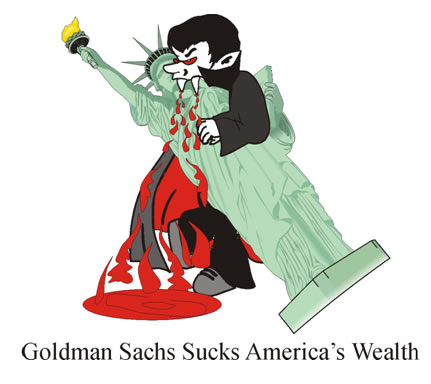

Goldman Sachs: A Vampire On The Jugular Of America

Companies / Market Manipulation Jul 20, 2009 - 02:58 AM GMTBy: Darryl_R_Schoon

…organized greed always defeats disorganized democracy - Matt Taibbi

…organized greed always defeats disorganized democracy - Matt Taibbi

In Rolling Stone Magazine, Matt Taibbi wrote what would never be read in The New York Times, The Financial Times, Fortune, Barrons and certainly not in the Washington

…If America is circling the drain, Goldman Sachs has found a way to be that drain -- an extremely unfortunate loophole in the system of Western democratic capitalism, which never foresaw that in a society governed passively by free markets and free elections, organized greed always defeats disorganized democracy. - Matt Taibbi, Goldman Sachs: The Great American Bubble Machine, Rolling Stone Magazine, July 2, 2009, issue 1082-83

Those at the center of power are often reticent to criticize others feeding at the same trough. It is left to those on the fringe, in this instance Rolling Stone Magazine, a reviewer of popular music, to state the ugly truth about what is happening at the center—that bank-holding company, née investment bank Goldman Sachs, engineered America’s serial bubbles in stocks, housing and commodities; and, has now profited immensely from both the bubbles and America’s subsequent collapse.

That bankers at Goldman Sachs will receive record bonuses the same year millions of Americans will lose their homes and their jobs is not by coincidence. Matt Taibbi’s article explains why and how this is so. In the game of last man standing called Western democratic capitalism the winner is clearly Goldman Sachs.

DEMOCRACY’S BIRTH WAS AN IMPROBABLE EVENT IT’S DEATH LESS SO

Taibbi’s statement, “organized greed always defeats disorganized democracy”, gives the understanding how America, once the greatest economic power in the world, lost its extraordinary productivity, wealth, and power in only a few decades.

The lofty intent of those who founded the US has today been effectively subverted. Democracy no longer serves the role intended by America’s founding fathers. Today, democracy serves instead the special interests that control America through a highly compromised, manipulated and mis-named “democratic process”.

Control of the democratic process is not difficult. It is done with money, money given to politicians who raise campaign funds by selling out those they are elected to serve. This is not only true for most Republicans and Democrats. It is true for most nations.

In this process, voters are temporarily satisfied when “their” candidate wins. In truth, “their” candidate was never theirs in the first place, already having been brokered and bought by powerful interest groups who have much to gain by their candidate’s ability to get elected.

DIVIDE AND CONQUER THE TWO-PARTY DANCE OF DISASTER

Instead of helping to solve society’s problems, the democratic process has been diverted by powerful and well-organized special interest groups. This diversion is accomplished by exploiting the conservative and liberal tendencies of the electorate, a diversion that enables special interests to maintain control no matter what party wins.

By exacerbating the natural tensions existing within society, special interests use politicians and the media to control the political dialogue, emphasizing issues that divide and inflame the electorate thereby diverting attention away from the destabilizing, dangerous and self-serving aims of special interests.

After every election, either conservatives or liberals will feel that victory has been achieved, their ideological opponents temporarily vanquished, their political ends accomplished; but nothing could be further from the truth as both conservatives and liberals have been duped in the process, a process best described as political pornography—as the aftermath is always somehow unfulfilling, no matter how exciting the initial attraction and foreplay.

In the end, very little gets solved, problems persist and proliferate, and the electorate becomes increasingly disillusioned—that is, until a new candidate is found by the special interests to again raise the hopes of both conservatives and liberals that this time it will be different.

SPECIAL INTEREST GROUPS AND THE RISE AND FALL OF NATIONS

The ability of special interest groups to dominate democracies is surprising only because democracies are relatively new; notwithstanding the Greek city-states and the earliest reports of democracy in ancient India—and my parody of an earlier imagined attempt, http://www.drschoon.com/articles/DemocracyInTheMadhouse.pdf .

Special interest groups far predate the modern democratic state. According to American economist, Mancur Olsen (1932-1988), author of The Rise And Decline Of Nations: Economic Growth, Stagflation, And Social Rigidities, 1982, Yale University Press, special interest groups arise in all nations and it is their presence and power that ultimately destroys the nations they dominate.

Mancur Olsen’s theory, the Logic Of Collective Action, posits the longer a nation is stable, the more likely special interest groups will rise and dominate that nation’s affairs and economy, making that nation less efficient and less productive and by so doing contribute to its ultimate downfall.

In a paper at Cornell University, Chia-chen Chou sheds light on Olsen’s Logic of Collective Action as follows:

Special interest organizations and collisions (distributional coalitions) reduce efficiency and make political life more divisive. Distributional coalitions struggle to maximize their own self-interests, that is, share of the national income rather than finding ways of increasing this income. [bold mine]:

Thus, special interest groups attempting to get a bigger slice of the pie will lead to decreased societal production…The underlying logic of collective action and its implications provide a general explanation for the economic growth and decline of states. The longer the period of stable government, the more special interest groups will form to rob the economy. [bold mine]:

Olsen’s Logic of Collective Action explains the increasing divisiveness of American politics, Wall Street’s successful robbery of America’s wealth, and the military-industrial complex’s role in America’s demise as a world power; and now that these issues have been resolved, the question remains, what’s next?

GOLD AND SILVER & THE COMING COLLAPSE

Societal collapse and widespread suffering are prospects I do not enjoy contemplating; and, were it not for my deep belief that what we see is what we see, not all there is, I would face the future with far less equanimity than I do.

We are in for some truly terrible times. The green shoots “seen” by Geithner and Bernanke make the LSD-based hallucinations of my generation seem rooted in rational experience; but those believing in these hallucinatory green shoots will find reality to be far different when the banker’s world of credit-based paper disintegrates.

According to Mancur Olsen’s theory, it is the dominance of special interest groups, e.g. the bankers, the healthcare industry, the military-industrial complex, etc., that led to the demise of the power and influence of the US.

Bankers are well aware of this entropic decline and are repositioning themselves in China and other nations where expansion still seems to be the order of the day. In this, they will fail, for the collapse of the West’s paper-based financial system will affect all nations, not just those now in decline.

Credit-based capital markets are in extreme distress everywhere and were it not for heavy government aid and intervention, they would have already collapsed. The bankers’ credit-based paper money has weakened the entire global economy and when it collapses, all credit-based paper money could be virtually worthless with only gold and silver retaining monetary value.

The case for gold and silver is simple as it is old; as the same story has been repeated during the last 1,000 years, first in the East then in the West. Gold and silver were money. Then paper currencies backed by gold and silver were introduced by bankers and governments and were substituted for gold and silver. Then gold and silver were removed from paper money because governments had spent the gold while printing more and more paper money. As a result, every experiment with paper money ended in disaster.

Note: On the subject of paper money, I highly recommend Ralph T. Foster’s Fiat Paper Money—The History And Evolution Of Our Currency. To order email tfdf(at)pacbell.net, phone (510) 645-3015, address: 2189 Bancroft Way, Berkeley, CA 94704 USA.

Today, paper money is far different than paper money fifty years ago. In 1959, the US dollar was still convertible to gold and 35 US dollars could be exchanged for one ounce of the precious metal. Today, it would take 900 to 1,000 US dollars to purchase that same ounce of gold.

This is the true cost of accepting the banker’s paper coupons as money. Over time, the banker’s paper money loses more and more value. We are in the end-times of our experiment with the bankers’ paper money and the system it gave rise to, credit-based capital markets.

Those who have their wealth invested in paper-based IOUs, e.g. treasuries, bonds, etc., will suffer the most in the coming meltdown. In the coming days, paper-based IOUs will become increasingly worthless and in the coming years, most IOUs will have little or no value, including government treasuries and currencies, as IOUs increasingly become ICPs—I Can’t Pay.

This is because the largest bubble of capitalism’s end-game is being formed right now, a bubble of stupendous proportions, a bubble composed of extraordinary amounts of government debt; and, when this bubble bursts, governments and their citizens will be its victims.

Of course, Goldman Sachs and the rest of the paper boys are hoping the vast majority of investors will continue to believe in their paper promises and will continue to leave their paper money on the table, their table, and to let the bankers do with it what they will.

This is the reason that financial interest groups have marshaled their considerable resources to defend paper markets against the increasing threat of rising prices of gold and silver as the price of gold and silver indicates the level of systemic distress in paper-based capital markets.

Over the past decade, private bankers have emptied national treasuries of gold bullion, selling this bullion on the open market in order to keep the price of gold low in order to mask the increasing vulnerability of their paper-based assets.

The US claims the US Treasury still holds approximately 7,000-8,000 tons of gold but has not allowed a public audit of its reserves since 1954; and since 1999 the UK and Swiss have seen their gold reserves decimated as bankers freely sold their gold in order to cap the rise in the price of gold to keep the banker’s paper money scheme intact.

This is perhaps the last opportunity for private investors to purchase gold when it is being diverted from public treasuries in order to keep gold prices artificially low. These publicly subsidized prices will not be available forever; for when the banker’s Ponzi-scheme of paper money collapses, gold will never again be this cheap.

But most investors will continue to play the banker’s game with the banker’s paper money and continue to invest in paper assets as it is the only game they know. What they don’t know is that the banker’s game is almost over; and, for those who understand what is happening, this is the opportunity of a lifetime to profit—and to survive.

GOLDMAN SACHS THE KING PIMP OF WALL STREET

Goldman Sachs is today the pre-eminent paper player in today’s paper markets, the king pimp of capitalism, Wall Street’s equivalent of Harlem’s fabled players of the past who lived opulently off the considerable labors of female prostitutes.

But the pimps on Wall Street have done Harlem’s pimps one better. Goldman Sachs and their fellow pimps benefit not just from the labor of women but from the labor of men as well.

The following is dedicated to the hard-working men and women of America:

Goldman Sachs’s your pimp

Who’s put America on the street

You do the bidding of Wall Street

Paying their bonuses and their keep

The bankers get your money

No matter what you say

Then they cut your credit

And charge you more for it each day

What’s a two-bit whore to do?

Complain to the pimp who’s pimping you?

What’s a two-bit whore to do?

Complain to the pimp who’s pimping you?

The bankers print your money

And charge you while they do

But the bankers at the Federal Reserve

Are no more Federal than me ‘n you

You may not like the pay

And the streets are awfully bad

But you’re gonna keep getting worked to death

‘til you know that you’ve been had

What’s a two-bit whore to do?

Complain to the pimp who’s pimping you?

What’s a two-bit whore to do?

Complain to the pimp who’s pimping you?

When Wall Street pimps take their cut of America’s money, they’re not alone. Without the US government, the pimps of Wall Street couldn’t do you like they do. There are two hands in your pockets—and they’re not yours.

Buy gold, buy silver, have faith

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.