Are Emerging Market Economies Leaving Us in the Dust?

Economics / Emerging Markets Jul 21, 2009 - 07:24 PM GMTBy: Kurt_Kasun

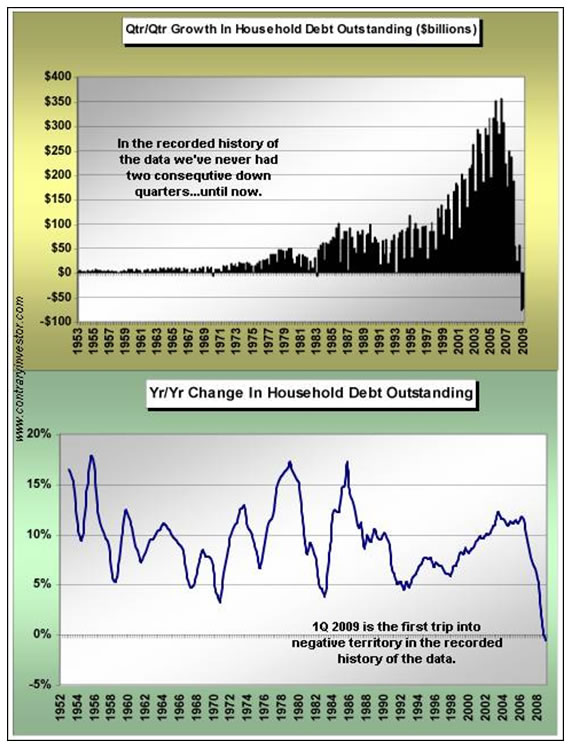

Nassim Taleb, author of The Black Swan, co-authored an editorial which appeared in the July 14th edition of the Financial Times, titled “Time to tackle the real evil too much debt”. The dirty little secret is that there is no avoiding the necessary pain and sacrifice that must occur in the aftermath of what can only be described as a period of the greatest overindulgence in the history of the world. Debt was the drug of choice and now we will continue to experience the inevitable hangover. Looking at the two jaw-dropping charts below, it should be quite obvious that it will take quite some time to burn off the excess debt that was created.

Nassim Taleb, author of The Black Swan, co-authored an editorial which appeared in the July 14th edition of the Financial Times, titled “Time to tackle the real evil too much debt”. The dirty little secret is that there is no avoiding the necessary pain and sacrifice that must occur in the aftermath of what can only be described as a period of the greatest overindulgence in the history of the world. Debt was the drug of choice and now we will continue to experience the inevitable hangover. Looking at the two jaw-dropping charts below, it should be quite obvious that it will take quite some time to burn off the excess debt that was created.

Courtesy: Brian Pretti “Going with the Flow” http://www.financialsense.com/Market/pretti/2009/0710.html

The western and developed world should brace itself for an extended period of credit contraction and the road to the “new normal” could be longer and bumpier than many economists first thought. Taleb and many others believe “that stimulus packages, in all their forms, make the same mistakes that got us here.” Taleb’s editorial concludes:

“It is sad to see that those who failed to spot the problem (or helped to cause it) are now in charge of the remedy. Just as the impending crisis was obvious to those of us who specialize in complexity and extreme deviations, the solution is plain to see. We need an aggressive, systematic debt-for-equity conversion.”

Ray Dalio, the CEO of Bridgewater Associates, in a Barron’s February 9th interview who, according to Barron’s “began sounding alarms” early in 2007 “about the dangers of excessive financial leverage, expresses concerns similar to Taleb’s. Falling short of calling for a conversion of all debt to equity, he tends to concentrate on further restructurings as a necessary solution:

“They are cutting costs to service the debt. But they haven't yet done much restructuring. Last year, 2008, was the year of price declines; 2009 and 2010 will be the years of bankruptcies and restructurings. Loans will be written down and assets will be sold. It will be a very difficult time. It is going to surprise a lot of people because many people figure it is bad but still expect, as in all past post-World War II periods, we will come out of it OK. A lot of difficult questions will be asked of policy makers… Only when those debts are actually written down will we get to the point where we will have credit growth. There is a mortgage debt piece that will need to be restructured. There is a giant financial-sector piece -- banks and investment banks and whatever is left of the financial sector -- that will need to be restructured. There is a corporate piece that will need to be restructured, and then there is a commercial-real-estate piece that will need to be restructured.”

The bottom line is that we find ourselves buried in an avalanche of debt. The following picture which appeared on the June 13th edition of The Economist magazine pretty much sums up the situation:

Courtesy: The Economist

http://www.economist.com/printedition/index.cfm?d=20090613

Multiply that baby by $300 million and you have a good picture of our predicament.

The deleveraging process is likely to be every bit as painful going down as is was delightful on the way up. The question for investors is how in the world do you make money in an economy saddled with debt? At some point, as the private sector off-loads its debt to the public sector, the safehaven status of US treasuries becomes called into question. And American companies are staring down the barrel indebted consumers whose savings rates are likely to climb possibly into double digits as they try to restore family balance sheets. Not a whole lot of potential there except for perhaps investing in publicly-traded debt collection agencies.

Many strategists and pundits who are consumed in the “inflation/deflation” debate and who are trying to time the sequence of when money velocity (M*V=P*Q) will once again rise and unleash torrent of trillions of dollars of newly minted money (or will the artful central bankers around the world withdraw the appropriate amounts at the exact appropriate time and execute the most beautiful and deftly-executed “exit strategy” of all-time) should consider a more important question…namely, are emerging markets leaving us in the dust?

Two components are necessary in order for this to occur. The emerging market countries need to have the willingness and ability to do so. It was thought that they did back in 2007 when the term “de-coupling” swept the investment world’s stage. The theory was that China and other emerging countries we see their economies and financial markets move in directions independent of the US and the developed world. We all know how that turned out.

But much has changed since then. The Asian-exporting countries, particularly China, are keenly aware of the charts similar the ones posted at the beginning of this article. When the Japanese commissioned the Maekawa report in the mid-1980s in an effort to break their dependence on exports, it was not clear, as it is today, that the US consumer is “down for the count”. They didn’t have the incentive, as the Chinese do today, to make the change.

The recognition by the export-driven parasites that they need another host country for nourishment will force economies like Taiwan, Singapore, Hong Kong, Indonesia, South Korea and others to seek another alternative destinations to deliver their products. China is a prime candidate. China, while having a huge trade surplus with the US, has had almost an equally large trading deficit with its regional partners. This trend should likely reverse with the US and accelerate with SE Asia and the commodity-producing countries.

Many will correctly point out that China (and the other BRIC countries) does not yet have the ability to absorb the loss of consumption that continues to occur in the US and the western world. This is true. However, the moment that it becomes clear that the emerging world will in fact supplant the developed world in consumption, the primary concerns will no longer rest upon how long it will take the West to deleverage or whether or not money velocity will pick up to let loose hyperinflation; rather, it will be on how fast investment dollars flow from the West to the East as investors rush to price in this watershed event and current and capital accounts surpluses and deficits eventually come to stage stunning reversals of capital and goods flow.

No sooner did Bloomberg run and article earlier in the week (“Emerging Markets Priciest Since 2007 When Shares Fell”) then did the emerging markets, in true contrarian fashion, collectively take off again, exceeding the highly-celebrated weekly gains (once again) experienced in the US market indices. The article pointed out that the last two times the in which the valuations of emerging markets were higher than developed markets (2000 and 2007) it marked a major “top” with a crash in all world markets soon to follow. Will the third time be the charm and will emerging markets leave us in the dust for good?

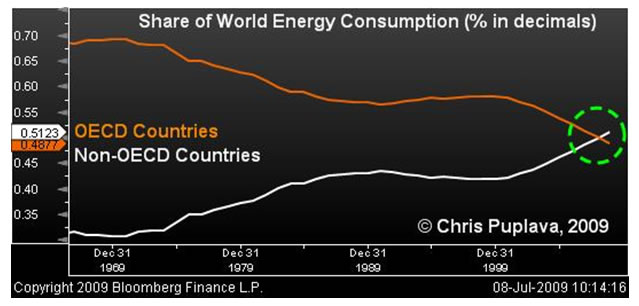

The two charts below support just that possibility. In the first, we see that, for the first time, developing countries oil consumption has surpassed that of the worlds’ top 30 (OECD) developed countries:

Courtesy: Chris Puplava “Commodities: Bursting Bubble or Crouching Tiger?”

http://www.financialsense.com/Market/cpuplava/2009/0708.html

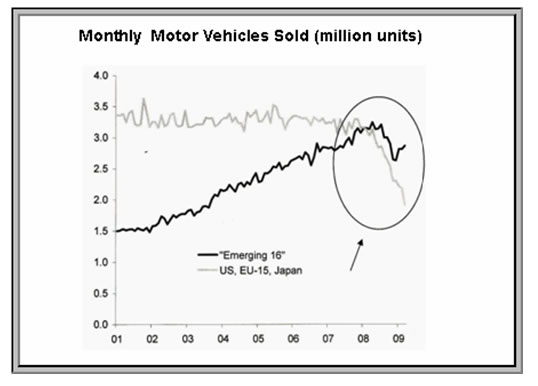

The second chart illustrates how motor vehicle sales in developed economies have fallen below those in emerging economies:

Courtesy: Dr. Marc Faber Monthly Market Commentary (July 2009) “The Trouble with Our Times is that the Future will Not Be what it used to Be”

I think it is safe to conclude that gains in emerging market “real economies” relative to gains (or continued losses) in developed countries will continue and will enentually translate to developing countries capturing a greater share of overall world stock market capitalization.

I fear that this trend will not stay under the radar of the world’s institutional investor’s for much longer. While the focus for now remains on restoring the economic vitality of the US and the rest of the in-debted developed world, and on the impact of the highly-anticipated exit strategy, if it becomes clear that the the BRIC countries have transitioned from an export-model to more balanced and domestically-oriented approach, then we might be reading about a different kind of “exit strategy” -- how to exit capital investments in the West and to migrate them to the East and the rest of the developing world.

By Kurt Kasun

A contributing writer to GreenFaucet.com , Kurt Kasun writes a high-end investment timing service, GlobalMacro, which is focused on identifying opportunities that produce returns in excess of market with reasonable risk. He is strategically located in Washington , D.C. , a key to maintaining contacts and relationships which help Kurt understand global policy and economic factors as they emerge. His investment approach has always been macro in nature largely due to his undergraduate studies at the U.S. Military Academy at West Point (B. S. National Security, Public Affairs, 1989) and his graduate studies at George Mason University (M.A. International Commerce and Policy, 2006).

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Kurt Kasun Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.