Postive Divergence a NON-Confirmation of Secular Stocks Bear Market

Stock-Markets / Dow Theory Apr 09, 2009 - 03:01 AM GMTBy: Submissions

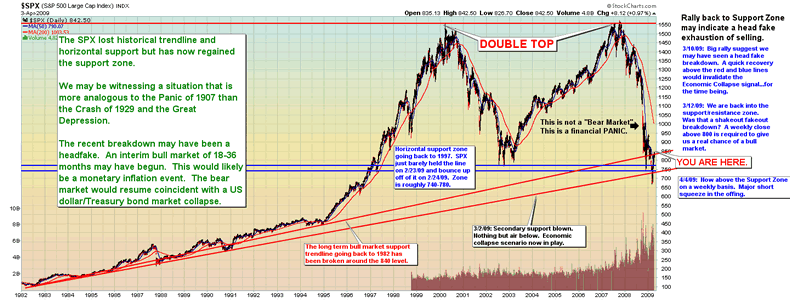

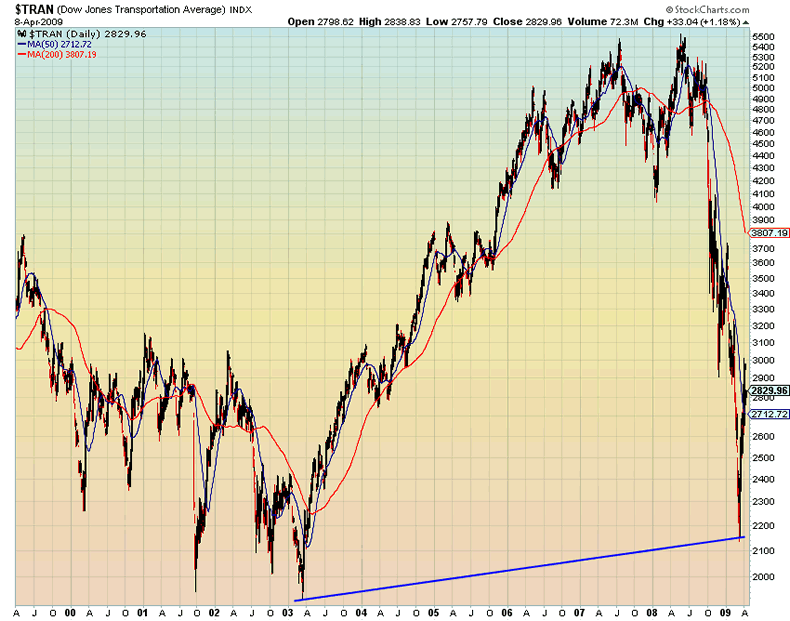

Steven Vincent writes: The DJTA did not confirm the DJIA move below 2002 lows.Much has been written about the Dow Theory confirmation of a continuation of a perceived Secular Bear Market. When the Dow Transports Index violated its November '08 lows it is held to have confirmed the INDU's move to new bear market low and thus validated the hypothesis that the markets had entered a Secular Bear Market and that the existing downtrend would continue.

Steven Vincent writes: The DJTA did not confirm the DJIA move below 2002 lows.Much has been written about the Dow Theory confirmation of a continuation of a perceived Secular Bear Market. When the Dow Transports Index violated its November '08 lows it is held to have confirmed the INDU's move to new bear market low and thus validated the hypothesis that the markets had entered a Secular Bear Market and that the existing downtrend would continue.

Bears have had that analysis called into question as both indices have regained their November '08 low and more.

I believe this apparent signal failure can be explained by examining a longer term NON-confirmation between the INDU and the DJTA. Simply, the Dow made a marginally lower low in comparison to its 2003 bear market low and the Transports did not. It would seem that the longer term bullish non-confirmation has trumped the shorter term bearish confirmation. It's also worth noting that both indices bested their prior highs subsequent to the 2003 bear market bottom yet that bullish confirmation did not establish a sustainable bull trend.

Dow Theory analysts contend that the longer term time frame does not negate the near term Dow Theory signal. Nonetheless. this is a Positive Divergence and a NON-Confirmation of a Secular Bear Market placing the recent move in the category of a Financial Panic similar to the Panic of 1907. We technically remain in a Secular Bull Market (although just barely) and the next bull move (underway) would be either part of an ongoing Secular Bull Market distribution top of Grand Super Cycle proportions OR the end of the Cyclical Bear Market that began in 2000 and the resumption of the Secular Bull Market. It’s also worth noting that similarly, the Nasdaq did not confirm the breakdown below the 2003 lows.

Please see the charts:

My current market stance is bullish until SPX 1000 or its 200 DMA on the upside OR SPX 790 on the downside, whichever comes first.

You can follow my charts and semi-daily updates here: http://stockcharts.com/def/servlet/Favorites.CServlet?obj=ID3279450

Steven Vincent

“End the Fed! Sound Money for America”

© 2009 Copyright Steven Vincent - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.