Strengthening Yen Spells Trouble for the Carry Trade and S&P500

Stock-Markets / Yen Carry Trade Sep 02, 2009 - 02:01 AM GMTBy: Donald_W_Dony

The Yen Carry Trade has provided an enormous source of capital for traders around the world. The strength or weakness of the Japanese currency played a vital role during the last bull market and the present bear equity down turn. Though the longer-term picture for the Yen appears favourable for a continuation of the carry trade, the recent month-over-month relationship between the S&P 500 and the Yen is turning against the index.

The Yen Carry Trade has provided an enormous source of capital for traders around the world. The strength or weakness of the Japanese currency played a vital role during the last bull market and the present bear equity down turn. Though the longer-term picture for the Yen appears favourable for a continuation of the carry trade, the recent month-over-month relationship between the S&P 500 and the Yen is turning against the index.

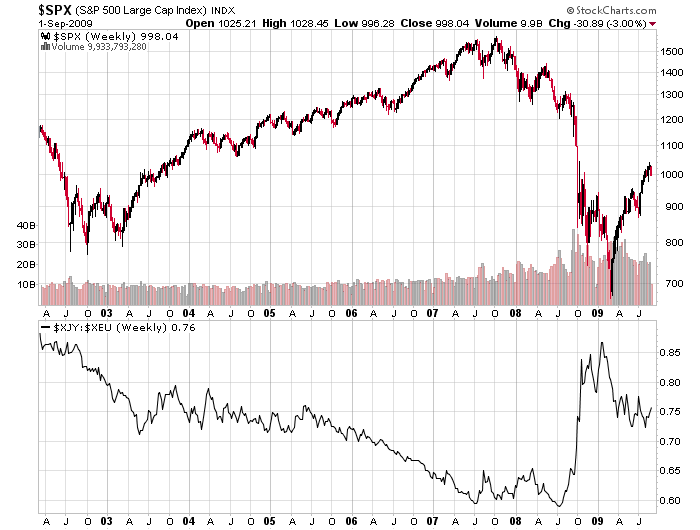

The Yen/Euro cross (lower portion of the Chart 1) has a tight correlation to the broad-based S&P 500. Longer-term models (Chart 2) illustrate the actions of the lower performing Yen and the subsequent movement of the S&P 500 from 2002.

With the peak in the currency cross in early 2009, and the overall pattern this year, still supports additional base-building for stocks (see the July 3rd report: http://www.technicalspeculator.com..). However, the outlook for an extension of the present advance for the S&P 500 is rapidly diminishing. Models are indicating that the Yen should be favourable into November. Historical data implies weakness can therefore be anticipated for the S&P 500.

Bottom line: The rising Yen is normally negative for stocks. Models indicate that the S&P 500 should progress lower for the next two months and the current trend of the Yen to continue.

Additional data and research will be available in the September newsletter.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2009 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.