Credit Crisis Bailouts Mean Survival Of The Biggest Banks

Companies / Credit Crisis 2009 Aug 30, 2009 - 09:42 AM GMTBy: Mike_Shedlock

On account of Fed sponsorship, Banks 'Too Big to Fail' Have Grown Even Bigger.

On account of Fed sponsorship, Banks 'Too Big to Fail' Have Grown Even Bigger.

When the credit crisis struck last year, federal regulators pumped tens of billions of dollars into the nation's leading financial institutions because the banks were so big that officials feared their failure would ruin the entire financial system.

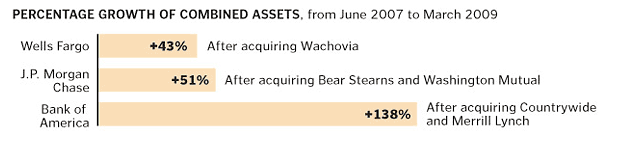

Today, the biggest of those banks are even bigger.

J.P. Morgan Chase, an amalgam of some of Wall Street's most storied institutions, now holds more than $1 of every $10 on deposit in this country. So does Bank of America, scarred by its acquisition of Merrill Lynch and partly government-owned as a result of the crisis, as does Wells Fargo, the biggest West Coast bank. Those three banks, plus government-rescued and -owned Citigroup, now issue one of every two mortgages and about two of every three credit cards, federal data show.

"It is at the top of the list of things that need to be fixed," said Sheila C. Bair, chairman of the Federal Deposit Insurance Corp. "It fed the crisis, and it has gotten worse because of the crisis."

Fresh data from the FDIC show that big banks have the ability to borrow more cheaply than their peers because creditors assume these large companies are not at risk of failing. That imbalance could eventually squeeze out smaller competitors. Already, consumers are seeing fewer choices and higher prices for financial services, some senior government officials warn.

Officials waived long-standing regulations to make the deals work. J.P. Morgan Chase, Bank of America and Wells Fargo were each allowed to hold more than 10 percent of the nation's deposits despite a rule barring such a practice. In several metropolitan regions, these banks were permitted to take market share beyond what the Department of Justice's antitrust guidelines typically allow, Federal Reserve documents show.

"There's been a significant consolidation among the big banks, and it's kind of hollowing out the banking system," said Mark Zandi, chief economist of Moody's Economy.com. "You'll be left with very large institutions and small ones that fill in the cracks. But it'll be difficult for the mid-tier institutions to thrive."

"The oligopoly has tightened," he added.

Last October, when the Fed was arranging the merger between Wells Fargo and Wachovia, it identified six other metropolitan regions in which the combined company would either exceed the Justice Department's antitrust guidelines or hold more than a third of an area's deposits. But the central bank thought local competition in each of those places was sufficient to allow the merger to go through, documents show.

Camden Fine, president of the Independent Community Bankers of America, said those comments reveal the government's preferential treatment of big banks. He doubted whether the Fed would approve the merger of community banks if the combined company ended up controlling more a third of the market.

"To favor one class of financial institutions over another class skews the market. You don't have a free market; you have a government-favored market," he said. "We will never have free markets again if you have the government picking winners and losers."

At times Shelia Bair seems to have a clue, other times not. Judging from her comment on too big to fail: "It fed the crisis, and it has gotten worse because of the crisis", she once again shows signs of intelligent thought.

There's lots more to see in the article including a link to charts showing Residential Mortgage and Bank Deposit Market Share.

For more on how too big to fail is creating winners and loses, please see Tale of Two Economies.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.