Gold $1000 or Bust

Commodities / Gold & Silver 2009 Aug 25, 2009 - 07:54 AM GMTBy: Howard_Katz

Listen carefully, dear gold bug. You are living in a world which is insane. All around you are the incredibly stupid people who, in the past, believed that the earth was flat and that one could fly by standing on a magic carpet. From every source of opinion comes the 21st century version of those beliefs.

Listen carefully, dear gold bug. You are living in a world which is insane. All around you are the incredibly stupid people who, in the past, believed that the earth was flat and that one could fly by standing on a magic carpet. From every source of opinion comes the 21st century version of those beliefs.

Above is the 10 year chart of the CRB index. Let us consider the subjects of fact and opinion:

Fact: The CRB has been going up for the past 10 years and is now more than double its level of late 2001.

Opinion: All of the economic authority figures are screaming at the top of their lungs that we are in a period of “deflation” (by which they mean that prices are going down). Perhaps you remember the Wall Street Journal editorial and op-ed pages in 2001. They were screaming “deflation” in article after article. They were especially focused on commodity prices.

If you listened to the Wall Street Journal at that time, you certainly did not buy gold or any other commodity. Perhaps you bought stocks, perhaps some internet stocks on the NASDAQ. If you did, then let me inform you that, while the WSJ was telling you that prices were going down, it put its own news-stand price up (by 33%). Don’t they know that, when a businessman lowers his price, he sells more product, and in a general period of price decline (e.g., 1866-1896), one makes bigger profits by lowering the price to the consumer? This was how John D. Rockefeller made his fortune. He kept lowering the price of kerosene. Perhaps this is why they call him a robber baron.

More Opinion: More recently, it has been the New York Times which has told us that general prices are coming down. They were not so forward as to use the word “deflation.” Rather they used circumlocutions, such as “financial crisis” or “Great Recession.” But everyone understood what they meant. In just seven trading days in early October last year, the DJI dropped by almost 3,000 points. Commodities dropped, stocks dropped. There was a rush to buy dollars and fixed instruments, and this rush was called a flight to safety.

Can you imagine this? Here were a mass of people rushing to commit financial suicide, and it was called “FLIGHT TO SAFETY.”

The truth about the “financial crisis” of 2008 will soon be revealed to everyone who is honest and not afraid to call a spade a spade. One day in late summer ’08, Henry Paulson ran screaming to George Bush. “Financial crisis, financial crisis, the sky is falling.” President Bush, who was pretty good on foreign policy but had no sense of economics, believed him and declared a financial crisis. The “crisis” would later turn out to be a crisis for Goldman Sachs, Paulson’s old firm.

Then the New York Times, which never tired of telling us how stupid President Bush was, believed his every word. And the three together, Paulson, Bush and the NYT ran around shouting, “financial crisis, financial crisis, the sky is falling.”

You know what happened then, dear gold bug, every newspaper, news magazine or TV or radio show began to shout “recession, depression.” And in the middle of this forecast of a coming severe decline in prices, the Times RAISED its news stand price (by 33%)

And then, dear gold bug, when all was said and done, $750 billion was stolen from the working people of America and given a group of Wall Street firms which owed money to Goldman Sachs and otherwise would not be able to pay. That was the only crisis. The real crisis of 2008 was that Goldman Sachs would have to eat some of its bad loans.

And now, dear gold bug, I want to ask what you think is happening to the economy. Study the chart of the CRB index. Remember that consumer prices do not go up because of cost-push “inflation.” There is no such thing as cost-push “inflation.” “Cost-push inflation” means that first wages go up. This raises costs for business, and they are forced to raise their prices. The only problem with this is that IT HAS NEVER HAPPENED IN HISTORY. Always the money supply increases first, then prices increase second and finally wages increase third. Businessmen are not forced to raise their prices by rising labor costs. The demand from the final consumer (who has more money in his hands from the increase in the money supply) pulls prices up. If we happen to be in an upswing in the commodity pendulum (as we are at present), then this demand pull is especially strong, and we can easily see the rise in commodity prices before the rise in consumer prices.

So, take a look at the CRB index above. Is it going up or going down?

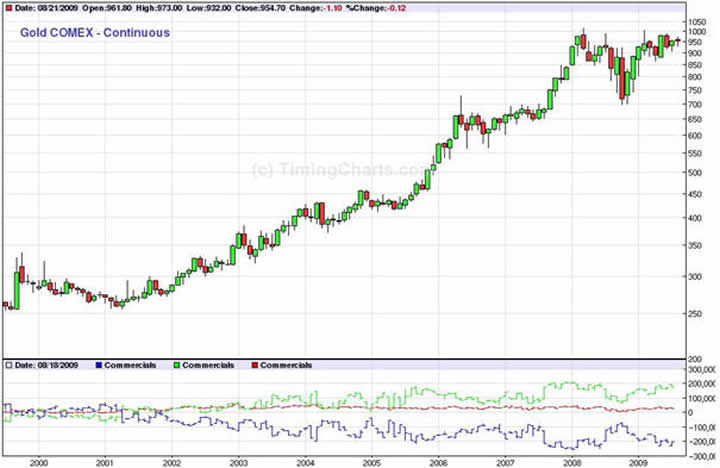

Yes, it is going up. Now you have used your own common sense, and this has made you smarter than the Wall Street Journal, the New York Times and pretty much everyone with a title in the field of economics. And if there is any question in your mind, take a look at the following chart of the price of gold and answer the same question: up or down? Remember that gold is representative of commodities in general. However, it is more user friendly because it is well-traded and is less volatile than most other commodities.

So what is gold, the representative commodity, doing? Is it going up or down? Yes, the answer is that simple. Gold is going up. Why then are a few months decline (which in gold have already been recovered) permitted to outweigh ten years of price action? Isn’t it clear that we had a simple case of an intermediate reaction interrupting a long term price advance? Isn’t every long term advance interrupted by such minor declines? Where is the “crisis?”

“But wait,” Mr. Katz. “It couldn’t be as simple as you are making it sound. If it were that simple, then why are all those experts saying the opposite? Why is Bernanke saying that he personally has just slain the dragon of a Second Great Depression? Could all of those economics professors and commentators and officials, all of them, be wrong? Why are you going against all those respected authorities?”

Well, I have been going against respected authorities since 1955 (the year I entered Harvard). In that year, one of the economic professors went down to Washington, D.C. and told the country that we were on the verge of another 1929. This professor, John Kenneth Galbraith, was a crackpot. He was awarded his chair of economics at Harvard because he was a whore for the bankers, who had recently acquired a privilege which was akin to legal counterfeiting, the privilege to create money out of nothing. Now the bankers needed to convince the country that printing money would make the country wealthy, that it was the road to plenty. So they bribed Harvard. (They didn’t call it a bribe, of course.) And you are impressed with the name of Harvard and the big fancy title, you and the rest of the country. So you believed. And as soon as you believed, the bankers were able to steal your wealth.

Don’t you get it? If anyone is trying to con you or cheat you or steal from you, then he has to appeal to something that you (and most everyone else) will believe. So he needs to get some big institution with a lot of respect on his side. There are always such institutions in any society ready to sell out. The founders of the institution, many generations ago, won the public respect by many years of hard work, solid ability and integrity. But as time passes, control is taken over by a new breed which is willing to betray its old reputation for ready cash on the barrelhead.

When I went to Harvard in 1955, I did not buy the economics they were teaching. I was a “bad” boy. I decided to study economics on my own. I found real economists from whom to learn, economists whose theories worked in reality. Meanwhile Galbraith made a fool out of himself. The stock market did not crash after his 1955 statement. Indeed, it turned and ran up from DJI 400 to DJI 1000 over the next 11 years. Then I went out into the world. I predicted the rise in gold from $35/oz. to $875/oz. over the 1970s and caught the gold top on Jan. 21, 1980. I predicted the grand cycle bull market in stocks in 1982. I predicted the crash of Oct. 1987 but turned bullish again the day after. I played the internet bubble of 1999 but sold out my Yahoo in January 2000. And I turned bullish on gold once again in Dec. 2002. Meanwhile all of the self-anointed “experts” with impressive titles were making fools of themselves as their predictions went awry one after the other.

So you can go with me (and a few other independent-minded gold bugs), or you can go with the establishment. You can believe on the basis of reasoned argument or long titles. Whether you succeed or fail will be up to you.

For example, look at the above chart of gold. Doesn’t it seem that gold is going up in almost a straight line? When it gets too far away from its line, it has to have a pull back, as it did in May 2006. Again, in March 2008 gold both got too far from its line and simultaneously hit the round number of 1,000. That is why it has been moving sideways since March ’08.

Think of this! All those people selling gold because it hit a round number! They are like children. Much of the selling over the past 18 months has been based on thinking no more complex than that. You can beat these markets. The people against whom you are trading just are not that smart.

To take another example, the cash for clunkers program is much in the news these days. The Government steals wealth from some of the hard working people of the society and gives it out like lollipops to any passer-by, on the condition that they destroy their cars. The result is that the quantity of cars in the country is reduced. All the economic authority figures tell us that this is stimulating the economy (i.e., making us richer). F.D.R. did the same thing in the 1930s. He put in a program to kill pigs and plow under crops. The same newspapers you rely on tell us that this was a wonderful measure which helped bring the country out of depression. The theory behind both the pig killing and the car trashing was started by John Maynard Keynes, who said:

“Pyramid-building, earthquakes, even wars may serve to increase wealth….”

John Maynard Keynes, The General Theory of Employment,

Interest and Money, (New York, Harcourt Brace, 1964), p. 129.

These are the idiots who are running our society. You have to close your ears to them and go according to what works. I publish a newsletter, the One-handed Economist ($300/year), which analyses the markets. Right now I am a gold bug, true and blue. I expect gold to start to move after Labor Day and for $1,000 to topple soon thereafter. If you are interested in learning real economics, then check out my web site, www.thegoldspeculator.com. If you want some good economic thinking at no cost, visit my blog site, www.thegoldspeculator.blogspot.com.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.