Betting Against Leveraged Stock Market Traders

Stock-Markets / Stock Index Trading Aug 11, 2009 - 09:19 AM GMTBy: Guy_Lerner

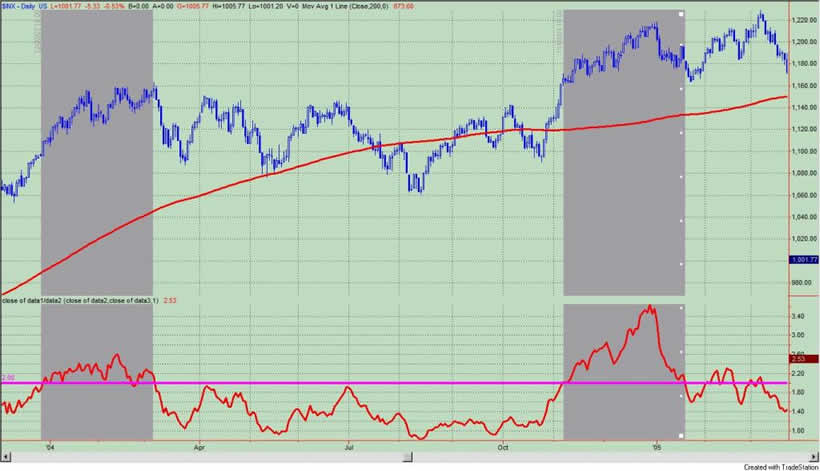

By now you should know that one of my favorite aspects of the Rydex data is the amount of assets in the bullish and leveraged funds versus the amount of assets in the leveraged and bearish funds. Not only do we get to see what direction these market timers think the market will go, but we also get to see how much conviction (i.e., leverage) they have in their beliefs. See figure 1 a daily graph of the S&P500 (symbol: $INX) with the Rydex leveraged bulls (green line) versus the leveraged bears (red line) in the lower panel. Typically, we want to bet against the Rydex market timer even though they only represent a small sample of the overall market.

By now you should know that one of my favorite aspects of the Rydex data is the amount of assets in the bullish and leveraged funds versus the amount of assets in the leveraged and bearish funds. Not only do we get to see what direction these market timers think the market will go, but we also get to see how much conviction (i.e., leverage) they have in their beliefs. See figure 1 a daily graph of the S&P500 (symbol: $INX) with the Rydex leveraged bulls (green line) versus the leveraged bears (red line) in the lower panel. Typically, we want to bet against the Rydex market timer even though they only represent a small sample of the overall market.

Figure 1. Rydex Bullish and Leveraged v. Rydex Bearish and Leveraged/ daily

As of yesterday's close, the amount of assets in the bullish and leveraged funds was 2.53 times that in the bearish and leveraged funds, and this represents the highest value since November, 2004.

Figures 2 through 8 are daily charts of the S&P500. The indicator in the lower panel is the ratio of bullish and leveraged assets to the bearish and leveraged assets. The horizontal pink line (over the indicator) is set to a level of 2. Figure 2 runs from October, 2001 to October, 2002; figure 3 runs from October, 2002 to December, 2003; figure 4 runs from December, 2003 to December, 2004; figure 5 runs from December, 2004 to December, 2005; figure 6 runs from December, 2005 to December, 2006; figure 7 runs from December, 2006 to December, 2007; figure 8 is December, 2007 to the present. The gray vertical lines identify those times when the ratio is greater than 2 or above the horizontal pink line.

Figure 2. October, 2001 to October, 2002

Figure 3. October, 2002 to December, 2003

Figure 4. December, 2003 to December, 2004

Figure 5. December, 2004 to December, 2005

Figure 6. December, 2005 to December, 2006

Figure 7. December, 2006 to December, 2007

Figure 8. December, 2007 to Present

I look at this data and many other pieces of data and I ask: where do we go from here? Even if we go higher and even if the sentiment data is wrong, I am convinced I will have a better -more risk adjusted opportunity - ahead of me. That's my story for now!

By Guy Lerner

http://thetechnicaltakedotcom.blogspot.com/

Guy M. Lerner, MD is the founder of ARL Advisers, LLC and managing partner of ARL Investment Partners, L.P. Dr. Lerner utilizes a research driven approach to determine those factors which lead to sustainable moves in the markets. He has developed many proprietary tools and trading models in his quest to outperform. Over the past four years, Lerner has shared his innovative approach with the readers of RealMoney.com and TheStreet.com as a featured columnist. He has been a regular guest on the Money Man Radio Show, DEX-TV, routinely published in the some of the most widely-read financial publications and has been a marquee speaker at financial seminars around the world.

© 2009 Copyright Guy Lerner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Guy Lerner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.