Has the U.S. Housing Market Hit Bottom?

Housing-Market / US Housing Jul 29, 2009 - 07:25 PM GMTBy: Tim_Iacono

Now that a number of recent housing reports are generating some incredibly positive headlines and the global economy appears to be slowly digging its way out of an enormous hole that was created last fall when the world nearly came to an end, the burning question on the minds of millions of people is ... Has the housing market hit bottom?

Now that a number of recent housing reports are generating some incredibly positive headlines and the global economy appears to be slowly digging its way out of an enormous hole that was created last fall when the world nearly came to an end, the burning question on the minds of millions of people is ... Has the housing market hit bottom?

There is no shortage of answers.

There is no shortage of answers.

Unfortunately, most of them are far too simple and, in most cases, the individual or organization providing the answer has a bias of some sort.

I'm no exception.

We sold our house about five years ago and have been renting ever since.

We plan to buy again, but not until at least next year and we hope to get a lot more house for our money than we could today.

That's the soonest that I think the bottom in home prices is likely to occur around here in the price range we're looking, though a bottom in home sales may already be behind us, and this is what makes the recent discussion of a housing bottom so complicated - "hitting bottom" means different things to different people living in different parts of the country.

The discourse on this subject is full of misinformation and deception from parties with vested interests that will inevitably lead people to make horrendously bad decisions that they'll regret in another year or two while others may postpone decisions that would be best made today.

With my biases out of the way, a few thoughts on a housing market bottom are offered here. In this article, regional differences will largely be set aside and the focus will be on three sets of national housing data - new home sales, existing home sales, and existing home prices.

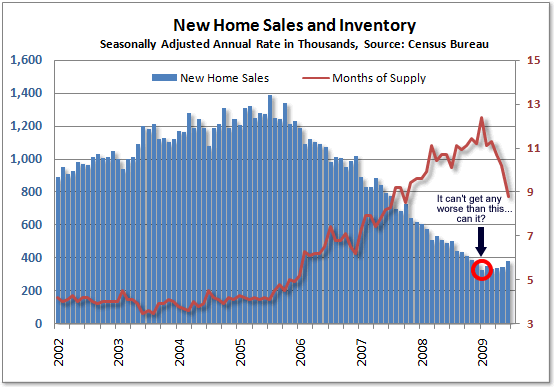

New Home Sales Have Bottomed

First, let's look at the home building industry, which, up until a couple years ago had accounted for about 10 to 15 percent of all home sales. Then, the homebuilders' share gradually sank to about half that amount as waves of foreclosures started hitting the market at much lower prices, cutting into their business dramatically.

Ironically, many of these foreclosure sales were homes that the builders had built and sold a couple years prior. Disgruntled home buyers who, in 2006 and 2007, complained about how builders were slashing prices on Phase III after they bought in Phase II ultimately had the last laugh in 2008 and 2009 when they walked away from their almost-brand-new home and the bank sold it at a 40 percent discount to the going prices for Phase III.

Don't feel too sorry for the homebuilders - they had a few very good years.

Anyway, things have gotten so bad in the new home construction business over the last year or so that they really can't get any worse - not only did new home sales set new all-time lows for a data series that goes back more than 40 years, they simply obliterated every other housing downturn over that period in population-adjusted terms.

The annual rate of 329,000 units seen in January of this year was not only less than the 1981 low in nominal terms, but, after accounting for the increase in population, it was not much more than half that level.

Interestingly, there couldn't have been two different eras for the homebuilders as far as the cost of money is concerned - back then they were sending truck loads of sawed up two-by-fours to the Federal Reserve building in Washington D.C. because Paul Volcker was on a mission to squash inflation with interest rates approaching 20 percent, whereas, today, the Fed has interest rates pegged at zero.

And speaking of the central bank, their legions of economists might think that housing has bottomed when looking at new home construction because this has a direct impact on economic growth - residential construction has been a drag on GDP for about four years now and, from a direct macro-economic perspective, the worst is probably behind us.

For the homebuilders, it's hard to imagine how things could get any worse than they were in January, so, unless this downturn morphs back into the Great Depression II, things have got to get better. In this case, it's probably fair to say that the bottom is already behind us.

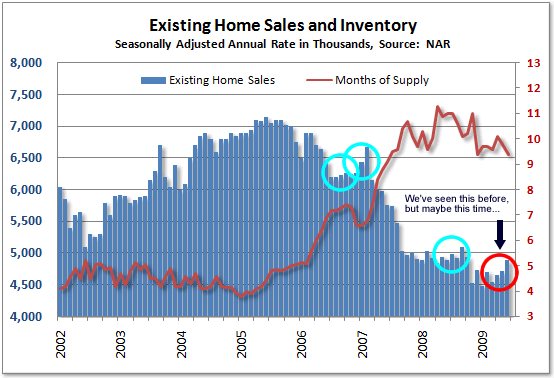

Existing Home Sales Have Probably Bottomed

If you're in the business of selling real estate, then you've got to be thinking that you've seen the worst of the housing bubble's mean side and you may be correct in this assessment now that banks are realizing they're not going to get 2006 prices for all those foreclosed homes that have been sitting on their books for the last year or so.

There's a booming business in distressed property sales that have buoyed existing home sales for months now (much to the dismay of the homebuilders). Foreclosures and short sales accounted for some 70 percent of all home sales in Las Vegas last month and that's a good thing.

The "market" is doing what it is supposed to do - price discovery - and the fact that a lot of prices these days are being discovered through auctions is just part of that process.

And those who dismiss the lower prices fetched on distressed property sales as some sort of a temporary phenomenon should realize that they are doing so at their own peril - there's a lot more of this inventory in the pipeline as the next wave of bad loans wash up on the shores of mortgage lenders and ultimately appear on Realtor.com or Auction.com where, eventually, they'll lower their reserve prices and make a few more sales.

Though it's not as clear-cut as in the case of new home sales, existing home sales probably made a bottom back in January although the same caveats about the Great Depression II apply.

The fact that there have been a few false starts before (circled in blue above) should be some cause for concern (particularly the one in late-2008 as it relates to the possibilities of another Great Depression), but, as long as the central bank keeps pumping money into the system and as long as the government continues to guarantee the vast majority of mortgages via the wards of the state - Fannie Mae and Freddie Mac - eventually, all the excess housing inventory will be worked down and the bottom in existing home sales is probably behind us.

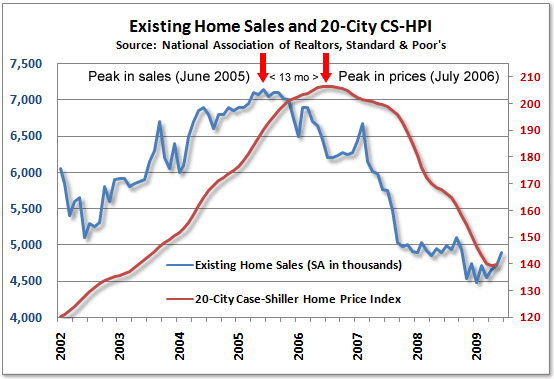

Before moving on to the next section on a bottom in home prices, it's important to remember that there's a big difference between home sales and home prices along with the timing of their respective bottoms.

Generally speaking, real estate agents (those who survived the last few years) are now a much happier lot than they were earlier in the year because they're making more sales. No sales means no commissions, and whether those commissions are large or something less than large makes little difference.

A real estate agent would be much more willing to help you buy or sell a house at $250,000 rather than not make that transaction at all and the fact that the home may have fetched $400,000 a couple years ago or that it may only be worth $200,000 next year doesn't really matter - they'll help you make the sale at the price you agree to and they'll try to make you feel good about it because, if they don't make the sale, they don't get paid.

A sale is a sale, but a bottom in home sales is quite different than a bottom in home prices.

Home Prices Will Not Bottom for Some Time

The vast majority of people in the world today are neither home builders or real estate sales agents, so, despite everything you hear and read about home sales - up, down, or flat - they really aren't all that relevant to most of us.

If you're like all the other prospective home buyers or sellers out there today, the only thing that you should be concerned about are home prices - whether they'll keep going down or if they've already reached a bottom.

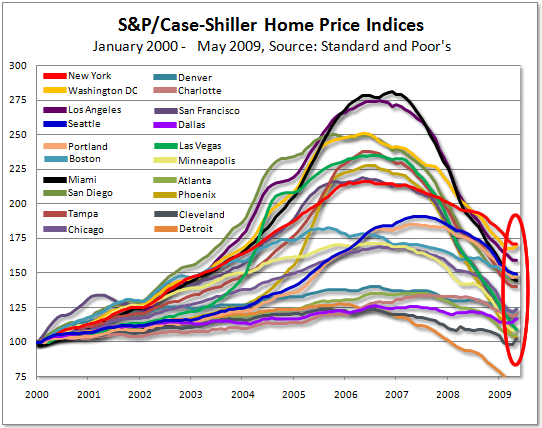

The financial world has been buzzing over the last week as rising new home sales and rising existing home sales were followed up by yesterday's blockbuster report from the folks who run the Case-Shiller Home Price Index that - GASP! - home prices ROSE from April to May.

There it is for all to see in the colorful graphic below - the housing boom and bust in all its glory along with those little squiggles upward on the right-hand side, a sort of resurrection of the housing market by the sounds of some of the press coverage.

Yes, unfortunately, Detroit is still off the chart - a much bigger bust than boom...

More than a few anxious housewives have no doubt been elbowing their hubbies in recent days to cancel that golf game on Saturday and schedule a house-hunting expedition because the news is once again full of reports about rising home prices.

As can be seen clearly in China today, nothing excites people more than when prices rise.

While the first increase in the Case-Shiller Home Price Index in three years is a seminal event to be sure, it's probably not quite what it's being played up to be in your local real estate sales office where, remember, folks are more interested in sales than prices.

Combining the excitement people feel when prices rise with the excitement real estate agents feel when sales volume rises is a big part of the reason for the enormous rise and fall depicted above.

Just as there was virtually no experience with home prices that rose as fast as they did from 2002 to 2006 or falling as fast as home prices fell between 2007 and 2009, there is little background that anyone can draw on to predict what a "bottom" in home prices might look like, but you can just about be guaranteed that the price bottom will lag the sales bottom by at least a year as it did during the peak.

Shown below is evidence of such as the National Association of Realtors' existing home sales are plotted on the same chart as the Case Shiller 20-City Home Price Index - a 13 month lag.

Those who think that the relationship between sales and price at the bottom will somehow be different than the relationship between these two at the peak have virtually no data to back that claim.

Unfortunately, as Ben Bernanke famously said a few years ago, home prices have not declined nationally since the Great Depression.

If the bottom in sales occurred in January, why couldn't the May Case Shiller price data indicate a bottom in price?

Well, anything's possible, but this particular scenario is quite unlikely.

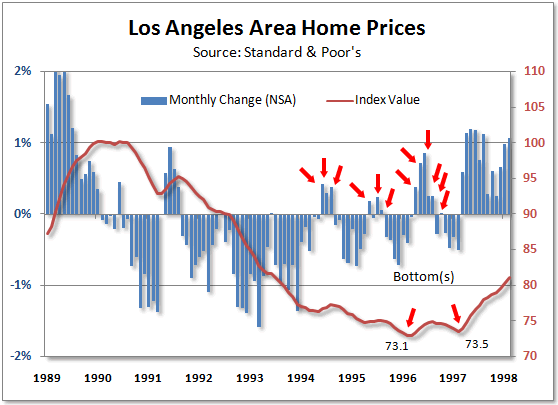

While there is no national data to draw on for housing price bottoms, there is one case study that provides some valuable information and it should help to put yesterday's Case-Shiller report on rising home prices into a little better perspective - the Los Angeles housing market in the 1990s.

As shown below, housing bottoms can be long, drawn-out affairs with lots of false signals.

In the case of Los Angeles in the 1990s, it was almost two full years from the first positive reading in the price index in June 1994 until the ultimate low in February 1996. And lest anyone get too excited about that bottom in 1996, another one occurred a year later in 1997.

From what little experience there is with housing price bottoms, the odds don't favor a lasting reversal in prices in the near-term and when it comes, the rebound won't be that impressive. You'll know when home prices hit bottom when people stop talking about them.

It is important to note that in some low-priced areas where subprime loans began souring a couple years ago and foreclosure sales have been brisk for some time, the bottom in prices may be near, if not already here. Also, in parts of the country where there was never much of a boom or bust, higher prices may be seen in the near-term, but, those are about the only exceptions.

For people like you and me (at least, most of you), don't look for a bottom in prices until at least sometime next year.

By Tim Iacono

Email : mailto:tim@iaconoresearch.com

http://www.iaconoresearch.com

http://themessthatgreenspanmade.blogspot.com/

Tim Iacano is an engineer by profession, with a keen understanding of human nature, his study of economics and financial markets began in earnest in the late 1990s - this is where it has led. he is self taught and self sufficient - analyst, writer, webmaster, marketer, bill-collector, and bill-payer. This is intended to be a long-term operation where the only items that will ever be offered for sale to the public are subscriptions to his service and books that he plans to write in the years ahead.

Copyright © 2009 Iacono Research, LLC - All Rights Reserved

Tim Iacono Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.