Gold is Setting the Stage for Another Flat Summer

Commodities / Gold & Silver May 19, 2007 - 10:54 AM GMTBy: Donald_W_Dony

Though Gold remains in a stable long-term up trend, there is some weakness building over the 2-3 weeks. Is this the beginning of another flat summer season? Technical evidence seems to be pointing in that direction.

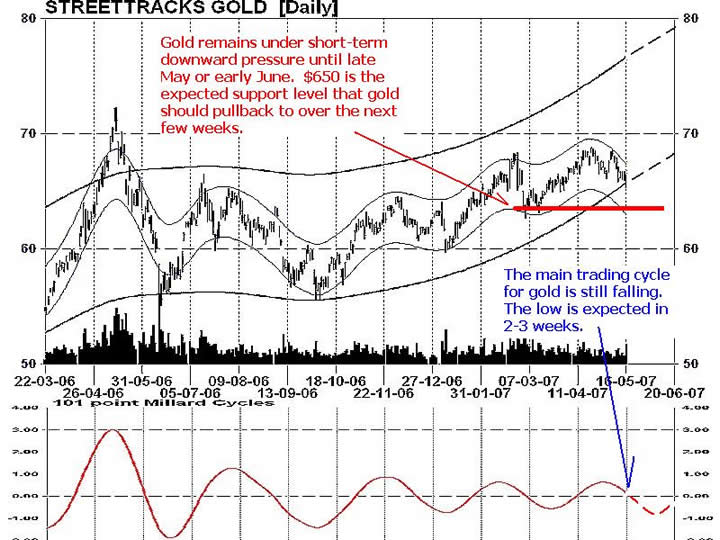

Gold has been trading since mid-2006 in a series of gradual ladder steps upward. Each major low has progressed higher or at least equal to the last step. This is the normal pattern for a developing up trend. In the case of the last low in early March 2007 (see Chart 1)

CHART1

Gold has rallied up from $650 to just under $700 and now is rolling over back to the starting point of about $650 again. This coming low is expected to arrive within the next 2-3 weeks. As gold trades in an approximate 14-week cycle, this precious metal should begin advancing by mid-June and reaching another low point by late August or early September. However, summer is historically not a strong period for the yellow metal. 4 out of 5 times gold lingers and trades flat during the hottest months of the year and does not begin to shine again until late in the 3rd quarter. This is largely due to traders being on holidays and the lull before the up coming demand in jewellery for the Indian wedding season.

CHART 2

Golds longer-term secular rise remains intact. In Chart 2, the precious metal continues to trade over the important 65-week moving average. This line has represented the separation of a bull and bear for gold for several decades. Currently the upward sloping line rests at $625. This indicates that gold can drop down to this level and still be advancing in a bull market. It also suggests that by year end, this forecasting line will reach $725. As gold usually trades $20-$50 over this moving average in the 4th quarter, the precious metal could hit $750-$775 by December if the current trend continues.

CHART3

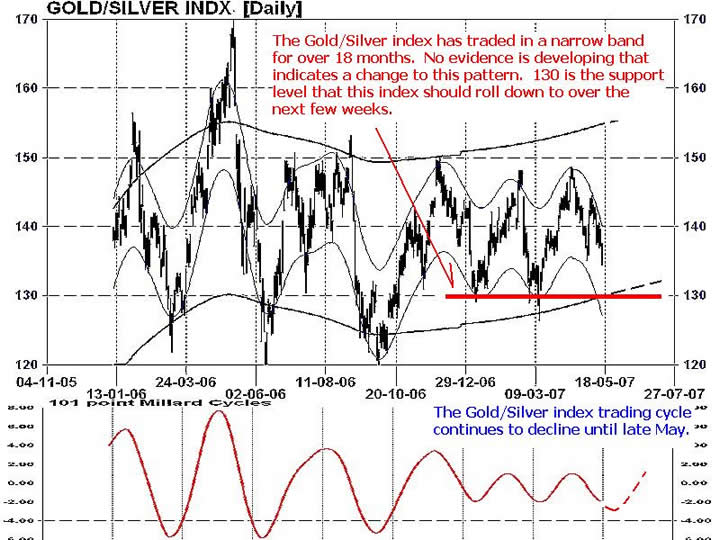

Even with the slow increase in the spot price of the yellow metal, gold stocks have languished in a sleepy trading band for over 18 months. Chart 3 illustrates that only briefly during the 2nd quarter of 2006 was the Philadelphia Gold/Silver Index capable of venturing beyond the solid resistance level of 155 before falling back into the band. Technical evidence suggests a change in this current formation is unlikely for the next few months.

CHART4

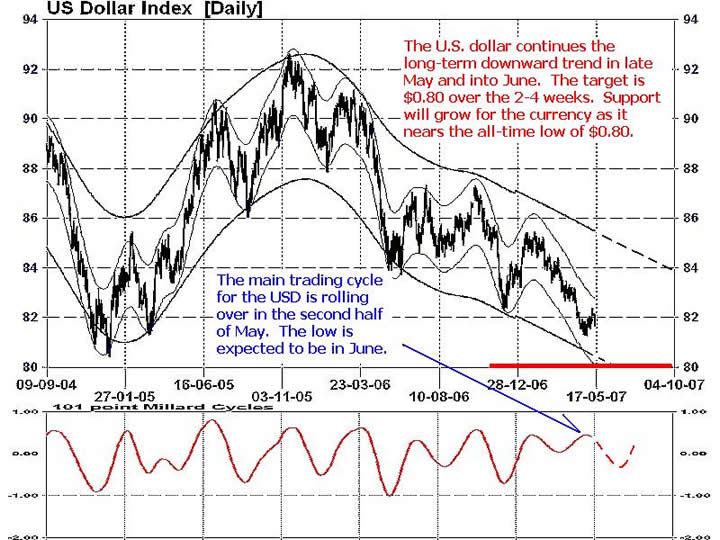

The short-term trading action of the U.S. dollar is a slight wildcard for gold at present levels. As the fundamentally bleak currency slowly descends down to the $0.80 level over the next 2-4 weeks, growing buying support can be expected. The dollar has never dropped below this critical line-in-the-sand and resistance to break this barrier could be remarkable. With the U.S. dollar and gold normally trending in opposite directions, potential propping of the weak greenback can stall golds upward movement considerably.

MY CONCLUSION: The anticipated weakness in gold over the next few weeks is part of the on going interplay between the U.S. dollar and yellow metal. Important support is developing for the dollar as it nears $0.80 which can cap the precious metals growth in the short-term. Gold and silver stocks are displaying uninspiring performance in spite of a slowly ascending precious metals market. Expected stubborn resistance from the descending dollar will likely pin golds growth over the next few months until September.

More information is in the May newsletter of the Technical Speculator.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2007 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.