Peak Oil, Crude Oil Supply Data Doesn't Lie

Commodities / Crude Oil Aug 26, 2009 - 01:09 AM GMTBy: Puru_Saxena

ENERGY - After the epic crash last year, the price of oil is stabilising and it should rise exponentially over the following years. Over the past year, global consumption has stayed weak, however once the economy recovers, crude oil should resume its secular bull-market.

ENERGY - After the epic crash last year, the price of oil is stabilising and it should rise exponentially over the following years. Over the past year, global consumption has stayed weak, however once the economy recovers, crude oil should resume its secular bull-market.

Despite the 'demand destruction' hype, it is interesting to note that during this severe global recession, worldwide oil usage has dropped by a minuscule 2.7%. So, what will happen when the world comes out of this recession? Who will rise up to the challenge and meet our insatiable thirst for energy? These are critical questions not many are willing to ask.

According to the US Department of Energy, liquid fuel demand in the developed nations peaked in August 2005 at 41.89 million barrels per day. Since then, it has plunged by 3.6 million barrels per day to 38.27 million barrels per day. However, you may want to note that despite these tough economic conditions, consumption has been extremely resilient in the emerging world. For instance, demand in the developing countries peaked in October 2008 at 46.33 million barrels per day and it is down by only 0.36 million barrels per day! I don't know about you but I am amazed that the worst global recession in decades has barely managed to shrink energy demand in the developing world. Whilst this is wonderful news for the energy investor, it is a terrible sign for society.

At present, our world is using up roughly 84 million barrels of liquid fuels per day and for the moment at least, there is sufficient supply to meet demand (Figure 1). However, when economic activity picks up, it won't take much for demand to zip right past supply. Remember, it is much easier to increase usage, but it takes a long time to ramp up production. So, unless this is a permanent global recession (which I doubt), it is inevitable that the price of oil will go up significantly over the medium to long-term.

Figure 1: Supply and demand - balanced for now

Source: www.yardeni.com

On the supply side of the equation, let me be clear. If I was asked to pick the biggest threat to a sustainable economic recovery, 'Peak Oil' would top that list. Remember, 'Peak Oil' doesn't mean that we are running out of oil reserves, crude will be around for decades. However, 'Peak Oil' does imply that we are dangerously close to peak global oil production. 'Peak Oil' also means that rather than experiencing a burst in oil supplies as many expect, from here onwards, we will witness sharp declines in global flow rates. In a nutshell, the era of cheap energy is over and the price of crude oil will rocket higher over the coming decade.

Now, many skeptics will argue that if 'Peak Oil' was real, the price of oil wouldn't have dropped to roughly US$30 per barrel in last autumn's stunning crash. Valid point; but let us not forget that the spectacular plunge occurred at a time when global economic activity virtually came to a standstill. Let us also keep in mind that last autumn's crash in asset prices was caused by a total freeze in credit and the associated asset liquidation. Whilst I agree that the final action in crude oil's parabolic blow-off last July smacked of speculation, I can assure you that speculation alone couldn't have created a multi-year boom whereby the price of crude oil went up by almost 1500%! As you can see from Figure 1 above, supply clearly fell short of demand between 2005 and 2008 and this is why we had a magnificent bull-market in crude oil.

Make no mistake, global demand for liquid fuels will rise again and if my homework is correct, supply won't be able to keep up. If you ignore the noise and review hard data, you will observe that the vast majority of the world's most prolific oil provinces are now past peak production and in a state of permanent depletion. According to the BP Statistical Review of World Energy, out of the 54 oil producing nations and regions in the world, only 14 are still increasing production. Alarmingly, 30 oil producing nations and regions are definitely past their peak output and the remaining 10 appear to have modestly declining production rates. Put another way, when weighted by production, 'Peak Oil' is already a grim reality in 61% of the oil producing world!

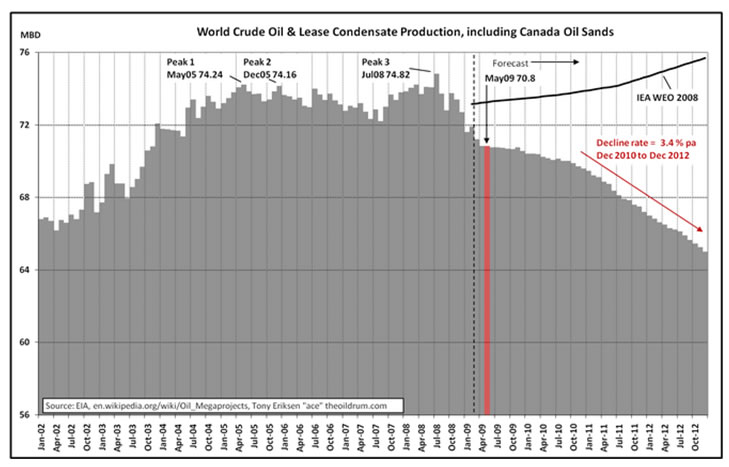

Still not convinced about 'Peak Oil'? Then review Figure 2 which charts the expected combined flow rates for crude oil, lease condensates and Canadian Oil Sands. As you can see from the grey shaded area, production is about to decline by roughly 5 million barrels per day by 2012.

Figure 2: Has crude oil production peaked?

Source: The Oil Drum

Ironically, Figure 2 also plots the optimistic (almost laughable) forecast made by the International Energy Agency (IEA) in its "World Energy Outlook 2008". Interestingly, in last year's "World Energy Outlook", the IEA stated that in order to fulfil its optimistic projections, the world had to install 64 million barrels per day of new supply by 2030 or the equivalent of six times the Saudi Arabian output! Furthermore, the IEA declared that the energy industry had to invest hundreds of billions of dollars every year to achieve this favourable outcome.

Now, I can understand that the IEA is a government funded agency so it has to paint a rosy picture, but it is ominous that the energy watchdog failed to mention where this surplus oil would come from!

Well, I guess you get the idea. Global crude oil production has probably peaked, new discoveries have dried up and there is a shortage of capital for investment purposes. Apart from these factors, if you believe the energy optimists, all is well in the energy industry and the price of oil is about to drop to zero!

After years of extensive research, I have no doubt in my mind that unless global demand stays weak forever, we will see supply shortages in the not too distant future. And before that occurs, the price of crude oil will stage an explosive rally. Accordingly, I suggest that all my readers allocate a large proportion of their investment portfolio to upstream energy companies and to businesses in the energy services sector.

Finally, in the energy complex, the price of natural gas is still scraping along its recent crash low and this is a fantastic long-term investment opportunity. As we approach winter in the Northern Hemisphere and heating demand picks up, we are likely to see a big rally in the price of natural gas. So, investors may want to allocate capital to this unbelievably inexpensive commodity.

Puru Saxena publishes Money Matters, a monthly economic report, which highlights extraordinary investment opportunities in all major markets. In addition to the monthly report, subscribers also receive “Weekly Updates” covering the recent market action. Money Matters is available by subscription from www.purusaxena.com.

Puru Saxena

Website – www.purusaxena.com

Puru Saxena is the founder of Puru Saxena Wealth Management, his Hong Kong based firm which manages investment portfolios for individuals and corporate clients. He is a highly showcased investment manager and a regular guest on CNN, BBC World, CNBC, Bloomberg, NDTV and various radio programs.

Copyright © 2005-2009 Puru Saxena Limited. All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.