Why did the U.S. Government Confiscate Gold in 1933 and Can It Happen Again?

Commodities / Gold & Silver 2009 Aug 14, 2009 - 01:00 PM GMT In this the second part of this series we look at the big global picture when President Roosevelt’s Administration confiscated the gold of U.S. citizens. Based on this part, in the next part we contemplate whether it can happen again.

In this the second part of this series we look at the big global picture when President Roosevelt’s Administration confiscated the gold of U.S. citizens. Based on this part, in the next part we contemplate whether it can happen again.

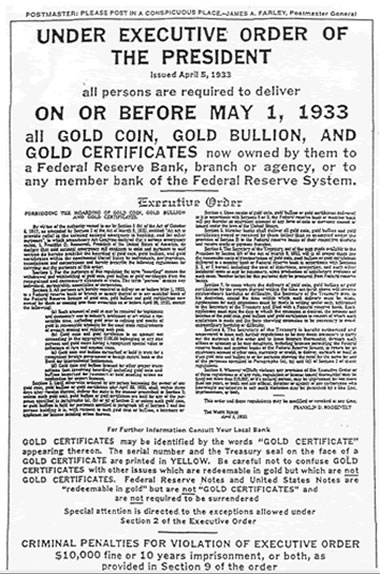

At the right you will see the actual executive order in which U.S. citizens lost the right to own gold. From May 1st 1933 until 1971, U.S. citizens could no longer hold gold as a protection against paper money, which also lost its gold backing at the same time.

At the right you will see the actual executive order in which U.S. citizens lost the right to own gold. From May 1st 1933 until 1971, U.S. citizens could no longer hold gold as a protection against paper money, which also lost its gold backing at the same time.

Foreign central banks could continue to exchange the U.S. dollars that came into their possession [known as Eurodollars for decades] for gold and did so particularly when the $ was devalued and then floated against the gold price in 1971.

Why?

The ‘why’ of it all, is critical to our understanding of the global monetary system now! There were two distinct phases to the process that began in 1933.

- The economic time period was as the great depression was coming to an end in the world. It was a time when Hitler came to power in Germany and that country turned on the growth taps with its war machine driving Germany out of its depression into a resurgence of that country ahead of the Second World War. It became clear to all that monetary turmoil was to continue. More money was needed to start and to fuel growth in the U.S. despite the fact that the traditional way of growing money [against real growth in the economy] would hold the world back for a considerable period of years still. With money tied to gold and the U.S. needing to fuel its money supply it appeared reasonable to increase the government’s stock of gold forcefully and dramatically. The first step was this order confiscating gold. All but rare gold coins were handed over to the government under the threat of a $10,000 fine or 10 years in prison. These threats were persuasive enough. U.S. citizens complied in full.

- Perhaps a mix of the need for an even larger increase in the money supply and the gathering war clouds persuaded the U.S. government to go further still and revalue gold by a full 75%. Remember, it was still gold that was money plus the I.O.U.’s issued

against it [see the notes illustrated here]. [You can enlarge it by pulling the corner dot when you click on the note]. The U.S. $ as we have now is not any form of I.O.U., it can only be changed for another $ and has not backing whatsoever, except in our mind’s eye. So any expansion of money supply had to be against an increasing stock of gold. In the event of war it was clear to the Allies that the U.S. would be the best place to hold their gold too. [One of the war tactics is to forge your enemy’s money and cause a monetary breakdown in his ranks too.] So in 1935 the dollar was devalued from $20 to one ounce of gold down to $35 to one ounce of gold [one has to wrap your mind round the idea that the $ was measured by gold not gold by the $]. Remember too that it was a world of fixed exchange rates only. No exchange rates floated, or were devalued or revalued. It would take another 35 years before this changed! The expansion in the money supply that this caused combined with the war preparations caused a huge U.S. growth and brought back the days of prosperity to the States [who became suppliers of goods to the world from then on for the next 35 year and more].

against it [see the notes illustrated here]. [You can enlarge it by pulling the corner dot when you click on the note]. The U.S. $ as we have now is not any form of I.O.U., it can only be changed for another $ and has not backing whatsoever, except in our mind’s eye. So any expansion of money supply had to be against an increasing stock of gold. In the event of war it was clear to the Allies that the U.S. would be the best place to hold their gold too. [One of the war tactics is to forge your enemy’s money and cause a monetary breakdown in his ranks too.] So in 1935 the dollar was devalued from $20 to one ounce of gold down to $35 to one ounce of gold [one has to wrap your mind round the idea that the $ was measured by gold not gold by the $]. Remember too that it was a world of fixed exchange rates only. No exchange rates floated, or were devalued or revalued. It would take another 35 years before this changed! The expansion in the money supply that this caused combined with the war preparations caused a huge U.S. growth and brought back the days of prosperity to the States [who became suppliers of goods to the world from then on for the next 35 year and more].

Gold Travels to the States.

This had an international effect because, for either ignorance or willing compliance by foreign governments, they did not devalue their currencies against gold at the same time, in 1935. So a gold dealer could buy gold at the old price of $20 outside the U.S., in foreign currencies sell it to the U.S. for $35 an ounce. Gold up and left the developed world and headed to Fort Knox very quickly making the Bullion Bankers very happy indeed. That’s how the states managed to acquire over 26,000 tonnes of gold ahead of the outbreak of war in Europe in 1939.

The post war monetary system called the Bretton-Woods system still had gold in the background behind currencies, but U.S. individuals were not allowed to enjoy this security. European could and did enjoy access to gold and gold bonds [such as the Rente Pinot and the Rente Giscard in France] and still do. But it was not until 1971 that U.S. citizens could own gold privately again.

The fact that it has happened before makes it possible that it can happen again! It is wise to make sure that you are not vulnerable to such an act.

We will look at this in more detail in a later part of the series. To ensure you get the entire series, please subscribe to Gold Forecaster through: - www.GoldForecaster.com

These are the titles in the next part: -

These are the titles in the next part: -

The $ replaces Gold

Gold is Money no more.

Can Gold confiscation happen again?

Gold Forecaster regularly covers all fundamental and Technical aspects of the gold price in the weekly newsletter. To subscribe, please visit www.GoldForecaster.com

![]()

By Julian D. W. Phillips

Gold-Authentic Money

Copyright 2009 Authentic Money. All Rights Reserved.

Julian Phillips - was receiving his qualifications to join the London Stock Exchange. He was already deeply immersed in the currency turmoil engulfing world in 1970 and the Institutional Gold Markets, and writing for magazines such as "Accountancy" and the "International Currency Review" He still writes for the ICR.

What is Gold-Authentic Money all about ? Our business is GOLD! Whether it be trends, charts, reports or other factors that have bearing on the price of gold, our aim is to enable you to understand and profit from the Gold Market.

Disclaimer - This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Gold-Authentic Money / Julian D. W. Phillips, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; Gold-Authentic Money / Julian D. W. Phillips make no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold-Authentic Money / Julian D. W. Phillips only and are subject to change without notice.

Julian DW Phillips Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.