Sovereign Wealth Funds and the Global Economic Crisis

Politics / Sovereign Wealth Funds Jul 23, 2009 - 06:24 AM GMT The global economic crisis has left many sophisticated institutional investors reeling. Most are yet to fully recover even though markets have clawed back some of their early losses. Worst hit are the hedge funds with exposure to financials and commodities.

The global economic crisis has left many sophisticated institutional investors reeling. Most are yet to fully recover even though markets have clawed back some of their early losses. Worst hit are the hedge funds with exposure to financials and commodities.

For instance, New York based Ospraie Fund that was worth some $2.8 billion at the start of August 2008 wound up later in the year as its holdings took a massive hit due to falling commodity prices. London based RAB Capital, which invests in small cap mining stocks, had to seek protection from redemptions due to falling commodity prices and consequent poor performance. Assets under management by RAB have reportedly fallen by 74% in 2008.

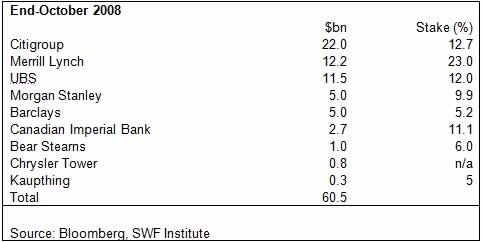

For instance, New York based Ospraie Fund that was worth some $2.8 billion at the start of August 2008 wound up later in the year as its holdings took a massive hit due to falling commodity prices. London based RAB Capital, which invests in small cap mining stocks, had to seek protection from redemptions due to falling commodity prices and consequent poor performance. Assets under management by RAB have reportedly fallen by 74% in 2008.It is not only regular hedge funds that have crash landed but also mighty Sovereign Wealth Funds (SWFs). The Monitor Group, a US based consulting firm, estimates SWFs to have lost $57.2 billion on the publicly disclosed investments of $125.7 billion they have made since 2006. According to a working paper on Gulf Cooperation Council (GCC) SWFs published by The Council on Foreign Relations (Brad Setser and Rachel Ziemba), SWFs in the GCC have lost as much as $350 billion in 2008. SWFs elsewhere haven’t faired any better.

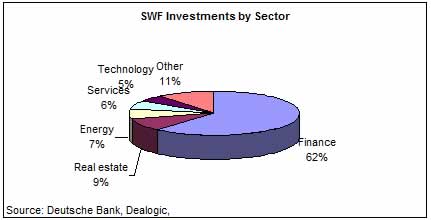

SWFs are returning to the market again and are making big investments. Some of these investments are in strategically important assets to their sponsors; i.e. their respective governments. SWFs have made a wide range of investments covering a multitude of sectors such as banks, real estate, energy and technology.

With their massive wealth and sprawling investments, SWFs have marked the rise of state capitalism. Owned directly by a sovereign government and managed independently of other state financial institutions, SWFs were created to manage the country’s foreign exchange reserves. Some high profile SWF investments include $3 billion in Blackstone Private Equity Firm by the Chinese Investment Corporation (CIC), $75 billion in Citigroup by Abu Dhabi Investment Authority (ADIA) and $800 million investment by Mudabala Investment Company from Abu Dhabi (Mudabala).

The advent of SWFs was viewed by many with considerable hostility and even prompted Mr. Larry Summers, the former US Treasury Secretary, to express concerns over potential threats by SWFs. Mr Summers’ concerns stem from the differences between investments by governments through SWFs and those by other conventional institutions as the former may have different motives. Mr Henry Paulson, another former US Treasury, urged the International Monetary Fund (IMF) to develop “best practices” to govern SWFs investments to, “demonstrate to critics that SWFs can be constructive, responsible participants in the international financial system.”

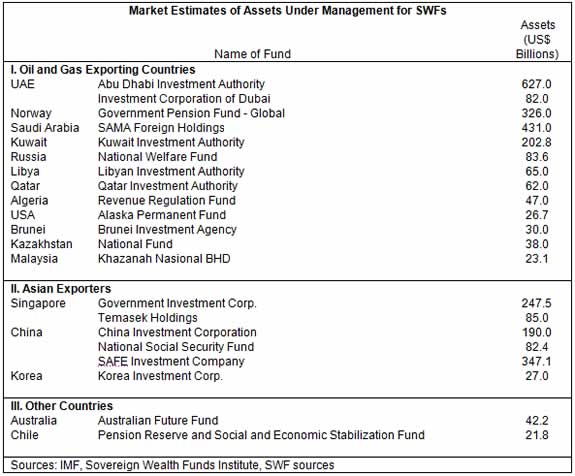

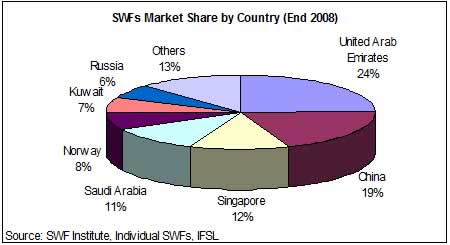

Those were the heady days of 2007-2008, when markets were defying gravity and oil was reaching new highs. And most of the SWFs are actually from oil rich nations. With government coffers brimming with foreign reserves on the back of the oil windfall, SWFs such as ADIA, Kuwait Investment Authority (KIA) and Qatar Investment Authority (QIA) were making inroads into markets in the West with investments in large corporations, banks and private equity firms.

Given the influence SWFs can exert and the magnitude of funds under their management (estimated to be $3.22 trillion), an analysis of SWFs and their investment strategies would prove to be appropriate. So what are the implications of these losses to the investment world? What have been the responses by SWFs? How will they change the investment strategy of these funds? What would be their role in a post financial crisis environment?

We interviewed investment officials and policy makers from several prominent SWFs to determine the answers to the questions above. In a series of articles we will be publishing views, findings and conclusions, of course within the boundaries of confidentiality.

One notable observation was that SWFs have started reducing their investment time horizons in response to market uncertainties and declines in reserve transfers. This appears to be the case particularly for SWFs established by oil producing countries. Views on expected returns have changed, leading to the postponement of some investments. It is fair to say that SWFs will not be making aggressive investments such as those in 2007 – 2008, unless of course the assets are at fire sale prices.

SWFs are also moving towards the establishment of stabilisation funds, to insulate their respective economies from falling commodity prices and export earnings. They are also expected to provide stability in fiscal revenues and protect against Dutch disease. Russia’s Stabilisation fund is a classic example which prevented the emergence of Dutch disease in the country.

SWFs as stabilisation funds are also expected to make investments in ailing domestic companies, as indicated by Kazakhstan’s sovereign wealth fund Samruk-Kazyna. The fund is seeking to buy gold, copper and iron assets which would benefit companies such as London listed KazakhGold Group (LSE: KZG), Kazakhmys (LSE: KAZ), Eurasian Natural Resources Corporation (LSE: ENRC) and Toronto listed Alhambra Corporation (TSX: ALH). Similar investments in local companies are expected by Singapore’s Temasek, CIC and Brazil’s SWF.

According to the International Monetary Fund (IMF) some SWFs are seeking indirect hedges in response to falling commodity prices. This would change the asset allocation strategy in the SWF portfolios resulting in overweighting assets that are negatively correlated with the price of the commodity that funds them. For example, though not exactly a SWF, Gazprom’s investment in Airbus Industries provides a natural hedge against falling energy prices. This may lead to SWFs seeking investments in new sectors and new regions as well as different asset classes that they have not invested in before.

This bodes well for sectors such as natural resources, particularly mining, as they currently have a relatively low exposure amongst current SWFs. At present, SWFs have the highest exposure to banks and financials, even after the market meltdown, followed by real estate and energy. As SWFs seek to diversify into other sectors, the mining sector emerges as an attractive candidate.

While SWFs have already made investments in the mining sector, it is worthwhile highlighting the latest SWF investment in a mining company. The China Investment Corporation (CIC) invested C$1.75 billion (US$1.5 billion) in Teck Cominco's (TSX: TCK.A and TCK.B, NYSE: TCK) outstanding Class B subordinate voting shares. This acquisition represents approximately 17.2 per cent equity and 6.7 per cent voting interests in the company. Other SWFs may also make similar investments in mining companies with Chinese SWFs however securing the lion share.

SWF investments in the energy sector is expect to be relatively low however, as most of the large SWF sponsoring governments already have an exposure to the sector either through investments already made or naturally through their own economies. SWF investments in oil are therefore expected to come from SWFs from countries that do not have oil resources (such as Korea Investment Corp, Temasek and Government of Singapore Investment Corporation) or from industrial nations such as China and Japan that are heavy energy consumers.

While the objectives of SWFs sponsoring governments cannot be fully ascertained, some display very clear-cut investment aims. For instance, Singapore’s Temasek Holdings acts like a reserve investment corporation seeking to generate returns to its sponsors through investments in diverse industries including energy and resources. Stabilisation funds such as the Kazakhstan National Fund seek to insulate the economy against the price swings of oil, gas and metals, on which the country heavily depends. The Government Pension Fund of Norway seeks to facilitate government savings necessary to meet future public pension expenditures and to support a long-term management of petroleum revenues.

However, concerns by the likes of Mr. Summers and Mr. Paulson are not ill-founded and it is imperative to determine if SWFs can be used as a government policy tool. Sponsoring countries could use the SWF muscle in a protectionist backlash. SWFs such as CIC can not only ensure base metal and energy supplies, they may also use their clout to gain access to greenfield energy and mining projects in places such as Africa.

Governments have so far not used their SWF clout as a policy tool. SWFs such as Temasek, ADIA, KIA and QIA have indeed remained passive partners. In the case of ADIA, Yousef al Otaiba, Abu Dhabi’s director of international affairs, even assured that they have no plans to use investments by ADIA as a foreign policy tool. CIC in its investment in Teck has also assured that they seek to be mere passive investors. One would fervently hope that SWFs would indeed follow similar policies and usher in a more effective system of corporate ownership.

Sources & Acknowledgements: Sovereign Wealth Fund Institute, International Monetary Fund, International Financial Services London, Council on Foreign Relations, The Economist, Individual Sovereign Wealth Funds, The Monitor Group

By Sam Kiri

http://www.proactiveinvestors.com

Proactiveinvestors North America was established to provide financial news, stock market news, and business financial news in Canada and the United States, reported from our offices in Toronto.

Copyright © Proactiveinvestors.co.uk, 2009. All Rights Reserved.

Proactiveinvestors Limited

Proactiveinvestors North America is part of the wider network of Proactiveinvestors websites that cover financial news in Australia, UK, and China. We are an international news organisation with offices in Beijing, Toronto, Sydney and the UK.

Our goal is to be a database of news, research, comment and analysis on listed companies across the world's major stock exchanges. Our articles offer up to date, informed, dynamic snap shots of a company’s past, present and future ambitions and we encourage our readers to research further material to make a rounded decision on a company's prospects.

No investment advice

The Company is a publisher and is not registered with or authorised by the Financial Services Authority (FSA). You understand and agree that no content published on the Site constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable or advisable for any specific person. You further understand that none of the information providers or their affiliates will advise you personally concerning the nature, potential, advisability, value or suitability of any particular security, portfolio of securities, transaction, investment strategy, or other matter.

You understand that the Site may contain opinions from time to time with regard to securities mentioned in other products, including company related products, and that those opinions may be different from those obtained by using another product related to the Company. You understand and agree that contributors may write about securities in which they or their firms have a position, and that they may trade such securities for their own account. In cases where the position is held at the time of publication and such position is known to the Company, appropriate disclosure is made. However, you understand and agree that at the time of any transaction that you make, one or more contributors may have a position in the securities written about. You understand that price and other data is supplied by sources believed to be reliable, that the calculations herein are made using such data, and that neither such data nor such calculations are guaranteed by these sources, the Company, the information providers or any other person or entity, and may not be complete or accurate.

From time to time, reference may be made in our marketing materials to prior articles and opinions we have published. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. As markets change continuously, previously published information and data may not be current and should not be relied upon.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.