U.S. Housing Market Hidden Backlog of Foreclosures

Housing-Market / US Housing Aug 21, 2009 - 04:15 AM GMTBy: Mike_Shedlock

When it comes to foreclosures, there is no such thing as a "safe state". Even states that did not engage in widespread use of liar loans and other silly mortgage lending practices are struggling with foreclosures. The issue is jobs, and unemployment is rising everywhere.

When it comes to foreclosures, there is no such thing as a "safe state". Even states that did not engage in widespread use of liar loans and other silly mortgage lending practices are struggling with foreclosures. The issue is jobs, and unemployment is rising everywhere.

Please consider Foreclosure Woes Spread To Areas Once Thought Safe.

Amid record levels of home foreclosures nationwide, there are worrying signs that the foreclosure crisis could be spreading to parts of the country that had previously been relatively unscathed.

Last month, for example, RealtyTrac, a private firm that tracks foreclosure data, recorded sharp spikes in foreclosures in states like Idaho, Oregon, Utah, and Illinois, where the prolonged recession is cited as the culprit.

"It surprised us when we went from a state with a low level of subprime lending to a state with a high level of foreclosures," says Gerry Mildner, the director of the Center for Real Estate at Portland State University. "Most of our problems have to do with unemployment rather than with toxic loans.

RealtyTrac's Sharga points to several other states that have seen alarming jumps in unemployment, including Kentucky, Alabama and North and South Carolina.

"We won't know what the impact of these rises in unemployment will be until a year from now," says Sam Khater, a senior economist with First American CoreLogic, a private real estate data firm.

What worries Khater more are states where sharply rising unemployment is coupled with many homeowners who already owe more than their houses are worth. He points to states like Ohio, Georgia and Illinois. Home prices in Illinois, for example, fell 14.8 percent in June compared with a year earlier. "Their price decline has been accelerating," he says.

The actual foreclosure rates are hard to predict in part because a number of state governments, along with federal government-sponsored Fannie Mae and Freddie Mac, have instituted a range of delays and moratoriums on foreclosures.

"The government has a pretty big chokehold on the foreclosure process," says Madeline Schnapp, the director of macroeconomic research at TrimTabs Investment Research. But that also means that there is a hidden backlog of home loans in default that could end up in foreclosure.

Moody's Economy.com estimates that lenders will foreclose on 1.89 million homes in 2009, up from 1.43 million last year.RealtyTrac's Sharga says "We don't see much improvement until 2011." With that, mainsteam thought is staring to approach the 2102 possible bottom I suggested two years ago. At the time, no one thought home prices would fall for this long. Perhaps I will turn out to be an optimist.

TransUnion: Mortgage Delinquencies Still Rising

Delinquencies are a leading indicator of foreclosures and Mortgage delinquency rates are still rising.

TransUnion released the results of its analysis of trends in the mortgage industry for the second quarter of 2009 and the associated impact on the U.S. consumer.

The report showed that mortgage loan delinquency (the ratio of borrowers 60 or more days past due) increased for the tenth straight quarter, hitting an all-time national average high of 5.81 percent for the second quarter of 2009, an 11.3 percent increase from the first quarter rate. This is an indication we still have a ways to go before we see the foreclosure rate return to something more normal.

TransUnion’s forecasts indicate the 2009 mortgage delinquency rates continuing to climb at a slower pace, reaching less than 7 percent by year end. However, due to a continued downward trend in housing prices throughout the year as well as high unemployment levels, TransUnion does not see national delinquency rates beginning to fall until the first half of 2010.MBA Survey: Delinquencies Continue To Climb

The latest MBA National Delinquency Survey also shows Delinquencies Continue to Climb.

The delinquency rate for mortgage loans on one-to-four-unit residential properties rose to a seasonally adjusted rate of 9.24 percent of all loans outstanding as of the end of the second quarter of 2009, up 12 basis points from the first quarter of 2009, and up 283 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate includes loans that are at least one payment past due but does not include loans somewhere in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the second quarter was 4.30 percent, an increase of 45 basis points from the first quarter of 2009 and 155 basis points from one year ago. The combined percentage of loans in foreclosure and at least one payment past due was 13.16 percent on a non-seasonally adjusted basis, the highest ever recorded in the MBA delinquency survey.

The seasonally adjusted delinquency rate increased 35 basis points for prime loans (from 6.06 percent to 6.41 percent), 40 basis points for subprime loans (from 24.95 percent to 25.35 percent), and 58 basis points for FHA loans (from 13.84 percent to 14.42 percent), but decreased 15 basis points for VA loans (from 8.21 percent to 8.06 percent).Florida Worst State In Nation

Florida wins the dubious honor of being the worst state in the nation. A massive Twenty-three percent of home loans in Florida are past due or in foreclosure in the second quarter of this year. For more details please see Florida foreclosures on rise.

As home prices fell and the job picture worsened, the percentage of Florida home loans either past due or in foreclosure hit 23 percent in the second quarter, outpacing any other state in the nation.

The figure represents 807,000 loans, a staggering sum of the roughly 3.5 million mortgages outstanding in Florida.

"Florida deserves special mention as the worst state in the country," said Jay Brinkmann, chief economist of the Mortgage Bankers Association that released the numbers Thursday. "Nevada is a close second, but everyone else is far behind."Delinquencies and Foreclosures by State

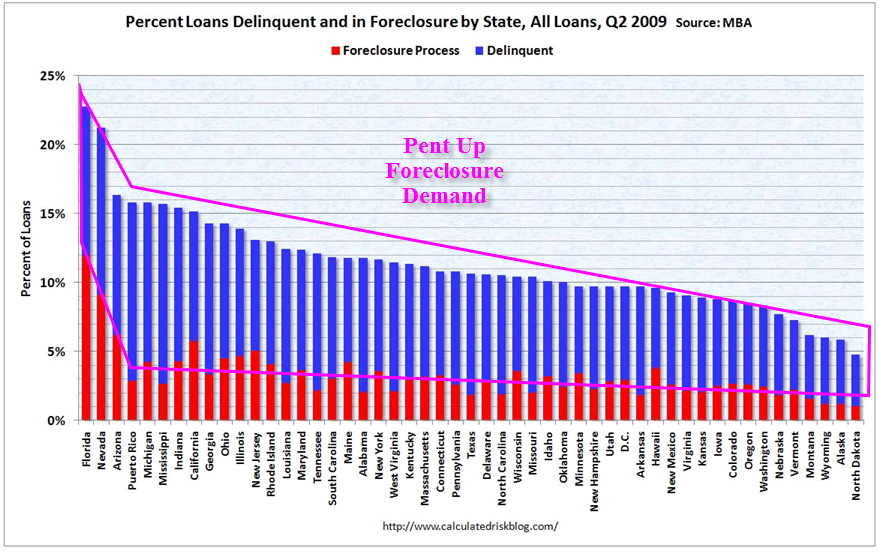

Calculated Risk has an excellent chart showing state by state totals in his post MBA Forecasts Foreclosures to Peak at End of 2010.

Annotations in hot pink are mine.

Pent-Up Foreclosure Demand

The area in pink represents potential foreclosure demand. Not all of that area will be foreclosed, but some of it sure will. The "Hidden Backlog" mentioned above (and highlighted in red) is within that pink area.

One thing missing from the chart is pent-up demand from those who are not delinquent yet have a huge incentive to walk because of massive negative equity.

For a look at "negative equity", moratoriums, and other foreclosure issues please see Brace for a Wave of Foreclosures, the Dam is About to Break.

TransUnion thinks national delinquency rates will begin to fall in the first half of 2010. I doubt it. Delinquencies and unemployment go hand in hand and unemployment rate is both high and rising discounting the ridiculous drop in the participation rate last month (See Jobs Contract 19th Straight Month; Unemployment Rate Inches Lower to 9.4% for details).

Moreover the unemployment rate is likely to keep rising for at least another year after the official end of the recession. Many hoping to hang on will get wiped out at the very bottom. That unfortunately is the way it has to be.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.