United States Destined to Become the Great Britain of the 21st Century?

Economics / US Economy Jun 04, 2009 - 12:55 PM GMTBy: James_Quinn

WHO ARE THOSE GUYS - Sheriff Ray Bledsoe: [to Butch and Sundance] You should have let yourself get killed a long time ago when you had the chance. See, you may be the biggest thing that ever hit this area, but you're still two-bit outlaws. I never met a soul more affable than you, Butch, or faster than the Kid, but you're still nothing but two-bit outlaws on the dodge. It's over, don't you get that? Your times is over and you're gonna die bloody, and all you can do is choose where.

WHO ARE THOSE GUYS - Sheriff Ray Bledsoe: [to Butch and Sundance] You should have let yourself get killed a long time ago when you had the chance. See, you may be the biggest thing that ever hit this area, but you're still two-bit outlaws. I never met a soul more affable than you, Butch, or faster than the Kid, but you're still nothing but two-bit outlaws on the dodge. It's over, don't you get that? Your times is over and you're gonna die bloody, and all you can do is choose where.

Do you ever get the feeling that we are being pursued by someone who wants to kill us? No matter what we do, they are still in pursuit. They never let up. We’ve tried deception, trickery, and frantic escapes. Now we have climbed a steep mountain and are cornered in a canyon with our pursuers above and a river below. We don’t have many choices. We could give up, we can fight and die, or jump and hope to live another day. Our pursuers are not going to surrender. They are going to keep pursuing us until we’re caught or dead.

Do you ever get the feeling that we are being pursued by someone who wants to kill us? No matter what we do, they are still in pursuit. They never let up. We’ve tried deception, trickery, and frantic escapes. Now we have climbed a steep mountain and are cornered in a canyon with our pursuers above and a river below. We don’t have many choices. We could give up, we can fight and die, or jump and hope to live another day. Our pursuers are not going to surrender. They are going to keep pursuing us until we’re caught or dead.

Butch Cassidy: Well, the way I figure it, we can either fight or give. If we give, we go to jail.

Sundance Kid: I've been there already.

Butch Cassidy: We could fight - they'll stay right where they are and starve us out. Or go for position, shoot us. Might even get a rock slide started, get us that way. What else can they do?

Sundance Kid: They could surrender to us, but I wouldn't count on that.

Butch Cassidy: Alright. I'll jump first.

Sundance Kid: No.

Butch Cassidy: Then you jump first.

Sundance Kid: No, I said.

Butch Cassidy: What's the matter with you?

Sundance Kid: I can't swim.

Butch Cassidy: Are you crazy? The fall will probably kill you.

Sundance Kid: Oh, shit...

The United States once had a Western frontier spirit. No challenge was too daunting. We were the pursuers, Great Britain was the pursued. We were a young nation with a rural population anxious to move to the big city and make their fortune. With fertility rates exceeding 6 births per woman for the 1st half of the 1800’s, a population explosion took place in the U.S. Fertility rates declined steadily, but still stayed above 4 for most of the 1800’s. The youthful nation created the Industrial Revolution, built thousands of miles of railroad tracks, created a financial banking system, became a manufacturing powerhouse, and adapted to an urban society. It wasn’t smooth progress, but it was relentless progress.

The United States once had a Western frontier spirit. No challenge was too daunting. We were the pursuers, Great Britain was the pursued. We were a young nation with a rural population anxious to move to the big city and make their fortune. With fertility rates exceeding 6 births per woman for the 1st half of the 1800’s, a population explosion took place in the U.S. Fertility rates declined steadily, but still stayed above 4 for most of the 1800’s. The youthful nation created the Industrial Revolution, built thousands of miles of railroad tracks, created a financial banking system, became a manufacturing powerhouse, and adapted to an urban society. It wasn’t smooth progress, but it was relentless progress.

A creative entrepreneurial spirit was unleashed with all its fury during the 1800’s in America. No problem was too big to solve. Mountains, rivers, oceans, wilderness, and darkness were just obstacles to a better tomorrow. Capitalism and the possibility of wealth and success drove many to create and innovate. The invention of the Cotton Gin revolutionized farming. The invention of the Steamboat revolutionized river travel. The creation of the steam locomotive and railways revolutionized land travel. The sewing machine revolutionized the textile industry. The telegraph and telephone revolutionized communication. The light bulb, electric motors, and diesel engine changed the world.

The invention of dynamite by Alfred Nobel in 1866 had a dramatic benefit in the operation of mines in the U.S. It also did a pretty good job helping outlaws open safes.

[Butch is robbing Woodcock's train for the second time]

Butch Cassidy: You can't want to get blown up again.

Woodcock: Butch, you know that if it were *my* money, there is nobody that I would rather have steal it than you. But, you see, I am still in the employment of E. H. Harriman, of Union Pacific Railroad.

Butch Cassidy: Well that ought to do it.

[after blowing the train car to smithereens]

Sundance Kid: Think ya used enough dynamite there, Butch?

The period from 1865 to 1901 is referred to as The Gilded Age, coined by Mark Twain in 1873. This period witnessed the establishment of a modern industrial economy. A national transportation and communication network was created, the corporation became the foremost form of business organization, and a managerial revolution transformed business operations. By the beginning of the twentieth century, per capita income and industrial production in the United States exceeded that of any other country except Britain. Long hours and hazardous working conditions led many workers to attempt to form labor unions despite strong opposition from industrialists and the courts. The businessmen created industrial towns and cities in the Northeastern U.S. with new factories, and contributed to the creation of an ethnically diverse industrial working class which produced the wealth owned by rising super-rich industrialists and financiers such as Cornelius Vanderbilt, John D. Rockefeller, Andrew Carnegie, and J.P. Morgan. Their critics called them robber barons, referring to their use of overpowering and sometimes unethical financial manipulations.

A confluence of demographic factors, the industrial revolution, and urbanization led the United States to become the greatest financial and manufacturing powerhouse in world history, eventually overtaking Great Britain in the early years of the 20th Century. We have retained this position into the 21st Century. Based on the current confluence of demographic trends, bad decisions by U.S. policymakers, the urbanization of the developing world, and the overreach that global empires always succumb to, the United States will not be the dominant world power at the end of the 21st Century. The likely successor will be China.

Demographics

The population of the United States literally exploded during the mid 1800’s. From 17 million inhabitants (2.5 million which were slaves) in 1840, the United States experienced a fivefold increase to 76 million citizens by 1900. This enormous increase occurred despite the loss of 600,000 men in the prime of life during the Civil War. Great Britain’s population doubled over this same time frame. With fertility rates between 4 and 7 children (versus 2 today) during the 1800’s, much of the growth was home grown. More than 80% of the population lived on farms in the early 1800’s as it was essential to have many children to work the farm. The fertility rates steadily declined as the country shifted from a rural society to an urban society.

During the Gilded Age approximately 10 million immigrants came to the United States, many in search of religious freedom and greater prosperity. This mammoth immigration from Europe and Asia sparked tension and anger among many in the U.S. The new immigrants came to urban America, where disease, overcrowding and crime festered. As a result, relations became openly hostile, with many Americans becoming anti-immigrant, fearing the customs, religion, and poverty of the new immigrants, considering them less desirable than old immigrants. In reality, these new immigrants were essential to the growth of the country. Between 1870 and 1880, 140,000 Chinese immigrants arrived in the U.S. with many working on the Transcontinental Railway project. Labor unions such as the American Federation of Labor strongly opposed the presence of Chinese labor, by reason of both economic competition and race. Congress banned further Chinese immigration through the Chinese Exclusion Act in 1882, which prohibited Chinese laborers from entering the United States. This racism is why every major city in the U.S. has a Chinatown.

U.S. POPULATION

The other huge demographic benefit that the U.S. had over Great Britain and Germany was its youth. In 1860, the median age of the U.S. population was 19.4 years old. The median age in England was 27 years old. With 50% of the U.S. population under the age of 20 from 1860 through 1880, there was an unlimited supply of labor to supercharge the engine of growth. The youthfulness of America led to a tremendous sense of vitality and optimism about the future. The percentage decrease in the 20 to 39 age group between 1860 and 1880 is a reflection of the youth wiped out by the Civil War. Despite this setback, the young Americans changed the world. The benefit of a youthful society is that failure and obstacles are brushed off. The reckless adventure of youth leads to discoveries, inventions and new ideas. The older a society gets the more cautious and set in their ways. The following chart paints a disturbing picture for America. In 1860 over 50% of the population was under 20 years old. By 2040 less than 26% of the population will be under 20 years old. With 20% of the population expected to be over 64 years old, the passion, reckless adventurism, and vitality will be in limited supply. Just the cost to support 80 million old folks will be crushing. Developing countries with young populations will be gaining on us.

Urbanization & Industrialization

The 2nd Industrial Revolution from 1850 until 1900 changed the face of America. In 1850, more than 80% of Americans lived on farms. By 1920, only 50% lived on farms. Today, only 20% of Americans live in rural areas. This shift resulted from technological progress. A six-fold increase in real wages made children more expensive in terms of forgone opportunities to work and increases in agricultural productivity reduced rural demand for labor, a substantial portion of which traditionally had been performed by children in farm families. The US rural population plummeted, as farmers were displaced by mechanization and forced to migrate to urban factory jobs. America’s westward expansion allowed over 400 million acres of new land to be put under cultivation between 1870 and 1910 while the number of Americans involved in farming dropped by one third.

New farming techniques and agricultural mechanization facilitated both processes. The reaper allowed farmers to quadruple their harvesting efficiency by replacing hand labor with a mechanical device. Manufacturing became the dominant industry after the Civil War. The world was taken by storm as the United States exited the Civil War with a 5% share of worldwide manufacturing output and expanded it to almost 20% by 1900. The market share was stolen from the United Kingdom and France.

The period between 1850 and 1900 was marked by the increasing concentration of people, political power, and economic activity in urban areas. In 1860, there were nine cities with populations over 100,000 and by 1910 there were fifty. These new large cities were laid inland along new railroad routes such as Denver, Chicago, and Cleveland. Industrialization and urbanization reinforced each other and urban areas became increasingly congested. As a result of unsanitary living conditions, diseases like cholera, dysentery, and typhoid fever struck urban areas with increasing frequency. Cities responded by paving streets, digging sewers, sanitizing water, constructing housing, and creating public transportation systems.

The completion of the Transcontinental Railroad in 1869 had the effect of stimulating a period of consolidation and technological standardization. It was during this time that railroad magnates such as Jay Gould and Cornelius Vanderbilt amassed vast power and fortunes from consolidation of smaller rail lines into national corporations. Between 1850 and 1890, over 120,000 miles of railroad were laid. This was a huge undertaking that required vision, brute strength, and the promise of potential riches if accomplished. Capitalism is not pretty, but has proven to generate wealth and progress better than any other system.

There was a lot of thinking, inventing, and creating going on in the U.S. during the late 1800’s.

Sundance Kid: You just keep thinkin' Butch. That's what you're good at.

Butch Cassidy: [to Sundance] Boy, I got vision, and the rest of the world wears bifocals.

Thomas Edison and Alexander Graham Bell transformed the country with the invention of the light bulb and the telephone between 1876 and 1880. Between 1882 and 1920 the number of generating plants in the US increased from one in downtown Manhattan to nearly 4,000. While the earliest generating plants were constructed in the immediate vicinity of consumers, plants generating electricity for long-distance transmissions were in place by 1900. Between 1877 and 1893 (the term of Bell's patent coverage) the number of phones leased by Bell's company increased from 3,000 to 260,000, although these were largely limited to businesses and government offices that could afford the relatively high rates. After the Bell patents expired, thousands of independent operators became incorporated and their competition for services to middle and low-class households as well as rural farmers drove prices down significantly. By 1920, there were 13 million phones in the United States providing service to 39 percent of all farm households and 34 percent of non-farm households.

The discovery of oil in western Pennsylvania in 1859 changed the course of America for the next century. Between 1880 and 1920, the amount of oil refined annually jumped from 26 million barrels to 442 million. The discovery of large oil fields in Texas, Oklahoma, Louisiana, and California in the early 20th century contributed greatly to these states' rapid industrialization. America became addicted and dependent on oil for heating, lighting, lubricating, and running cars, trucks, and machinery. This dependence on oil could ultimately contribute to the downfall of the U.S. economy.

Economic Growth

The 1800’s had the usual ups and downs economically. But, there were a few themes that dominated. GDP grew consistently, with a big spike in the 2nd half of the century. The 1800’s were also characterized by deflation. The U.S. was able to generate tremendous growth using virtually no government debt, except during the Civil War. The National Debt stood at $2.3 billion in 1872 and dropped to $1.7 billion by 1888. Lastly, the U.S. currency was rock steady because it was backed by gold. The National Currency Act of 1863 established the dollar as the national currency. The National Banking Acts of 1864 and 1865 created the infrastructure of our national banking system. In 1865 there were 1,643 banks in the U.S. By 1896 there were 11,500 banks operating in the U.S. Financial panics occurred when expansion and over-investment got out of hand in 1873 and 1893. They were violent and short.

The GDP per person grew moderately in the 1800’s as the population of the country exploded. As the Industrial Revolution progressed, GDP per Capita accelerated. The late 1800’s were a time of good deflation from excess supply, driven by new technology. The new inventions (light bulb, telephone), railroads and machines powered by oil created tremendous productivity and excess capacity. The economy grew an extraordinary 4% per year in real terms between 1870 and 1896, as wholesale prices fell 50%. Tremendous growth and progress were achieved while deflation reigned. The U.S. also learned that there can be economic benefits to war. The Spanish-American War began in 1898. The U.S. gained control of the former colonies of Spain in the Caribbean and Pacific. The war increased the business and earnings of American railroads, increased the output of American factories, and stimulated industry and commerce.

![[gdp.bmp]](/images/2009/June/us-economy-4_image010.jpg)

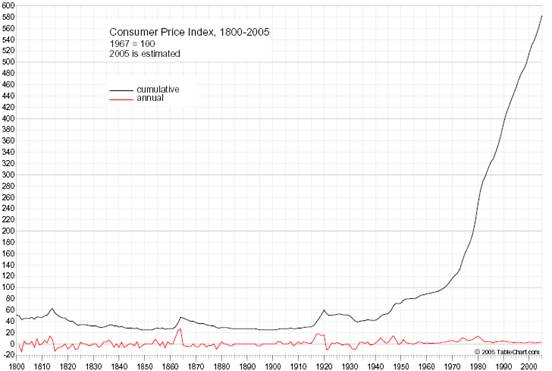

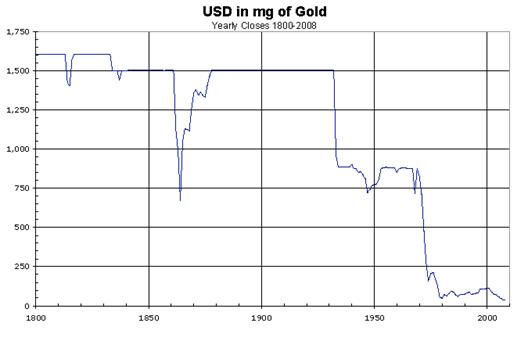

Data compiled by the Federal Reserve Bank of Minneapolis paints a fascinating picture about inflation. During the entire 100 years from 1800 to 1900, there was inflation in only 22 of those years. There was deflation during 39 of those years, and zero inflation in the other 39 years. Most of the inflation occurred during the War of 1812 and the Civil War. An item that cost you $100 in 1800 would have cost you $50 in 1900. It does appear that tremendous economic growth can be achieved without inflation. This has not been what has been preached since 1913. In the 98 years of the Federal Reserve’s existence, the United States has had 86 years of inflation and 12 years of deflation. The massive inflation has generated false growth in GDP, especially since Nixon closed the gold window in 1971.

The U.S. achieved phenomenal growth with no inflation and utilization of very little public debt. Except for the spike during the Civil War, political leaders kept a lid on government spending. All revenues were generated from excise taxes and tariffs. There was no personal or corporate income tax during the 1800’s except for a brief period during the Civil War. The U.S. entered the 19th Century with public debt at 10% of GDP and departed the 19th Century with public debt at 10% of GDP. Today, it stands at 80% of GDP and accelerating upwards. These low debt levels gave the U.S. a tremendous competitive advantage over the UK. With a vast global empire, the UK had public debt exceeding 250% of GDP in the early 1800’s and had to utilize considerable resources to paying that debt down throughout the 19th Century.

The U.S. dollar was stable during the entirety of the 1800’s, except during the brief inflationary period during the War of 1812 and the more dramatic inflationary period during the Civil War. The stability of the dollar was constant versus gold from 1870 until FDR seized all the gold in the country in the early 1930’s, when it collapsed by approximately 50%. Since Nixon closed the gold window in 1971, the dollar has collapsed another 47% versus gold. Stating that we have a strong dollar policy has been a bold faced lie.

The U.S. dollar was stable during the entirety of the 1800’s, except during the brief inflationary period during the War of 1812 and the more dramatic inflationary period during the Civil War. The stability of the dollar was constant versus gold from 1870 until FDR seized all the gold in the country in the early 1930’s, when it collapsed by approximately 50%. Since Nixon closed the gold window in 1971, the dollar has collapsed another 47% versus gold. Stating that we have a strong dollar policy has been a bold faced lie.

China Rising

The United States began its long trek to becoming a worldwide economic powerhouse during the 19th Century, leading to domination of the 20th Century. The dominant power at the start of the 19th Century was the United Kingdom. Today, they have the 6th highest GDP, just ahead of Italy. In 1970, U.S. GDP was $1 trillion and has risen to $14 trillion today. China’s GDP in 1970 was $92 billion. Today, it is $4.2 trillion a 4,450% increase in 28 years. China has been growing their GDP at an 8% to 10% pace for over a decade. They now have the 3rd largest economy in the world, and will pass Japan as the 2nd largest economy on the planet within the next 5 years. Sometime between 2030 and 2050, China will overtake the United States as the largest economy in the world.

The tremendous growth is being driven by the migration of millions of people from farms to the cities. By 2007, 594 million Chinese lived in urban areas. The United Nations has forecast that China's population will have about an equal number of people staying in the rural and urban areas by 2015. In the long term, nearly 70% of the population will live in urban areas by 2035. According to Professor Lu Dadao, president of the Geographical Society of China (GSC), China’s urbanization took 22 years to increase to 39.1% from 17.9%. It took Britain 120 years, the U.S., 80 years, and Japan more than 30 years to accomplish this.

This rapid urbanization will create huge infrastructure growth as more roads, sewers, houses, manufacturing plants, power plants, public transportation, and office buildings will need to be built. This trend is identical to the U.S. trend in the 1800’s. The urbanization has caused pollution, illness and congestion problems. These issues also occurred in the U.S. during the 1800’s. The efforts to solve these problems will create even more growth. The manufacturing of goods for America will slowly be replaced by production for its own internal demand. Eventually, China will not be as dependent on the U.S. for its economic existence.

The population of China is currently 1.3 billion, more than 4 times the size of the U.S. population. China’s population is not expected to grow much, if at all, between now and 2050. This is a dramatic difference from the U.S. in the 1800’s, as immigration and high birthrates drove the population upward. The birthrate in China of 1.7 is not high enough to even maintain its current population level over the long-term.

Most of the arguments that I hear regarding why China will not pass the U.S. economically relate to their aging population. After examining the current age distribution and the projected distribution between now and 2050, there is very little difference between the U.S. and China on a percentage basis. It is clear that young populations lead to more vitality, growth, and invention. As the chart below details, 20.1% of the Chinese population is under the age of 15. In the U.S., 21.4% of the population is under the age of 15. Now here is wear the rubber meets the road. Because China’s total population is 1.3 billion, 20.1% under 15 years old equals 267 million people. Their youth almost equals the United States’ entire population. The U.S. only has 60 million people under the age of 15.

By 2050 the U.S. demographic picture will only be slightly better than China’s on a percentage basis. In addition to the fact that China starts with a population 4 times the size of the U.S., they will benefit greatly from the shift from a rural society to an urban society. The U.S. already has 80% of its population living in non-rural areas. By 2050, China will likely reach a similar percentage. This means that approximately 600 million people will move from rural areas to urban areas in the next 40 years. This figure is mind boggling. In addition, the people moving are likely to be young. The old people will stay on their farms and subsist as they always have. The youthful urban population will drive progress and advancement.

The piece of the pie that is missed by many is the rapid education of China’s youth. In 1978 there were virtually no Chinese students enrolled in Post-graduate programs or studying abroad. Today, there are close to 1 million Chinese students in Post-graduate programs and in excess of 100,000 students studying abroad. One third of all the graduate students in U.S. Science and Engineering programs are not U.S. citizens. With 267 million children under the age of 15 combined with rapid urbanization and desire for advanced education, China is an economic juggernaut. There will be no denying them the economic crown by the middle of this century. It is inevitable.

The ascendance of China does not necessarily mean that the United States will descend. The United Kingdom entered the 1800’s with a tremendous amount of public debt. Through economic growth, fewer military conflicts, and control of spending, they were able to reduce their debt from 250% of GDP to 50% of GDP by 1900. The current U.S. economic position appears to be more dire than that of the UK in 1800. With total debt exceeding 350% of GDP, a global empire with troops stationed in 120 countries, two ongoing wars, a National Debt that will reach $14 trillion in the next two years, $56 trillion of unfunded future liabilities, and a rapidly aging populace, the ability for rapid economic growth is nil. We’ve lived above our means for decades and now we’re broke.

Butch Cassidy: Do you believe I'm broke already?

Etta Place: Why is there never any money, Butch?

Butch Cassidy: Well, I swear, Etta, I don't know. I've been working like a dog all my life and I can't get a penny ahead.

Etta Place: Sundance says it's because you're a soft touch, and always taking expensive vacations, and buying drinks for everyone, and you're a rotten gambler.

Butch Cassidy: Well that might have something to do with it.

The United States has a choice. We can follow the fiscal path planned out by Ben Cassidy and the Goldman Kid. Attempting to borrow, print money and spend like drunken outlaws will leave us an economy no better than Bolivia’s. We will die like dogs in a hail of gunfire in a two bit Bolivian town.

Butch Cassidy: Jeesh, all Bolivia can't look like this.

Sundance Kid: How do you know? This might be the garden spot of the whole country. People may travel hundreds of miles just to get to this spot where we're standing now. This might be the Atlantic City, New Jersey of all Bolivia for all you know.

I prefer the spirit that Butch Cassidy exhibited when he was challenged as the leader of the Hole in the Wall Gang. He didn’t surrender. He didn’t back down. He used his common sense and brains to win the fight.

Butch Cassidy: No, no, not yet. Not until me and Harvey get the rules straightened out.

Harvey Logan: Rules? In a knife fight? No rules.

[Butch immediately kicks Harvey in the groin]

Butch Cassidy: Well, if there aint' going to be any rules, let's get the fight started. Someone count. 1,2,3 go.

Sundance Kid: [quickly] 1,2,3, go.

[Butch knocks Harvey out]

Flat Nose Curry: I was really rooting for you, Butch.

Butch Cassidy: Well, thank you, Flatnose. That's what sustained me in my time of trouble.

Americans have a lot of fight left in them. If we go straight and kick our spending and debt habit we can push off the day of reckoning. If we continue on the reckless current fiscal path, the Chinese, among others, will catch and pass us before the middle of the century. Our standard of living will enter permanent decline and we will become the Great Britain of the 21st Century. The choice is ours. To discuss our future, join me at www.TheBurningPlatform.com.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2009 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

gift

20 May 10, 07:55 |

Economics

Economics matter more than ever in the 21 ST Century. |