Gold Bull Market Next stop is $2,100 not $1,300

Commodities / Gold & Silver 2009 Jul 02, 2009 - 07:54 AM GMTBy: Jordan_Roy_Byrne

Practically everyone in the gold community has mentioned the inverse head and shoulders pattern on the gold chart and the corresponding $1,300 target. The target is correct but the interpretation of the pattern is not entirely correct. That target comes from the pattern being a reversal pattern but in the current case of Gold it is not a reversal pattern. There is no downtrend it is reversing from. However, the pattern can actually function as a continuation pattern as John Murphy explains in his book, Technical Analysis of the Financial Markets:

Practically everyone in the gold community has mentioned the inverse head and shoulders pattern on the gold chart and the corresponding $1,300 target. The target is correct but the interpretation of the pattern is not entirely correct. That target comes from the pattern being a reversal pattern but in the current case of Gold it is not a reversal pattern. There is no downtrend it is reversing from. However, the pattern can actually function as a continuation pattern as John Murphy explains in his book, Technical Analysis of the Financial Markets:

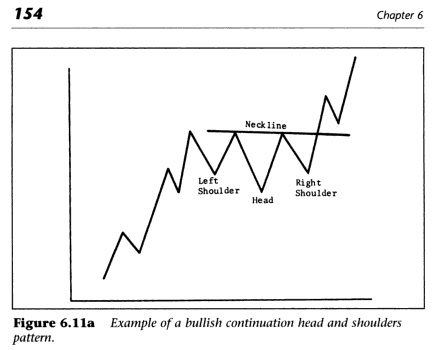

“In the previous chapter, we treated the head and shoulders pattern at some length and described it as the best known and most trustworthy of all reversal patterns. The head and shoulders pattern can sometimes appear as a continuation instead of reversal pattern. In the continuation head and shoulders variety, prices trace out a pattern except that the middle trough in an uptrend tends to be lower than either of the two shoulders.”

Below is a picture from the book:

The pattern is a continuation pattern because it ensures the continuation of the prior trend. Continuation patterns themselves don’t produce price targets. In a continuation pattern like a flag or pennant, you usually take the length of the preceding move and add it to the top of the flag/pennant to get a price target. Point being, it’s possible for $1,300 to be a target but it’s not the level that we should be focusing on.

Cup and Handle Pattern

Gold has formed sort of a cup and handle pattern more than a few times. The first example is from 1999 to 2003 and the second example is from 1996 to 2004. Please note the four steps of the pattern that occurred in both cases. The pattern can have a simple target and a logarithmic target. I find that the logarithmic target is achieved in the long-term patterns. The target is calculated by taking the percent distance from the bottom of the cup to the top and then adding it to the top. (Example- 200 to 400 is 100%, so the target is 800).

Far more important than the inverse head and shoulders, is this mega long-term cup and handle pattern. It has completed the three steps and a move above $1,000/oz would confirm that the 4th step (impulsive advance) is underway. Using $730 and a low of $255, I calculate a logarithmic price target of $2,089. In the previous two patterns, which evolved over eight years and four years, it took less than a year in both cases for the target to be reached (following the third step).

At present Gold is struggling between $920 and $940. There is better than a 50-50 chance that the US Dollar rebounds, which would likely send Gold to support at $880.

If you are interested in more detailed and thorough analysis of Gold, Silver, the Dollar, and numerous gold/silver stocks, then you can click the link below to find out all the details about our new newsletter. We specialize in tracking the technicals and sentiment (short term options data and short interest) on 40 gold/silver stocks.

http://trendsman.com/Newsletter/GSletter.htm

By Jordan Roy-Byrne

trendsman@trendsman.com

Editor of Trendsman Newsletter

http://trendsman.com

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.