Subprime Mortgage Problems Quarantined? Ask the Home Builders

Housing-Market / US Housing Jun 19, 2007 - 09:01 AM GMTBy: Paul_L_Kasriel

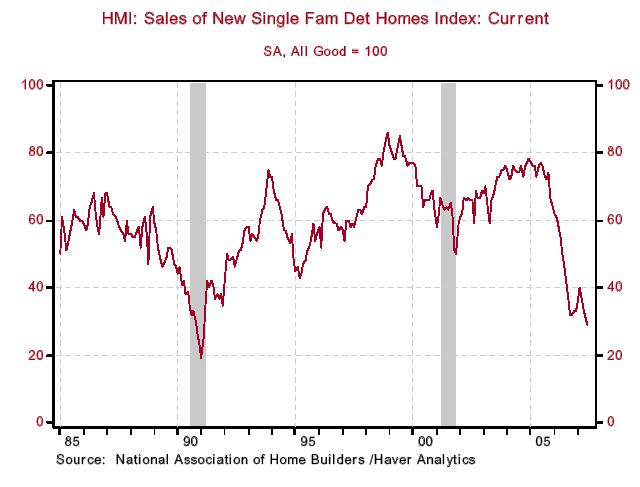

The National Association of Home Builders (NAHB) index of current sales of new single-family homes edged down a tick to 29 in the June survey, the lowest reading for this housing cycle and the lowest reading since early 1991 (see Chart 1). Why? I will let David Seiders, the NAHB's chief economist, tell you in his own words: "It's clear that the crisis in the subprime sector has prompted tighter lending standards in much of the mortgage market, and interest rates on prime-quality home mortgages have moved up considerably during the past month along with long-term Treasury rates."

The National Association of Home Builders (NAHB) index of current sales of new single-family homes edged down a tick to 29 in the June survey, the lowest reading for this housing cycle and the lowest reading since early 1991 (see Chart 1). Why? I will let David Seiders, the NAHB's chief economist, tell you in his own words: "It's clear that the crisis in the subprime sector has prompted tighter lending standards in much of the mortgage market, and interest rates on prime-quality home mortgages have moved up considerably during the past month along with long-term Treasury rates."

The president of the NAHB, Brian Catalde, a home builder from El Segundo, California, added some flavor: "Builders continue to report serious impacts of tighter lending standards on current home sales as well as cancellations, and they continue to trim prices and offer a variety of non-price incentives to work down sizable inventory positions." The June drop in the homes-sold index marks the fourth consecutive monthly decline. If May housing starts, which will be reported tomorrow, are not down sharply, then there will be about as much disconnect from reality in the housing starts data as there is in the retail sales data.

Chart 1

Liquidity Slowing?

It sure is with regard to how much U.S commercial banks are providing of late. Adjusted by the CPI, the year-over-year change in U.S. total bank credit (loans and investments) hit a recent peak of about 9% in October 2006. As of May, that year-over-change had slowed to about 4.8% (see Chart 2). As mortgage defaults continue to rise and regulators issue new more restrictive mortgage lending "guidelines," bank credit growth is likely to slow still more. And goodness knows what will happen if a few of the private equity loan deals sour.

Chart 2

By Paul L. Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2007 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.