U.S. Dollar Crash Has Started as Pressure Mounts

Currencies / US Dollar Aug 06, 2009 - 05:50 AM GMTBy: Frederic_Simons

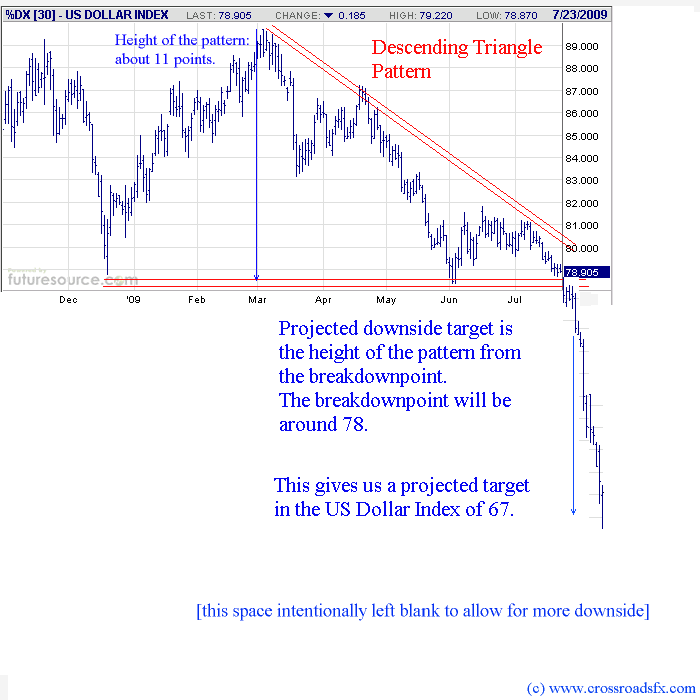

The US Dollar has shown further weakness during the last days. The support at about 78 in the US Dollar index has been breached to the downside. Technically, this means that the downside target of about 67 has been activated, and that downside momentum should be building up during the next days.

The US Dollar has shown further weakness during the last days. The support at about 78 in the US Dollar index has been breached to the downside. Technically, this means that the downside target of about 67 has been activated, and that downside momentum should be building up during the next days.

To illustrate the possible coming downtrend in the US Dollar, we are adding the chart of our previous newsletter:

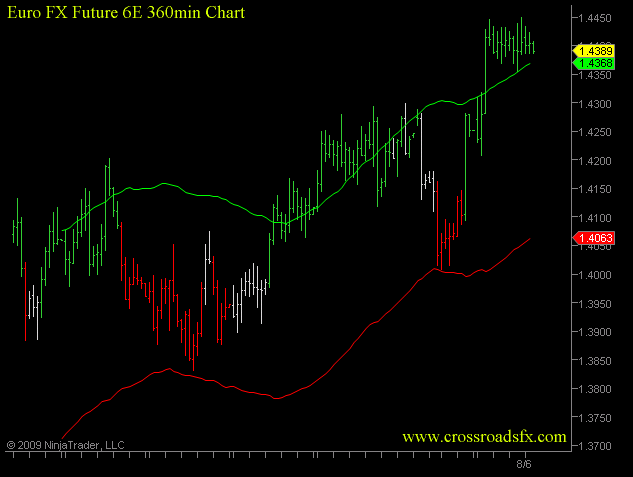

The EUR/USD exchange rate has been moving up accordingly as visible in the following short and longer term charts. Please notice that today is the day of the European Central Bank Decision, so that there may be some volatility, especially during the press conference. Tomorrow is non-farm payroll announcement, with typically big volatility as well. We are definitely not ruling out a small upside blip in the US Dollar in order to shake out some short before the big move gets underway.

[Please click here for additional information about the trading system and how to read the charts]

Both the short term and the longer term EUR/USD chart are currently bullish, pointing to higher prices in the EUR/USD. As mentioned, the economic data releases during the next 48 hours might result in some volatility. The EUR/USD exchange rate would only turn bearish on the longer time frame if it trades below the red sell line, currently at 1.4063.

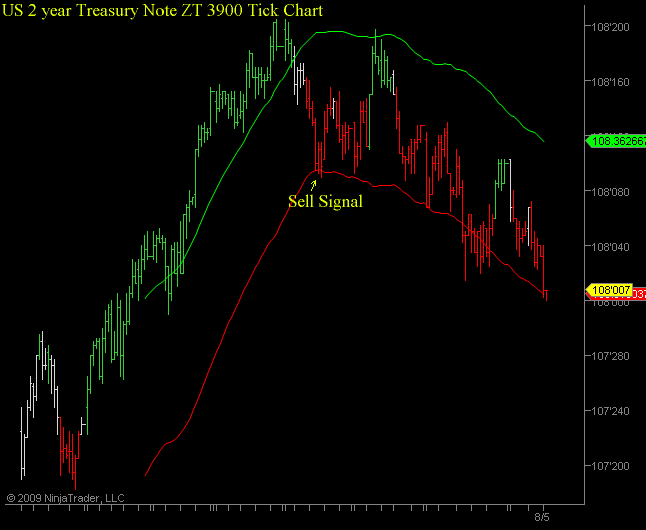

US Treasury Bonds have also been weak during the last two days, which might indicate further trouble for the US-Dollar. Expecially the short end of the yield curve (2 Year Treasuries) has been very weak during the last week:

As a conclusion, the US Dollar seems to have started its crash mode, having broken resistance to the downside. As treasuries are also beginning to show weakness, prepare for the downtrend in the US Dollar to gain momentum and a rising volatility.

If you have any questions, please do not hesitate to contact us by writing an email to

New: Discounted subscription fees for retail (non-professional) investors.

New: Discounted subscription fees for retail (non-professional) investors. 3 Month subscription for only 75 USD !

By Frederic Simons

http://www.crossroadsfx.hostoi.com

© 2009 Copyright Frederic Simons - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Shalom P. Hamou

09 Aug 09, 03:21 |

Bernanke's Dark Kingdom.

Abstract: I am going to show here that central banks have excessive powers which are coherent neither with democratic principles nor with morality. Their existence can not be justified from a mathematical point of view. Worse, in light of the exercise of their extraordinary power by Bernanke, I argue that they can pose a real threat to democracy, peace, privacy and individual freedom. Because of the immediate dangers that are evoked in these lines I strongly suggest that you reproduce my deeds. Read "Bernanke's Dark Kingdom." __________ |