Towards New Global Currency, New Financial World Order

Politics / Global Financial System Apr 08, 2009 - 01:50 AM GMTBy: Global_Research

Following the 2009 G20 summit, plans were announced for implementing the creation of a new global currency to replace the US dollar's role as the world reserve currency. Point 19 of the communiqué released by the G20 at the end of the Summit stated, “We have agreed to support a general SDR allocation which will inject $250bn (£170bn) into the world economy and increase global liquidity.” SDRs, or Special Drawing Rights, are “a synthetic paper currency issued by the International Monetary Fund.” As the Telegraph reported, “the G20 leaders have activated the IMF's power to create money and begin global "quantitative easing". In doing so, they are putting a de facto world currency into play. It is outside the control of any sovereign body. Conspiracy theorists will love it.”[1]

Following the 2009 G20 summit, plans were announced for implementing the creation of a new global currency to replace the US dollar's role as the world reserve currency. Point 19 of the communiqué released by the G20 at the end of the Summit stated, “We have agreed to support a general SDR allocation which will inject $250bn (£170bn) into the world economy and increase global liquidity.” SDRs, or Special Drawing Rights, are “a synthetic paper currency issued by the International Monetary Fund.” As the Telegraph reported, “the G20 leaders have activated the IMF's power to create money and begin global "quantitative easing". In doing so, they are putting a de facto world currency into play. It is outside the control of any sovereign body. Conspiracy theorists will love it.”[1]

The article continued in stating that, “There is now a world currency in waiting. In time, SDRs are likely to evolve into a parking place for the foreign holdings of central banks, led by the People's Bank of China.” Further, “The creation of a Financial Stability Board looks like the first step towards a global financial regulator,” or, in other words, a global central bank.

The article continued in stating that, “There is now a world currency in waiting. In time, SDRs are likely to evolve into a parking place for the foreign holdings of central banks, led by the People's Bank of China.” Further, “The creation of a Financial Stability Board looks like the first step towards a global financial regulator,” or, in other words, a global central bank.

It is important to take a closer look at these “solutions” being proposed and implemented in the midst of the current global financial crisis. These are not new suggestions, as they have been in the plans of the global elite for a long time. However, in the midst of the current crisis, the elite have fast-tracked their agenda of forging a New World Order in finance. It is important to address the background to these proposed and imposed “solutions” and what effects they will have on the International Monetary System (IMS) and the global political economy as a whole.

A New Bretton-Woods

In October of 2008, Gordon Brown, Prime Minister of the UK, said that we “must have a new Bretton Woods - building a new international financial architecture for the years ahead.” He continued in saying that, “we must now reform the international financial system around the agreed principles of transparency, integrity, responsibility, good housekeeping and co-operation across borders.” An article in the Telegraph reported that Gordon Brown would want “to see the IMF reformed to become a ‘global central bank' closely monitoring the international economy and financial system.”[2]

On October 17, 2008, Prime Minister Gordon Brown wrote an op-ed in the Washington Post in which he said, “This week, European leaders came together to propose the guiding principles that we believe should underpin this new Bretton Woods: transparency, sound banking, responsibility, integrity and global governance . We agreed that urgent decisions implementing these principles should be made to root out the irresponsible and often undisclosed lending at the heart of our problems. To do this, we need cross-border supervision of financial institutions; shared global standards for accounting and regulation ; a more responsible approach to executive remuneration that rewards hard work, effort and enterprise but not irresponsible risk-taking; and the renewal of our international institutions to make them effective early-warning systems for the world economy.[Emphasis added]”[3]

In early October 2008, it was reported that, “as the world's central bankers gather this week in Washington DC for an IMF-World Bank conference to discuss the crisis, the big question they face is whether it is time to establish a global economic "policeman" to ensure the crash of 2008 can never be repeated.” Further, “any organisation with the power to police the global economy would have to include representatives of every major country – a United Nations of economic regulation.” A former governor of the Bank of England suggested that, “the answer might already be staring us in the face, in the form of the Bank for International Settlements (BIS),” however, “The problem is that it has no teeth. The IMF tends to couch its warnings about economic problems in very diplomatic language, but the BIS is more independent and much better placed to deal with this if it is given the power to do so.”[4]

Emergence of Regional Currencies

On January 1, 1999, the European Union established the Euro as its regional currency. The Euro has grown in prominence over the past several years. However, it is not to be the only regional currency in the world. There are moves and calls for other regional currencies throughout the world.

In 2007, Foreign Affairs, the journal of the Council on Foreign Relations, ran an article titled, The End of National Currency, in which it began by discussing the volatility of international currency markets, and that very few “real” solutions have been proposed to address successive currency crises. The author poses the question, “will restoring lost sovereignty to governments put an end to financial instability?” He answers by stating that, “This is a dangerous misdiagnosis,” and that, “The right course is not to return to a mythical past of monetary sovereignty, with governments controlling local interest and exchange rates in blissful ignorance of the rest of the world. Governments must let go of the fatal notion that nationhood requires them to make and control the money used in their territory. National currencies and global markets simply do not mix; together they make a deadly brew of currency crises and geopolitical tension and create ready pretexts for damaging protectionism. In order to globalize safely, countries should abandon monetary nationalism and abolish unwanted currencies, the source of much of today's instability.”

The author explains that, “Monetary nationalism is simply incompatible with globalization. It has always been, even if this has only become apparent since the 1970s, when all the world's governments rendered their currencies intrinsically worthless.” The author states that, “Since economic development outside the process of globalization is no longer possible, countries should abandon monetary nationalism. Governments should replace national currencies with the dollar or the euro or, in the case of Asia, collaborate to produce a new multinational currency over a comparably large and economically diversified area.” Essentially, according to the author, the solution lies in regional currencies.[5]

In October of 2008, “European Central Bank council member Ewald Nowotny said a ``tri-polar'' global currency system is developing between Asia, Europe and the U.S. and that he's skeptical the U.S. dollar's centrality can be revived.”[6]

The Union of South American Nations

The Union of South American Nations (UNASUR) was established on May 23, 2008, with the headquarters to be in Ecuador, the South American Parliament to be in Bolivia, and the Bank of the South to be in Venezuela. As the BBC reported, “The leaders of 12 South American nations have formed a regional body aimed at boosting economic and political integration in the region,” and that, “The Unasur members are Argentina, Bolivia, Brazil, Chile, Colombia, Ecuador, Guyana, Paraguay, Peru, Suriname, Uruguay and Venezuela.”[7]

The Union of South American Nations (UNASUR) was established on May 23, 2008, with the headquarters to be in Ecuador, the South American Parliament to be in Bolivia, and the Bank of the South to be in Venezuela. As the BBC reported, “The leaders of 12 South American nations have formed a regional body aimed at boosting economic and political integration in the region,” and that, “The Unasur members are Argentina, Bolivia, Brazil, Chile, Colombia, Ecuador, Guyana, Paraguay, Peru, Suriname, Uruguay and Venezuela.”[7]

The week following the announcement of the Union, it was reported that, “Brazilian President Luiz Inacio Lula da Silva said Monday that South American nations will seek a common currency as part of the region's integration efforts following the creation of the Union of South American Nations.” He was quoted as saying, “We are proceeding so as, in the future, we have a common central bank and a common currency.”[8]

The Gulf Cooperation Council and a Regional Currency

In 2005, the Gulf Cooperation Council (GCC), a regional trade bloc among Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates (UAE), announced the goal of creating a single common currency by 2010. It was reported that, “An economically united and efficient GCC is clearly a more interesting proposition for larger companies than each individual economy, especially given the impediments to trade evident within the region. This is why trade relations within the GCC have been a core focus of late.” Further, “The natural extension of this trend for increased integration is to introduce a common currency in order to further facilitate trade between the different countries.” It was announced that, “the region's central bankers had agreed to pursue monetary union in a similar fashion to the rules used in Europe.”[9]

In June of 2008, it was reported that, “Gulf Arab central bankers agreed to create the nucleus of a joint central bank next year in a major step forward for monetary union but signaled that a new common currency would not be in circulation by an agreed 2010 target.”[10] In 2002, it was announced that the “Gulf states say they are seeking advice from the European Central Bank on their monetary union programme.” In February of 2008, Oman announced that it would not be joining the monetary union. In November of 2008, it was announced that the “Final monetary union draft says Gulf central bank will be independent from governments of member states.”[11]

In March of 2009, it was reported that, “The GCC should not rush into forming a single currency as member states need to work out the framework for a regional central bank, Saudi Arabia's Central Bank Governor Muhammad Al Jasser.” Jasser was further quoted as saying, “It took the European Union 45 years to put together a single currency. We should not rush.” In 2008, with the global financial crisis, new problems were posed for the GCC initiative, as “Pressure mounted last year on the GCC members to drop their currency pegs as inflation accelerated above 10 per cent in five of the six countries. All of the member states except Kuwait peg their currencies to the dollar and tend to follow the US Federal Reserve when setting interest rates.”[12]

An Asian Monetary Union

In 1997, the Brookings Institution, a prominent American think tank, discussed the possibilities of an East Asian Monetary Union, stating that, “the question for the 21st century is whether analogous monetary blocs will form in East Asia (and, for that matter, in the Western Hemisphere). With the dollar, the yen, and the single European currency floating against one another, other small open economies will be tempted to link up to one of the three.” However, “the linkage will be possible only if accompanied by radical changes in institutional arrangements like those contemplated by the European Union. The spread of capital mobility and political democratization will make it prohibitively difficult to peg exchange rates unilaterally. Pegging will require international cooperation, and effective cooperation will require measures akin to monetary unification.”[13]

In 2001, Asia Times Online wrote an article discussing a speech given by economist Robert A. Mundell at Bangkok's Chulalongkorn University, at which he stated that, “[t]he "Asean plus three" (the 10 members of the Association of Southeast Asian Nations plus China, Japan, and Korea) ‘should look to the European Union as a model for closer integration of monetary policy, trade and eventually, currency integration'.”[14]

On May 6, 2005, the website of the Association of Southeast Asian Nations (ASEAN) announced that, “China, Japan, South Korea and the 10 members of the Association of Southeast Asian Nations (ASEAN) have agreed to expand their network of bilateral currency swaps into what could become a virtual Asian Monetary Fund,” and that, “[f]inance officials of the 13 nations, who met in the sidelines of the Asian Development Bank (ADB) annual conference in Istanbul, appeared determined to turn their various bilateral agreements into some sort of multilateral accord, although none of the officials would directly call it an Asian Monetary Fund.”[15]

In August of 2005, the San Francisco Federal Reserve Bank published a report on the prospects of an East Asian Monetary Union, stating that East Asia satisfies the criteria for joining a monetary union, however, it states that compared to the European initiative, “The implication is that achieving any monetary arrangement, including a common currency, is much more difficult in East Asia.” It further states that, “In Europe, a monetary union was achievable primarily because it was part of the larger process of political integration,” however, “There is no apparent desire for political integration in East Asia, partly because of the great differences among those countries in terms of political systems, culture, and shared history. As a result of their own particular histories, East Asian countries remain particularly jealous of their sovereignty.”

Another major problem, as presented by the San Francisco Fed, is that, “East Asian governments appear much more suspicious of strong supranational institutions,” and thus, “in East Asia, sovereignty concerns have left governments reluctant to delegate significant authority to supranational bodies, at least so far.” It explains that as opposed to the steps taken to create a monetary union in Europe, “no broad free trade agreements have been achieved among the largest countries in the region, Japan, Korea, Taiwan, and China.” Another problem is that, “East Asia does not appear to have an obvious candidate for an internal anchor currency for a cooperative exchange rate arrangement. Most successful new currencies have been started on the back of an existing currency, establishing confidence in its convertibility, thus linking the old with the new.”

The report concludes that, “exchange rate stabilization and monetary integration are unlikely in the near term. Nevertheless, East Asia is integrating through trade, even without an emphasis on formal trade liberalization agreements,” and that, “there is evidence of growing financial cooperation in the region, including the development of regional arrangements for providing liquidity during crises through bilateral foreign exchange swaps, regional economic surveillance discussions, and the development of regional bond markets.” Ultimately, “East Asia might also proceed along the same path [as Europe], first with loose agreements to stabilize currencies, followed later by tighter agreements, and culminating ultimately in adoption of a common anchor—and, after that, maybe an East Asia dollar.”[16]

In 2007, it was reported that, “Asia may need to establish its own monetary fund if it is to cope with future financial shocks similar to that which rocked the region 10 years ago,” and that, “Further Asian financial integration is the best antidote for Asian future financial crises.”[17]

In September of 2007, Forbes reported that, “An East Asian monetary union anchored by Japan is feasible but the region lacks the political will to do it, the Asian Development Bank said.” Pradumna Rana, an Asian Development Bank (ADB) economist, said that, “it appears feasible to establish a currency union in East Asia -- particularly among Indonesia, Japan, (South) Korea, Malaysia, Philippines, Singapore and Thailand,” and that, “The economic potential for monetary integration in Asia is strong, even though the political underpinnings of such an accord are not yet in place.” Further, “the real integration at the trade levels 'will actually reinforce the economic case for monetary union in Asia, in a similar way that real-sector integration did so in Europe,” and ultimately, “the road to an Asian monetary union could proceed on a 'multi-track, multi-speed' basis with a seamless Asian free trade area the goal on the trade side.”[18] In April of 2008, it was reported that, “ASEAN bank deputy governors and financial deputy ministers have met in Vietnam's central Da Nang city, discussing issues on the financial and monetary integration and cooperation in the region.”[19]

African Monetary Union

Currently, Africa has several different monetary union initiatives, as well as some existing monetary unions within the continent. One initiative is the “monetary union project of the Economic Community of West African States (ECOWAS),” which is a “regional group of 15 countries in West Africa.” Among the members are those of an already-existing monetary union in the region, the West African Economic and Monetary Union (WAEMU). The ECOWAS consists of Benin, Burkina Faso, Cote d'Ivoire, Guinea, Guinea Bissau, Mali, Niger, Senegal, Sierra Leone, Togo, Cape Verde, Liberia, Ghana, Gambia, and Nigeria.[20]

The African Union was founded in 2002, and is an intergovernmental organization consisting of 53 African states. In 2003, the Brookings Institution produced a paper on African economic integration. In it, the authors started by stating that, “Africa, like other regions of the world, is fixing its sights on creating a common currency. Already, there are projects for regional monetary unions, and the bidding process for an eventual African central bank is about to begin.” It states that, “A common currency was also an objective of the Organization for African Unity and the African Economic Community, the predecessors of the AU,” and further, that, “The 1991 Abuja Treaty establishing the African Economic Community outlines six stages for achieving a single monetary zone for Africa that were set to be completed by approximately 2028. In the early stages, regional cooperation and integration within Africa would be strengthened, and this could involve regional monetary unions. The final stage involves the establishment of the African Central Bank (ACB) and creation of a single African currency and an African Economic and Monetary Union.”

The paper further states that the African Central Bank (ACB) “would not be created until around 2020, [but] the bidding process for its location is likely to begin soon,” however, “there are plans for creating various regional monetary unions, which would presumably form building blocks for the single African central bank and currency.”[21]

In August of 2008, “Governors of African Central Banks convened in Kigali Serena Hotel to discuss issues concerning the creation of three African Union (AU) financial institutions,” following “the AU resolution to form the African Monetary Fund (AMF), African Central Bank (ACB) and the African Investment Bank (AIB).” The central bank governors “agreed that when established, the ACB would solely issue and manage Africa's single currency and monetary authority of the continent's economy.”[22]

On March 2, 2009, it was reported that, “The African Union will sign a memorandum of understanding this month with Nigeria on the establishment of a continental central bank,” and that, “The institution will be based in the Nigerian capital, Abuja, African Union Commissioner for Economic Affairs Maxwell Mkwezalamba told reporters.” Further, “As an intermediate step to the creation of the bank, the pan- African body will establish an African Monetary Institute within the next three years, he said at a meeting of African economists in the city,” and he was quoted as saying, “We have agreed to work with the Association of African Central Bank Governors to set up a joint technical committee to look into the preparation of a joint strategy.”[23]

The website for the Kenyan Ministry of Foreign Affairs reported that, “The African Union Commissioner for Economic Affairs Dr. Maxwell Mkwezalamba has expressed optimism for the adoption of a common currency for Africa,” and that the main theme discussed at the AU Commission meeting in Kenya was, “Towards the Creation of a Single African Currency: Review of the Creation of a Single African Currency: Which optimal Approach to be adopted to accelerate the creation of the unique continental currency.”[24]

A North American Monetary Union and the Amero

In January of 2008, I wrote an article documenting the moves toward the creation of a North American currency, likely under the name Amero. [See: Andrew G. Marshall, North-American Monetary Integration: Here Comes the Amero. Global Research: January 20, 2008 ] I will briefly outline the information presented in that article here.

In 1999, the Fraser Institute, a prominent and highly influential Canadian think tank, published a report written by Economics professor and former MP, Herbert Grubel, called, The Case for the Amero: The Economics and Politics of a North American Monetary Union. He wrote that, “The plan for a North American Monetary Union presented in this study is designed to include Canada, the United States, and Mexcio,” and a “North American Central Bank, like the European Central Bank, will have a constitution making it responsible only for the maintenance of price stability and not for full employment.”[25] He opined that, “sovereignty is not infinitely valuable. The merit of giving up some aspects of sovereignty should be determined by the gains brought by such a sacrifice,” and that, “It is important to note that in practice Canada has given up its economic sovereignty in many areas, the most important of which involve the World Trade Organization (formerly the GATT), the North American Free Trade Agreement,” as well as the International Monetary Fund and World Bank.[26]

Also in 1999, the C.D. Howe Institute, another of Canada's most prominent think tanks, produced a report titled, From Fixing to Monetary Union: Options for North American Currency Integration. In this document, it was written that, “The easiest way to broach the notion of a NAMU [North American Monetary Union] is to view it as the North American equivalent of the European Monetary Union (EMU) and, by extension, the euro.”[27] It further stated that the fact that “a NAMU would mean the end of sovereignty in Canadian monetary policy is clear. Most obviously, it would mean abandoning a made-in-Canada inflation rate for a US or NAMU inflation rate.”[28]

In May of 2007, Canada's then Governor of the Central Bank of Canada, David Dodge, said that, “North America could one day embrace a euro-style single currency,” and that, “Some proponents have dubbed the single North American currency the ‘amero'.” Answering questions following his speech, Dodge said that, “a single currency was ‘possible'.”[29]

In November of 2007, one of Canada's richest billionaires, Stephen Jarislowsky, also a member of the board of the C.D. Howe Institute, told a Canadian Parliamentary committee that, “Canada should replace its dollar with a North American currency, or peg it to the U.S. greenback, to avoid the exchange rate shifts the loonie has experienced,” and that, “I think we have to really seriously start thinking of the model of a continental currency just like Europe.”[30]

In November of 2007, one of Canada's richest billionaires, Stephen Jarislowsky, also a member of the board of the C.D. Howe Institute, told a Canadian Parliamentary committee that, “Canada should replace its dollar with a North American currency, or peg it to the U.S. greenback, to avoid the exchange rate shifts the loonie has experienced,” and that, “I think we have to really seriously start thinking of the model of a continental currency just like Europe.”[30]

Former Mexican President Vicente Fox, while appearing on Larry King Live in 2007, was asked a question regarding the possibility of a common currency for Latin America, to which he responded by saying, “Long term, very long term. What we propose together, President Bush and myself, it's ALCA, which is a trade union for all of the Americas. And everything was running fluently until Hugo Chavez came. He decided to isolate himself. He decided to combat the idea and destroy the idea.” Larry King then asked, “It's going to be like the euro dollar, you mean?” to which Fox responded, “Well, that would be long, long term. I think the processes to go, first step into is trading agreement. And then further on, a new vision, like we are trying to do with NAFTA.”[31]

In January of 2008, Herbert Grubel, the author who coined the term “amero” for the Fraser Institute report, wrote an article for the Financial Post, in which he recommends fixing the Canadian loonie to the US dollar at a fixed exchange rate, but that there are inherent problems with having the US Federal Reserve thus control Canadian interest rates. He then wrote that, “there is a solution to this lack of credibility. In Europe, it came through the creation of the euro and formal end of the ability of national central banks to set interest rates. The analogous creation of the amero is not possible without the unlikely co-operation of the United States. This leaves the credibility issue to be solved by the unilateral adoption of a currency board, which would ensure that international payments imbalances automatically lead to changes in Canada's money supply and interest rates until the imbalances are ended, all without any actions by the Bank of Canada or influence by politicians. It would be desirable to create simultaneously the currency board and a New Canadian Dollar valued at par with the U.S. dollar. With longer-run competitiveness assured at US90¢ to the U.S. dollar.”[32]

In January of 2009, an online publication of the Wall Street Journal, called Market Watch, discussed the possibility of hyperinflation of the United States dollar, and then stated, regarding the possibility of an amero, “On its face, while difficult to imagine, it makes intuitive sense. The ability to combine Canadian natural resources, American ingenuity and cheap Mexican labor would allow North America to compete better on a global stage.” The author further states that, “If forward policy attempts to induce more debt rather than allowing savings and obligations to align, we must respect the potential for a system shock. We may need to let a two-tier currency gain traction if the dollar meaningfully debases from current levels,” and that, “If this dynamic plays out -- and I've got no insight that it will -- the global balance of powers would fragment into four primary regions: North America, Europe, Asia and the Middle East. In such a scenario, ramifications would manifest through social unrest and geopolitical conflict.”[33]

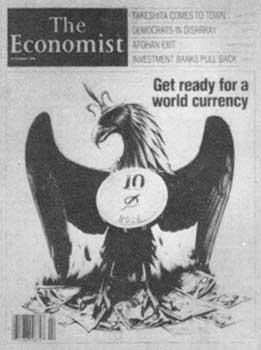

A Global Currency - The Phoenix

In 1988, The Economist ran an article titled, Get Ready for the Phoenix, in which they wrote, “THIRTY years from now, Americans, Japanese, Europeans, and people in many other rich countries and some relatively poor ones will probably be paying for their shopping with the same currency. Prices will be quoted not in dollars, yen or D-marks but in, let's say, the phoenix. The phoenix will be favoured by companies and shoppers because it will be more convenient than today's national currencies, which by then will seem a quaint cause of much disruption to economic life in the late twentieth century.”

The article stated that, “The market crash [of 1987] taught [governments] that the pretence of policy cooperation can be worse than nothing, and that until real co-operation is feasible (ie, until governments surrender some economic sovereignty) further attempts to peg currencies will flounder.” Amazingly the article states that, “Several more big exchange-rate upsets, a few more stockmarket crashes and probably a slump or two will be needed before politicians are willing to face squarely up to that choice. This points to a muddled sequence of emergency followed by patch-up followed by emergency, stretching out far beyond 2018-except for two things. As time passes, the damage caused by currency instability is gradually going to mount; and the very trends that will make it mount are making the utopia of monetary union feasible.”

Further, the article stated that, “The phoenix zone would impose tight constraints on national governments. There would be no such thing, for instance, as a national monetary policy. The world phoenix supply would be fixed by a new central bank, descended perhaps from the IMF. The world inflation rate-and hence, within narrow margins, each national inflation rate-would be in its charge. Each country could use taxes and public spending to offset temporary falls in demand, but it would have to borrow rather than print money to finance its budget deficit.” The author admits that, “This means a big loss of economic sovereignty, but the trends that make the phoenix so appealing are taking that sovereignty away in any case. Even in a world of more-or-less floating exchange rates, individual governments have seen their policy independence checked by an unfriendly outside world.”

The article concludes in stating that, “The phoenix would probably start as a cocktail of national currencies, just as the Special Drawing Right is today. In time, though, its value against national currencies would cease to matter, because people would choose it for its convenience and the stability of its purchasing power.” The last sentence states, “Pencil in the phoenix for around 2018, and welcome it when it comes.”[34]

Recommendations for a Global Currency

In 1998, the IMF Survey discussed a speech given by James Tobin, a prominent American economist, in which he argued that, “A single global currency might offer a viable alternative to the floating rate.” He further stated that, “there was still a great need” for “lenders of last resort.”[35]

In 1998, the IMF Survey discussed a speech given by James Tobin, a prominent American economist, in which he argued that, “A single global currency might offer a viable alternative to the floating rate.” He further stated that, “there was still a great need” for “lenders of last resort.”[35]

In 1999, economist Judy Shelton addressed the US House of Representatives Committee on Banking and Financial Services. In her testimony, she stated that, “The continued expansion of free trade, the increased integration of financial markets and the advent of electronic commerce are all working to bring about the need for an international monetary standard---a global unit of account.” She further explained that, “Regional currency unions seem to be the next step in the evolution toward some kind of global monetary order. Europe has already adopted a single currency. Asia may organize into a regional currency bloc to offer protection against speculative assaults on the individual currencies of weaker nations. Numerous countries in Latin America are considering various monetary arrangements to insulate them from financial contagion and avoid the economic consequences of devaluation. An important question is whether this process of monetary evolution will be intelligently directed or whether it will simply be driven by events. In my opinion, political leadership can play a decisive role in helping to build a more orderly, rational monetary system than the current free-for-all approach to exchange rate relations.”

She further stated that, “As we have seen in Europe, the sequence of development is (1) you build a common market, and (2) you establish a common currency. Indeed, until you have a common currency, you don't truly have an efficient common market.” She concludes by stating, “Ideally, every nation should stand willing to convert its currency at a fixed rate into a universal reserve asset. That would automatically create a global monetary union based on a common unit of account. The alternative path to a stable monetary order is to forge a common currency anchored to an asset of intrinsic value. While the current momentum for dollarization should be encouraged, especially for Mexico and Canada, in the end the stability of the global monetary order should not rest on any single nation.”[36]

Paul Volcker, former Governor of the Federal Reserve Board, stated in 2000, that, “If we are to have a truly global economy, a single world currency makes sense.” In a speech delivered by a member of the Executive Board of the European Central Bank, it was stated that Paul Volcker “might be right, and we might one day have a single world currency. Maybe European integration, in the same way as any other regional integration, could be seen as a step towards the ideal situation of a fully integrated world. If and when this world will see the light of day is impossible to say. However, what I can say is that this vision seems as impossible now to most of us as a European monetary union seemed 50 years ago, when the process of European integration started.”[37]

In 2000, the IMF held an international conference and published a brief report titled, One World, One Currency: Destination or Delusion?, in which it was stated that, “As perceptions grow that the world is gradually segmenting into a few regional currency blocs, the logical extension of such a trend also emerges as a theoretical possibility: a single world currency. If so many countries see benefits from currency integration, would a world currency not maximize these benefits?”

It outlines how, “The dollar bloc, already underpinned by the strength of the U.S. economy, has been extended further by dollarization and regional free trade pacts. The euro bloc represents an economic union that is intended to become a full political union likely to expand into Central and Eastern Europe. A yen bloc may emerge from current proposals for Asian monetary cooperation. A currency union may emerge among Mercosur members in Latin America, a geographical currency zone already exists around the South African rand, and a merger of the Australian and New Zealand dollars is a perennial topic in Oceania.”

The summary states that, “The same commercial efficiencies, economies of scale, and physical imperatives that drive regional currencies together also presumably exist on the next level—the global scale.” Further, it reported that, “The smaller and more vulnerable economies of the world—those that the international community is now trying hardest to help—would have most to gain from the certainty and stability that would accompany a single world currency.”[38] Keep in mind, this document was produced by the IMF, and so its recommendations for what it says would likely “help” the smaller and more vulnerable countries of the world, should be taken with a grain – or bucket – of salt.

Economist Robert A. Mundell has long called for a global currency. On his website, he states that the creation of a global currency is “a project that would restore a needed coherence to the international monetary system, give the International Monetary Fund a function that would help it to promote stability, and be a catalyst for international harmony.” He states that, “The benefits from a world currency would be enormous. Prices all over the world would be denominated in the same unit and would be kept equal in different parts of the world to the extent that the law of one price was allowed to work itself out. Apart from tariffs and controls, trade between countries would be as easy as it is between states of the United States.”[39]

Renewed Calls for a Global Currency

On March 16, 2009, Russia suggested that, “the G20 summit in London in April should start establishing a system of managing the process of globalization and consider the possibility of creating a supra-national reserve currency or a ‘super-reserve currency'.” Russia called for “the creation of a supra-national reserve currency that will be issued by international financial institutions,” and that, “It looks expedient to reconsider the role of the IMF in that process and also to determine the possibility and need for taking measures that would allow for the SDRs (Special Drawing Rights) to become a super-reserve currency recognized by the world community.”[40]

On March 23, 2009, it was reported that China's central bank “proposed replacing the US dollar as the international reserve currency with a new global system controlled by the International Monetary Fund.” The goal would be for the world reserve currency that is “disconnected from individual nations and is able to remain stable in the long run, thus removing the inherent deficiencies caused by using credit-based national currencies.” The chief China economist for HSBC stated that, “This is a clear sign that China, as the largest holder of US dollar financial assets, is concerned about the potential inflationary risk of the US Federal Reserve printing money.” The Governor of the People's Bank of China, the central bank, “suggested expanding the role of special drawing rights, which were introduced by the IMF in 1969 to support the Bretton Woods fixed exchange rate regime but became less relevant once that collapsed in the 1970s.” Currently, “the value of SDRs is based on a basket of four currencies – the US dollar, yen, euro and sterling – and they are used largely as a unit of account by the IMF and some other international organizations.”

However, “China's proposal would expand the basket of currencies forming the basis of SDR valuation to all major economies and set up a settlement system between SDRs and other currencies so they could be used in international trade and financial transactions. Countries would entrust a portion of their SDR reserves to the IMF to manage collectively on their behalf and SDRs would gradually replace existing reserve currencies.”[41]

On March 25, Timothy Geithner, Treasury Secretary and former President of the New York Federal Reserve, spoke at the Council on Foreign Relations, when asked a question about his thoughts on the Chinese proposal for the global reserve currency, Geithner replied that, “I haven't read the governor's proposal. He's a remarkably -- a very thoughtful, very careful, distinguished central banker. Generally find him sensible on every issue. But as I understand his proposal, it's a proposal designed to increase the use of the IMF's special drawing rights. And we're actually quite open to that suggestion . But you should think of it as rather evolutionary, building on the current architectures, than -- rather than -- rather than moving us to global monetary union [Emphasis added].”[42]

In late March, it was reported that, “A United Nations panel of economists has proposed a new global currency reserve that would take over the US dollar-based system used for decades by international banks,” and that, “An independently administered reserve currency could operate without conflicts posed by the US dollar and keep commodity prices more stable.”[43]

A recent article in the Economic Times stated that, “The world is not yet ready for an international reserve currency, but is ready to begin the process of shifting to such a currency. Otherwise, it would remain too vulnerable to the hegemonic nation,” as in, the United States.[44] Another article in the Economic Times started by proclaiming that, “the world certainly needs an international currency.” Further, the article stated that, “With an unwillingness to accept dollars and the absence of an alternative, international payments system can go into a freeze beyond the control of monetary authorities leading the world economy into a Great Depression,” and that, “In order to avoid such a calamity, the international community should immediately revive the idea of the Substitution Account mooted in 1971, under which official holders of dollars can deposit their unwanted dollars in a special account in the IMF with the values of deposits denominated in an international currency such as the SDR of the IMF.”[45]

Amidst fears of a falling dollar as a result of the increased open discussion of a new global currency, it was reported that, “The dollar's role as a reserve currency won't be threatened by a nine-fold expansion in the International Monetary Fund's unit of account, according to UBS AG, ING Groep NV and Citigroup Inc.” This was reported following the recent G20 meeting, at which, “Group of 20 leaders yesterday gave approval for the agency to raise $250 billion by issuing Special Drawing Rights, or SDRs, the artificial currency that the IMF uses to settle accounts among its member nations. It also agreed to put another $500 billion into the IMF's war chest.”[46] In other words, the large global financial institutions came to the rhetorical rescue of the dollar, so as not to precipitate a crisis in its current standing, so that they can continue with quietly forming a new global currency.

Creating a World Central Bank

In 1998, Jeffrey Garten wrote an article for the New York Times advocating a “global Fed.” Garten was former Dean of the Yale School of Management, former Undersecretary of Commerce for International Trade in the Clinton administration, previously served on the White House Council on International Economic Policy under the Nixon administration and on the policy planning staffs of Secretaries of State Henry Kissinger and Cyrus Vance of the Ford and Carter administrations, former Managing Director at Lehman Brothers, and is a member of the Council on Foreign Relations. In his article written in 1998, he stated that, “over time the United States set up crucial central institutions -- the Securities and Exchange Commission (1933), the Federal Deposit Insurance Corporation (1934) and, most important, the Federal Reserve (1913). In so doing, America became a managed national economy. These organizations were created to make capitalism work, to prevent destructive business cycles and to moderate the harsh, invisible hand of Adam Smith.”

He then explained that, “This is what now must occur on a global scale. The world needs an institution that has a hand on the economic rudder when the seas become stormy. It needs a global central bank.” He explains that, “Simply trying to coordinate the world's powerful central banks -- the Fed and the new European Central Bank, for instance -- wouldn't work,” and that, “Effective collaboration among finance ministries and treasuries is also unlikely to materialize. These agencies are responsible to elected legislatures, and politics in the industrial countries is more preoccupied with internal events than with international stability.”

He then postulates that, “An independent central bank with responsibility for maintaining global financial stability is the only way out. No one else can do what is needed: inject more money into the system to spur growth, reduce the sky-high debts of emerging markets, and oversee the operations of shaky financial institutions. A global central bank could provide more money to the world economy when it is rapidly losing steam.” Further, “Such a bank would play an oversight role for banks and other financial institutions everywhere, providing some uniform standards for prudent lending in places like China and Mexico. [However, t]he regulation need not be heavy-handed.” Garten continues, “There are two ways a global central bank could be financed. It could have lines of credit from all central banks, drawing on them in bad times and repaying when the markets turn up. Alternately -- and admittedly more difficult to carry out -- it could be financed by a very modest tariff on all trade, collected at the point of importation, or by a tax on certain global financial transactions.”

Interestingly, Garten states that, “One thing that would not be acceptable would be for the bank to be at the mercy of short-term-oriented legislatures.” In essence, it is not to be accountable to the people of the world. So, he asks the question, “To whom would a global central bank be accountable? It would have too much power to be governed only by technocrats, although it must be led by the best of them. One possibility would be to link the new bank to an enlarged Group of Seven -- perhaps a ''G-15'' [or in today's context, the G20] that would include the G-7 plus rotating members like Mexico, Brazil, South Africa, Poland, India, China and South Korea.” He further states that, “There would have to be very close collaboration” between the global bank and the Fed, and that, “The global bank would not operate within the United States, and it would not be able to override the decisions of our central bank. But it could supply the missing international ingredient -- emergency financing for cash-starved emerging markets. It wouldn't affect American mortgage rates, but it could help the profitability of American multinational companies by creating a healthier global environment for their businesses.”[47]

In September of 2008, Jeffrey Garten wrote an article for the Financial Times in which he stated that, “Even if the US's massive financial rescue operation succeeds, it should be followed by something even more far-reaching – the establishment of a Global Monetary Authority to oversee markets that have become borderless.” He emphasized the “need for a new Global Monetary Authority. It would set the tone for capital markets in a way that would not be viscerally opposed to a strong public oversight function with rules for intervention, and would return to capital formation the goal of economic growth and development rather than trading for its own sake.”

Further, the “GMA would be a reinsurer or discounter for certain obligations held by central banks. It would scrutinise the regulatory activities of national authorities with more teeth than the IMF has and oversee the implementation of a limited number of global regulations. It would monitor global risks and establish an effective early warning system with more clout to sound alarms than the BIS has.” Moreover, “The biggest global financial companies would have to register with the GMA and be subject to its monitoring, or be blacklisted. That includes commercial companies and banks, but also sovereign wealth funds, gigantic hedge funds and private equity firms.” He recommends that its board “include central bankers not just from the US, UK, the eurozone and Japan, but also China, Saudi Arabia and Brazil. It would be financed by mandatory contributions from every capable country and from insurance-type premiums from global financial companies – publicly listed, government owned, and privately held alike.”[48]

In October of 2008, it was reported that Morgan Stanley CEO John Mack stated that, “it may take continued international coordination to fully unlock the credit markets and resolve the financial crisis, perhaps even by forming a new global body to oversee the process.”[49]

In late October of 2008, Jeffrey Garten wrote an article for Newsweek in which he stated that, “leaders should begin laying the groundwork for establishing a global central bank.” He explained that, “There was a time when the U.S. Federal Reserve played this role [as governing financial authority of the world], as the prime financial institution of the world's most powerful economy, overseeing the one global currency. But with the growth of capital markets, the rise of currencies like the euro and the emergence of powerful players such as China, the shift of wealth to Asia and the Persian Gulf and, of course, the deep-seated problems in the American economy itself, the Fed no longer has the capability to lead single-handedly.”

He explains the criteria and operations of a world central bank, saying that, “It could be the lead regulator of big global financial institutions, such as Citigroup or Deutsche Bank, whose activities spill across borders,” as well as “act as a bankruptcy court when big global banks that operate in multiple countries need to be restructured. It could oversee not just the big commercial banks, such as Mitsubishi UFJ, but also the "alternative" financial system that has developed in recent years, consisting of hedge funds, private-equity groups and sovereign wealth funds—all of which are now substantially unregulated.” Further, it “could have influence over key exchange rates, and might lead a new monetary conference to realign the dollar and the yuan, for example, for one of its first missions would be to deal with the great financial imbalances that hang like a sword over the world economy.”

He further postulates that, “A global central bank would not eliminate the need for the Federal Reserve or other national central banks, which will still have frontline responsibility for sound regulatory policies and monetary stability in their respective countries. But it would have heavy influence over them when it comes to following policies that are compatible with global growth and financial stability. For example, it would work with key countries to better coordinate national stimulus programs when the world enters a recession, as is happening now, so that the cumulative impact of the various national efforts do not so dramatically overshoot that they plant the seeds for a crisis of global inflation. This is a big threat as government spending everywhere goes into overdrive.”[50]

In January of 2009, it was reported that, “one clear solution to avoid a repeat of the problems would be the establishment of a "global central bank" – with the IMF and World Bank being unable to prevent the financial meltdown.” Dr. William Overholt, senior research fellow at Harvard's Kennedy School, formerly with the Rand Institute, gave a speech in Dubai in which he said that, “To avoid another crisis, we need an ability to manage global liquidity. Theoretically that could be achieved through some kind of global central bank, or through the creation of a global currency, or through global acceptance of a set of rules with sanctions and a dispute settlement mechanism.”[51]

Guillermo Calvo, Professor of Economics, International and Public Affairs at Columbia University wrote an article for VOX in late March of 2009. Calvo is the former Chief Economist of the Inter-American Development Bank, and is currently a Research Associate at the National Bureau of Economic Research (NBER) and President of the International Economic Association and the former Senior Advisor in the Research Department of the IMF.

He wrote that, “Credit availability is not ensured by stricter financial regulation. In fact, it can be counterproductive unless it is accompanied by the establishment of a lender of last resort (LOLR) that radically softens the severity of financial crisis by providing timely credit lines. With that aim in mind, the 20th century saw the creation of national or regional central banks in charge of a subset of the capital market. It has now become apparent that the realm of existing central banks is very limited and the world has no institution that fulfils the necessary global role. The IMF is moving in that direction, but it is still too small and too limited to adequately do so.”

He advocates that, “the first proposal that I would like to make is that the topic of financial regulation should be discussed together with the issue of a global lender of last resort.” Further, he proposed that, “international financial institutions must be quickly endowed with considerably more firepower to help emerging economies through the deleveraging period.”[52]

A “New World Order” in Banking

In March of 2008, following the collapse of Bear Stearns, Reuters reported on a document released by research firm CreditSights, which said that, “Financial firms face a ‘new world order',” and that, “More industry consolidation and acquisitions may follow after JPMorgan Chase & Co.” Further, “In the event of future consolidation, potential acquirers identified by CreditSights include JPMorganChase, Wells Fargo, US Bancorp, Goldman Sachs and Bank of America.”[53]

In June of 2008, before he was Treasury Secretary in the Obama administration, Timothy Geithner, as head of the New York Federal Reserve, wrote an article for the Financial Times following his attendance at the 2008 Bilderberg conference, in which he wrote that, “Banks and investment banks whose health is crucial to the global financial system should operate under a unified regulatory framework,” and he said that, “the US Federal Reserve should play a "central role" in the new regulatory framework, working closely with supervisors in the US and around the world.”[54]

In November of 2008, The National, a prominent United Arab Emirate newspaper, reported on Baron David de Rothschild accompanying Prime Minister Gordon Brown on a visit to the Middle East, although not as a “part of the official party” accompanying Brown. Following an interview with the Baron, it was reported that, “Rothschild shares most people's view that there is a new world order. In his opinion, banks will deleverage and there will be a new form of global governance.”[55]

In February of 2009, the Times Online reported that a “New world order in banking [is] necessary,” and that, “It is increasingly evident that the world needs a new banking system and that it should not bear much resemblance to the one that has failed so spectacularly.”[56] But of course, the ones that are shaping this new banking system are the champions of the previous banking system. The solutions that will follow are simply the extensions of the current system, only sped up through the necessity posed by the current crisis.

An Emerging Global Government

Andrew G. Marshall is a Research Associate of the Centre for Research on Globalization (CRG). He is currently studying Political Economy and History at Simon Fraser University.

Andrew G. Marshall is a frequent contributor to Global Research. Global Research Articles by Andrew G. Marshall© Copyright Andrew G. Marshall, Global Research, 2009

Disclaimer: The views expressed in this article are the sole responsibility of the author and do not necessarily reflect those of the Centre for Research on Globalization. The contents of this article are of sole responsibility of the author(s). The Centre for Research on Globalization will not be responsible or liable for any inaccurate or incorrect statements contained in this article.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.