U.S. Dollar Continues to Top

Currencies / Forex Trading Apr 16, 2009 - 08:33 AM GMTBy: ForexPros

The USD held minor gains against some pairs today but ended the day mixed as cross-spreaders took gains off the table and put the majors into near-term S/R; traders note that stops in range and US data today contributed to intraday volatility but by the end of the day the majors held key S/R putting the Greenback back on the defense through the end of the week.

The USD held minor gains against some pairs today but ended the day mixed as cross-spreaders took gains off the table and put the majors into near-term S/R; traders note that stops in range and US data today contributed to intraday volatility but by the end of the day the majors held key S/R putting the Greenback back on the defense through the end of the week.

GBP rallied overnight to a high print at 1.5039 before profit-taking and aggressive sellers broke the rate back to the mid-1.4900 handle; the rate is holding firm around the 1.4960 area after regaining the 1.5000 handle several times during the day but upside resistance and sellers in the Sterling crosses kept the rate off the highs.

EURO flirted with the 100 day MA for most of the session making lows into support where official bids were seen into the low prints at 1.3146 before rebounding back to the 1.3230 area but was unable to hold the 1.3200 handle giving the bears something to work with. The 100 day MA comes in at 1.3192 and the rate will likely close around that level by end of day leaving both sides with ammunition for their side.

USD/JPY rallied on aggressive buying off the European lows of 98.14 back to the 99.00 handle; high prints at 99.67 never traded twice leaving the bulls on the defense as the rate dropped back under the 99.00 handle during the day. The release of the US Fed’s Beige Book gave a slight lift to the rate as post-release highs of 99.30 traded briefly but the rate is firm back around the 99.15 area into the end of day.

Traders note that cross-spreaders appear active in the Yen crosses but the move is more corrective suggesting that the bounce may be short-lived as the Japanese remain heavily long Yen putting the pressure on the rate.

USD/CHF rallied to a high print at 1.1490 but respected the 100 day MA and fell back under the 1.1440/50 area during the day but is closing firm at 1.1450 area suggesting that a test of the 1.1500/20 area is due but in my view the rate is simply testing upside resistance and will fail by the end of the week as the USD continues to correct.

USD/CAD made lows after the news today heading into stops around the 1.2060 area for a low print at 1.2012 making the rate the weakest on the board today; traders note that stops are likely lurking in substantial size under the 1.1980 area and with a close under the 1.2080 area likely today the rate will certainly drag the rest of the complex lower by the week’s end.

In my view, the Greenback is continuing to top and aggressive smart-money is working the short side after turning neutral earlier in the month. Late USD buyers will likely have enough firepower to lift the USD into resistance again but you can expect a drop after the move. Look for the Majors to continue in two-way trade overnight with the USD failing to hold gains into the end of week.

GBP/USD Daily

Resistance 3: 1.5120/30

Resistance 2: 1.5080

Resistance 1: 1.5020/30

Latest New York: 1.4975

Support 1: 1.4580

Support 2: 1.4550

Support 3: 1.4520

Comments

Rate continues higher after gains to start Monday, tests the psychological 1.5000 area in early New York and finds stops above; failure to close above the 1.5000 area today likely signals a pullback is coming. Retracement overnight holds support at 1.4800 area suggesting the rate will find buyers on a dip to 1.4800. Rate is holding the 100 day MA nicely and aggressive traders can look to buy dips. Pullback being bought by large names traders say. Traders note support is likely firm at the 1.4650 area now; pullbacks likely to be bought. Close over 1.4900 argues for further gains but tech resistance is firm ahead of 1.5000. Overhead target of the 1.5000 area likely to trade again but expect pressure. Traders feel the 23-year lows will likely remain secure. The shorts have lost control of the market above the 1.4440 area now; traders report stops in-range adding for two-way action.

Data due Thursday: All times EASTERN (-5 GMT)

NONE

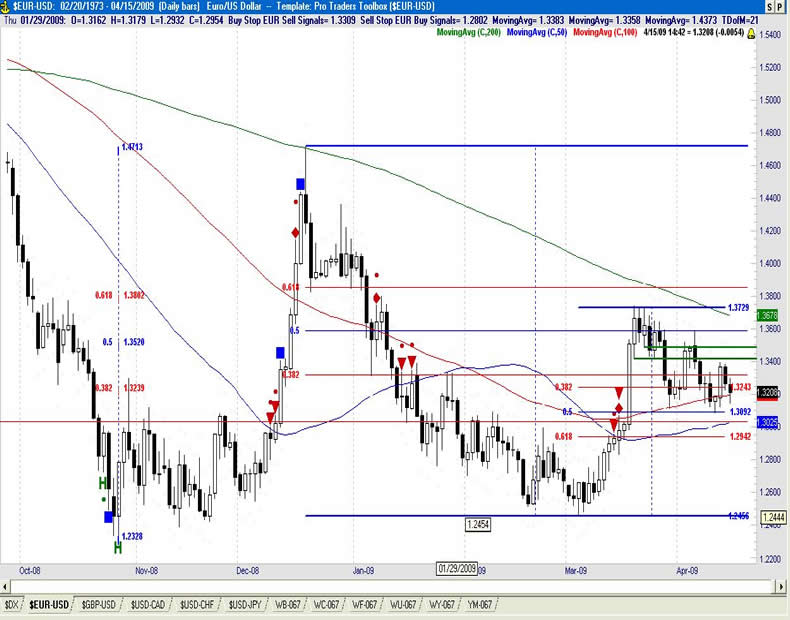

EURO/USD Daily

Resistance 3: 1.3380

Resistance 2: 1.3330

Resistance 1: 1.3290

Latest New York: 1.3207

Support 1: 1.3150

Support 2: 1.3120/30

Support 3: 1.3100

Comments

Rate has two-way overnight, holds support on a dip to 1.3150 area and rallies above 100 day MA. Bids said to be thicker; failure to extend higher with GBP a caution to the bulls. Traders note good sellers above the market but they may be late as traders note protective stops building again above the 1.3300/30 area. Traders report sovereign interest on the dip. Rate appears solid above the 100 day MA. Foothold over the 1.3500 handle needed to extend to the upside. Rate likely has stops building in both directions; overhead resistance at 1.3330/50 area back in play as initial support expected in that area fails. Long-term bulls are likely still in control of the market and this significant pullback is a buying opportunity in my view. Looking to buy this week again if 100 day MA continues to hold.

Data due Thursday: All times EASTERN (-5 GMT)

5:00am EUR CPI y/y

5:00am EUR Core CPI y/y

5:00am EUR Industrial Production m/m

11:00pm EUR ECB President Trichet Speaks

Analysis by: http://www.Forexpros.com - Written by Jason Alan Jankovsky

Forexpros offers the most definitive Forex portal on the web. It contains industry leading market analysis, up-to-the minute news and advanced trading

tools which provides brokers, traders and everyone involved in the financial market with an all-round guide to Forex.

Copyright © 2009 by ForexPros.com All rights reserved.

Disclaimer: Trading Futures and Options on Futures and Cash Forex transactions involves substantial risk of loss and may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

ForexPros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.