U.S. Housing Market, The 800,000 Pound Deflationary Gorilla

Housing-Market / US Housing Sep 08, 2009 - 12:30 AM GMTBy: Adam_Brochert

The housing market is rapidly deteriorating under the surface. A housing price collapse is a highly deflationary event because it affects so many banks and individuals. We are not close to a bottom in the real estate market and it is essentially almost impossible for it to come before the 2011-2012 time frame. If our government insists on continuing to subvert what's left of the free market system in real estate, it may take another decade to find the bottom.

The housing market is rapidly deteriorating under the surface. A housing price collapse is a highly deflationary event because it affects so many banks and individuals. We are not close to a bottom in the real estate market and it is essentially almost impossible for it to come before the 2011-2012 time frame. If our government insists on continuing to subvert what's left of the free market system in real estate, it may take another decade to find the bottom.

Here's a recent headline for you: "Nine years worth of condos flood uptown Charlotte." This is Charlotte, North Carolina folks. We're not talking about an obvious place like southern Florida, California, or Las Vegas. We're talking about a fairly typical non-coastal American city (I mean no offense to those in Charlotte who believe they are above or below average). Nine years supply at the current sales pace while credit continues to get tighter and unemployment is still rising?!

Here's a recent headline for you: "Nine years worth of condos flood uptown Charlotte." This is Charlotte, North Carolina folks. We're not talking about an obvious place like southern Florida, California, or Las Vegas. We're talking about a fairly typical non-coastal American city (I mean no offense to those in Charlotte who believe they are above or below average). Nine years supply at the current sales pace while credit continues to get tighter and unemployment is still rising?! Banks are now hiding foreclosures and refusing to list foreclosed homes on the market! Even worse, banks are allowing people who stop paying their mortgage to stay in their homes for 2 YEARS OR MORE without taking back the house.

This means that there is an absolutely huge pent-up supply of homes that will need to be sold onto the market eventually. This supply will hit right as the psychology for "investing" in real estate turns seriously south. People will be looking to rent, not buy, and yet an absolute flood of homes will need to be brought to market in this environment. By the way, the ability of people to buy (due to worsening unemployment and and ever tightening lending standards) will have decreased further as this supply eventually makes its way to the market. Many of these homes will be rented, forcing rents to decline as well (which in turn lowers the value of a home for a potential investor looking to buy a rental property).

Real estate is dead. Who can revive it? Government can (NOT). But that won't stop government from trying. "Stimulus" buying incentives trying to revive a burst bubble is a waste of people's hard-earned money and won't stop the slide in real estate prices, but it will destroy taxpayer wealth and lock unsuspecting citizens into debt on a depreciating asset.

According to an article in the Financial Times, Fannie and Freddie have "backed more than 70 per cent of new home loans since 2008." These loans, of course, will go bad in high numbers. Fannie and Freddie also have $5.5 trillion of outstanding debt and guarantees on securities and a combined $1.5 trillion of mortgages and mortgage-backed securities on their balance sheets according to the same article as well as getting heavily involved in the "loan modification" push from the current administration. The government is now backing 90% of new mortgages according to a different article in the Washington Post, since private banks are smart enough to stop making loans in this environment. So, the taxpayer will get ass-raped (again) as this house of cards is allowed to gradually collapse and implode. Anyone with any common sense can see that this is a huge pending disaster that now cannot be avoided, but I guarantee that politicians will act surprised when this causes a second (and third) real estate and fiscal crisis.

The moral hazards now in place have staggering implications. If your neighbors can live in their house for free, why should you pay the mortgage? If you're going to have to pay for the housing crisis anyway via taxes and looting of the U.S. Treasury by the banks, why not get something for yourself and/or your family by living for free and then walking away (might as well trash the place on the way out, too, just to get even and let off a little steam). I am not advising such behavior (though walking away may well be the best option for many individuals depending on state law and specific circumstances and I understand the frustration behind a "trash out"), but I am saying that such thinking and actions make sense to a significant portion of those who currently hold a mortgage. And for those who don't follow such things, this is not a subprime borrower issue (that's yesterday's news!), this is a prime borrower issue!

The housing wealth effect in reverse is also a powerful deflationary concept. People in aggregate can no longer use their homes as ATMs by taking out home equity lines of credit and other cash-out refinances to fuel consumption. Predictions that half of U.S. mortgages will be underwater by 2011 are not one crazy bear's thoughts, they are mainstream views! People who owe more on their homes than they are worth feel poorer and act accordingly (in aggregate). This decreases consumption and the consumer is needed to get "growth" back on track in the U.S.

And what about commercial real estate? Everyone knows this shoe is dropping right here and right now as retailers, restaurants and real estate-related businesses (among other types of businesses) see their sales drop off a cliff and are unable to make lease payments. Here's a brief summary of some ballpark numbers of the size of the problem, though I note with amusement that the author of this piece is already calling for a bailout (when in doubt, put it on the taxpayers' tab!).

All this real estate debt and all the pending defaults that will help lower the staggering amount of debt outstanding are highly deflationary. They will ensure a steady and high rate of bank failures for at least the next few years. To make things worse, the FDIC is essentially bankrupt already and we are just getting started with the bank failures. The FDIC is also conveniently ignoring undercapitalized banks for as long as possible (because they are broke and don't want the bad press of tapping their U.S. Treasury line of credit, which of course they are going to have to do eventually). This will end up costing taxpayers even more money when the involved banks are finally placed into receivership.

With banks unwilling and/or unable to lend (because they are scared and/or insolvent) and with citizens broke, drowning in debt and fearing a pink slip every day, the private, non-federal, for-profit federal reserve bank corporation is not going to be able to spark price inflation in asset classes like stocks, commodities or corporate bonds. And you can forget real estate. This popped bubble ain't coming back for at least a generation. Even once we hit bottom, we will scrape along the bottom for a few (several?) years.

This so-called gloom and doom is good news for savers and renters! Not only will home prices continue to fall, but rents will fall as well, so it will be cheaper and cheaper to live on a monthly expense basis and you will be able to save more money each year to buy a house in the future. This, of course, assumes that you can keep your job and income level and you put your savings in a safe place.

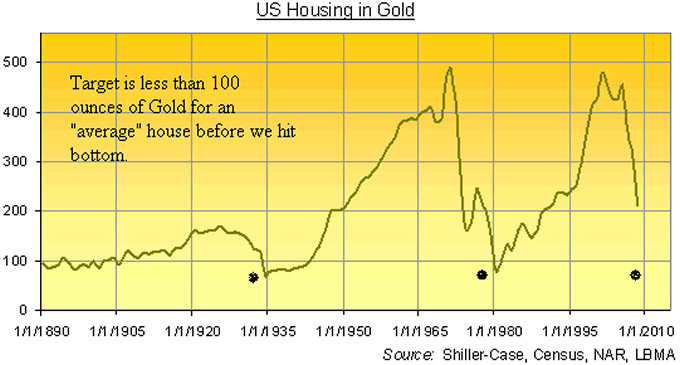

Consider putting some of those savings into physical Gold on the next Gold price drop, as Gold will continue to rise relative to real estate prices and provides insurance against a currency event that won't stop deflation but will devalue the U.S. Dollar significantly. Here's a chart stolen from an article by Adrian Ash at bullionvault.com (and defiled with my scribbles) that shows how much further housing prices will drop when priced in Gold before we reach "the" bottom in real estate in the U.S.:

There will be deals of a lifetime in real estate (even better than this one, which by the way shows that we have moved beyond the 1st inning in this real estate collapse) over the next decade for those who are patient and who can maintain some capital. In the mean time, the ongoing real estate bubble popping is an 800,000 pound deflationary gorilla that cannot be ignored in the inflation vs. deflation debate.

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2009 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.