Another Late Rally Lifts Stock Market Indices

Stock-Markets / Financial Markets 2009 Apr 17, 2009 - 06:06 AM GMTBy: PaddyPowerTrader

It seemed like déjà vu for the markets yesterday. They had a slow choppy start before a late rally resulted in more healthy gains. Traders yet again shrugged off concerns about the economy and instead bet that crucial earnings reports will impress. Consumer discretionary stocks staged the best advance with tech stocks not far behind. Will indices do it again heading into the weekend?

It seemed like déjà vu for the markets yesterday. They had a slow choppy start before a late rally resulted in more healthy gains. Traders yet again shrugged off concerns about the economy and instead bet that crucial earnings reports will impress. Consumer discretionary stocks staged the best advance with tech stocks not far behind. Will indices do it again heading into the weekend?

Today’s Market Moving Stories

- The Euro took another hit overnight after ECB President Jean-Claude Trichet said he appreciated US comments that a strong dollar was in its interests. He also said that the ECB would do what was necessary to restore confidence in the global economy. They would decide on non-standard policy steps in May, but that it was important not to create expectations. EURUSD traded as low as 1.3065 during Asian trade as the downward trend continues.

- British Trade and Investment Minister Mervyn Davies said that he is not worried about a further slide in Sterling, saying that a weak currency will help drive the British economy out of recession. They are going to need a bit for help as the OECD thinks that the UK economy will contract by 3.7% this year while the IMF thinks it will suffer an even worse 3.8% decline.

- Federal Reserve Bank of San Francisco President Janet Yellen signalled that it was a mistake to allow Lehman Brothers to collapse, saying the firm was “too big to fail” and its bankruptcy caused a “quantum” jump in the magnitude of the financial crisis.

- Economic data continues to be poor as US housing construction unexpectedly plunged in March and the number of people receiving jobless benefits grew. But those reports also included some silver linings suggesting the recession may be easing. The pace of new-home construction seems to be nearing a bottom and first-time jobless benefit claims fell more than expected for the second straight week.

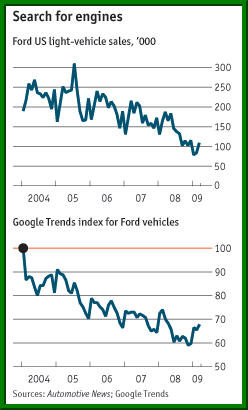

Googling As A New Leading Indicator

Here’s a strange economic indicator, but as the strongly correlated graph on the right suggests, it could be a good one. Hal Varian, a professor of economics at the University of California, believes that data on internet searches can help predict certain kinds of economic statistics before they become available. He argues that fluctuations in the frequency with which people search for certain words or phrases online can improve the accuracy of the models used to predict, for example, retail-sales figures or house sales. He uses Google Trends to test this and the correlation between searches for Ford vehicles and Ford’s actual vehicle sales suggests that he may be onto a winner. However Mr Varian does have a vested interest in finding such correlations as he is also Google’s chief economist!

Here’s a strange economic indicator, but as the strongly correlated graph on the right suggests, it could be a good one. Hal Varian, a professor of economics at the University of California, believes that data on internet searches can help predict certain kinds of economic statistics before they become available. He argues that fluctuations in the frequency with which people search for certain words or phrases online can improve the accuracy of the models used to predict, for example, retail-sales figures or house sales. He uses Google Trends to test this and the correlation between searches for Ford vehicles and Ford’s actual vehicle sales suggests that he may be onto a winner. However Mr Varian does have a vested interest in finding such correlations as he is also Google’s chief economist!

Equities

- Google reported first quarter earnings of $5.16 per share, which was about $0.23 better than the analyst consensus of $4.93. This was due to strong cost cutting measures. Will this mean that they won’t pamper their rapidly expanding work force as much going forward. Revenue was slightly below expectations, rising 10.1% yoy to $4.07bn. The shares are expected to open about 1% down when the US gets going at 14:30.

- Biogen reported EPS of $1.05 after hours. Élan traders would have been watching the Tysabri revenue figure which came in at $165 million, below the $188.3 million consensus. However, Biogen did give a relatively positive outlook. Their shares were off about 1.7% in afterhours and Élan have opened up in Dublin about 0.5% down.

- Irish Nationwide released their 2008 results showing an after tax loss of €243 million, heavily impacted by a loan loss provision of €464 million. They’ve admitted that their ability to raise funding “on a continuing basis” is dependant on the State bank guarantee. Not good news and it’s weighing down the other Irish banking heavies, AIB and Bank of Ireland, this morning.

- Sony Ericsson swung to a net loss of €293 million in the first quarter of 2009. Last year, the firm posted a profit of €133 million. They expect the global handset market to contract by at least 10% in 2009.

- Southwest Airlines and Ryanair are very similar companies – after all, Michael O’Leary did copy the American company’s business model when he took over. Anyway, Southwest reported disappointing Q1 results yesterday and their shares dropped over 10%. They’re down 60% since last September alone. In contrast Ryanair are up nearly 50% since last September. The fortunes of the US economy has been quite a good leading indicator for the European economy in the past couple of years. If this continues to hold true for the airline industry, then Ryanair could be under pressure in the months ahead.

- JPMorgan Chase beat Wall Street expectations with its first-quarter earnings and issued forceful statements about its confidence in its own strength, saying that they would like to repay the bailout money from the government “as soon as possible.” Net income was $2.1bn, 40 cents a share.

- Less than a year after Toyota overtook General Motors to nab the top spot, Volkswagen may pass Toyota as the world’s top selling automaker in the first quarter. With Germans snapping up subsidised cars, Volkswagen has seen robust demand in its main markets, while its Japanese rival suffered sharp declines.

Economic And Earnings Today

The major economic release today is the preliminary University of Michigan consumer sentiment survey for April 14:55. The expectation is for a slight improvement in the figure to 58.5 from 57.3 in March.

Before US open today, Citigroup reports its first quarter results, and is expected to post a loss of $0.34 per share unlike other major financial institutions that have reported profits. General Electric is also slated to release its first quarter results before the open. Earnings per share is expected to drop roughly 50% to $0.21 per share, with its financial business expected to show weakness.

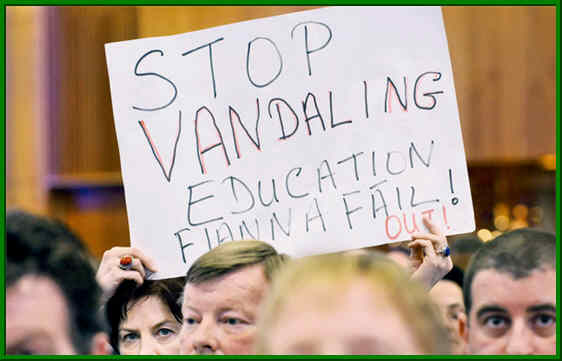

And Finally… Idiot Teacher Vandaling Her Own Career

She should count her lucky stars that she even has a job. If I was the boss, and she was protesting against me, showing that level of incompetence, I would have her fired instantly!

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.

© 2009 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.