Goldman Forecasts China Economy in the Ascendency

Economics / China Economy Jun 11, 2009 - 09:36 AM GMTBy: Richard_Shaw

Goldman Sachs now forecasts that the China economy will overtake the US as the world’s largest economy by 2027. Several emerging market countries are predicted by Goldman to overtake key developed market countries in the not too distant future.

Goldman Sachs now forecasts that the China economy will overtake the US as the world’s largest economy by 2027. Several emerging market countries are predicted by Goldman to overtake key developed market countries in the not too distant future.

They predict near term-growth for China at 8.3% in 2009 and 10.5% in 2010, compared to the world economy at -1.1% for 2009 and 3.3% for 2010.

Ranking countries by projected GDP for 2027, Goldman sees:

- China

- United States

- EU-5

- India

- Japan

- Germany

- Russia

- UK

- Brazil

- France

By 2050, Goldman sees this ranking:

- China

- United States

- India

- EU-5

- Brazil

- Russia

- UK

- Japan

- France

- Germany

The World Bank president says that China is the force that is stabilizing the world economy and may be the force to pull the world out of its slump, while acknowledging the fragile nature of the world situation and its vulnerability to new shocks.

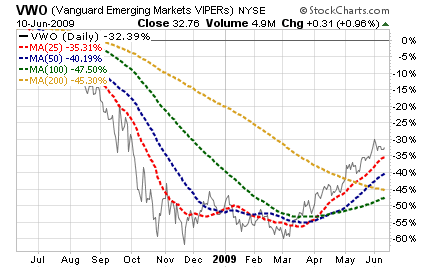

We have consistently suggested that investors consider higher emerging markets equity exposures than are typically recommended.

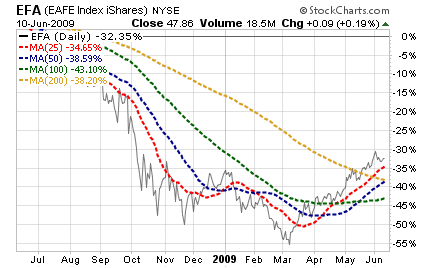

Generally, we suggest that wherever you are in the allocation spectrum between equities, bonds and other; that your equities portion thinking begin with a world market-cap mixture from which you deviate based on perceived opportunity and risk. We think the opportunities in emerging markets are greater than the opportunities in the US and EAFE countries, but with more volatility.

Consistent with the shift in the balance of economic power from developed toward emerging countries is the recent transfer of ownership of auto brands: Jaguar to an Indian company, Hummer to a Chinese company, Opel to a Canadian company with the help of equity from a Russian state controlled bank, and now Volvo being considered for purchase by a Chinese company.

Those auto changes are tangible examples and illustrations of continuing growth and financial power shift toward emerging countries — and of course, let’s not forget the central role China is playing in buying US massive Treasury issuance.

Once the lender to emerging markets, the US is now the borrower from them. Once the financial disciplinarian to emerging markets, the US is now the one being cautioned to show discipline itself by China, its banker.

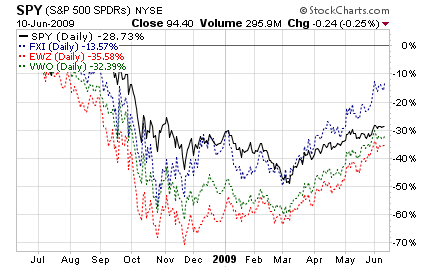

We own an emerging market basket (VWO), as well as China (FXI) and Brazil (EWZ) directly; and are overweight emerging markets within our equity allocation.

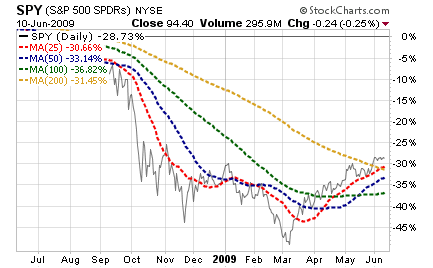

The emerging markets are closer to a bull condition than the US or other developed markets. Accordingly, they should be somewhat more fully invested in an intended ultimate allocation than the US or EAFE countries by those who are reinvesting in stages based on evolving trends.

The primary trend is still down for most major indexes, as well as for China, but we may be in the process of approaching a new up trend (which would be indicated by an upward slope to the 200-day moving average by the cautious and conservative) — then again the situation is far from certain.

We are not out of the woods yet, so there is still plenty that can go wrong. Keeping a sharp eye on developments, or better yet persistent trailing stop loss orders, is the prudent thing to do.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2009 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.