Gold and HUI Gold Stocks Hit Resistance, Risk of Pullback

Commodities / Gold & Silver 2009 May 28, 2009 - 02:21 AM GMTBy: Chris_Vermeulen

Gold stocks have been performing well but I cannot help but notice that the gold sector has reached a major resistance levels on the monthly chart. As much as I would like gold stocks to continue higher we must be ready for a pullback.

Gold stocks have been performing well but I cannot help but notice that the gold sector has reached a major resistance levels on the monthly chart. As much as I would like gold stocks to continue higher we must be ready for a pullback.

I have moved my stops higher to lock in profits from the recent rally in price. If the price breaks down from here I will be sitting in cash having made a decent profit, and I waiting for the next low risk entry point buy or short gold.

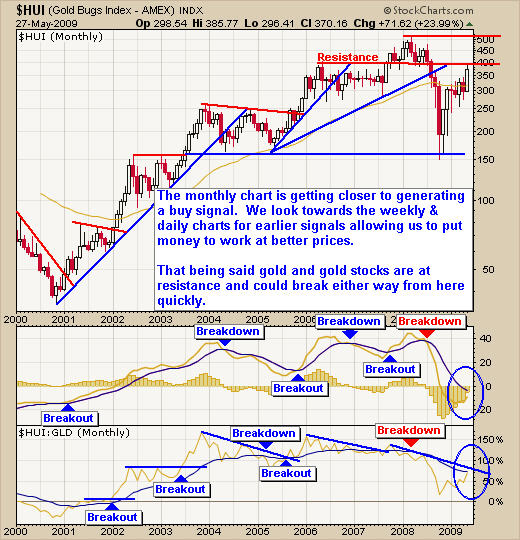

Gold Bugs Index – Monthly Chart

You can see clearly that we are at a resistance level in the monthly time frame. Two things happen at resistance levels. The price eventually breaks though and surges higher or eventually drops like a rock. This is the reason why I am pointing this out. I want everyone to be ready for a quick movement. Either to watch your longs increase in value or to lock in profits if the price breaks down from here. The daily chart helps more with entry and exit points but it’s important to remember that the monthly chart is at resistance which holds a lot of power.

Gold Bugs Daily Chart – Gold Stocks

Gold stocks have been channeling for several months and last week they broke to the upside. As you can see from the chart below the index opened down at the support trend line and rallied to close much higher on Wednesday.

This is a bullish candle but not the type of candle I wanted to see. What I like to see on a bounce off support is a close above the previous days high. This signals there is power behind the move. Today’s price action was good but not the best. We want to see sideways or upward movement within a couple days for this trend to continue higher.

The US Dollar

The US dollar chart looks like a roller coaster over the past 9 months. Currencies now move and trade like stocks/commodities, its crazy.

This chart shows a solid head and shoulder pattern indicating prices could drop as low as 76 within the next couple months. The head & shoulders pattern has proved to be very accurate especially with currencies. We will most likely see some type of bounce at this current level but overall the trend is down.

The falling dollar will help boost the price of gold in US dollars which could give gold and gold stocks that nudge through the current resistance levels.

Active Trading Conclusion:

Gold and gold stocks have been moving higher and many of us are long positions surrounding this commodity. I can feel the pressure building in the market with fear of inflation, and the overall economy. Something is going to happen quickly here with gold and the US dollar.

Remember to raise and place your exit orders to lock in current profits on any type of pullback/breakdown.

Hello, I'm Chris Vermeulen founder of TheGoldAndOilGuy and NOW is YOUR Opportunity to start trading GOLD, SILVER & OIL for BIG PROFITS. Let me help you get started.

If you would like more information on my trading model or to receive my Free Weekly Trading Reports - Click Here

I have put together a Recession Special package for yearly subscribers which is if you join for a year ($299) I will send you $300 FREE in gas, merchandise or grocery vouchers FREE which work with all gas stations, all grocery stores and over 100 different retail outlets in USA & Canada.

If you have any questions please feel free to send me an email. My passion is to help others and for us all to make money together with little down side risk.

To Your Financial Success,

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.