One Sixth Of All Construction Loans In Trouble

Companies / Credit Crisis 2009 Sep 06, 2009 - 12:51 AM GMTBy: Mike_Shedlock

The New York Times has an interesting article about construction loans that Inquiring minds will want to read. Please consider Construction Loans Falter, a Bad Omen for Banks.

The New York Times has an interesting article about construction loans that Inquiring minds will want to read. Please consider Construction Loans Falter, a Bad Omen for Banks.

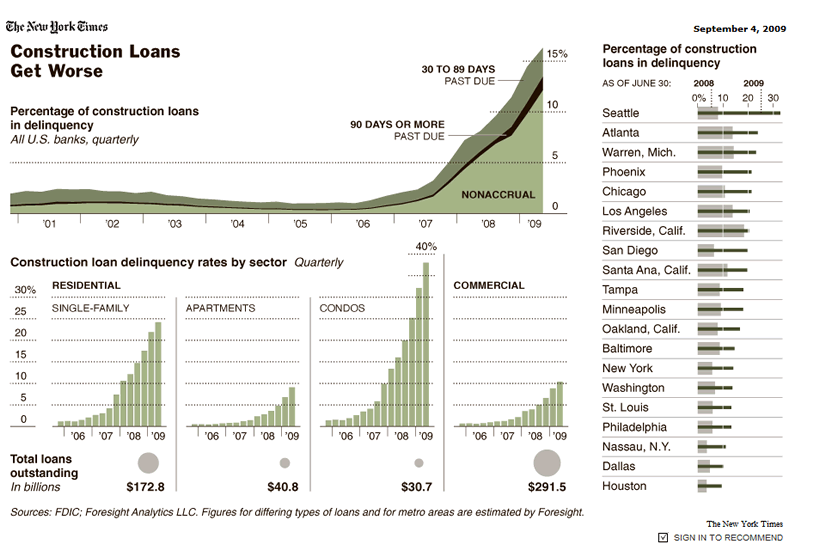

Reports filed by banks with the Federal Deposit Insurance Corporation indicate that at the end of June about one-sixth of all construction loans were in trouble. With more than half a trillion dollars in such loans outstanding, that represents a source of major losses for banks.

Construction loans were highly attractive in recent years for many banks, particularly smaller ones without a national presence. One reason was that other types of loans were not easy to make. A handful of big banks came to dominate credit card loans, for example, and corporate loans were often turned into securities.

Construction loans, however, needed local expertise and were not easy to standardize. In a booming real estate market, there were few losses on such loans.

It is in commercial real estate construction — be it stores or office buildings — that the pain seems likely to rise. At the end of June, $291 billion in such loans was outstanding, down only a few billion from the peak reached earlier this year.

“On the commercial side,” said Matthew Anderson, a partner in Foresight Analytics, a research firm based in Oakland, Calif., “I think we are fairly early in the down cycle.”

Foresight estimates that 10.4 percent of commercial construction loans are troubled, but expects that to increase as the year goes on.

Construction Loans Problems By Type

Local Expertise? What Local Expertise?

One has to laugh at the statement "Construction loans, however, needed local expertise".

In regards to "local", Pray tell what did Chicago-based Corus bank know about condo construction in Florida, California, and Georgia?

Indeed, what expertise was displayed by anyone, anywhere in regards to construction loans?

How Bad An Omen?

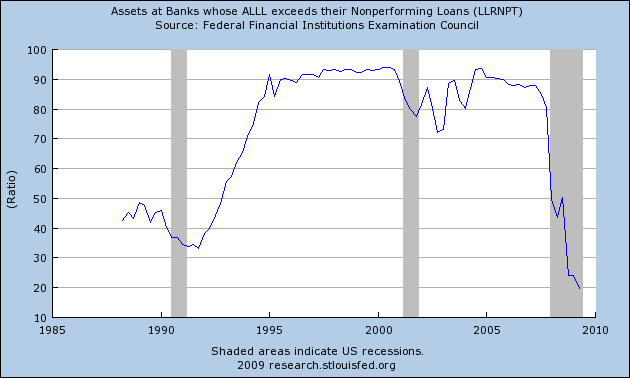

Just how bad an omen this is for banks depends on whether or not the problem is getting worse (it is), and how much banks have allocated in loan loss provisions.

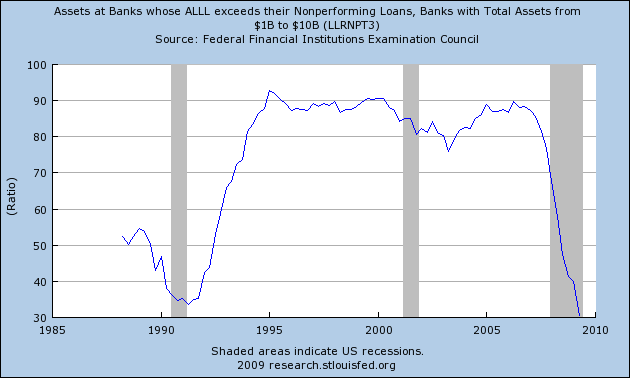

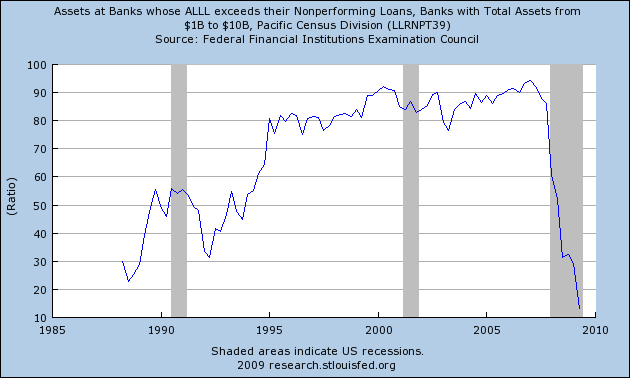

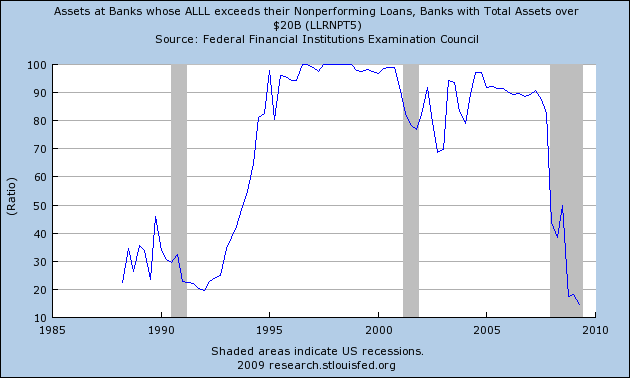

In regards to loan loss provisions, here are a few pertinent charts from How Overpriced Is The S&P 500?

Assets at banks whose ALLL exceeds Nonperforming loans

Banks with Total Assets from $1B to $10B where ALLL exceeds Nonperforming loans

Banks with Total Assets from $1B to $10B (Pacific Region) where ALLL exceeds Nonperforming loans

Banks with Total Assets over $20B where ALLL exceeds Nonperforming loans

Remember that allowances for loan losses will decrease as charge offs increase. However, the above charts are in relation to non-performing loans.

Because allowances for loan losses are a direct hit to earnings, and because allowances are at ridiculously low levels, bank earnings have been wildly over-stated. Moreover, even as problem loans are increasing and expected to keep increasing, allowances for loan losses have gone the other direction.

"Bad Omen" is a serious understatement.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.