U.S. Congress Proposes Seling Crude Oil Reserves To Halt Price Increases

Commodities / Crude Oil Jun 21, 2009 - 01:55 AM GMTBy: Mike_Shedlock

Inquiring minds are investigating legislation that would sell US oil reserves in an attempt to bring down the price of gasoline. Can such a scheme possibly work?

Inquiring minds are investigating legislation that would sell US oil reserves in an attempt to bring down the price of gasoline. Can such a scheme possibly work?

Please consider US Reps File Bill To Tap SPR To Counter Oil Price Rise.

Several influential U.S. House Democrats have filed a bill that would require the government to tap the nation's Strategic Petroleum Reserve to counter rising oil prices.

Reps. Ed Markey, D-Mass., Chris Van Hollen, D-Md. and Peter Welch, D-Vt., said their legislation would direct the Department of Energy to sell 70 million barrels of more expensive light, sweet crude and replace it with cheaper heavy crude.

By mandating a release of oil into the market, legislators want to try and shake some speculators out of the market. Many lawmakers blame what they term " excessive" speculation in the market for skyrocketing crude prices, despite many economists citing the fundamentals of supply and demand as being the primary drivers.

The revenues brought in from the price differential in the swap would then go back into the SPR account to fill the reserve back up to its 727-million barrel capacity.Constant Price Theories

Hello guys, assuming you were selling reserves in enough quantity to matter (a mighty assumption indeed, as we shall see in a moment) the very act of demanding more sour crude while selling sweet crude would artificially suppress the price of sweet while artificially raising the price for the sour. Did this simple economic fact escape you?

Moreover, if and when the strategic reserves became all sour crude, what would you do then?

Oil Production and Consumption

Let's now address the issue of whether selling 70 million barrels of light crude would do anything at all and if so for how long.

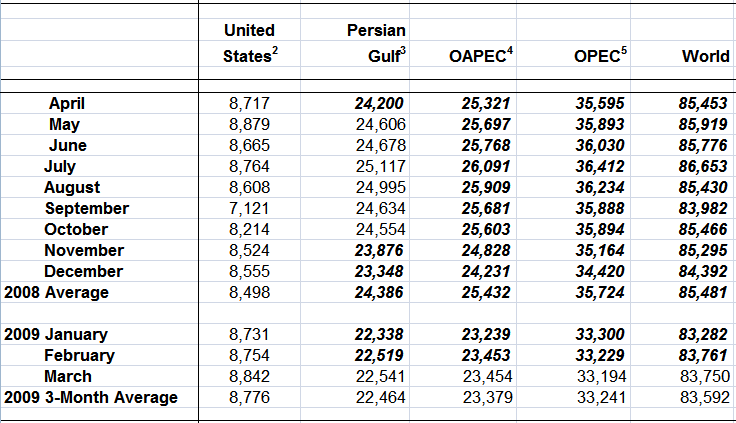

Production figures from the Department of Energy in thousands of barrels.

The above table is from the EIA - Energy Information Administration as of June 9, 2009. The chart shows the entire world's production was about 85 million barrels per day in 2008 and is roughly 84 million barrels per day now.

A Look at the Consumption Side

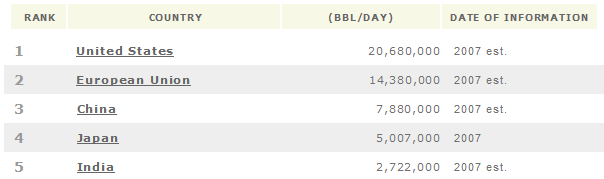

The CIA World Factbook shows the following consumption figures.

OECD Oil Consumption

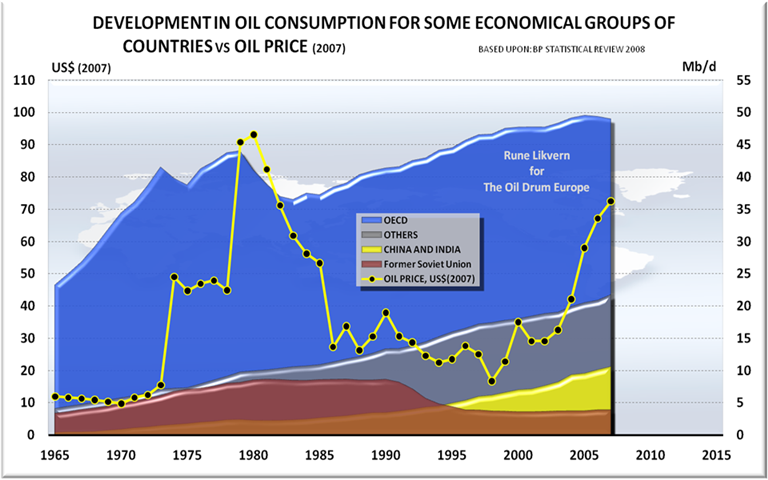

Inquiring minds are taking a look at a chart Rune Likvern posted on the Oil Drum addressing the question Has OECD oil consumption peaked?

The first thing to note is how the price of oil does not necessarily move in conjunction with consumption.

More importantly, the chart also shows total world consumption is about 85 million barrels a day (no surprise as consumption plus reserves should match production). The proposal to sell 70 million barrels is not even a single day's worth of global consumption! Even if Congress authorized a swap for the entire reserves, it would amount to a mere 9 days worth of global consumption.

Sweet vs. Sour

By the way, the price differential between sweet and sour crude which the fine Congressmen proposed would finance the scheme, averaged less than $1 in the first quarter of 2009 according to Alon USA .

The WTI/WTS crude oil differentials for the first quarter of 2009 decreased to $0.94 per barrel compared to $4.67 per barrel for the first quarter of 2008.

Yahoo Finance has the current WTS to WTI spread at -$2.34 (a premium of $2.34 for light crude). Excuse me for asking, but exactly how much per barrel would it cost to deplete the reserves of 70 million barrels of light crude and replace them with 70 million barrels of sour? Is the handling free of charge by magic genies?

Meaning of Strategic

Finally, the whole reason we have SPR is for national emergencies. The "S" in "SPR" stands for "Strategic". $70 oil is not even a hardship, let alone a strategic need.

Representatives Ed Markey of Massachusetts, Chris Van Hollen of Maryland, and Peter Welch of Vermont have proven they do not know a thing about oil consumption, the meaning of the word strategic, the price points of crude, or even general economic theory about pricing.

Their proposal to tap oil reserves is what happens when political hacks start writing bills on things they know nothing about, which in general is everything.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.