Green Shoots Recovery Are a Mirage, Economy Will Deteriorate Further

Economics / Recession 2008 - 2010 Aug 13, 2009 - 07:36 AM GMTBy: Moses_Kim

If there's one thing you can bank on, it's that the public will be controlled by emotional whims rather than rational judgment. I do my best to lay out the facts, and whenever possible, support my claims with hard data. When the characteristics of the the data change, my outlook will as well.

If there's one thing you can bank on, it's that the public will be controlled by emotional whims rather than rational judgment. I do my best to lay out the facts, and whenever possible, support my claims with hard data. When the characteristics of the the data change, my outlook will as well.

Until then, I will report things as they are, not as I want them to be.

That being said, I see foreboding storm clouds in the horizon not unlike the storm clouds I perceived in 2007. I will lay out briefly why I feel the economy will deteriorate further.

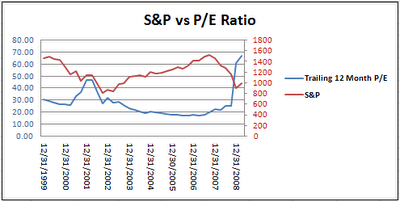

P/Es in the Stratosphere

In a sign of the crazy times we live in, P/E ratios at historically high levels are shrugged off by investors. Speculation is rife, and like in all bubbles, ridiculous P/E ratios are justified by unrealistic growth scenarios that will never materialize. Trailing 12 month P/E ratios are at 67, which implies fair value in the S&P is closer to 250 than 1000. The truth hurts, but 401ks are about to turn into 101ks.

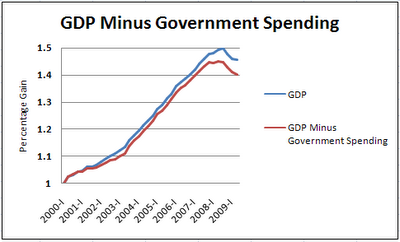

GDP Minus Government Spending Collapsing

The brouhaha resulting from improving GDP figures masks the inconvenient fact that without a 10% increase in government spending, GDP figures would have been disastrous. Although big government cheerleaders led by Paul Krugman will celebrate this development, the fact remains that you can't get something for nothing.

Debt-financed spending is not without cost; the costs are merely transferred to future generations. While the model of instant gratification has served us well, we are rapidly approaching the breaking point.

Below is a chart of GDP minus government spending. Note the growing role of government spending in GDP.

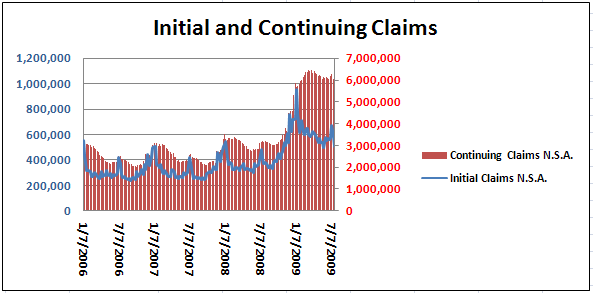

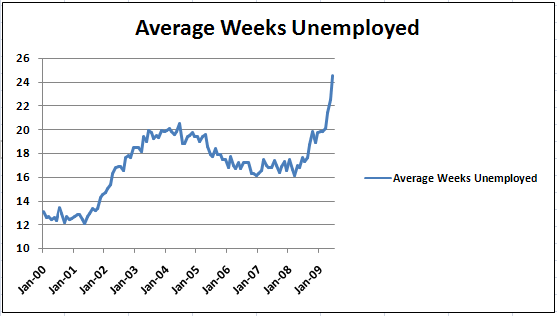

Unemployment Rising

The way the media report unemployment, most people probably think we have achieved an upturn in unemployment. However, only the rate of decline in job losses is improving. We are still shedding jobs at an unprecedented rate, which makes it hard for me to see how we will get out of this downturn after just 20 months.

The following charts of initial claims, continuing claims, and average weeks unemployed help bear out the extent of the unemployment crisis.

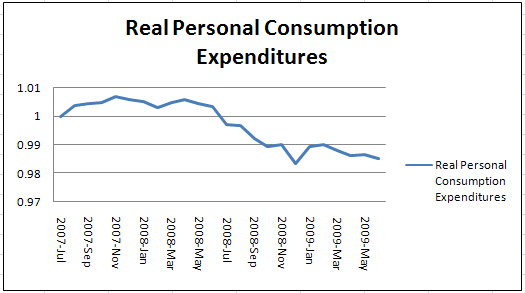

Consumer Spending Weak

No other indicator will give you a better idea of where we are headed than consumer spending, since consumption accounts for 70% of our economy. Even with stimulus checks from the government, consumers are retrenching at a rapid clip.

As long as the unemployment situation isn't addressed, consumer spending will continue to remain weak. Note that stimulus in May and June skewed numbers to the upside.

Any objective economic analysis will show that "green shoots" are just a mirage. We are approaching a major inflection point in the economy that will catch most people by surprise. Investors should exercise caution in the months and years ahead as sell-offs are likely to be brutal.

Don't be swayed by media hype; stay focused on the facts.

By Moses Kim

http://expectedreturns.blogspot.com/

Graduate of Columbia University with a B.A. in History. Student of the markets focused on long-term economic trends. I believe the markets are inefficient, and that these inefficiencies can be exploited to attain profitable returns.

© 2009 Copyright Moses Kim - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Fast Ben

07 Sep 09, 05:54 |

Debt Deflation

An economy built on DEBT is a false economy. |