines in the prices of existing single family homes across the United States, with 13 of the 20 metro areas showing record rates of annual decline, and 14 reporting declines in excess of 10% versus January 2008.

“The chart above depicts the annual returns of the 10-City Composite and the 20-City Composite Home Price Indices. Following the lead of the 14 metro areas described above, the 10-City and 20-City Composites also set new records, with annual declines of 19.4% and 19.0%, respectively.

“‘Home prices, which peaked in mid-2006, continued their decline in 2009,' says David Blitzer, Chairman of the Index committee at Standard & Poor's. ‘There are very few bright spots that one can see in the data.'”

Source: Standard & Poor's , March 31, 2009.

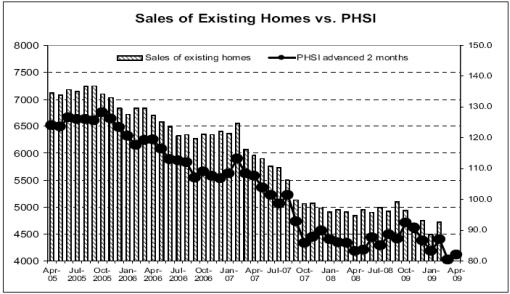

Asha Bangalore (Northern Trust): Pending Home Sales Index - positive sign

“The Pending Home Sales Index (PHSI) of the National Association of Realtors rose to 82.1 in February from 80.4 in the prior month. The PHSI leads actual sales of existing homes by one/two months. The February gain of the index is a positive sign for home sales during March/April 2009.”

Source: Asha Bangalore, Northern Trust , April 1, 2009.

Asha Bangalore (Northern Trust): Consumer confidence retraces a small part of loss

“The Conference Board's Consumer Confidence Index rose slightly to 26 in March from a record low of 25.3 in February. The strength was entirely from the Expectation Index (28.9 versus 27.3 in February) as the Present Situation Index (21.5 from 22.3 in February) dropped in March.”

Source: Asha Bangalore, Northern Trust , March 31, 2009.

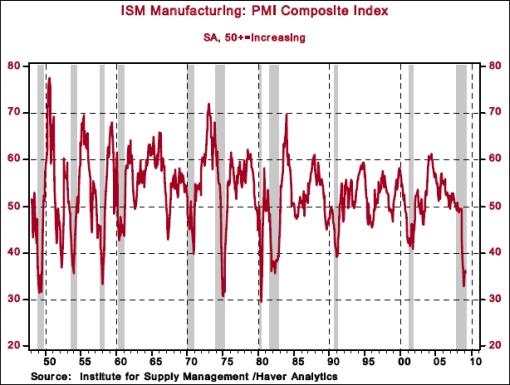

Asha Bangalore (Northern Trust): Factory sector is tiptoeing toward a recovery

“The ISM manufacturing survey results for March indicate that the factory sector is contracting less rapidly compared with the situation in February. The composite index edged up to 36.3 in March from 35.8 in February. The level of the composite index denotes a contraction of the factory sector but the March reading is now notably higher than the cycle low of 32.9 seen in December 2008. The New Orders Index (41.2, +8.1 points) recorded the largest gain among the different components of the survey.

“Indexes tracking production employment, exports, imports, backlogs, and prices advanced in March, while indexes measuring vendor deliveries and inventories fell.”

Source: Asha Bangalore, Northern Trust , April 1, 2009.

CNBC: Gross Talks Bonds

“Bond holders are still negotiating and hoping, with Bill Gross, Pimco, and CNBC's Erin Burnett.”

Source: CNBC , March 31, 2009.

Bloomberg: Geithner's non-recourse gift keeps on giving to Gross

“Treasury Secretary Timothy Geithner's plan to rid banks and markets of devalued assets may be a boon for Pimco's Bill Gross.

“The plan may reward investors with 20% annual returns on ‘really ‘toxic' mortgages bought at 45 cents on the dollar by allowing them to borrow six times their money with ‘non-recourse' government-backed debt, New York-based Credit Suisse Group AG analysts Carl Lantz and Dominic Konstam wrote in a report. That loan would be worth 15 cents to an investor seeking the same return who can't use borrowed money.

“Geithner's Public-Private Investment Program, or PPIP, promises to boost prices enough to encourage banks, insurers and hedge funds to sell their mortgage holdings, freeing them to make loans while creating a potential windfall for investors. Federal Reserve Chairman Ben Bernanke said March 20 that ‘credit market dysfunction' is countering efforts to fix the economy.

“‘One of the challenges has been that leverage has really been pulled away from the system and as a result the kinds of returns investors are looking for haven't really been available,' said Ken Hackel, head of fixed-income strategy at RBS Securities in Greenwich, Connecticut. RBS is one of the 16 primary dealers that are obligated to bid at the Treasury's auctions of government debt and which trade with the Fed.

“Since Geithner unveiled the plan on March 23, Pimco, which manages the world's biggest bond fund, and New York-based BlackRock, the largest publicly traded US asset manager, said they may be interested in participating in PPIP.

“‘This is perhaps the first win/win/win policy to be put on the table,' Gross, co-chief investment officer of Newport Beach, California-based Pimco, said in an e-mailed statement last week.”

Source: Jody Shenn, Bloomberg , April 2, 2009.

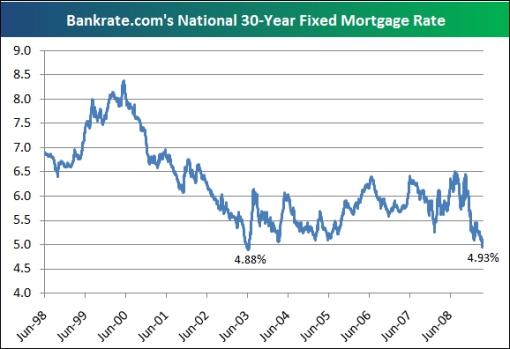

Bespoke: 30-year fixed mortgage drops below 5%

“The national average 30-year fixed mortgage rate dipped below 5% as of last Friday to a level of 4.93%. The only other time it was below 5% in the last ten years was back in June 2003. One reason that the Fed is buying up Treasuries is to get this mortgage rate lower in order to help the consumer and the struggling housing market. So far the Fed announcement has done a pretty good job of lowering mortgage rates, but we're sure they want to see it even lower.”

Source: Bespoke , March 30, 2009.

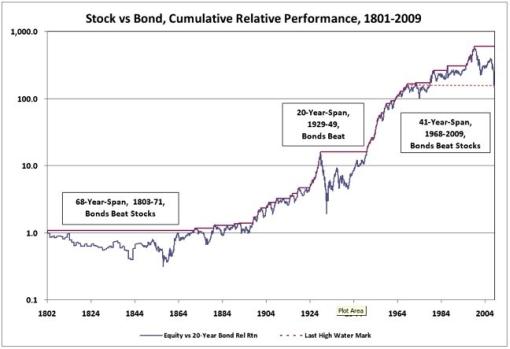

John Mauldin (Thoughts from the Frontline):

“Starting at any time from 1980 up to 2008, an investor in 20-year treasuries, rolling them over every year, beats the S&P 500 through January 2009! Even worse, going back 40 years to 1969, the 20-year bond investors still win, although by a marginal amount. And that is with a very bad bond market in the ‘70s.

“Let's go back to the really long run. Starting in 1802, we find that stocks have beat bonds by about 2.5%, which, compounding over two centuries, is a huge differential. But there were some periods just like the recent past where stocks did in fact not beat bonds.

“Look at the following chart. It shows the cumulative relative performance of stocks over bonds for the last 207 years. What it shows is that early in the 19th century there was a period of 68 years where bonds outperformed stocks, another similar 20-year period corresponding with the Great Depression, and then the recent episode of 1968-2009.

Source: John Mauldin, Thoughts from the Frontline , March 30, 2009

Bespoke: Largest 4-week winning streak since 1933

“The S&P 500 has now been up for 4 straight weeks, registering a gain of 23.28%. Interestingly, the last time we had a 4-week winning streak that saw gains of at least 10% was 10/02-11/02, which was the start of the five year bull market that ran until 10/9/07. … this is the 3rd strongest 4-week winning streak on record, and the strongest since April 1933.

“The average change in the fifth week following these 4-week periods has been 0.24%, while the median change has been -0.35%. The average change over the next 4 weeks has been 1.87%.”

Source: Bespoke , April 3, 2009.

Bespoke: S&P 500 breaks above recent highs

“The S&P 500 took out its high from last week of 832 today, as the index is currently resting above the 840 mark. Technicians will be watching to see if the index can close above these prior highs, and if it does, it will be another positive for the uptrend that the market is currently in.”

Source: Bespoke , April 2, 2009.

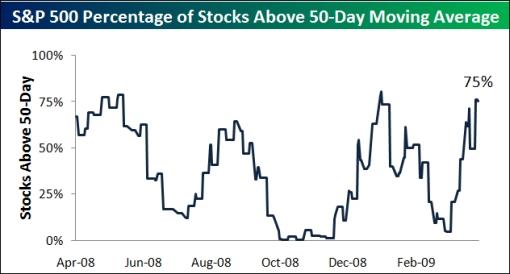

Bespoke: Percentage of stocks above 50-day moving averages

“Currently, 75% of the stocks in the S&P 500 are trading above their 50-day moving averages. While this is a strong breadth measure, it has also been a level that has been met with selling pressure in the past. Health Care and Utilities are the only two sectors that still have less than half of their stocks trading above their 50-days. Technology, Consumer Discretionary, Materials, and Telecom all have more than 90% of stocks trading above their 50-days, which is definitely an overbought reading.”

Source: Bespoke , April 3, 2009.

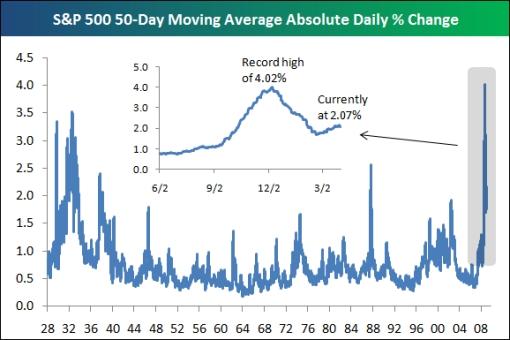

Bespoke: Market volatility drastically lower, but still high

“In late 2008, the market experienced its most volatile 50-day period ever. At one point, the average daily move of the S&P 500 over the prior 50 days was 4%! While volatility is still very high, it has nearly been cut in half from its peak in late 2008. As shown below, the average daily change for the S&P 500 over the last 50 days has been 2.07%.”

Source: Bespoke , April 1, 2009.

Richard Russell (Dow Theory Letters): Identifying a bear market bottom

“First, based on the 76 years of the Lowry's studies, prior to a bear market bottom, it is usual for their Selling Pressure Index (supply) to decline significantly, indicating that the desire to sell is being exhausting. Secondly, Lowry's Buying Power Index (demand) begins to climb well before the final bear market bottom.

“This is NOT what has occurred. From its March 9 low, the Buying Power Index has risen an impressive 46 points. However, and this is the big problem, since March 9 Lowry's Selling Pressure Index has declined by a mere 13 points. Thus, Selling Pressure has only dropped half as much as Buying Power has advanced. This suggests that there is still far too much desire to sell built into this market. Any cessation of buying will therefore succumb to selling, and this is NOT how new bull markets start. Selling Pressure is still far too high.

“From another standpoint I continue to believe that this advance is not the beginning of a bull market. Primary movements in the stock market tend to have a slow, persistent plodding look. In contrast, corrective moves tend to be rapid and violent, often spurred on by panic short covering. The action of this market since the March lows has the look of a secondary correction. The speed and the steep angle of ascent is suggestive of a bear market rally.

“Since March 9, the Dow has gained roughly 940 points in nine days. Thus, the Dow has regained 15% of its bear market losses in a mere nine days. This is bear market correction-type action.”

Source: Richard Russell, The Dow Theory Letters , March 31, 2009.

Richard Russell (Dow Theory Letters): Watch out for fizzling rallies

“The following from Financial Sense : The latest 23% surge in the Dow Jones Industrials towards the psychological 8,000-level, is its seventh significant rally of 1,000-points or more, since October 2007. During the bear market from 1929 to the bottom in 1932, the Dow Industrials fell by almost 90%. There were six bear-market rallies during that stretch, with returns of more than 20%, each one fueling a sense of renewed optimism. Yet each counter-trend rally ultimately fizzled-out and unraveled, before market indexes skidded to new lows.

“As 2009 opened, three weeks before Barack Obama took office, the Dow Jones Industrials closed at 9,034 on January 2nd, its highest level since the autumn panic. The Dow Industrials melted down to as low as 6,500 on March 6, for an overall decline of 30% in two months, and to its lowest level in 12-years. The Dow Jones Commodity Index skidded to a six-year low, after tumbling by 57% since last July.

“We are now in the third Dow rally of 1000 points or more since October 7, 2007. The first over-1000 point rally started in March, 2008. The second started on November 17, 2008. The most recent over-1000 rally started on March 2, 2009. The first two rallies were wiped out with new lows in the Dow after the rallies fizzled.”

Source: Richard Russell, Dow Theory Letters , July 3, 2009.

Bespoke: Strategists continue to lower year-end S&P 500 price targets

“Below we have updated our table of strategist price targets for the S&P 500 at the end of 2009. UBS, Goldman Sachs, Credit Suisse, HSBC, and Barclays have all already lowered their year-end S&P 500 price targets. Bank of America actually recently increased their price target from 975 to 1,030. The average year-end S&P 500 price target is currently 956.5, which equates to a gain of just over 20% from the index's current level. At the start of the year, the average year-end price target was 1,050.”

Source: Bespoke , March 31, 2009.

David Fuller (Fullermoney): Trillions of bailout money will buy downside cushion

“Forget a depression - the trillions of financial rescue packages will buy a downside cushion followed by economic recovery, even though more lagging bad data is in the pipeline.

“Forget another stock market meltdown - not all stock markets are equal but the bear has been ending since last October's selling climax and the new bull is led by Asian emerging markets and South American resources markets.

“Forget long-dated government bonds as a safe haven - they are now a sucker's game, propped up by the threat and occasional reality of quantitative easing, at a time when risk appetite is slowly returning.

“Forget US dollar safe haven - it is a Madoff-style Ponzi scheme, in which it pays to ask for your money back early.

“Expect commodity inflation - this is being led by precious metals and copper.”

Source: David Fuller, Fullermoney , March 31, 2009.

Jeffrey Saut (Raymond James): Kites!?

“Last week the DJIA and DJTA broke out above their respective 50-day moving averages (DMAs). They also now reside above their 10-DMAs and 30-DMAs. The 34% rally by the Transports since their March 9, 2009 low is particularly interesting given the Trannies' economic sensitivity; and, amid cries that we are in a Great Depression environment.

“And don't look now, but lumber has quietly gained nearly 30% since its February 2009 low. Again, that's pretty impressive action given the current housing backdrop!

“Meanwhile, we are watching Personal Consumption Expenditures (PCE), for this is how recessions end. Indeed, if the ‘real' PCE has stabilized, the end of the recession is not far off. Manifestly, the stock market always turns-up before the economy bottoms. So if the January/February strength in the PCE is for real, it is an extremely positive event. However, if the PCE strength is just a reaction to the +5.8% COLA adjustment, as well as the 13.2% increase in IRS tax refunds year/year, then the upcoming month's data will revert to a more subdued reading. Accordingly, we are watching the PCE closely.

“While we are watching, however, our investments in platinum broke out to new reaction ‘highs' last week, and indices playing to Brazil are attempting to break out to the upside. Still, it is day 16 in the ‘buying stampede' and we have turned cautious. And, isn't it interesting how the markets follow the news, for following ‘Friday's fall' (-148 DJIA) the Obama Administration warned that some banks will need more government aid and that bankruptcy might be the best option for GM and Chrysler.”

Source: Jeffrey Saut, Raymond James , March 30, 2009.

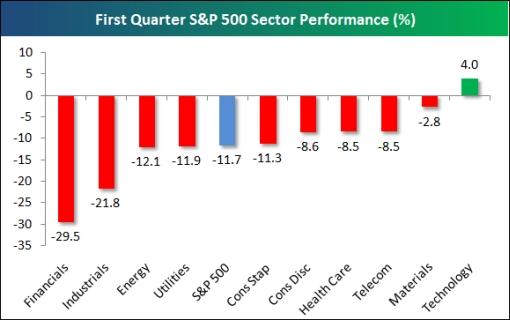

Bespoke: First quarter sector performance

“As shown in the chart below, the S&P 500 was down 11.7% in the first quarter of 2009. Six sectors outperformed the index, while four underperformed. The Financial sector was by far the worst performer with a decline of 29.5%. Industrials, Energy and Utilities were the three other sectors that underperformed the market as a whole. Only one sector finished the quarter in positive territory - Technology (4%). Consumer Staples, Consumer Discretionary, Health Care, Telecom, and Materials are the other five sectors that outperformed the market.”

Source: Bespoke , March 31, 2009.

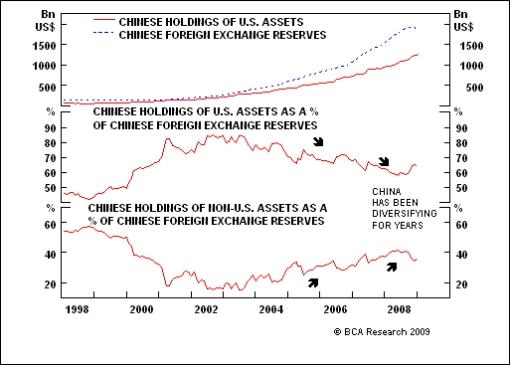

BCA Research: Disenchanted with the US dollar

“The US dollar is unlikely to be dislodged as the dominant reserve currency any time soon.

“There are legitimate reasons for the Chinese to be worried about their dollar holdings: China's foreign exchange reserves total $2 trillion, or 48% of GDP. The Chinese authorities are growing increasingly disenchanted with their exposure to the US dollar, worried that Fed policy is debasing the currency.

“Last week central bank Governor Zhou called for a reform of the international monetary system that would see the US dollar replaced as a reserve currency, such as the SDR. However, leaked parts of the upcoming G20 Communique do not hint that such a ‘super sovereign' currency is being seriously discussed at high levels. Even if a consensus forms that a new reserve currency is a good idea, global authorities would have to convince international business people to invoice in SDRs. Moreover, a wide variety of financial assets denominated in SDRs would have to be developed and traded in deep markets. Such a massive undertaking would take many years to develop.

“More likely, China will continue to slowly diversify away from the US dollar into other countries, a process that has been ongoing for years. China is unlikely to suddendly ‘dump' US dollar assets, as this would damage China's own interests. Bottom line: The structural downtrend in the US dollar has probably resumed, but it should be a fairly benign adjustment.”

Source: BCA Research , March 31, 2009.

Financial Times: China and Argentina in currency swap

“China, which is pushing to end the dominance of the dollar as a worldwide reserve, has agreed a Rmb70 billion currency swap with Argentina that will allow it to receive renminbi instead of dollars for its exports to the Latin American country.

“Xinhua, the official Chinese news agency, said the deal was signed on Sunday by Zhou Xiaochuan, governor of the People's Bank of China, and Martín Redrado, Argentine central bank president, in Medellín, Colombia, where they are attending a meeting of the Inter-American Development Bank.

“An Argentine official confirmed a deal had been discussed and said the fine print was being worked out and negotiations were ‘very advanced'.

“Beijing has signed Rmb650 billion of deals since December with Malaysia, South Korea, Hong Kong, Belarus, Indonesia and, now, Argentina in an attempt to unblock trade financing that has been severely curtailed by the crisis.”

Source: Jude Webber, Financial Times , March 31, 2009.

Bloomberg: Frank Holmes says “odds favor” oil prices rising to $65

“Frank Holmes, chief executive officer of US Global Investors, talks with Bloomberg's Pimm Fox about the outlook for oil, gold and commodity prices. Holmes also discusses mark-to-market accounting and his investment picks of San Juan Basin Royalty Trust and AngloGold Ashanti.”

Source: Bloomberg , March 31, 2009.

CEP News: ECB's rate cut takes into account subdued prices & weak demand, Trichet says

“The European Central Bank's decision to lower interest rates to a record low of 1.25% took into account weak price pressures and deteriorating economic growth, said ECB President Jean-Claude Trichet, noting that further unconventional policy measures would be discussed in May.

“‘After today's decision, we expect price stability to be maintained over the medium term, thereby supporting the purchasing power of euro area households,' Trichet said during his press conference following the central bank's rate announcement on Thursday.

“‘The Governing Council will continue to ensure a firm anchoring of medium-term inflation expectations,' he said.

“Trichet said the ECB Governing Council ‘voted by consensus' to lower the main refinancing rate by 25 basis points to a record low 1.25%. Economists, however, had expected a 50 bps cut.

“In his introductory remarks, Trichet noted that economic activity has weakened markedly in the euro area and that it will likely remain at a low level for the year.

“Nevertheless, falling commodity prices and large amounts of stimulus to the economy and the financial system should help consumption recover in 2010, he said, adding that risks to the economy are broadly balanced as a result.

“Disinflationary pressures, due largely to the sharp fall in global commodity prices, are likely to push price growth temporarily into negative territory, he said, but added that such developments are ‘not relevant from a monetary policy perspective'.

Source: CEP News , April 2, 2009.

CEP News: Government efforts having effect on financial markets, says ECB's Bini Smaghi

“Signs that government stimulus measures are having a positive effect on financial markets are beginning to emerge, European Central Bank Executive Board member Lorenzo Bini Smaghi said.

“Government efforts, including fiscal stimulus plans and rescue measures, ‘are starting to be felt in financial markets,' Bini Smaghi said in a speech given in Milan, Italy on Monday.

“However, the financial industry is still likely to contract, even after the global economy finally recovers, the central banker said. Smaller profit margins and a smaller labour force in the sector is to be expected, he said.

“At the same time, global trade is likely to increase at a slower pace than before the crisis, Bini Smaghi said, adding that risk aversion is likely to remain at high levels for some time.”

Source: CEP News , March 30, 2009.

CEP News: SNB to use “all means” to prevent deflation, says Hildebrand

“The Swiss National Bank will continue to intervene in foreign exchange markets to bring down the value of the franc and reduce the risk of deflation, the central bank chairman Philipp Hildebrand said.

“In March, the SNB reduced its three-month Libor target rate by 25 basis points and announced that it would begin purchasing foreign currency through FX markets in an effort to counteract further appreciation of the Swiss currency.

“‘A renewed appreciation of the franc contains the risk of a sustained deflationary dynamic in Switzerland,' Hildebrand said at an event in Bern on Thursday. ‘It's about preventing' deflation ‘by all means'.”

Source: CEP News , April 2, 2009.

Reuters: Soros - Eastern Europe “prime candidate” for IMF help

“Billionaire investor George Soros said on Tuesday Eastern Europe was a ‘prime candidate' for International Monetary Fund (IMF) support.

“Speaking at the London School of Economic ahead of the G20 summit, Soros said: ‘G20 should not just provide pious words but should take steps to stabilise periphery countries.'”

Source: Cecilia Valente, Reuters , March 31, 2009.

CEP News: German manufacturing PMI improves further

“Declines in German manufacturing activity continued to slow in March, Markit Economics confirmed on Wednesday. However, activity in the sector continues to contract at a sharp pace, the research firm added.

“The German manufacturing purchasing managers index rose to 32.4 in March, up one point from February's figure and in line with both preliminary estimates and expectations.

“March's increase marks the second consecutive month of improvement after PMI reached a 12-year low in January of 32.0.

“Nevertheless, the figure remains well in contraction territory, with the average taken across Q1 as a whole notably lower than the previous quarter's figure.”

Source: CEP News , April 1, 2009.

CEP News: Improvement in UK services PMI suggests worst may be over

“The contraction in the UK services sector eased more than expected in March, suggesting that the worst in terms of activity declines has passed, Markit Economics said on Friday.

“The UK services purchasing managers index rose beyond expectations to 45.5 in March from February's 43.2 level. Economists had expected a far more modest gain to 43.5 for the month. March's gain is the largest recorded since last September.

“‘The latest upturn in the activity index and another improvement in business confidence to a post-Lehman Brothers high provide further evidence that the severe contractions in services output at the end of last year may now be behind us,' Markit senior economist Paul Smith said.”

Source: CEP News , April 3, 2009.

Nationwide: UK – surprise bounce in house prices

• House prices increased by 0.9% in March

• House purchase activity reaches highest level since May 2008

• Welcome signals of market improvement but too early to talk of house price recovery

“Commenting on the figures Fionnuala Earley, Nationwide's Chief Economist, said:

“‘Spring brought a surprise bounce to house prices in March. The price of a typical house increased for the first time since October 2007, rising by 0.9% during the month and reducing the annual rate of fall from -17.6% to -15.7%. This brings the price of a typical house to £150,946.

“The moderation in the annual rate of fall is somewhat distorted by conditions last year and so it would be unwise to draw strong conclusions from the significant slowdown in the annual rate of fall. Equally, while the rise in prices in March is welcome, it is far too soon to see this as evidence that the trough of the market has been reached.

“The Bank of England has already taken strong measures to ease the tensions in economic and financial markets by cutting rates and commencing quantitative easing. However it will take time for these to work through into the housing market before we can expect a sustained recovery in house prices.”

Source: Nationwide, April 2, 2009.

Li & Fung Research Centre: Chinese PMI rebounds to over 50%

“The PMI rebounded to 52.4% in March 2009, up from 49.0% in the previous month. The index was back to the expansionary zone of higher than 50% for the first time since October last year. Output index, new orders index and purchases of inputs index were also higher than the critical level of 50% in March. Except stocks of finished goods, all sub-indices were higher than their respective levels in the previous month. Of which, imports index grew strongly by 7.0 ppt. to 48.8% in March, compared to the previous month.”

Click here for the full report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.