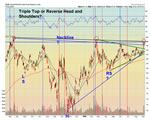

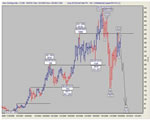

Gold Breakout, Real or Fake?

News_Letter / Financial Markets 2009 Sep 06, 2009 - 02:21 PM GMTBy: NewsLetter

Issue #70 Vol. 3

Issue #70 Vol. 3

Dear Reader

The seasonally worst month of the year for stocks got off to a mildly weak start with the Dow closing 1% lower at 9441. The U.S. Dollar continued to trade sideways above USD 78 attempting to form a bottom, though the longer the USD continues in this manner the harder it will become to break out higher above 80.

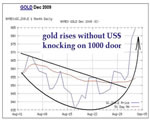

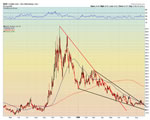

The major commodities news of the week was Gold finally resolving out of its converging triangle to breakout HIGHER. Much to the relief of patient gold bugs. However, whilst on face value the breakout is bullish for gold, it has yet to break above the previous high of $1030. My own take on gold is inline with the strong dollar analysis which is bearish for gold, clearly the markets are now signaling a potentially different scenario at work which does require an in depth analysis of Gold before I can comment further.

Meanwhile the G20 leaders concluded their weekend meeting in London by announcing in all but words that the real power still lies with the bankster's as no real action was taken on regulating bank bonuses which triggered the whole global financial crisis as bank officials proceeded to turn the financial institutions they worked for into hollow shells as billions were banked on the basis of fictitious non existant profits whilst inept regulators watched on.

The only thing that has changed to date is that the power is now even more concentrated than before as the likes of Goldman Sachs continue to turn tax payer bailout cash into balance sheet profits having been aided by their ex CEO of and former Treasury Secretary Henry Paulson. Meanwhile the bankrupt banks continue to drain the resources of tax payers across the world as losses continue to be nationalised.

By Nadeem Walayat

Editor, The Market Oracle.

Copyright © 2005-09 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Featured Analysis of the Week

|

|

|

|

|

|

|

|

|

INO TV - Watch From Your Computer for FREE Here are the newest authors: Jack Schwager, John Murphy, Jake Bernstein, and Ron Ianieri. All experts, all well recognized, and highly trafficked by our current members. http://tv.ino.com/ |

|

|

|

|

|

|

|

|

|

Most Popular Financial Markets Analysis of the Week :

| 1. Are We Facing a Banking Crisis? Is the Gold Price About to Explode? |

By:Brian_Bloom

FLIGHT TO SAFETY APPEARS IMMINENT

Summary

The markets appear to be anticipating a banking crisis.

| 2. Major Financial and Commodity Markets Turning Point Dead Ahead (Part I) |

By: The_BullBear

Major Financial and Commodity Markets Turning Point Dead Ahead (Part I)

A Transitional Period in Intermarket Relationships Will Likely Give Way to New Secular Trends

THE BULLBEAR MARKET REPORT

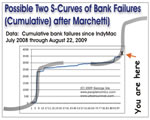

| 3. Six Million Home Foreclosures: Next Ticking Lehman-Style Bomb…FDIC Insured Banks? |

By: Andrew_Butter

Over a year ago Hank Paulson declared "The US Banking System Is A Safe and Sound One", the market's reaction to that piece of news was to short Fannie and Freddie into oblivion. A key issue there was holdings of mortgaged backed securities, specifically RMBS; valuations of those things depended on (a) their credit rating, (and once the LTV started to slip the rules said they had to be downgraded, so the price tanked), and (b) there was a rule of thumb that the value of those things was what an equivalent Treasury cost, less the cost of a CDS to insure them; when fear took over, the cost of a CDS went through the roof, the "market" (it never was a real market), froze. Then there was Lehman.

| 4. Spain, The Financial Black Hole In Europe's Balance Sheet |

By: John_Mauldin

Today's offering for this week's Outside the Box starts off with a quote from Titus Maccius Plautus: "I am a rich man as long as I don't pay my creditors." Even 2200 years ago, it seems that problems of credit were an issue.

INO TV - Watch From Your Computer for FREE Here are the newest authors: Jack Schwager, John Murphy, Jake Bernstein, and Ron Ianieri. All experts, all well recognized, and highly trafficked by our current members. http://tv.ino.com/ |

| 5. Robert Prechter and What's Behind Moves In Gold? |

By: Mike_Shedlock

In response to How Will China Handle The Yuan? I received many emails regarding a single statement I made: "Prechter, who does not view gold as money, thinks gold will collapse. Thus, not all deflationists think alike."

The first half of that statement "Prechter, who does not view gold as money" is an inaccurate representation of Prechter's views.

| 6. Gold and Silver Hidden Chart Messages |

By: Ronald_Rosen

We may have seen a blow off high for the 30 year T-bond when the price moved up and out of the channel that has been in effect since 1987. This channel was in place for 22 years without being violated in either direction. A blow-off high may indicate that a breach of the lower channel line will occur. A close below the lower channel line will indicate rising interest rates. That would be bullish for the U. S. Dollar and bearish for gold Vis a Vis the U. S. Dollar.

| 7. Gold Jumps Without U.S. Dollar Drop, Separation Before Liftoff |

By: Jim_Willie_CB

The latest development in the gold world is highly favorable. Summarize by saying from the rooftops that GOLD LEADS THE CURRENCIES in price movement. Gold is not only a metal, but the most important of currencies, whose importance will soon be confirmed on a worldwide basis. The enlightened realize that if gold had been a core to the banking systems, and to the currency systems, that the entire bank credit crisis would not have occurred. The dimwitted that dominate the landscape still utter nonsense about gold, only to have their prattle squelched and overrun, as it seems so tiresome and vacant anymore.

| Subscription |

You're receiving this Email because you've registered with our website.

How to Subscribe

Click here to register and get our FREE Newsletter

| About: The Market Oracle Newsletter |

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication.

(c) 2005-2009MarketOracle.co.uk (Market Oracle Ltd) - The Market Oracle asserts copyright on all articles authored by our editorial team. Any and all information provided within this newsletter is for general information purposes only and Market Oracle do not warrant the accuracy, timeliness or suitability of any information provided in this newsletter. nor is or shall be deemed to constitute, financial or any other advice or recommendation by us. and are also not meant to be investment advice or solicitation or recommendation to establish market positions. We recommend that independent professional advice is obtained before you make any investment or trading decisions. ( Market Oracle Ltd , Registered in England and Wales, Company no 6387055.

Registered office: 226 Darnall Road, Sheffield S9 5AN , UK )

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.