Gold Miner Fundamentals About to Improve

Commodities / Gold & Silver 2009 Jun 23, 2009 - 03:10 AM GMTBy: Adam_Brochert

The cost of mining real money (i.e. Gold) out of the ground is about to decrease relative to the cost of Gold (again). Fundamentals DO NOT immediately translate into stock price changes, but they lay the groundwork for stock prices to change at some point in the future. I am intermediate-term bearish on senior Gold mining stocks, but will be looking to buy more once I think the current correction is over. The fundamentals are about to become even more supportive than they are already.

The cost of mining real money (i.e. Gold) out of the ground is about to decrease relative to the cost of Gold (again). Fundamentals DO NOT immediately translate into stock price changes, but they lay the groundwork for stock prices to change at some point in the future. I am intermediate-term bearish on senior Gold mining stocks, but will be looking to buy more once I think the current correction is over. The fundamentals are about to become even more supportive than they are already.

To review, I am bullish on Gold miners because I believe we are in deflation, not inflation. Most people interested in Gold miners believe inflation and/or hyperinflation lurks, but Gold miners do better during deflation than inflation. Why is this true? Simple. Gold is money and cash holds up well during a deflation - this is why Gold is near its all-time highs. Commodities such as energy decline during deflation and this is why they are way down from their all times highs and about to drop further, while Gold is about to rise and re-challenge its all time highs. Commodities, along with labor and capital equipment, reflect the main variable costs for Gold mining firms.

When the price of Gold increases relative to the costs of mining Gold, Gold mining companies increase their profits. This is true whether the price of Gold is increasing, flat or even decreasing! Remember Wal-Mart if you don't understand how a firm can cut the cost of the good(s) it sells and still make higher profits (it can if it cuts costs faster than it decreases the price(s) of the good(s) it sells).

On the other hand, if the oil price (as an example) is increasing faster than the Gold price while both are going higher, Gold mining firms have a hard time making more money/increasing profits (e.g., spring and summer 2008). Certainly there are times in an inflationary environment that the price of Gold rises more rapidly than the price of other commodities, but rarely is this as predictable as during a deflationary environment.

For Gold miners, the easiest way to assess profitability is to divide the price of Gold by the costs of mining. When this ratio is increasing, Gold miner profitability for producing mines is increasing. A crude estimation of Gold miner profitability can be obtained by dividing the price of Gold by the price of a basket of commodities. Though many commodities are not needed to mine Gold, others are essential (e.g., energy).

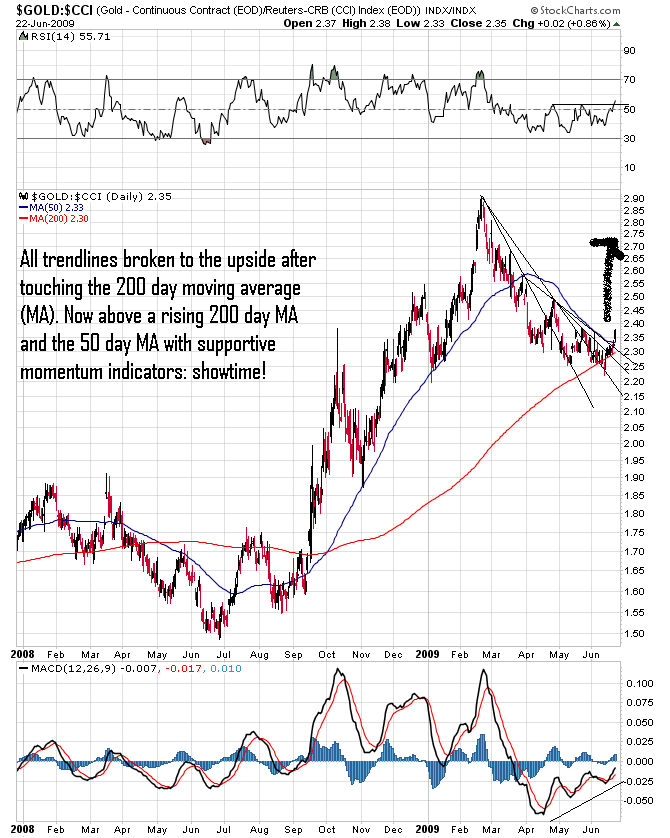

I use the Gold price divided by the Continuous Commodity Index ($CCI) to follow this ratio. Now, keep in mind that a change in fundamentals will eventually be followed by a change in the stock price, but the lag time can sometimes be significant. However, eventually increased profits for Gold miners should be reflected in their stock price, all other things being equal.

Here is a current chart of the $Gold:$CCI ratio on a daily candlestick chart as of today's close (6/23/09):

Now keep in mind that this ratio chart is bullish for Gold miner profitability and should ultimately improve the Gold mining sector stock prices after a lag, but this ratio chart is not indicative of inflation. During a deflationary depression, which I believe has already begun (i.e. Kondratieff Winter), the Gold price will probably hang around near its all time highs and even make new nominal highs while other commodities tank. Commodities do poorly during deflation, but Gold is a currency and is cash/money, not a commodity.

Firms that dig money out of the ground during a deflation (when everyone needs money) are rewarded handsomely for their efforts. It is cheaper to dig Gold out of the ground when costs such as energy and labor are falling relative to the market price of Gold, thus profit margins increase for Gold miners during deflationary periods. So, this chart is bullish for Gold miners but does not mean that those who hold Gold will get rich other than in a relative sense.

In other words, those who stay invested in real estate, general stocks, and commodities like oil will lose most of what they've invested but those who hold cash (i.e. Gold) will maintain what they've got and increase their wealth relative to their neighbors. I think Gold at $2000/ounce is a reasonable peak during a deflationary depression. The potential dynamics of a currency crisis, should a geopolitical event occur that dethrones the U.S. Dollar as the reserve currency of the world, make the built in insurance policy Gold offers against a rapid currency devaluation important in the economic crisis in which we find ourselves.

However, if the last deflationary depression is a guide, the real money to be made is in Gold stocks, not the Gold price. Once an investor anchors his or her portfolio with physical Gold, he or she should look to Gold mining companies for speculative profits. Now is not the time to invest new money in the senior Gold mining sector in my opinion. This is because the worst cyclical bear market in general stocks most of us will see in our lifetimes has begun a new leg down to re-test the spring '09 and fall '08 lows, which may or may not hold.

Such wicked bear legs down in general stock market indices spare few stocks and risk is too high right now to be investing new money in any stocks, including the Gold miners. Having said this, I believe the lows for the price of Gold will be in this week and then Gold will move to re-test its all-time highs over $1000/ounce. Now is a great time to secure some physical Gold coins or bars if one has not already established an anchor for their investment portfolio. And please do not mistake the fraudulent GLD ETF for an equivalent to physical Gold held outside the financial system - insurance cannot be trusted to those who have already shown a penchant for committing fraud (i.e. Goldman Sachs and JP Morgan are two of the custodians for the GLD ETF).

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2009 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Adam Brochert Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.