Key Asset Category Stock Trend Lines Regression Analysis

Stock-Markets / Sector Analysis Aug 16, 2009 - 11:10 AM GMTBy: Richard_Shaw

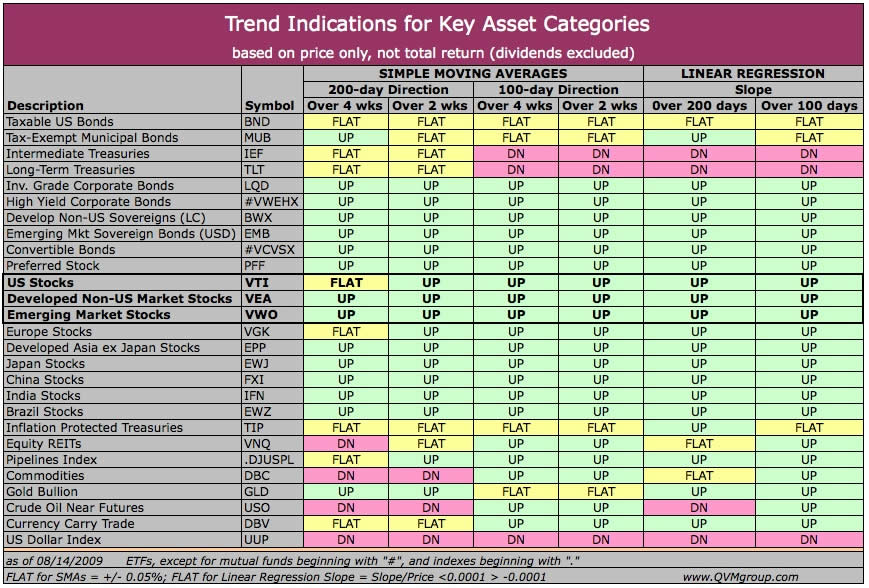

Here are the simple moving average directions and linear regression slopes for 200-days and 100-days for representative funds or indexes for twenty-seven key asset categories that we follow closely.

Overall, we find this data encouraging.

Of course, this information doesn’t say they will be no retracement, but certainly a preponderance of upward trends is more encouraging than a preponderance of downward trends.

The fear factor has clearly receded (down trend in Treasuries and the Dollar are good examples of that), and the risk appetite has clearly returned for now (strong performance of below investment grade bonds relative to investment grade bonds, and strong performance of emerging market debt, are good examples of that). The inter-market indications merely support the obvious, which is that a broad spectrum of stock indexes are no longer trending down.

We are fully invested at this time in all but our real asset and commodities allocations, having gone through a staged re-risking process after exiting the markets in July of 2008. We are partially reinvested in commodities and real assets at this time. We seek to limit catastrophic risk with persistent trailing stop loss orders on each position.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2009 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.